Key Insights

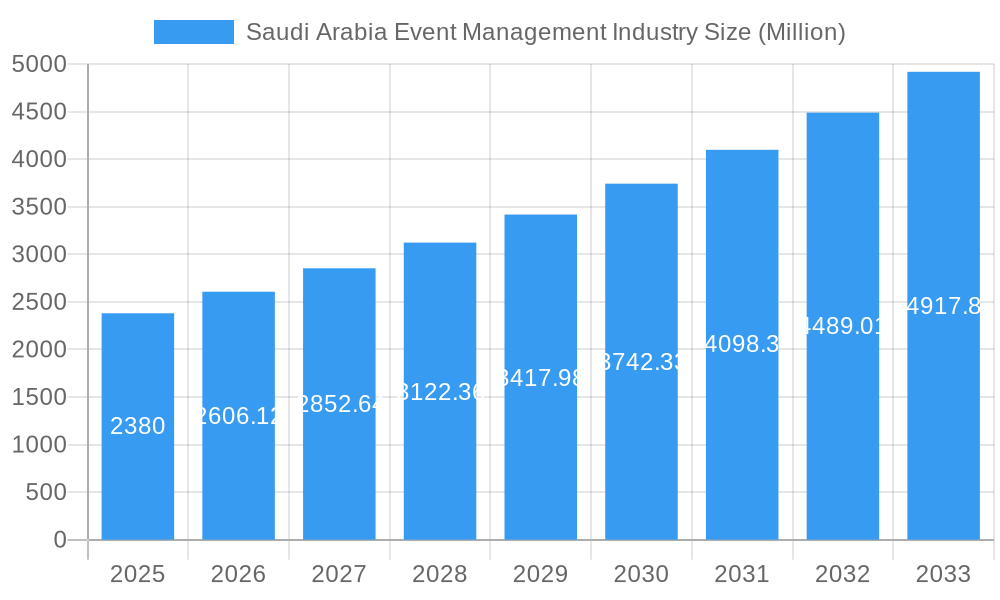

The Saudi Arabian event management industry is experiencing robust growth, projected to reach a market size of $2.38 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.74% from 2019 to 2033. This expansion is fueled by several key drivers. Significant government investments in infrastructure development, tourism promotion, and diversification of the economy under Vision 2030 are creating a fertile ground for the events sector. The increasing number of international and domestic conferences, exhibitions, and entertainment events further stimulates demand for professional event management services. Moreover, a burgeoning young population with high disposable income and a growing preference for experiential activities contributes to the industry's dynamism. The rise of digital technologies and innovative event formats also plays a crucial role, enabling more efficient planning, marketing, and execution of events. While challenges exist, such as competition and the need to continuously adapt to evolving consumer preferences, the long-term outlook for the Saudi Arabian event management industry remains exceptionally positive.

Saudi Arabia Event Management Industry Market Size (In Billion)

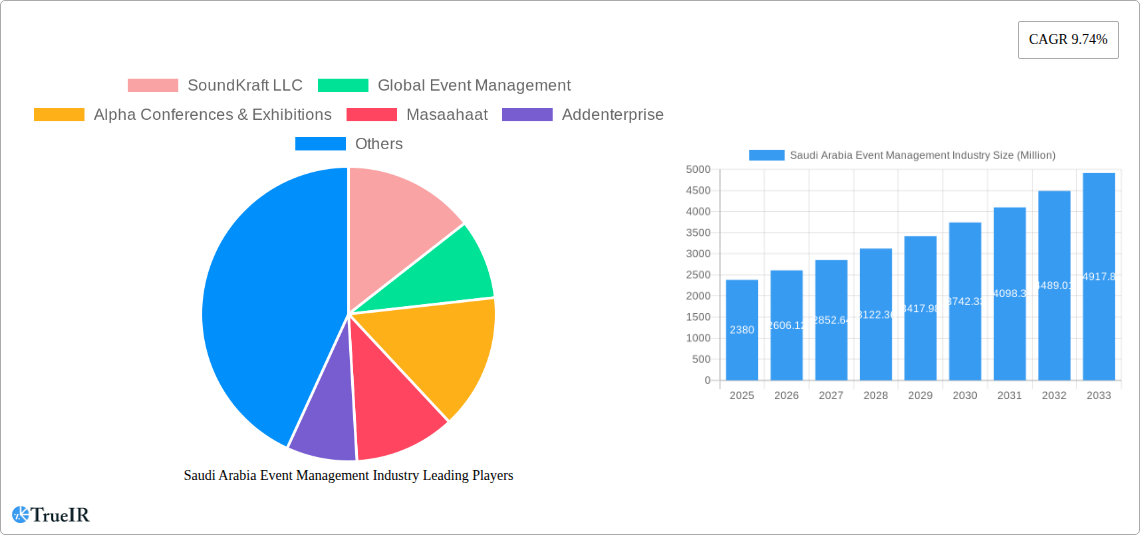

The industry's segmentation likely includes various niche areas like corporate events, conferences & exhibitions, weddings, festivals, and concerts. Major players such as SoundKraft LLC, Global Event Management, and Riyadh Exhibitions Company Ltd are currently shaping the market landscape, showcasing its competitive yet rapidly expanding nature. Further growth will be driven by leveraging technology to enhance event experiences, adopting sustainable practices, and catering to evolving cultural preferences within the Saudi Arabian context. Future market analysis should consider deeper segmentation data for a more precise forecast, taking into account regional variations within Saudi Arabia itself and incorporating the influence of emerging technologies and global trends on event planning and execution. The projected CAGR suggests substantial expansion over the forecast period (2025-2033), indicating significant opportunities for both established and emerging players within the industry.

Saudi Arabia Event Management Industry Company Market Share

Saudi Arabia Event Management Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia event management industry, covering market size, trends, competitive landscape, and future outlook from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and a forecast period of 2025-2033. This report is crucial for investors, industry professionals, and anyone seeking to understand the dynamic opportunities and challenges within this rapidly evolving sector. The market is expected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Saudi Arabia Event Management Industry Market Structure & Competitive Landscape

The Saudi Arabian event management industry exhibits a moderately concentrated market structure, with a Herfindahl-Hirschman Index (HHI) estimated at XX in 2025. Key players such as SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, and KonozRetaj hold significant market share, although the market is also characterized by numerous smaller players. The industry is driven by innovation in event technology, including virtual and hybrid event platforms, and augmented reality/virtual reality (AR/VR) experiences. Government initiatives promoting tourism and diversification of the Saudi economy significantly impact market growth, encouraging foreign investment and large-scale event projects. However, regulatory changes and obtaining necessary permits can sometimes pose challenges. Product substitutes, like online webinars or virtual conferences, pose a moderate competitive threat, albeit one that is currently offset by the demand for in-person networking and experiential events. End-user segmentation is diverse, encompassing corporate events, conferences, exhibitions, festivals, and private celebrations. Mergers and acquisitions (M&A) activity is moderate, with approximately XX M&A deals recorded between 2019 and 2024, primarily focused on smaller companies merging to increase their market reach and service offerings.

Saudi Arabia Event Management Industry Market Trends & Opportunities

The Saudi Arabia event management market is experiencing robust growth, driven by Vision 2030's focus on diversifying the economy and developing the tourism sector. The market size increased from XX Million in 2019 to XX Million in 2024, and is projected to reach XX Million by 2025 and XX Million by 2033. This growth is fueled by several key trends:

- Technological advancements: Increased adoption of event technology, including registration software, virtual event platforms, and data analytics tools, is streamlining operations and enhancing the attendee experience.

- Shifting consumer preferences: A growing demand for immersive and experiential events is driving innovation in event formats and designs. Consumers increasingly seek unique and memorable experiences, leading to a rise in niche events and themed experiences.

- Competitive dynamics: Increased competition among event management companies is driving innovation and efficiency, leading to more competitive pricing and a wider range of services.

The market penetration rate for event management services is relatively high within urban areas, but there remains significant potential for growth in smaller cities and regions. The increasing disposable income and a young, tech-savvy population further contribute to market expansion.

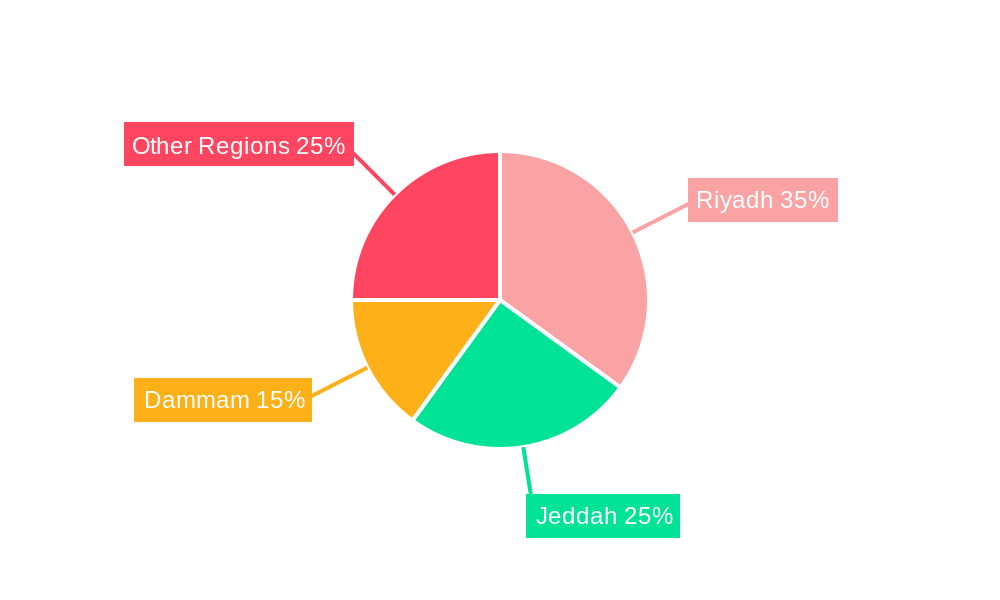

Dominant Markets & Segments in Saudi Arabia Event Management Industry

The Riyadh region dominates the Saudi Arabian event management market, accounting for approximately XX% of total revenue in 2025, driven by:

- Robust infrastructure: Riyadh possesses world-class venues and infrastructure, making it an attractive destination for large-scale events.

- Government support: Government initiatives focused on developing Riyadh as a major global events hub are attracting significant investment and promoting economic activity.

- Strong corporate presence: Riyadh's concentration of major corporations increases demand for corporate events and conferences.

Other key segments driving market growth include:

- Corporate events: The burgeoning corporate sector fuels demand for meetings, conferences, and incentive travel events.

- Exhibitions and trade shows: The government's focus on attracting foreign investment and promoting local industries is driving growth in exhibitions and trade shows.

- Cultural and entertainment events: The growing tourism sector is fueling demand for festivals, concerts, and other entertainment events.

Saudi Arabia Event Management Industry Product Analysis

The Saudi Arabian event management industry offers a wide range of services, from basic event planning and execution to specialized services such as virtual event production, destination management, and attendee engagement strategies. Recent innovations include the integration of data analytics to optimize event planning and measure ROI. Technological advancements are shaping the industry, allowing for more customized and immersive event experiences through AR/VR applications and interactive elements. The success of event management firms hinges on their ability to leverage technology, create unique experiences, and establish strong relationships with clients and venues.

Key Drivers, Barriers & Challenges in Saudi Arabia Event Management Industry

Key Drivers:

- Government initiatives to diversify the economy and boost the tourism sector are creating significant opportunities for event management companies.

- Technological advancements are enhancing event planning, execution, and attendee experiences.

- Increasing disposable income and a growing young population fuel demand for entertainment and events.

Challenges:

- Competition from international and local event management companies creates pressure on pricing and profitability. This competition is estimated to reduce average margins by approximately XX% by 2033.

- Regulatory complexities and obtaining necessary permits can create delays and add to operational costs.

- Supply chain disruptions can affect the availability of essential resources and services, impacting event delivery.

Growth Drivers in the Saudi Arabia Event Management Industry Market

The Saudi Arabia event management industry's growth is propelled by Vision 2030's focus on economic diversification and tourism development. This initiative fuels increased investment in infrastructure and event venues, stimulating demand for various events. Furthermore, technological advancements, including AR/VR and data analytics, enhance the event experience, attract participants, and increase overall efficiency. A young and growing population with higher disposable incomes also drives the need for diverse events and entertainment options.

Challenges Impacting Saudi Arabia Event Management Industry Growth

Challenges include navigating complex regulatory frameworks, procuring necessary permits efficiently, and ensuring consistent supply chain operations amidst potential disruptions. The competitive landscape, with both domestic and international players, presents challenges, especially in pricing and securing clients. Maintaining skilled labor and adapting to evolving technological advancements are also crucial aspects of overcoming these challenges.

Key Players Shaping the Saudi Arabia Event Management Industry Market

- SoundKraft LLC

- Global Event Management

- Alpha Conferences & Exhibitions

- Masaahaat

- Addenterprise

- SELA

- Luxury KSA

- Heights

- Benchmark Events

- Riyadh Exhibitions Company Ltd

- Markable General Trading LLC

- KonozRetaj

List Not Exhaustive

Significant Saudi Arabia Event Management Industry Milestones

- December 2023: Comma, a leading Saudi Arabian PR and event management agency, partnered with UK-based ALTER, expanding its capabilities and market reach.

- January 2024: dmg events announced the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show, indicating a significant investment in the sports and leisure sector.

Future Outlook for Saudi Arabia Event Management Industry Market

The Saudi Arabia event management industry is poised for continued growth, driven by Vision 2030's ambitious goals. Increased investment in infrastructure, coupled with technological advancements and a growing young population, will fuel demand. Strategic partnerships and mergers & acquisitions will further shape the competitive landscape. Opportunities exist in developing niche events, leveraging technology for enhanced experiences, and expanding into new regions. The market presents a significant potential for both established players and new entrants.

Saudi Arabia Event Management Industry Segmentation

-

1. End User

- 1.1. Corporate

- 1.2. Individual

- 1.3. Public

-

2. Type

- 2.1. Music Concert

- 2.2. Festivals

- 2.3. Sports

- 2.4. Exhibitions and Conferences

- 2.5. Corporate Events and Seminars

- 2.6. Other Types

-

3. Revenue Source

- 3.1. Ticket Sale

- 3.2. Sponsorship

- 3.3. Other Revenue Sources

Saudi Arabia Event Management Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Event Management Industry Regional Market Share

Geographic Coverage of Saudi Arabia Event Management Industry

Saudi Arabia Event Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.3. Market Restrains

- 3.3.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.4. Market Trends

- 3.4.1. The Market is Influenced by Major International Events Being Held in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Event Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Corporate

- 5.1.2. Individual

- 5.1.3. Public

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Music Concert

- 5.2.2. Festivals

- 5.2.3. Sports

- 5.2.4. Exhibitions and Conferences

- 5.2.5. Corporate Events and Seminars

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Revenue Source

- 5.3.1. Ticket Sale

- 5.3.2. Sponsorship

- 5.3.3. Other Revenue Sources

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SoundKraft LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Event Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpha Conferences & Exhibitions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Masaahaat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Addenterprise

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SELA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Luxury KSA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heights

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benchmark Events

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riyadh Exhibitions Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Markable General Trading LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KonozRetaj **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SoundKraft LLC

List of Figures

- Figure 1: Saudi Arabia Event Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Event Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 6: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 7: Saudi Arabia Event Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Event Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 14: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 15: Saudi Arabia Event Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Event Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Event Management Industry?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Saudi Arabia Event Management Industry?

Key companies in the market include SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, KonozRetaj **List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Event Management Industry?

The market segments include End User, Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

6. What are the notable trends driving market growth?

The Market is Influenced by Major International Events Being Held in Saudi Arabia.

7. Are there any restraints impacting market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

8. Can you provide examples of recent developments in the market?

January 2024 - dmg events, an international exhibition organizer, is preparing to introduce two upcoming events in Saudi Arabia: the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Event Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Event Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Event Management Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Event Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence