Key Insights

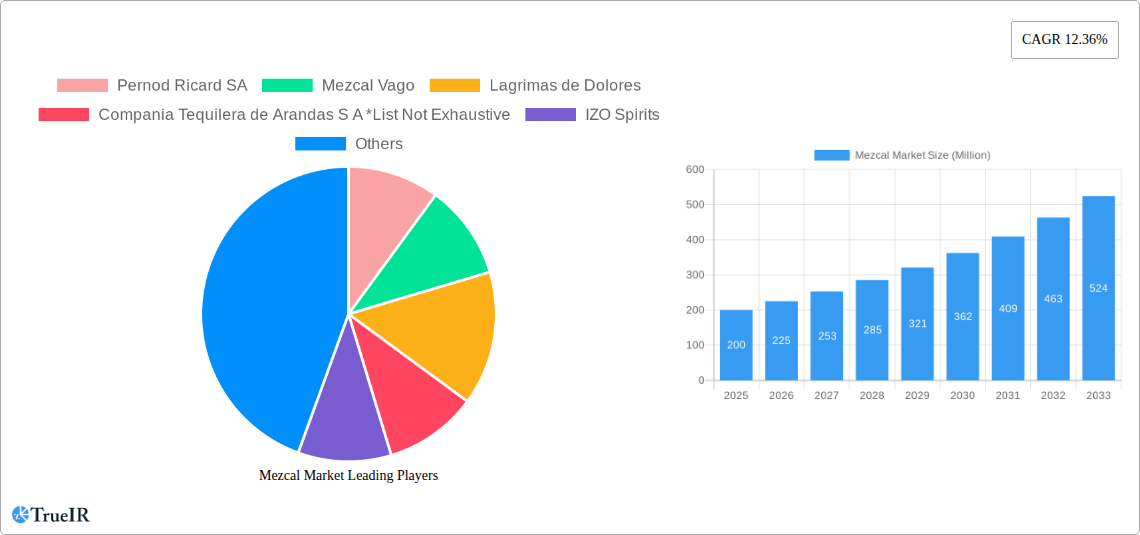

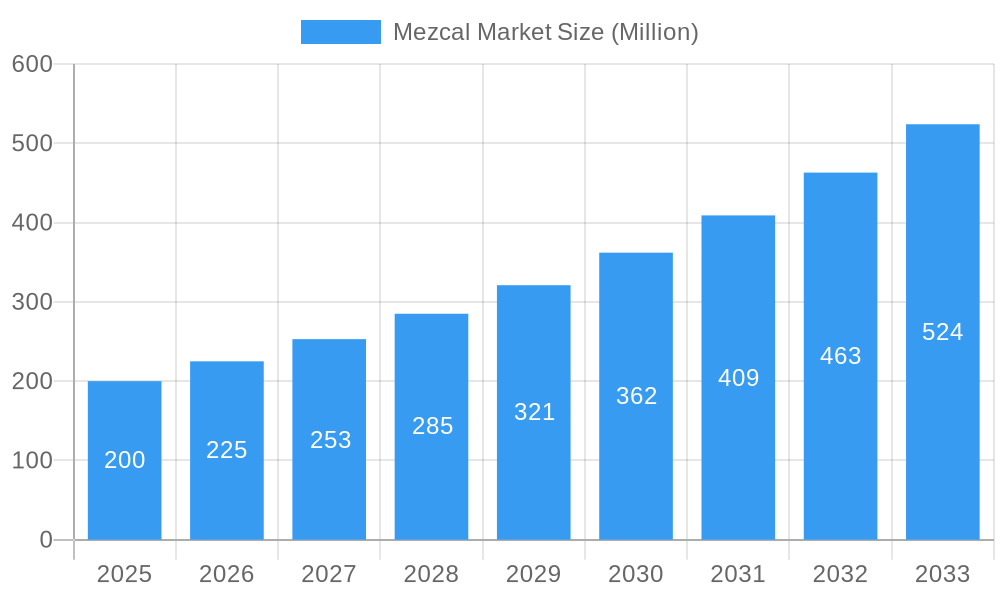

The global mezcal market, valued at XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.36% from 2025 to 2033. This surge is fueled by several key factors. Increasing consumer awareness of mezcal's unique characteristics and artisanal production methods is driving demand, particularly among younger, affluent demographics seeking premium spirits with a strong sense of place and heritage. The growing popularity of agave-based spirits within the broader cocktail culture, coupled with innovative product development (e.g., flavored mezcals, ready-to-drink options) further contributes to market expansion. The off-trade channel, encompassing retail sales, is experiencing significant growth, as consumers increasingly purchase mezcal for home consumption. Geographic expansion into new markets, particularly in Europe and Asia, presents lucrative opportunities for producers. However, challenges remain, including the potential for supply chain disruptions due to the slow-growing nature of agave plants, and ensuring sustainable and ethical sourcing practices.

Mezcal Market Market Size (In Million)

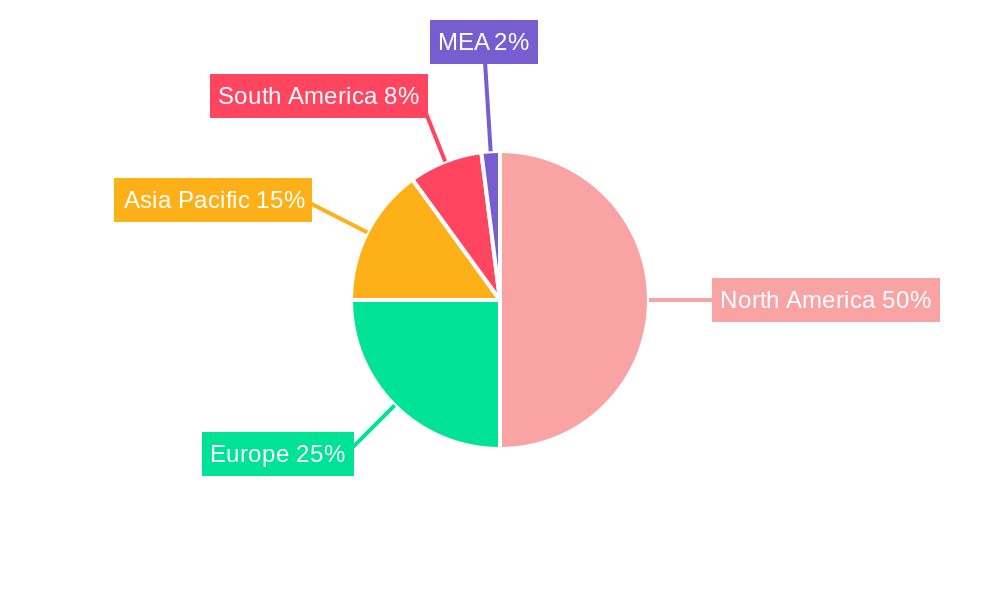

Despite the challenges, the market's segmentation offers opportunities. The reposado and añejo segments are experiencing faster growth compared to joven, reflecting a preference for more complex flavor profiles. Key players like Pernod Ricard SA, Mezcal Vago, and others are leveraging their brand recognition and distribution networks to capitalize on market trends. Regional variations in preferences exist, with North America currently dominating the market, followed by Europe and select regions in Asia Pacific. Continued investment in marketing and brand building, coupled with responsible sourcing and production, will be crucial to navigating the complexities of this dynamic and growing market. Furthermore, the increased focus on sustainable practices and ethical sourcing will play a crucial role in shaping the market's long-term trajectory.

Mezcal Market Company Market Share

Mezcal Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Mezcal market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate the market's current state and future trajectory. Expect detailed breakdowns of market segments, competitive landscapes, and key growth drivers, all presented with clear data visualization and actionable insights. The report includes a detailed analysis of market size reaching xx Million by 2033, demonstrating robust growth and significant market potential.

Mezcal Market Structure & Competitive Landscape

The global Mezcal market is characterized by a moderately concentrated landscape, with several key players vying for market share. While a precise concentration ratio requires detailed market share data (currently unavailable and estimated at xx%), the presence of both large multinational corporations like Pernod Ricard SA and Diageo PLC alongside smaller, artisanal producers like Mezcal Vago and Ilegal Mezcal creates a dynamic competitive environment. Innovation drives market expansion through product diversification (e.g., variations in aging and agave types) and premiumization strategies. Regulatory frameworks, particularly those related to agave production and labeling, significantly impact market operations. The market witnesses growing interest in sustainable and ethically sourced Mezcal, which is prompting significant investment in eco-friendly practices. Product substitutes, such as other spirits (tequila, whiskey), compete for consumer preference. End-user segmentation is predominantly driven by demographics (age, income) and consumption patterns (occasional vs. regular drinkers). The M&A landscape is active, as seen in recent acquisitions such as Diageo PLC's acquisition of Mezcal Unión, indicating strong consolidation trends and investor confidence. The estimated volume of M&A activities between 2019 and 2024 reached xx Million USD.

Mezcal Market Trends & Opportunities

The Mezcal market exhibits substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Rising consumer awareness of Mezcal's unique flavor profile and artisanal production methods is a critical driver. The increasing popularity of premium and super-premium spirits, coupled with the growing preference for authentic and handcrafted products, significantly impacts market expansion. Technological advancements in agave cultivation and distillation techniques contribute to product quality improvements and production efficiency. Changes in consumer preferences, marked by increased demand for ethically and sustainably produced beverages, further influence the market's trajectory. Competitive dynamics are shaped by both established players expanding their portfolios and new entrants capitalizing on the market's growth potential. Market penetration rates vary across regions, with higher penetration in established markets like the US and Mexico and substantial untapped potential in emerging markets. The global market value is estimated to reach xx Million by 2025 and xx Million by 2033.

Dominant Markets & Segments in Mezcal Market

The North American market, particularly the United States, currently dominates the global Mezcal market. This dominance stems from increased consumer awareness, established distribution networks, and high disposable income levels. Within product types, Mezcal Joven holds the largest market share due to its accessibility and affordability.

Key Growth Drivers:

- Increased Consumer Demand: Rising consumer awareness and appreciation for the unique taste of Mezcal.

- Premiumization Trend: The growing demand for higher-quality, premium Mezcal products.

- Strong Export Markets: Robust export growth into key markets like the US and Europe.

Market Dominance Analysis: The US market's dominance is further reinforced by the presence of strong distribution channels, a highly developed retail sector and increasing popularity within the cocktail culture. However, Mexico remains the largest production area, enjoying robust domestic consumption and exports. The on-trade channel (bars, restaurants) significantly contributes to the total market revenue due to the popularity of Mezcal cocktails.

Mezcal Market Product Analysis

Product innovation within the Mezcal market centers on exploring diverse agave varietals, experimenting with aging techniques, and enhancing product presentation. The competitive advantage lies in producing high-quality, authentic Mezcal that aligns with consumer preferences for premium, sustainably sourced products. Technological advancements in distillation and bottling processes streamline production, reduce costs, and improve product consistency. The market showcases a strong fit between the unique artisanal nature of Mezcal and the increasing demand for authentic and handcrafted beverages.

Key Drivers, Barriers & Challenges in Mezcal Market

Key Drivers:

- Growing consumer preference: The rising popularity of premium spirits, cocktails and the desire for authentic experiences drives significant growth.

- Product diversification: The introduction of new product variations (e.g., different agave types, aging processes) expands market appeal.

- Expansion into new markets: The growth in Mezcal’s global popularity facilitates entry into numerous new markets.

Challenges and Restraints:

- Supply chain limitations: The dependence on specific agave varieties, coupled with slow agave growth, creates supply chain vulnerabilities. The impact of these limitations is estimated to restrain the market growth by xx% over the forecast period.

- Regulatory hurdles: Varying regulations regarding Mezcal production and labeling across different countries pose challenges to international expansion.

- Competitive pressures: The increasing number of players in the market intensifies competition, impacting pricing and market share.

Growth Drivers in the Mezcal Market Market

The growth of the Mezcal market is driven by rising global demand for premium spirits, a growing appreciation for artisanal and handcrafted products, and increasing investments in sustainable production practices. The expansion into new international markets, coupled with innovative product development, further fuels market expansion. Economic factors, such as rising disposable incomes in key consumer markets, enhance the affordability and accessibility of Mezcal for a broader range of consumers. Supportive government policies and regulations in some regions facilitate growth and investor confidence.

Challenges Impacting Mezcal Market Growth

Challenges include the limited availability of agave and potential supply chain disruptions. Regulatory complexities concerning labeling and production standards across different countries hinder market access and expansion. Intense competition among established and emerging brands puts pressure on pricing and profit margins. These factors can negatively impact market growth and require innovative strategies from market participants to mitigate their effects.

Key Players Shaping the Mezcal Market Market

- Pernod Ricard SA

- Mezcal Vago

- Lagrimas de Dolores

- Compania Tequilera de Arandas S A

- IZO Spirits

- El Silencio Holdings INC

- Fidencio Mezcal

- William Grant & Sons Ltd

- Ilegal Mezcal SA

- Rey Campero

- Diageo PLC

Significant Mezcal Market Industry Milestones

- October 2021: IZO Spirits launched a limited-edition Mezcal Añejo Cenizo, showcasing innovation within the premium segment.

- January 2022: Diageo PLC's acquisition of Mezcal Unión significantly expanded its presence in the Mezcal market, demonstrating consolidation trends within the industry.

- March 2022: Compañia Tequilera de Arandas S.A. de C.V.'s Lobos 1707 launched in Canada, highlighting the growing international demand for premium Mezcal.

Future Outlook for Mezcal Market Market

The Mezcal market is poised for continued growth, driven by increasing consumer demand, product innovation, and expansion into new geographical markets. Strategic partnerships and collaborations within the industry will play a crucial role in shaping the market's future. The potential for further premiumization and the rising demand for sustainable and ethically sourced Mezcal present significant opportunities for growth and market expansion. The market is expected to witness both consolidation amongst major players and the continued emergence of smaller, artisanal brands catering to niche consumer segments.

Mezcal Market Segmentation

-

1. Product Type

- 1.1. Mezcal Joven

- 1.2. Mezcal Reposado

- 1.3. Mezcal Anejo

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade Channel

-

2.2. Off-Trade Channel

- 2.2.1. Online Retail Stores

- 2.2.2. Offline Retail stores

Mezcal Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

- 3. Rest of the World

Mezcal Market Regional Market Share

Geographic Coverage of Mezcal Market

Mezcal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Premium Distilled Agave-Based Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mezcal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mezcal Joven

- 5.1.2. Mezcal Reposado

- 5.1.3. Mezcal Anejo

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade Channel

- 5.2.2. Off-Trade Channel

- 5.2.2.1. Online Retail Stores

- 5.2.2.2. Offline Retail stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mezcal Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mezcal Joven

- 6.1.2. Mezcal Reposado

- 6.1.3. Mezcal Anejo

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade Channel

- 6.2.2. Off-Trade Channel

- 6.2.2.1. Online Retail Stores

- 6.2.2.2. Offline Retail stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Mezcal Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mezcal Joven

- 7.1.2. Mezcal Reposado

- 7.1.3. Mezcal Anejo

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade Channel

- 7.2.2. Off-Trade Channel

- 7.2.2.1. Online Retail Stores

- 7.2.2.2. Offline Retail stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of the World Mezcal Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mezcal Joven

- 8.1.2. Mezcal Reposado

- 8.1.3. Mezcal Anejo

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade Channel

- 8.2.2. Off-Trade Channel

- 8.2.2.1. Online Retail Stores

- 8.2.2.2. Offline Retail stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Pernod Ricard SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mezcal Vago

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Lagrimas de Dolores

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Compania Tequilera de Arandas S A *List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 IZO Spirits

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 El Silencio Holdings INC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Fidencio Mezcal

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 William Grant & Sons Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ilegal Mezcal SA

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rey Campero

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Diageo PLC

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global Mezcal Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mezcal Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Mezcal Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Mezcal Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Mezcal Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Mezcal Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Mezcal Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mezcal Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Mezcal Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Mezcal Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Mezcal Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Mezcal Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Mezcal Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Mezcal Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Rest of the World Mezcal Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Rest of the World Mezcal Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Rest of the World Mezcal Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Rest of the World Mezcal Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Rest of the World Mezcal Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mezcal Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Mezcal Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Mezcal Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Mezcal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Mezcal Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Mezcal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Mezcal Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Mezcal Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Mezcal Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mezcal Market?

The projected CAGR is approximately 12.36%.

2. Which companies are prominent players in the Mezcal Market?

Key companies in the market include Pernod Ricard SA, Mezcal Vago, Lagrimas de Dolores, Compania Tequilera de Arandas S A *List Not Exhaustive, IZO Spirits, El Silencio Holdings INC, Fidencio Mezcal, William Grant & Sons Ltd, Ilegal Mezcal SA, Rey Campero, Diageo PLC.

3. What are the main segments of the Mezcal Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Increasing Demand for Premium Distilled Agave-Based Beverages.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

March 2022: Compañia Tequilera de Arandas S.A. de C.V.'s Lobos 1707, the ultra-premium tequila and mezcal brand, announced its launch into the Canadian market. Lobos 1707 commemorated its expansion with an official launch event in Toronto.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mezcal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mezcal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mezcal Market?

To stay informed about further developments, trends, and reports in the Mezcal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence