Key Insights

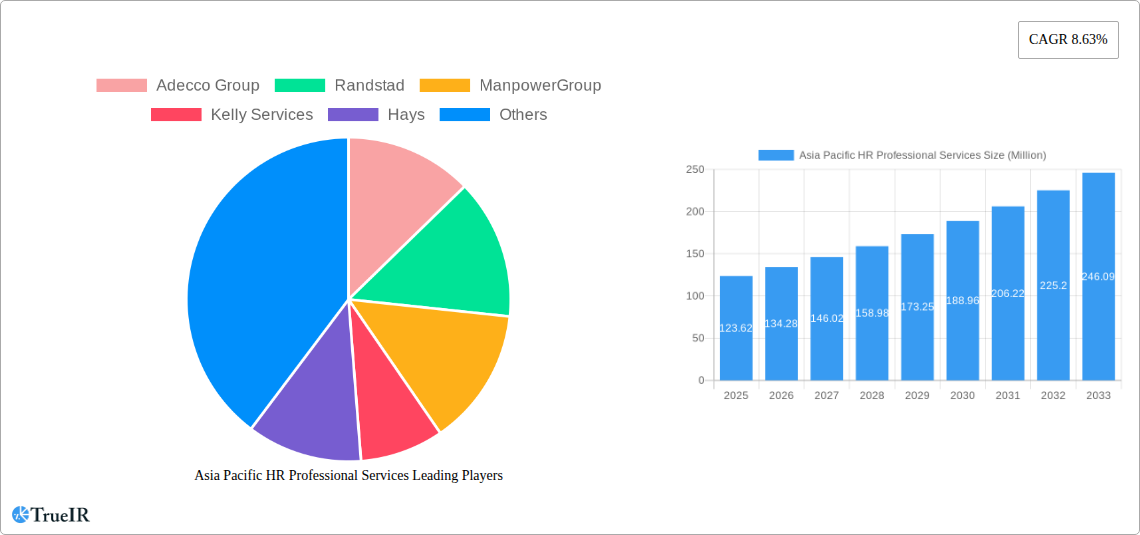

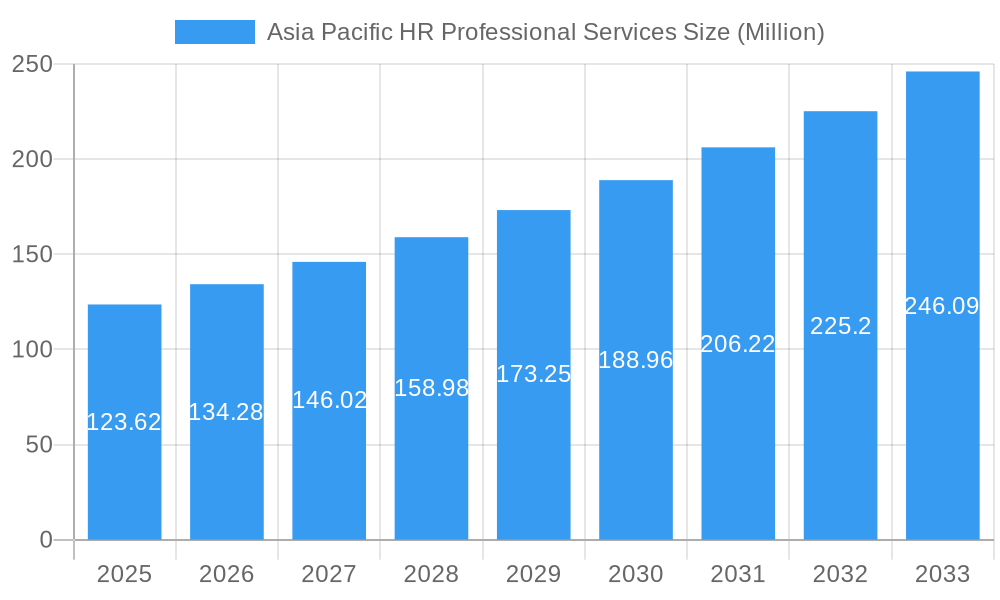

The Asia Pacific HR professional services market, valued at $123.62 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.63% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, the region's burgeoning economies and increasing workforce necessitate sophisticated HR solutions. Secondly, the rising adoption of technology, including HR technology (HRTech) and artificial intelligence (AI) in recruitment, talent management, and payroll processing, fuels market growth. Furthermore, the increasing focus on employee engagement, well-being, and diversity & inclusion initiatives further boosts demand for specialized HR services. Leading players like Adecco Group, Randstad, ManpowerGroup, and others are strategically investing in technological advancements and expanding their service portfolios to capture this growing market share. Competition is fierce, however, with smaller, agile firms offering niche services vying for market position.

Asia Pacific HR Professional Services Market Size (In Million)

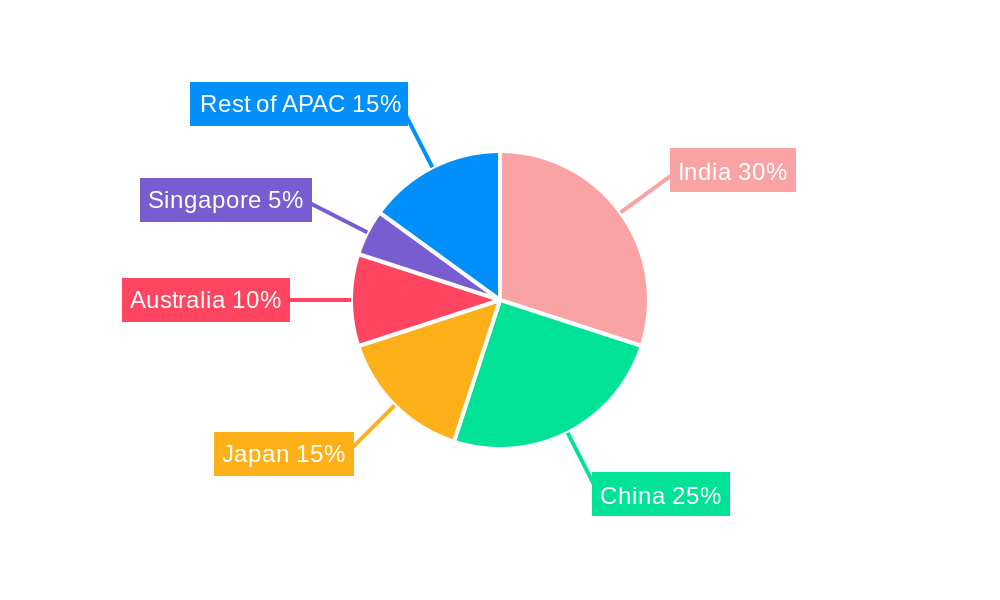

The market's segmentation likely encompasses various service offerings such as recruitment process outsourcing (RPO), HR consulting, payroll management, talent acquisition, and learning & development. Geographical variations within the Asia Pacific region are expected, with countries like India, China, Japan, Australia, and Singapore presenting significant market opportunities due to their advanced economies and large workforces. While the specific regional breakdown is unavailable, it's reasonable to assume that these nations account for the majority of market share, with growth varying based on economic development and regulatory frameworks within each respective country. Challenges include regulatory changes, evolving workforce demographics, and the need to consistently adapt to technological advancements to maintain a competitive edge. The overall forecast indicates a promising future for HR professional services in Asia Pacific, presenting significant opportunities for growth and innovation for both established players and emerging firms.

Asia Pacific HR Professional Services Company Market Share

Asia Pacific HR Professional Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific HR professional services market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data from the historical period (2019-2024) to provide a robust and reliable prediction of future market trends. The report covers market size exceeding $XX Million, exploring key players like Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer, and delves into crucial segments influencing growth.

Asia Pacific HR Professional Services Market Structure & Competitive Landscape

The Asia Pacific HR professional services market exhibits a moderately concentrated structure, with the top 10 players holding an estimated xx% market share in 2025. Concentration ratios are expected to fluctuate slightly over the forecast period due to mergers and acquisitions (M&A) activity and the entry of new players. Innovation in areas such as AI-driven recruitment tools and data analytics is a significant driver, while regulatory changes impacting data privacy and labor laws create ongoing challenges. Product substitutes, such as in-house recruitment teams and freelance platforms, exert moderate competitive pressure. The market is segmented by service type (e.g., recruitment, outsourcing, consulting) and industry vertical (e.g., technology, finance, healthcare).

- Market Concentration: Top 10 players hold xx% market share (2025).

- M&A Activity: An estimated xx Million USD worth of M&A transactions occurred in the historical period, with a projected xx Million USD in the forecast period.

- Innovation Drivers: AI-powered recruitment tools, data analytics, and specialized niche services.

- Regulatory Impacts: Data privacy regulations (e.g., GDPR-like regulations in various APAC countries) and evolving labor laws are key factors.

- Product Substitutes: Increasing adoption of in-house recruitment and freelance platforms.

- End-User Segmentation: Diverse across industries (technology, finance, manufacturing, etc.), company size (SMEs to large enterprises), and service needs.

Asia Pacific HR Professional Services Market Trends & Opportunities

The Asia Pacific HR professional services market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors, including a rising demand for skilled labor, increasing adoption of technology in HR processes, and a growing preference for flexible work arrangements. Technological shifts, such as the integration of AI and machine learning in recruitment and talent management, are significantly altering the competitive landscape. The market penetration rate of these technologies is projected to increase from xx% in 2025 to xx% by 2033. Changing consumer preferences, including a greater emphasis on work-life balance and employee well-being, also influence the demand for specialized HR services. Competitive dynamics are shaped by the constant need for innovation, cost optimization, and strategic alliances to gain market share. Market size is projected to surpass $XX Million by 2033.

Dominant Markets & Segments in Asia Pacific HR Professional Services

China, India, and Australia are the dominant markets in the Asia Pacific region, driven by strong economic growth, a burgeoning middle class, and a large pool of skilled and unskilled labor.

- Key Growth Drivers in China: Rapid economic expansion, significant investment in infrastructure, and increasing demand for skilled professionals in technology and manufacturing.

- Key Growth Drivers in India: Large and young workforce, growing IT sector, and government initiatives promoting skill development.

- Key Growth Drivers in Australia: Robust economy, a high demand for specialized skills, and a favorable regulatory environment.

- Dominant Segments: Recruitment services, particularly for specialized roles (technology, finance), and HR consulting are major segments. The outsourcing segment is also experiencing considerable growth.

The detailed analysis reveals that China's market dominance is largely attributed to its substantial economic growth and extensive infrastructure development. Its vast workforce, coupled with government initiatives fostering skill development, further bolsters the market's expansion. India's expanding IT sector and proactive government policies similarly contribute to its strong market performance. Meanwhile, Australia benefits from its strong economy and a high demand for specialized skills. These factors combined, illustrate the nuanced yet robust nature of the Asia Pacific HR professional services market.

Asia Pacific HR Professional Services Product Analysis

The Asia Pacific HR professional services market is witnessing significant product innovation, with the increasing adoption of cloud-based solutions, AI-powered recruitment tools, and data analytics platforms. These technologies are enhancing efficiency, improving decision-making, and creating new opportunities for competitive advantage. The market fit of these innovations is high, driven by the increasing need for agile and data-driven HR solutions. The integration of these technologies with traditional HR services is also driving market growth.

Key Drivers, Barriers & Challenges in Asia Pacific HR Professional Services

Key Drivers: Rapid economic growth across several APAC nations, increasing demand for skilled labor, technological advancements (AI, big data), and government initiatives promoting workforce development are key drivers. For example, initiatives such as the "Make in India" campaign have spurred significant demand for HR services.

Challenges: Stringent data privacy regulations, varying labor laws across different countries, supply chain disruptions impacting talent acquisition, and intense competition from established players and new entrants are key challenges. For example, supply chain disruptions caused by the pandemic highlighted the vulnerability of recruitment processes dependent on international travel and physical interactions. The estimated impact on revenue loss for the top 10 players due to these disruptions was approximately $XX Million in 2022.

Growth Drivers in the Asia Pacific HR Professional Services Market

The market's growth is propelled by robust economic expansion in key APAC nations, the rising need for specialized skills across various sectors, increased adoption of technology, and governmental policies aiming to improve workforce development. This creates a favorable environment for HR service providers, presenting significant opportunities for expansion and innovation.

Challenges Impacting Asia Pacific HR Professional Services Growth

The Asia Pacific HR services market faces challenges including navigating diverse regional regulations, supply chain complexities, intense competition, and evolving technological demands. These issues require adaptability and strategic planning from market players.

Key Players Shaping the Asia Pacific HR Professional Services Market

Significant Asia Pacific HR Professional Services Industry Milestones

- July 2023: Kelly Services announced strategic restructuring to enhance efficiency and effectiveness.

- May 2024: ManpowerGroup reaffirmed its commitment to VivaTech as a Platinum Partner.

Future Outlook for Asia Pacific HR Professional Services Market

The Asia Pacific HR professional services market is poised for continued growth, driven by sustained economic expansion, technological innovation, and evolving workforce needs. Strategic opportunities exist in leveraging AI and data analytics to enhance service offerings, focusing on specialized talent acquisition, and expanding into emerging markets. The market's potential is substantial, with ample room for growth and innovation in the coming years.

Asia Pacific HR Professional Services Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-as-a-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll And Compensation Management

- 2.5. Other Functions

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia-Pacific

Asia Pacific HR Professional Services Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia Pacific HR Professional Services Regional Market Share

Geographic Coverage of Asia Pacific HR Professional Services

Asia Pacific HR Professional Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.3. Market Restrains

- 3.3.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.4. Market Trends

- 3.4.1. Recruitment and Talent Acquisition is the Largest Segment in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific HR Professional Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-as-a-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll And Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adecco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Randstad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ManpowerGroup

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kelly Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hays

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Half

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegis Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hudson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Michael Page

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Adecco Group

List of Figures

- Figure 1: Global Asia Pacific HR Professional Services Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific HR Professional Services Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Provider Type 2025 & 2033

- Figure 4: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Provider Type 2025 & 2033

- Figure 5: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Provider Type 2025 & 2033

- Figure 7: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Function Type 2025 & 2033

- Figure 8: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Function Type 2025 & 2033

- Figure 9: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Function Type 2025 & 2033

- Figure 11: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Geography 2025 & 2033

- Figure 16: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Geography 2025 & 2033

- Figure 17: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Geography 2025 & 2033

- Figure 19: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 13: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 14: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 15: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific HR Professional Services?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Asia Pacific HR Professional Services?

Key companies in the market include Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, Mercer.

3. What are the main segments of the Asia Pacific HR Professional Services?

The market segments include Provider Type, Function Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

6. What are the notable trends driving market growth?

Recruitment and Talent Acquisition is the Largest Segment in the Market Studied.

7. Are there any restraints impacting market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

8. Can you provide examples of recent developments in the market?

May 2024: ManpowerGroup is set to reaffirm its status as a critical contributor to the 8th edition of Europe's largest startup and tech event, VivaTech, by returning as a Platinum Partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific HR Professional Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific HR Professional Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific HR Professional Services?

To stay informed about further developments, trends, and reports in the Asia Pacific HR Professional Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence