Key Insights

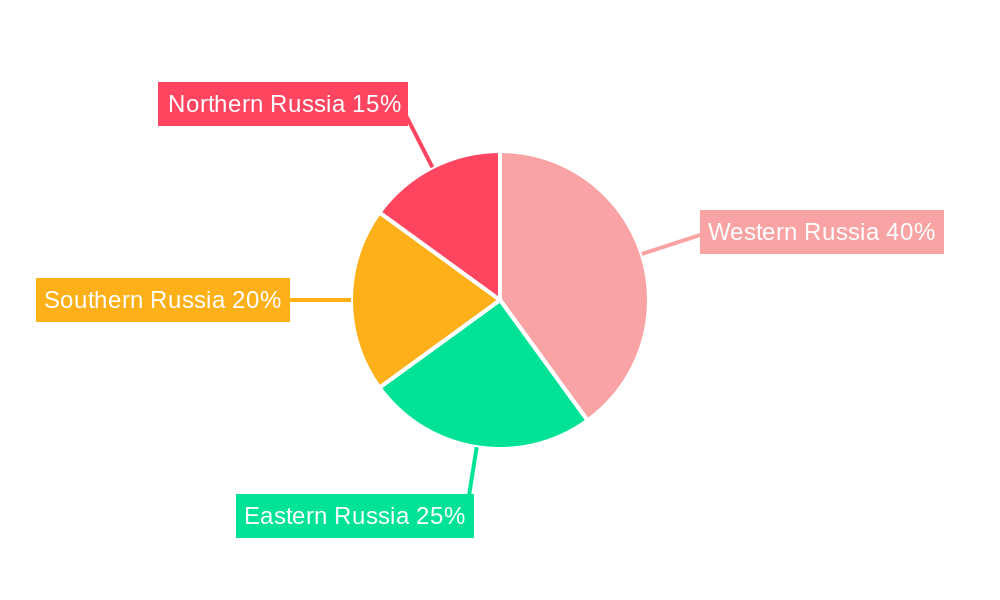

The Russian rail freight transport market, valued at approximately 313 billion in 2024, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 5.5% from 2024 to 2033. This expansion is driven by Russia's extensive geography, necessitating efficient long-haul freight solutions, and increasing industrial activity, particularly in mining and energy, which elevates demand for rail freight services. Government initiatives focused on modernizing the rail network and enhancing infrastructure further support this growth. The market is segmented by service type (transportation, maintenance, switching, storage), cargo type (containerized, non-containerized, liquid bulk), and destination (domestic, international). Containerized freight is anticipated to be the fastest-growing segment, driven by e-commerce growth and international trade efficiency. Key market constraints include commodity price fluctuations, geopolitical uncertainties, and potential sanctions. Major players include Russian Railways, TransContainer, and other private operators. Western Russia is expected to exhibit higher growth rates due to superior infrastructure and proximity to economic centers.

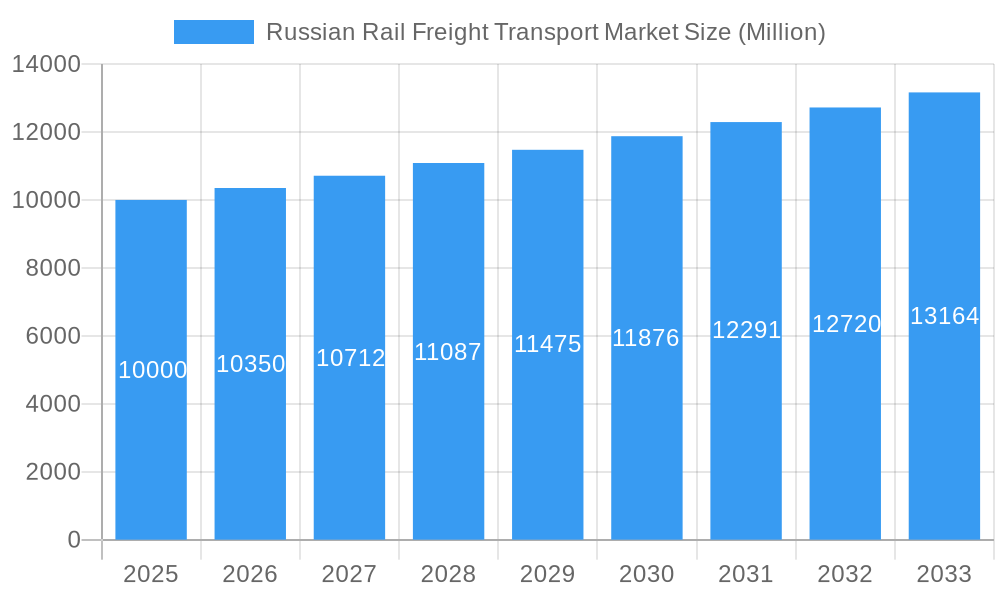

Russian Rail Freight Transport Market Market Size (In Billion)

The forecast period indicates a progressive market expansion, fueled by ongoing modernization and increased trade. While state-owned entities like Russian Railways are expected to maintain dominance, private companies are poised to gain market share through specialization, technological innovation, and a focus on niche segments such as containerized freight and high-value goods. Their success will depend on adaptability to regulatory changes, cost management, and the development of robust logistics solutions. Expansion into international markets, particularly in Asia and Europe, presents a significant growth opportunity, contingent on efficient border crossings and infrastructure development. Sustained long-term growth requires continued investment in technology and infrastructure, alongside a stable geopolitical environment.

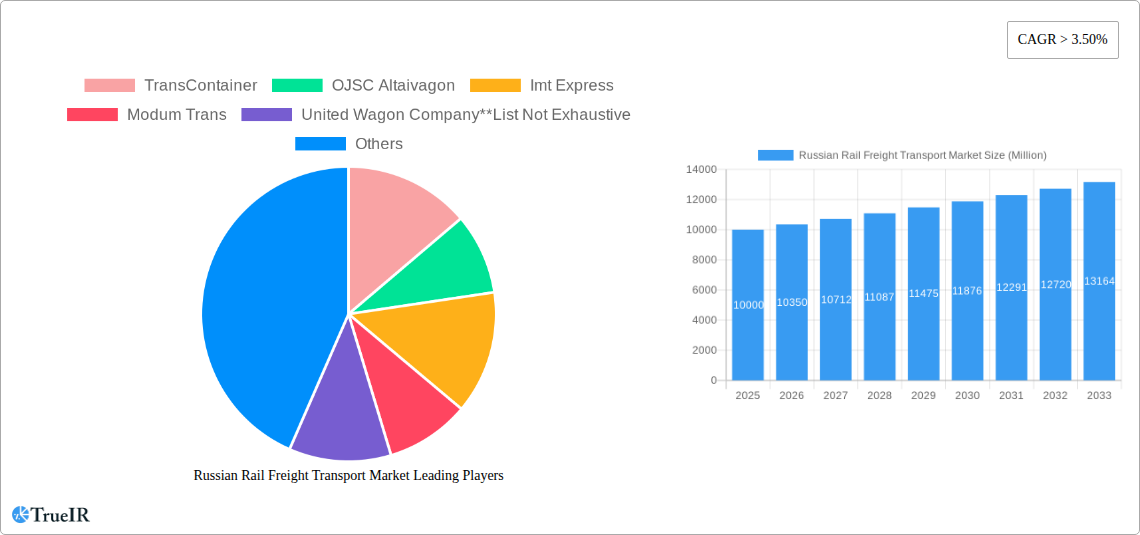

Russian Rail Freight Transport Market Company Market Share

Russian Rail Freight Transport Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Russian rail freight transport market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive data and expert analysis to illuminate market trends, opportunities, and challenges. The report encompasses key segments, competitive dynamics, and future growth projections, all while utilizing high-volume keywords to ensure optimal search engine visibility.

Russian Rail Freight Transport Market Structure & Competitive Landscape

The Russian rail freight transport market exhibits a complex structure influenced by a mix of state-owned enterprises and private players. Market concentration is relatively high, with a few dominant players controlling a significant share of the market. This is reflected in a Herfindahl-Hirschman Index (HHI) of xx in 2024 (estimated). However, the market is not static; increased competition from smaller private operators is emerging, driven by deregulation efforts and the ongoing liberalization of the sector.

Innovation Drivers: Technological advancements, such as the adoption of advanced train control systems, digitalization of logistics processes, and improved rail infrastructure, are key drivers of market innovation.

Regulatory Impacts: Government regulations, including those related to safety, environmental protection, and pricing, play a significant role in shaping the market dynamics. Recent regulatory changes aimed at promoting private sector participation are likely to reshape the competitive landscape.

Product Substitutes: Road transport is the main substitute for rail freight, but the inherent advantages of rail in terms of cost-efficiency for bulk transport and long distances maintain its dominance.

End-User Segmentation: The market caters to diverse end-users across various sectors, including mining, manufacturing, agriculture, and energy. The relative contribution of each sector to the overall market demand shifts with economic conditions and government policy.

M&A Trends: The market has witnessed a moderate level of M&A activity in recent years, primarily focused on consolidating smaller players and enhancing operational efficiency. The value of M&A deals between 2019 and 2024 is estimated at $xx Million.

Russian Rail Freight Transport Market Trends & Opportunities

The Russian rail freight transport market is characterized by significant growth potential, driven by several key trends and emerging opportunities. The market size, estimated at $xx Million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033, reaching $xx Million by the end of the forecast period. This growth is fueled by increasing industrial output, growing e-commerce (driving demand for containerized freight), and government investments in infrastructure upgrades.

Technological shifts towards automation, digitalization, and enhanced efficiency across rail operations are creating new opportunities. Consumer preferences are increasingly shifting towards reliable and cost-effective transportation solutions, solidifying the demand for rail freight. Intensifying competition within the market necessitates constant innovation and strategic adaptation by players to maintain a strong market position and gain competitive advantage. The penetration rate of containerized freight is expected to increase from xx% in 2025 to xx% by 2033, reflecting the growing demand for efficient and secure intermodal transport solutions.

Dominant Markets & Segments in Russian Rail Freight Transport Market

The domestic market segment constitutes the largest share of the Russian rail freight transport market, reflecting the substantial volume of internal goods transportation. However, the international segment is expected to witness faster growth, driven by increasing cross-border trade and the development of new rail corridors.

Key Growth Drivers for Domestic Segment: Expanding industrial activity, government investment in infrastructure development within Russia, and the continuous enhancement of the rail network.

Key Growth Drivers for International Segment: Government initiatives to promote trade partnerships with neighboring countries and the expansion of rail connections to regions such as Central Asia and China.

Within the cargo type segment, non-containerized freight continues to dominate, although the share of containerized (including intermodal) cargo is steadily growing. The liquid bulk segment shows relatively stable growth, driven by the energy sector's requirements.

Service: Transportation services dominate the market, followed by services allied to transportation, especially the maintenance of railcars and tracks.

Cargo Type: Non-containerized freight remains the largest segment in volume terms but containerized freight demonstrates higher growth prospects.

Destination: The domestic market represents a larger share currently, but the international market shows higher growth potential.

Russian Rail Freight Transport Market Product Analysis

Technological advancements in rail freight transport are driving product innovation, focusing on efficiency, safety, and sustainability. Modernized locomotives with higher haulage capacity, improved rolling stock, and advanced logistics management systems are enhancing operational efficiency and reducing transit times. These innovations are providing a competitive advantage to operators capable of adopting and integrating new technologies. The market is seeing growing demand for advanced sensor-based monitoring systems for real-time tracking and predictive maintenance, reflecting the increasing focus on operational safety and efficiency.

Key Drivers, Barriers & Challenges in Russian Rail Freight Transport Market

Key Drivers: Government investments in rail infrastructure modernization, growing industrial output and trade, and increasing demand for efficient and reliable transportation solutions are key drivers. The push towards digitalization and automation is also accelerating market growth.

Challenges: Aging rail infrastructure in certain regions, competition from road transport, fluctuating energy prices, and bureaucratic hurdles in regulatory processes pose significant challenges. Supply chain disruptions caused by geopolitical factors also impact the market significantly, potentially reducing annual growth by xx%.

Growth Drivers in the Russian Rail Freight Transport Market

Key growth drivers include: substantial government investment in infrastructure upgrades, a growing industrial base demanding efficient transportation, and increasing cross-border trade. Furthermore, the adoption of advanced technologies, such as digital logistics and automated systems, further fuels market expansion.

Challenges Impacting Russian Rail Freight Transport Market Growth

Significant challenges include aging infrastructure in some areas, stiff competition from road transportation, and geopolitical factors that cause supply chain volatility. Regulatory complexities and associated bureaucratic delays also hinder market growth.

Key Players Shaping the Russian Rail Freight Transport Market

- TransContainer

- OJSC Altaivagon

- Imt Express

- Modum Trans

- United Wagon Company

- JSC RZD Logistics

- RAIL1520 Ltd

- Mecheltrans

- Russian Railways

- InterRail Service LLC

Significant Russian Rail Freight Transport Market Industry Milestones

October 2022: Russia announces plans to develop a major transport hub in Iran, focusing on the Rasht-Anzali railway line and the Anzali port, indicating expansion of international rail freight.

February 2023: Russian Railways (RZD) reports that eastbound train freight shipments surpassed westbound shipments for the first time in 2022 (80 million tonnes vs 76 million tonnes), reflecting shifting trade patterns.

Future Outlook for Russian Rail Freight Transport Market

The Russian rail freight transport market is poised for continued growth, driven by ongoing infrastructure development, technological advancements, and increasing industrial activity. Strategic partnerships, investments in sustainable solutions, and efficient regulatory frameworks will shape the future trajectory of the market. Opportunities exist for players who can adapt to evolving market dynamics, embrace technological innovation, and effectively address the inherent challenges.

Russian Rail Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

Russian Rail Freight Transport Market Segmentation By Geography

- 1. Russia

Russian Rail Freight Transport Market Regional Market Share

Geographic Coverage of Russian Rail Freight Transport Market

Russian Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Technological innovations in Railways has increased dependency on various rail freight transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TransContainer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OJSC Altaivagon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Imt Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Modum Trans

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Wagon Company**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSC RZD Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RAIL1520 Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mecheltrans

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Russian Railways

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 InterRail Service LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TransContainer

List of Figures

- Figure 1: Russian Rail Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Russian Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Russian Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: Russian Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Russian Rail Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Russian Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 7: Russian Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Russian Rail Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Rail Freight Transport Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Russian Rail Freight Transport Market?

Key companies in the market include TransContainer, OJSC Altaivagon, Imt Express, Modum Trans, United Wagon Company**List Not Exhaustive, JSC RZD Logistics, RAIL1520 Ltd, Mecheltrans, Russian Railways, InterRail Service LLC.

3. What are the main segments of the Russian Rail Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 313 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Technological innovations in Railways has increased dependency on various rail freight transport.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

February 2023: According to Russian Railways (RZD) Chairman Oleg Belozerov, during a meeting with Russian President Vladimir Putin, eastbound train freight shipments in Russia will surpass westbound shipments for the first time in 2022, at 80 million tonnes compared to 76 million tonnes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Russian Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence