Key Insights

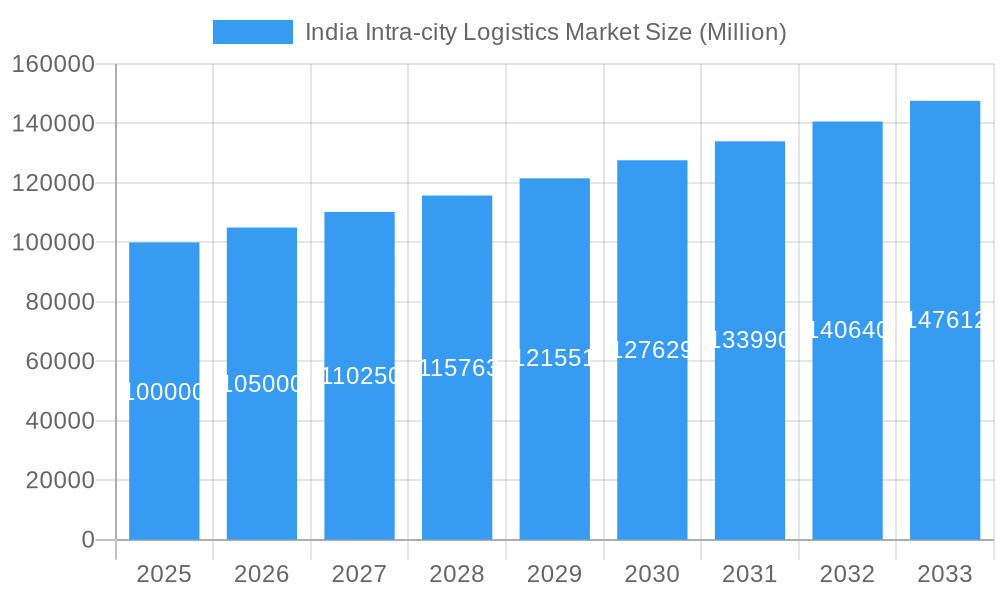

The India intra-city logistics market is experiencing robust growth, fueled by the burgeoning e-commerce sector and rapid urbanization. With a current market size estimated at ₹100 billion (approximately $12 billion USD) in 2025, and a compound annual growth rate (CAGR) exceeding 5%, the market is projected to reach ₹160 billion (approximately $20 billion USD) by 2033. This expansion is driven by increasing consumer demand for faster and more reliable delivery services, the rise of quick commerce models, and the expanding reach of online retail in even Tier II and III cities. Key segments driving this growth include transportation (primarily last-mile delivery), warehousing and distribution, and value-added services such as reverse logistics and inventory management. Major metropolitan areas like Delhi, Mumbai, Bangalore, Hyderabad, and Chennai are significant contributors to market volume, reflecting their dense populations and high e-commerce activity.

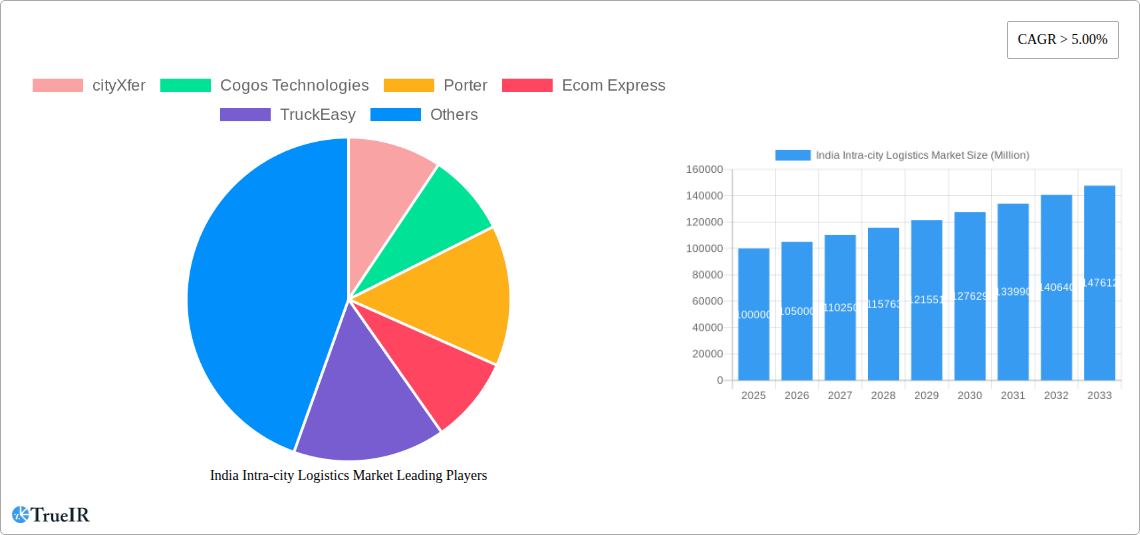

India Intra-city Logistics Market Market Size (In Billion)

The market's growth is further facilitated by technological advancements, including the adoption of route optimization software, real-time tracking systems, and the integration of Artificial Intelligence in logistics operations. However, challenges remain, such as infrastructure limitations (particularly in smaller cities), traffic congestion, high fuel costs, and a shortage of skilled drivers. Despite these constraints, the market's positive trajectory is expected to continue, driven by sustained e-commerce growth and increasing investment in logistics infrastructure and technology. The competitive landscape is dynamic, featuring a mix of established players like DTDC and Ecom Express, and newer entrants leveraging technology to improve efficiency and service levels. The market is likely to see further consolidation as companies seek to expand their reach and optimize their operations.

India Intra-city Logistics Market Company Market Share

India Intra-city Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the India intra-city logistics market, offering invaluable insights for investors, businesses, and stakeholders. With a comprehensive study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report leverages extensive data and expert analysis to illuminate market trends, opportunities, and challenges. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

India Intra-city Logistics Market Structure & Competitive Landscape

The Indian intra-city logistics market is characterized by a moderately fragmented structure, with a Herfindahl-Hirschman Index (HHI) of approximately xx in 2024. While several large players like cityXfer, Cogos Technologies, Porter, Ecom Express, TruckEasy, DTDC, FM Logistic India, Lets Transport, Shadowfax, and Blowhorn hold significant market share, numerous smaller regional players also contribute significantly. The market exhibits high competitive intensity, driven by factors such as price competition, service differentiation, and technological innovation.

- Market Concentration: The market is moderately concentrated, with the top 5 players accounting for approximately xx% of the market share in 2024.

- Innovation Drivers: Technological advancements, such as AI-powered route optimization, IoT-enabled tracking, and drone delivery, are significantly shaping the market.

- Regulatory Impacts: Government regulations regarding permits, licensing, and environmental standards impact operational costs and entry barriers.

- Product Substitutes: While direct substitutes are limited, efficient public transportation systems can partially substitute intra-city logistics for certain goods and services.

- End-User Segmentation: The market caters to diverse end-users, including e-commerce companies, FMCG businesses, manufacturing firms, and individual consumers. E-commerce is a significant growth driver.

- M&A Trends: The market witnessed notable M&A activity in recent years, including the acquisition of Whizzard by Mahindra Logistics and the acquisition of Porter’s FMCG modern trade business by COGOS Technologies. These acquisitions signal consolidation and expansion strategies. The total M&A volume in the last 5 years amounted to approximately xx Million.

India Intra-city Logistics Market Market Trends & Opportunities

The Indian intra-city logistics market is experiencing exponential growth fueled by several key factors. The burgeoning e-commerce sector, rapid urbanization, and increasing consumer demand for faster and more reliable delivery services are propelling market expansion. Technological advancements are further optimizing operations, reducing costs, and enhancing service quality. Market penetration rates for technology-enabled logistics solutions are steadily increasing, with significant opportunities for companies offering innovative solutions. The market is expected to witness a substantial increase in demand for warehousing and distribution services, especially in metropolitan areas. The competitive landscape is dynamic, with existing players focusing on expanding their service offerings and technological capabilities while new entrants constantly emerge. The market size is expected to reach xx Million in 2025 and xx Million by 2033, driven by a CAGR of xx%. Consumer preferences are shifting towards same-day and next-day delivery options, putting pressure on logistics providers to improve efficiency and responsiveness.

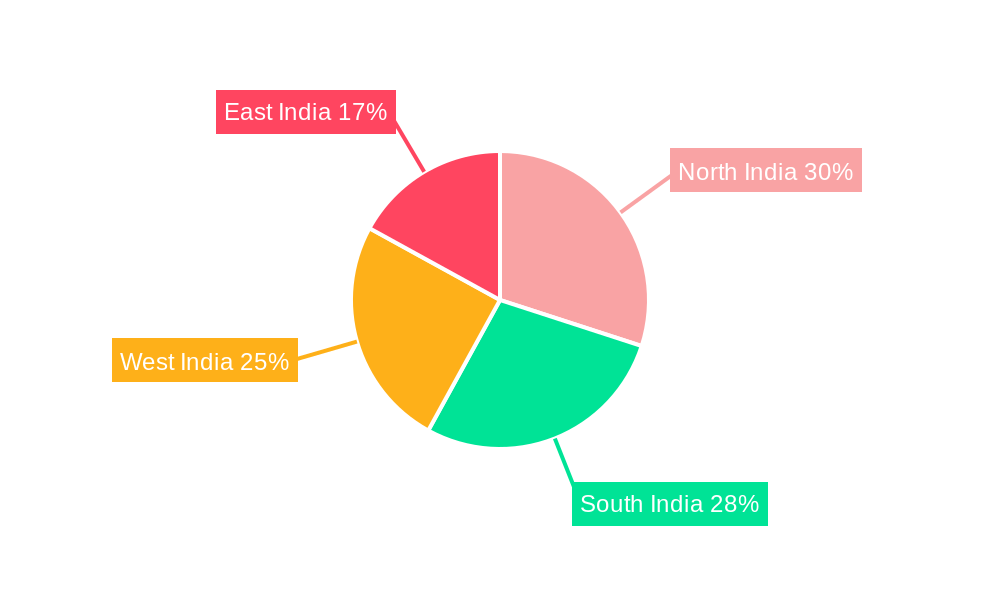

Dominant Markets & Segments in India Intra-city Logistics Market

The Indian intra-city logistics market displays significant regional variations, with Delhi, Mumbai, Bangalore, and Chennai emerging as the leading cities. These cities benefit from higher population density, robust economic activity, and well-developed infrastructure.

By City:

- Delhi: Strong e-commerce presence and high population density make it a dominant market.

- Bangalore: A technological hub with a large number of businesses and consumers relying heavily on logistics.

- Mumbai: High population, a major commercial center, and significant e-commerce activity make it a key market.

- Hyderabad: Rapid urbanization and growing industrial activity are driving market growth.

- Chennai: A significant industrial and commercial center contributes to its market size.

- Others: Smaller cities contribute significantly to the overall market but at a slower pace compared to the leading cities.

By Service:

- Transportation: This remains the largest segment, driven by increasing demand for last-mile delivery services.

- Warehousing and Distribution: This is a rapidly growing segment as businesses focus on efficient inventory management.

- Value-added Services: Services like reverse logistics, packaging, and labeling are gaining traction.

Growth drivers for the leading cities include:

- Developed infrastructure (road networks, warehousing facilities).

- Favorable government policies (ease of doing business, infrastructure development).

- High population density and consumer spending.

- Strong e-commerce presence.

India Intra-city Logistics Market Product Analysis

Product innovations in the intra-city logistics market focus on enhancing efficiency, transparency, and customer experience. Technology-driven solutions such as route optimization software, real-time tracking systems, and automated warehousing are gaining popularity. These innovations improve delivery speed, reduce operational costs, and enhance customer satisfaction. Companies are also focusing on developing specialized services tailored to specific industry needs, such as temperature-controlled transportation for pharmaceuticals and time-sensitive deliveries for perishable goods. The competitive advantage lies in offering superior technology, reliable service, and competitive pricing.

Key Drivers, Barriers & Challenges in India Intra-city Logistics Market

Key Drivers: The burgeoning e-commerce sector, rapid urbanization, increasing disposable incomes, and government initiatives promoting infrastructure development are key drivers. Technological advancements in areas like route optimization and last-mile delivery solutions are further accelerating market growth. The growing preference for faster delivery options and improved customer experience also fuels market expansion.

Challenges: Challenges include traffic congestion in major cities, inadequate infrastructure in certain areas, high fuel costs, stringent regulatory compliance, and the need for skilled labor. These factors add to the operational costs and can impact service delivery. The competitive landscape also presents challenges, with intense competition and pressure to maintain profitability. The lack of proper infrastructure in certain regions leads to increased delivery times and higher costs.

Growth Drivers in the India Intra-city Logistics Market Market

Key growth drivers include the robust growth of the e-commerce sector, increasing urbanization, and government initiatives to improve infrastructure. Technological advancements in tracking and route optimization are further enhancing efficiency and reducing costs. Rising consumer expectations for faster and more reliable delivery services also boost demand.

Challenges Impacting India Intra-city Logistics Market Growth

Traffic congestion in major cities, inadequate infrastructure in certain regions, and high fuel costs represent significant challenges. Regulatory complexities, the need for skilled labor, and intense competition add to the hurdles. These factors impact operational efficiency, increase costs, and limit market expansion.

Key Players Shaping the India Intra-city Logistics Market Market

- cityXfer

- Cogos Technologies

- Porter

- Ecom Express

- TruckEasy

- DTDC

- FM Logistic India

- Lets Transport

- Shadowfax

- Blowhorn

Significant India Intra-city Logistics Market Industry Milestones

- July 2022: Bengaluru-based COGOS Technologies acquired logistics startup Porter's FMCG modern trade business, strengthening its platform and municipal logistics capabilities.

- November 2022: Mahindra Logistics acquired delivery services provider Whizzard, enhancing its last-mile delivery and electric vehicle-based services.

Future Outlook for India Intra-city Logistics Market Market

The future of the India intra-city logistics market looks promising, driven by sustained growth in e-commerce, urbanization, and technological advancements. Strategic opportunities lie in leveraging technology to improve efficiency, expanding into underserved markets, and offering specialized value-added services. The market is poised for significant expansion, presenting lucrative opportunities for businesses to capitalize on the rising demand for fast, reliable, and cost-effective intra-city logistics solutions.

India Intra-city Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Distribution

- 1.3. Value-added Services

-

2. City

- 2.1. Delhi

- 2.2. Bangalore

- 2.3. Mumbai

- 2.4. Hyderabad

- 2.5. Chennai

- 2.6. Others

India Intra-city Logistics Market Segmentation By Geography

- 1. India

India Intra-city Logistics Market Regional Market Share

Geographic Coverage of India Intra-city Logistics Market

India Intra-city Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Intra-city Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Delhi

- 5.2.2. Bangalore

- 5.2.3. Mumbai

- 5.2.4. Hyderabad

- 5.2.5. Chennai

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 cityXfer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cogos Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porter

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecom Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TruckEasy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DTDC**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FM Logistic India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lets Transport

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Blowhorn

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 cityXfer

List of Figures

- Figure 1: India Intra-city Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Intra-city Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 3: India Intra-city Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 5: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 6: India Intra-city Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Intra-city Logistics Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the India Intra-city Logistics Market?

Key companies in the market include cityXfer, Cogos Technologies, Porter, Ecom Express, TruckEasy, DTDC**List Not Exhaustive, FM Logistic India, Lets Transport, Shadowfax, Blowhorn.

3. What are the main segments of the India Intra-city Logistics Market?

The market segments include Service, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

November 2022 - Mahindra Logistics acquired delivery services provider Whizzard. Mahindra Logistic's current last-mile delivery business and its electric vehicle-based delivery services would be enhanced by the acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Intra-city Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Intra-city Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Intra-city Logistics Market?

To stay informed about further developments, trends, and reports in the India Intra-city Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence