Key Insights

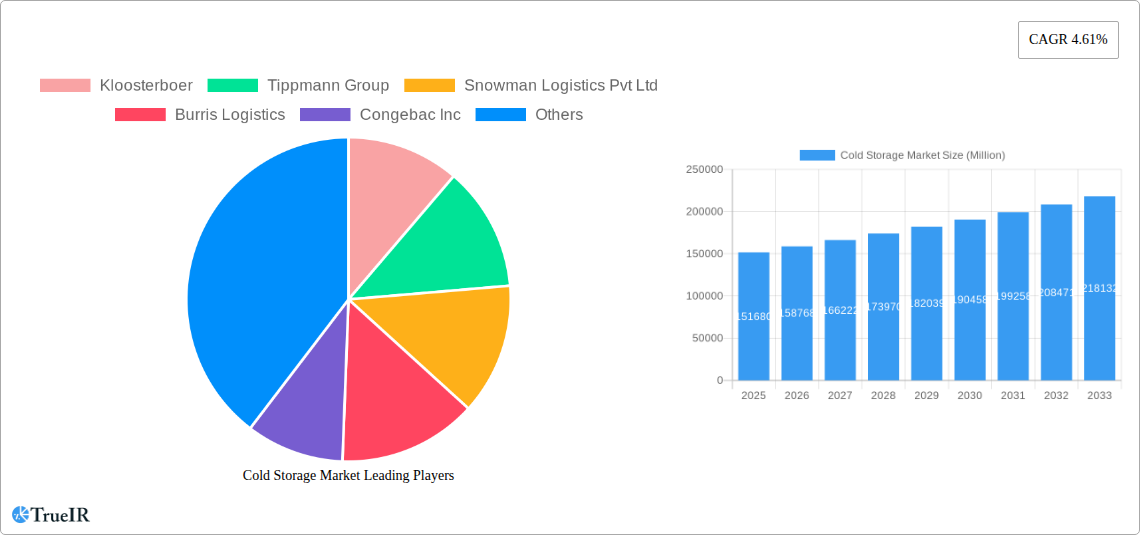

The global cold storage market, valued at $151.68 billion in 2025, is projected to experience robust growth, driven by the increasing demand for perishable goods, advancements in cold chain technologies, and the expansion of the e-commerce sector. The market's Compound Annual Growth Rate (CAGR) of 4.61% from 2019 to 2024 indicates a steady upward trajectory, expected to continue through 2033. Key drivers include the rising global population, escalating disposable incomes in developing economies, and a growing preference for processed and convenience foods. The increasing need for efficient and reliable cold chain solutions to minimize food waste and maintain product quality further fuels market expansion. Segmentation reveals significant opportunities within various construction types (bulk storage, production stores, ports), temperature ranges (chilled, frozen), and applications (fruits & vegetables, dairy, fish & meat, processed food, pharmaceuticals). The competitive landscape is characterized by both large multinational corporations like Americold Logistics and Lineage Logistics, and regional players catering to specific needs.

Cold Storage Market Market Size (In Billion)

The market's growth is influenced by several factors. Expansion into emerging markets with developing cold chain infrastructure presents significant growth potential. Technological advancements, such as automated storage and retrieval systems and improved temperature monitoring, enhance efficiency and reduce operational costs. However, the market also faces challenges, including high capital investment required for cold storage facilities, stringent regulatory compliance, and the vulnerability to power outages and fluctuations in energy prices. To capitalize on opportunities, companies are focusing on strategic partnerships, technological innovations, and expanding their geographical footprint to better serve the growing demand for reliable cold chain solutions across diverse sectors. The continued rise of e-commerce and the need for effective last-mile delivery further contributes to the market's expanding growth potential.

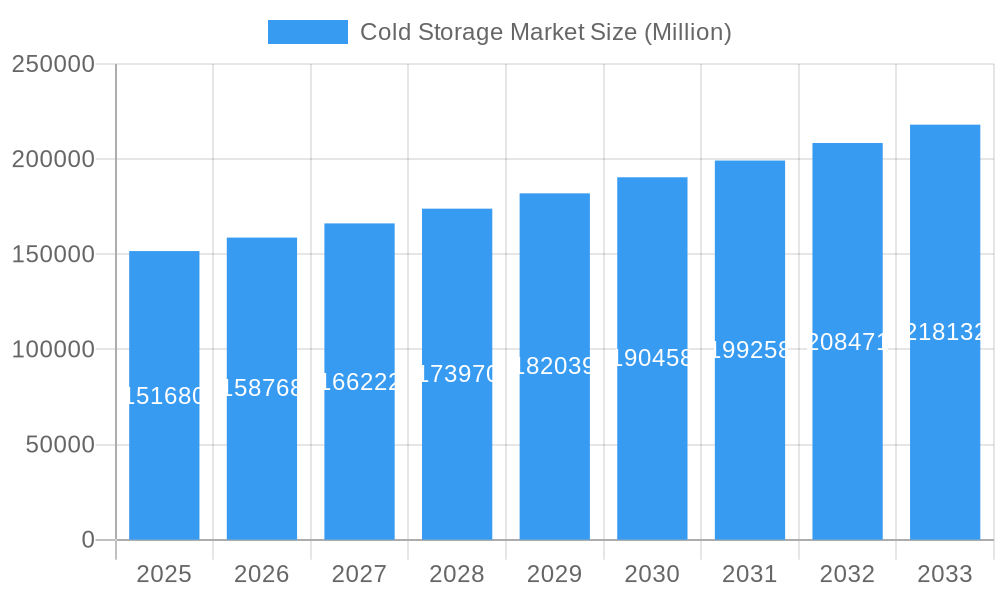

Cold Storage Market Company Market Share

Cold Storage Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global cold storage market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, and future growth potential. The market is projected to reach xx Million by 2033, showcasing significant growth opportunities across various segments.

Cold Storage Market Structure & Competitive Landscape

The global cold storage market exhibits a moderately concentrated structure, with several major players holding significant market share. Key players include Americold Logistics LLC, Lineage Logistics Holdings, Kloosterboer, Tippmann Group, and Snowman Logistics Pvt Ltd, among others. The market's competitive landscape is shaped by factors such as innovation in cold chain technology, stringent regulatory frameworks concerning food safety and temperature control, and the emergence of substitute technologies.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. This concentration is further amplified by mergers and acquisitions (M&A) activity, with an estimated xx Million in M&A transactions between 2019 and 2024.

- Innovation Drivers: Technological advancements such as automated storage and retrieval systems (AS/RS), improved refrigeration technologies, and the integration of IoT sensors are driving market growth.

- Regulatory Impacts: Stringent regulations concerning food safety and hygiene standards influence operational costs and necessitate significant investments in technology upgrades.

- Product Substitutes: While traditional cold storage remains dominant, alternative preservation methods (e.g., modified atmosphere packaging) pose some degree of competitive pressure, albeit limited due to specific application requirements.

- End-User Segmentation: The market caters to diverse end-user segments, including fruits & vegetables, dairy, fish & seafood, meat, processed food, and pharmaceuticals, each characterized by unique storage needs and temperature requirements.

- M&A Trends: The increased consolidation in the cold storage industry reflects companies' pursuit of economies of scale, geographical expansion, and access to advanced technology.

Cold Storage Market Trends & Opportunities

The global cold storage market is experiencing robust growth, driven by several key factors. The increasing demand for fresh and processed food products, coupled with the expansion of e-commerce and the growing need for temperature-sensitive pharmaceutical products, is fueling market expansion. Technological advancements, such as the adoption of automation, IoT-enabled monitoring systems, and energy-efficient refrigeration technologies, are further augmenting market growth.

The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with significant growth anticipated in emerging economies due to rising disposable incomes, evolving consumer preferences, and improving cold chain infrastructure. Market penetration rates vary significantly across regions, with developed markets exhibiting higher saturation levels compared to developing economies. The market is expected to see xx Million in market value by 2033.

Dominant Markets & Segments in Cold Storage Market

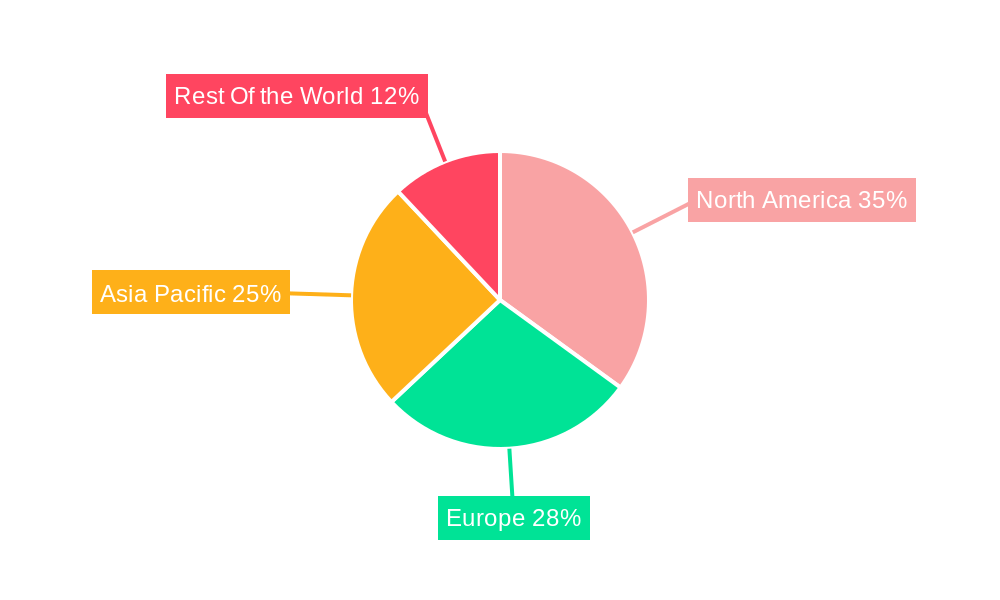

The cold storage market exhibits varying growth trajectories across different regions, construction types, temperature ranges, and applications.

- By Region: North America and Europe currently hold significant market shares, driven by strong demand for processed foods and pharmaceuticals. However, Asia-Pacific is projected to witness the fastest growth rate during the forecast period due to rising population, improving infrastructure, and escalating demand for refrigerated goods.

- By Construction Type: Bulk storage facilities currently dominate the market, reflecting the needs of large-scale food processors and distributors. However, the demand for specialized production stores and port-based cold storage is also growing.

- By Temperature: The frozen segment accounts for a larger market share compared to the chilled segment, primarily driven by the substantial demand for frozen food products.

- By Application: Fruits & vegetables, dairy, and meat & seafood are leading application segments, contributing to the bulk of market demand. The pharmaceutical segment is also showing significant growth.

Key Growth Drivers:

- Developing Economies: Rapid urbanization and rising disposable incomes are driving demand in emerging economies.

- E-commerce Expansion: The rise of online grocery and pharmaceutical deliveries fuels the demand for efficient cold chain logistics.

- Government Initiatives: Supportive policies and infrastructure development in several countries are bolstering market growth.

Cold Storage Market Product Analysis

The cold storage market showcases a dynamic product landscape, with continuous advancements in refrigeration technologies, automation, and intelligent monitoring systems. Recent innovations focus on enhancing energy efficiency, reducing operational costs, and improving temperature control precision. These improvements are crucial to maintain the quality of temperature-sensitive goods while minimizing spoilage and waste, leading to increased market acceptance. The integration of IoT sensors allows for real-time monitoring, optimizing energy consumption and reducing maintenance costs, a major competitive advantage.

Key Drivers, Barriers & Challenges in Cold Storage Market

Key Drivers:

- Technological advancements in refrigeration and automation.

- Rising demand for temperature-sensitive products.

- Increasing urbanization and changing consumer lifestyles.

- Stringent regulatory frameworks driving investment in updated facilities.

Challenges:

- High capital investment for setting up cold storage facilities.

- Fluctuations in energy prices influencing operational costs.

- Maintaining a robust and reliable cold chain across the supply chain.

- Stringent regulations regarding food safety and quality control.

Growth Drivers in the Cold Storage Market Market

The market expansion is propelled by technological innovations enhancing efficiency and cost-effectiveness, the burgeoning demand for chilled and frozen goods, and supportive governmental policies fostering infrastructure development within the cold chain industry. The rising popularity of e-commerce for groceries and pharmaceuticals is further contributing to the significant demand for reliable cold storage solutions.

Challenges Impacting Cold Storage Market Growth

The industry faces challenges such as high upfront investment costs in infrastructure and maintaining consistently low temperatures, especially in developing regions with unreliable power grids. Strict regulations and compliance requirements also impose significant costs on operators. Moreover, optimizing cold chain logistics across diverse geographical areas presents logistical complexities. Lastly, intense competition among existing players and potential new entrants presents an ongoing hurdle to maintaining consistent profitability.

Key Players Shaping the Cold Storage Market Market

- Kloosterboer

- Tippmann Group

- Snowman Logistics Pvt Ltd

- Burris Logistics

- Congebac Inc

- Cloverleaf Cold Storage

- The United States Cold Storage

- Lineage Logistics Holdings

- NewCold

- VX Cold Chain Logistics

- Constellation Cold Logistics

- Nichirei Corporation

- Americold Logistics LLC

Significant Cold Storage Market Industry Milestones

- March 2023: Lineage Logistics established a new Southern Europe headquarters in Madrid, signifying expansion and strengthening its European network.

- March 2023: Americold Property Trust launched a facility extension in Santa Perpetua, Barcelona, increasing storage capacity and service offerings in Spain.

Future Outlook for Cold Storage Market Market

The cold storage market is poised for continued expansion, driven by sustained growth in the food and pharmaceutical sectors, e-commerce growth, and ongoing technological advancements. Strategic investments in automated systems, improved energy efficiency, and expansion into developing markets represent key opportunities for market players. This will lead to enhanced operational efficiency and improved responsiveness to the evolving demands of a dynamic global market.

Cold Storage Market Segmentation

-

1. Construction Type

- 1.1. Bulk storage

- 1.2. Production stores

- 1.3. Ports

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits & Vegetables

- 3.2. Dairy, Fish, Meat, & Seafood

- 3.3. Processed Food

- 3.4. Pharmaceuticals

- 3.5. Others

Cold Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest Of the World

Cold Storage Market Regional Market Share

Geographic Coverage of Cold Storage Market

Cold Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Bulk storage

- 5.1.2. Production stores

- 5.1.3. Ports

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits & Vegetables

- 5.3.2. Dairy, Fish, Meat, & Seafood

- 5.3.3. Processed Food

- 5.3.4. Pharmaceuticals

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest Of the World

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. North America Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Bulk storage

- 6.1.2. Production stores

- 6.1.3. Ports

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits & Vegetables

- 6.3.2. Dairy, Fish, Meat, & Seafood

- 6.3.3. Processed Food

- 6.3.4. Pharmaceuticals

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Europe Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Bulk storage

- 7.1.2. Production stores

- 7.1.3. Ports

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits & Vegetables

- 7.3.2. Dairy, Fish, Meat, & Seafood

- 7.3.3. Processed Food

- 7.3.4. Pharmaceuticals

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Asia Pacific Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Bulk storage

- 8.1.2. Production stores

- 8.1.3. Ports

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits & Vegetables

- 8.3.2. Dairy, Fish, Meat, & Seafood

- 8.3.3. Processed Food

- 8.3.4. Pharmaceuticals

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. Rest Of the World Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Bulk storage

- 9.1.2. Production stores

- 9.1.3. Ports

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits & Vegetables

- 9.3.2. Dairy, Fish, Meat, & Seafood

- 9.3.3. Processed Food

- 9.3.4. Pharmaceuticals

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kloosterboer

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tippmann Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Snowman Logistics Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burris Logistics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Congebac Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cloverleaf Cold Storage

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The United States Cold Storage

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lineage Logistics Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NewCold

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 VX Cold Chain Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Constellation Cold Logistics**List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Nichirei Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Americold Logistics LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Kloosterboer

List of Figures

- Figure 1: Global Cold Storage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 3: North America Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 4: North America Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 5: North America Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 6: North America Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 11: Europe Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 12: Europe Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 13: Europe Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 14: Europe Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 19: Asia Pacific Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 20: Asia Pacific Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 21: Asia Pacific Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 22: Asia Pacific Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest Of the World Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 27: Rest Of the World Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Rest Of the World Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 29: Rest Of the World Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 30: Rest Of the World Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest Of the World Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest Of the World Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest Of the World Cold Storage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 2: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cold Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 10: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 11: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 15: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 18: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 19: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Storage Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Cold Storage Market?

Key companies in the market include Kloosterboer, Tippmann Group, Snowman Logistics Pvt Ltd, Burris Logistics, Congebac Inc, Cloverleaf Cold Storage, The United States Cold Storage, Lineage Logistics Holdings, NewCold, VX Cold Chain Logistics, Constellation Cold Logistics**List Not Exhaustive, Nichirei Corporation, Americold Logistics LLC.

3. What are the main segments of the Cold Storage Market?

The market segments include Construction Type, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.68 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

March 2023: Lineage Logistics, one of the top global suppliers of temperature-controlled industrial REIT and logistics solutions, established a new Southern Europe headquarters in Madrid, Spain. Lineage's new offices in Madrid demonstrate the company's ongoing commitment to the area and create the groundwork for future expansion. Also, the increasing attention on Southern Europe strengthens ties to the hub network of Lineage Logistics in Northern Europe and elsewhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Storage Market?

To stay informed about further developments, trends, and reports in the Cold Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence