Key Insights

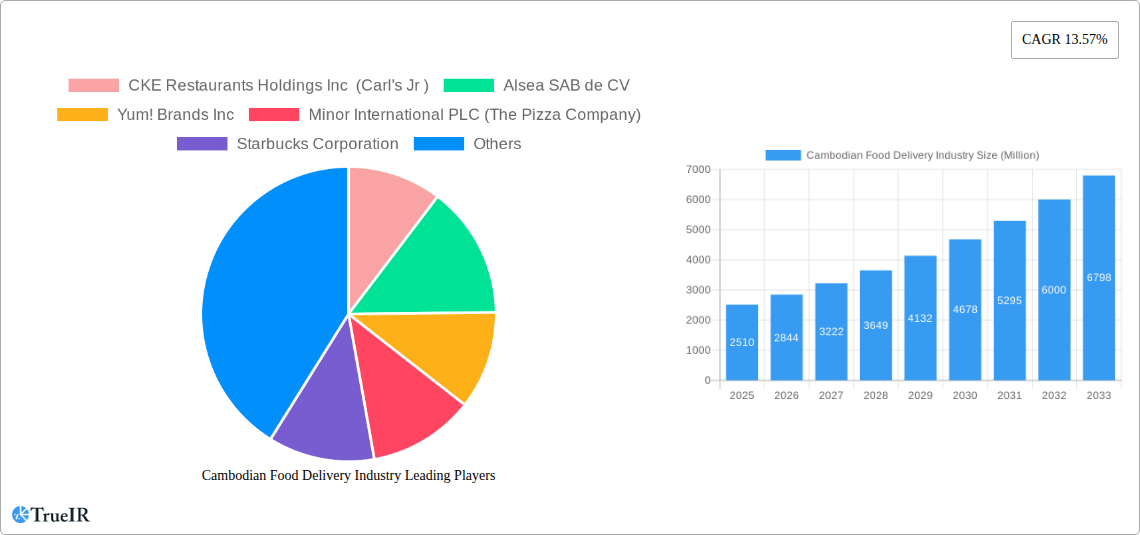

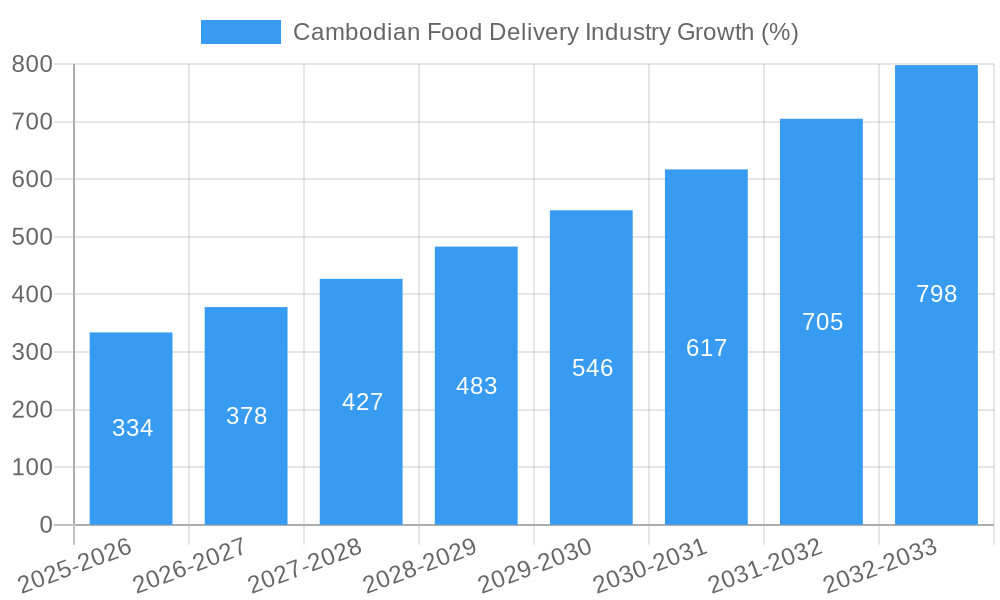

The Cambodian food delivery market, valued at $2.51 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.57% from 2025 to 2033. This surge is fueled by several key factors. The increasing penetration of smartphones and affordable internet access is empowering a digitally savvy consumer base eager to embrace convenient online ordering. Rapid urbanization and evolving lifestyles are also contributing to the market's expansion, with busy professionals and young demographics increasingly reliant on food delivery services to manage their time effectively. Furthermore, a burgeoning middle class with rising disposable incomes fuels demand for diverse culinary experiences readily available through delivery platforms. Competition is intensifying, with both international players like Domino's and local establishments vying for market share, driving innovation in delivery services, menu offerings, and customer loyalty programs. The market is segmented across diverse restaurant types, including full-service restaurants, fast food outlets, cafes, and street food vendors, each catering to specific consumer preferences and price points. The dominance of chained outlets versus independent outlets will likely shift over the forecast period, reflecting the adaptability and marketing reach of larger corporations.

The market's growth is not without challenges. Infrastructure limitations, particularly in rural areas, can hinder efficient delivery networks. Maintaining food quality and hygiene standards during transit is also a critical concern impacting consumer trust and brand reputation. Moreover, regulatory frameworks governing food safety and delivery operations need to adapt to the industry's rapid expansion to ensure consumer protection. The successful players will likely be those that effectively navigate these challenges by investing in technology, logistics, and robust quality control measures, while simultaneously adapting to the evolving demands of Cambodian consumers. The forecast period promises significant growth opportunities for businesses that understand the intricacies of this dynamic market, capitalizing on its potential while mitigating the inherent risks.

Cambodian Food Delivery Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Cambodian food delivery industry, offering invaluable insights for investors, businesses, and stakeholders. With a focus on market trends, competitive landscapes, and future growth projections, this report utilizes data from 2019-2024 (Historical Period), with estimations for 2025 (Base Year and Estimated Year), and forecasts extending to 2033 (Forecast Period). The study covers a market valued at over XX Million USD in 2025, projecting significant growth over the next decade.

Cambodian Food Delivery Industry Market Structure & Competitive Landscape

The Cambodian food delivery market exhibits a diverse structure with varying degrees of market concentration across different segments. While independent outlets still dominate in terms of sheer numbers, chained outlets, particularly in the fast-food segment, are rapidly gaining traction, driven by increasing consumer demand for convenience and brand recognition. The market's competitive intensity is moderate, with several key players vying for market share.

Market Concentration: While precise concentration ratios are unavailable for the entire market, analysis suggests a relatively fragmented landscape with a Herfindahl-Hirschman Index (HHI) estimated to be around xx, indicating moderate concentration. The fast-food sector demonstrates higher concentration compared to other segments like street food.

Innovation Drivers: Technological advancements, particularly in mobile ordering and delivery platforms, are key innovation drivers. The rise of digital payment methods further fuels market expansion.

Regulatory Impacts: Regulatory frameworks concerning food safety, hygiene, and licensing influence market dynamics. Changes in these regulations could significantly impact operational costs and market entry barriers.

Product Substitutes: Traditional dine-in restaurants and home-cooked meals remain primary substitutes. However, the convenience offered by food delivery services continues to drive sector growth.

End-User Segmentation: The market caters to a broad range of consumers, from young professionals to families. Geographic location and income levels also influence consumption patterns.

M&A Trends: The acquisition of Domino's Pizza businesses in Cambodia, Malaysia, and Singapore by DPE in August 2022 for USD 214 million highlights the growing interest in the region. Further consolidation is expected in the coming years.

Cambodian Food Delivery Industry Market Trends & Opportunities

The Cambodian food delivery market is experiencing robust growth, fueled by several key factors. The rising adoption of smartphones and increasing internet penetration significantly drives the market. Changing lifestyles and a preference for convenience are boosting demand for food delivery services across various segments.

Market size is projected to reach XX Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is still relatively low, with significant untapped potential for expansion. Technological shifts, including the adoption of advanced delivery logistics and customer relationship management (CRM) systems, are enhancing operational efficiency and optimizing customer experience.

Consumer preferences are gradually evolving, with a growing demand for healthier food options and diversified cuisines. Competition in the market is intensifying, prompting companies to invest in brand building, loyalty programs, and innovative service offerings to maintain market share.

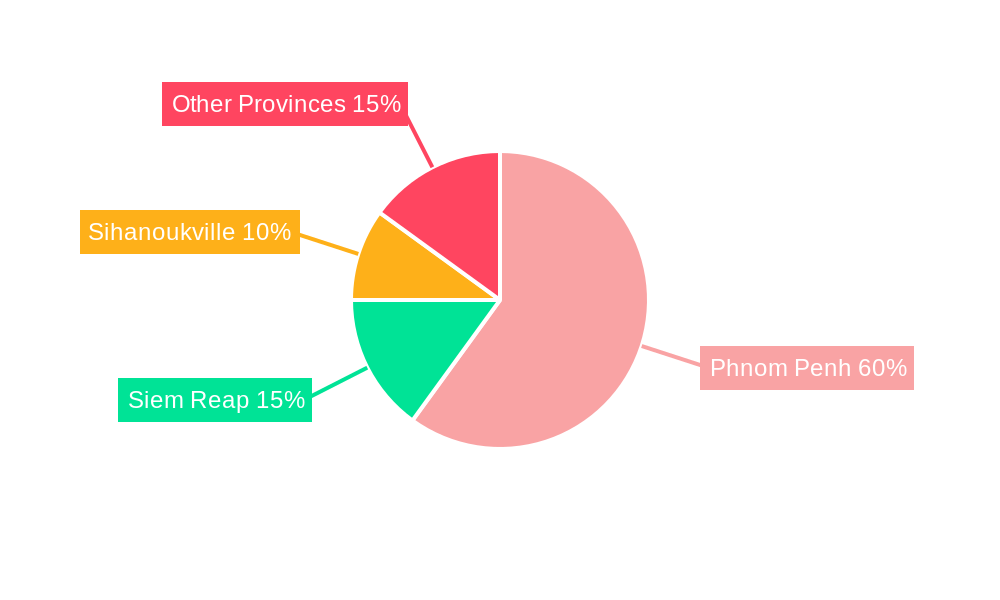

Dominant Markets & Segments in Cambodian Food Delivery Industry

The Phnom Penh metropolitan area constitutes the most significant market, followed by Siem Reap and other urban centers. Growth is primarily driven by increasing urbanization, rising disposable incomes, and a young, tech-savvy population.

Key Growth Drivers:

- Improving Infrastructure: Investments in transportation networks and digital infrastructure are facilitating efficient delivery services.

- Government Policies: Supportive government policies aimed at fostering entrepreneurship and promoting digital adoption further boost market growth.

- Rising Disposable Incomes: Increasing disposable incomes amongst urban populations fuel spending on food delivery services.

Dominant Segments:

- Type: Fast food and cafes/bars currently dominate, with full-service restaurants showing moderate growth potential. The 100% home delivery/takeaway segment is expanding rapidly.

- Structure: Independent outlets currently make up the majority of the market, but chained outlets are increasingly encroaching upon their share as international players expand.

Cambodian Food Delivery Industry Product Analysis

Product innovation focuses on enhancing delivery speed, optimizing order accuracy, and improving the customer experience through mobile applications offering diverse payment options and real-time order tracking. Competitive advantages stem from superior technology, efficient logistics networks, and strategic partnerships with restaurants.

Key Drivers, Barriers & Challenges in Cambodian Food Delivery Industry

Key Drivers:

- Technological advancements enabling faster, more efficient delivery and customer-friendly applications.

- Rising disposable incomes and increasing urbanization fueling demand for convenience.

- Government initiatives promoting digitalization and entrepreneurship.

Key Challenges:

- Traffic congestion in major cities creates delivery delays and increases operational costs. This can account for approximately xx% of delivery failures.

- Lack of reliable infrastructure in some areas limits service reach and affects efficiency.

- Intense competition puts pressure on pricing and profit margins.

Growth Drivers in the Cambodian Food Delivery Industry Market

The market's growth is propelled by rising smartphone penetration, increasing internet access, and evolving consumer preferences towards convenience. Government support for the digital economy and investments in logistics infrastructure further contribute to growth.

Challenges Impacting Cambodian Food Delivery Industry Growth

Challenges include infrastructure limitations, traffic congestion impacting delivery times, and the need for consistent food safety regulations and enforcement. Competition is fierce, necessitating continuous innovation and cost optimization.

Key Players Shaping the Cambodian Food Delivery Industry Market

- CKE Restaurants Holdings Inc (Carl's Jr)

- Alsea SAB de CV

- Yum! Brands Inc

- Minor International PLC (The Pizza Company)

- Starbucks Corporation

- Papa John's International Inc

- Restaurant Brands International Inc

- Thalias Co Ltd

- Domino's Pizza Inc.

- Berkshire Hathaway Inc (Dairy Queen)

Significant Cambodian Food Delivery Industry Industry Milestones

- August 2021: Pizza Hut enters the Cambodian market through a partnership with United Food Group.

- August 2022: Starbucks launches online sales in Cambodia through Wingmall.

- August 2022: DPE acquires Domino's Pizza businesses in Cambodia, Malaysia, and Singapore for USD 214 million. This significantly impacted market consolidation and competitive dynamics.

Future Outlook for Cambodian Food Delivery Industry Market

The Cambodian food delivery market is poised for sustained growth, driven by rising disposable incomes, expanding internet and smartphone penetration, and further development of the country's digital infrastructure. Strategic partnerships, innovative service offerings, and effective marketing strategies will be crucial for companies seeking to capitalize on this significant market potential. The continued expansion of e-commerce and digital payment systems will further contribute to market expansion.

Cambodian Food Delivery Industry Segmentation

-

1. Type

- 1.1. Full Service Restaurants

- 1.2. Self-service Restaurants

- 1.3. Fast Food

- 1.4. Street Stalls/Kiosks

- 1.5. Cafes/Bars

- 1.6. 100% Home Delivery/Takeaway

-

2. Structure

- 2.1. Chained Outlets

- 2.2. Independent Outlets

Cambodian Food Delivery Industry Segmentation By Geography

- 1. Cambodia

Cambodian Food Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Application of Collagen in End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Growing Inclination Toward Clean Label Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Online Food Delivery Apps

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodian Food Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Full Service Restaurants

- 5.1.2. Self-service Restaurants

- 5.1.3. Fast Food

- 5.1.4. Street Stalls/Kiosks

- 5.1.5. Cafes/Bars

- 5.1.6. 100% Home Delivery/Takeaway

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CKE Restaurants Holdings Inc (Carl's Jr )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alsea SAB de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Minor International PLC (The Pizza Company)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Starbucks Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Papa John's International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Restaurant Brands International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thalias Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Domino's Pizza Inc.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berkshire Hathaway Inc (Dairy Queen)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CKE Restaurants Holdings Inc (Carl's Jr )

List of Figures

- Figure 1: Cambodian Food Delivery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cambodian Food Delivery Industry Share (%) by Company 2024

List of Tables

- Table 1: Cambodian Food Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cambodian Food Delivery Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Cambodian Food Delivery Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Cambodian Food Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Cambodian Food Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cambodian Food Delivery Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Cambodian Food Delivery Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: Cambodian Food Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodian Food Delivery Industry?

The projected CAGR is approximately 13.57%.

2. Which companies are prominent players in the Cambodian Food Delivery Industry?

Key companies in the market include CKE Restaurants Holdings Inc (Carl's Jr ), Alsea SAB de CV, Yum! Brands Inc, Minor International PLC (The Pizza Company), Starbucks Corporation, Papa John's International Inc, Restaurant Brands International Inc, Thalias Co Ltd, Domino's Pizza Inc., Berkshire Hathaway Inc (Dairy Queen).

3. What are the main segments of the Cambodian Food Delivery Industry?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Application of Collagen in End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

Growing Influence of Online Food Delivery Apps.

7. Are there any restraints impacting market growth?

Growing Inclination Toward Clean Label Products.

8. Can you provide examples of recent developments in the market?

In August 2022, DPE announced the purchase of Domino's Pizza businesses in Cambodia, Malaysia, and Singapore for USD 214 million. A binding agreement has been entered into between DPE and Impress Foods Pte Ltd, which owns Domino's Pizza Singapore and Domino's Pizza Cambodia at 100%; Mikenwill (M) Sdn Bhd, which holds 100% of Dommal Food Services Sdn Bhd, the Malaysian franchise holder; and with minority Cambodian shareholders for the remaining 35%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodian Food Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodian Food Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodian Food Delivery Industry?

To stay informed about further developments, trends, and reports in the Cambodian Food Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence