Key Insights

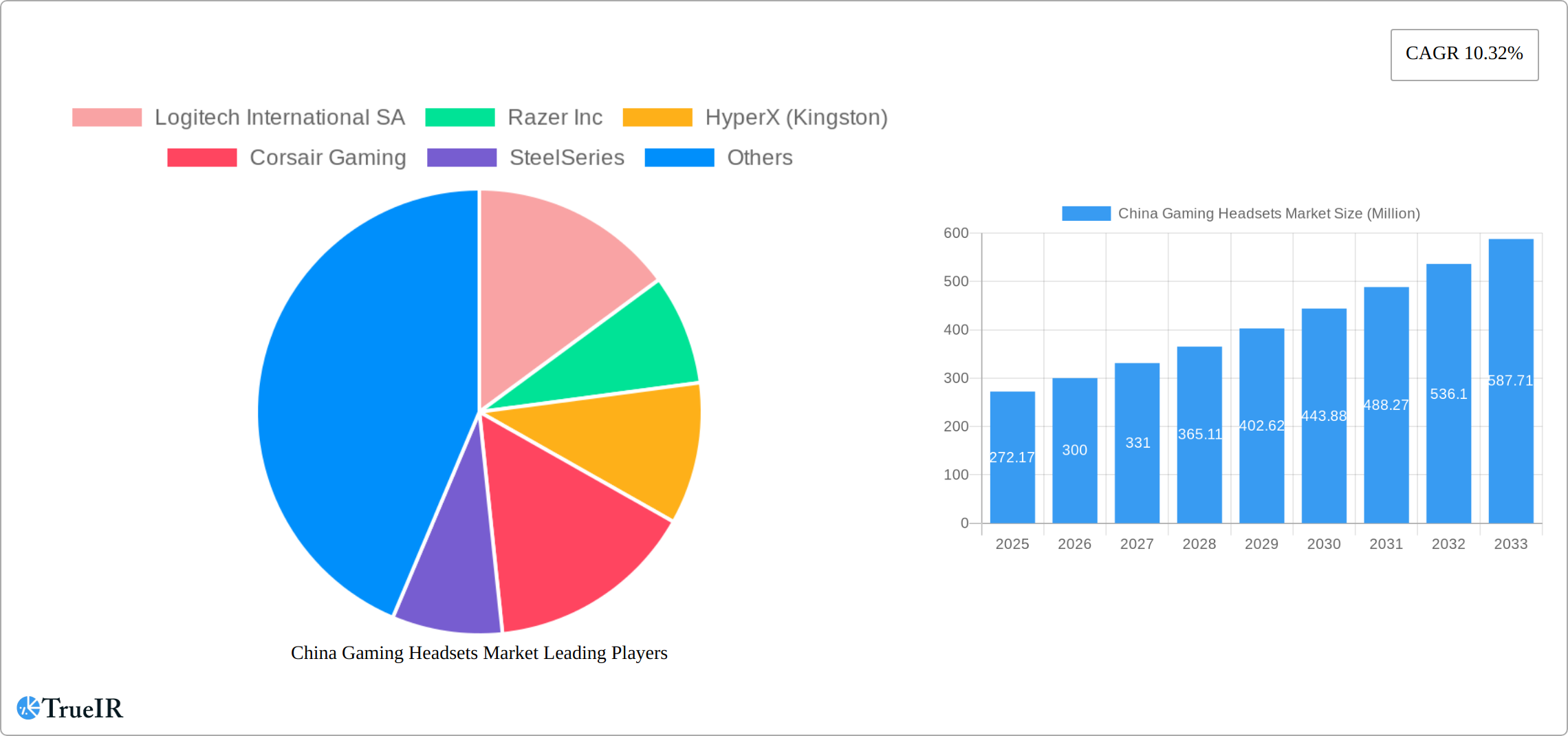

The China gaming headset market, valued at $272.17 million in 2025, is projected to experience robust growth, driven by a burgeoning esports scene, rising disposable incomes among young consumers, and increasing penetration of high-speed internet and mobile gaming. The market's Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the increasing popularity of mobile gaming, the rise of cloud gaming services offering seamless access to high-quality gaming experiences, and the growing demand for immersive audio experiences to enhance gameplay. Furthermore, technological advancements leading to improved sound quality, comfort, and features like noise cancellation are fueling market growth. The competitive landscape is characterized by both established international brands like Logitech, Razer, and HyperX, and emerging domestic players catering to specific preferences within the Chinese market. While challenges such as potential economic fluctuations and intense competition exist, the overall market outlook remains positive, with continued growth expected throughout the forecast period.

The segment breakdown (missing from the provided data) likely includes various headset types such as wired, wireless, and Bluetooth headsets, categorized further by features like noise cancellation and surround sound. Price points will also be a key segmentation factor, with varying levels of quality and features influencing consumer choices. Regional variations within China itself could also be a significant segmentation factor, with demand varying across urban and rural areas, and influenced by local consumer preferences and purchasing power. The dominance of specific brands will likely vary across segments, reflecting their strengths in particular technologies and target audiences. To maintain their market share, established companies will need to innovate and adapt their strategies to meet evolving consumer demands and address the competitive pressure from both domestic and international rivals.

China Gaming Headsets Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning China gaming headsets market, offering invaluable insights for industry stakeholders, investors, and strategists. With a comprehensive analysis spanning the period 2019-2033, this report leverages extensive market research and data to forecast market trends, identify key players, and unveil lucrative opportunities within this rapidly evolving sector. The study period covers 2019-2024 (historical period), with 2025 as the base and estimated year, and a forecast period extending to 2033. Expect detailed analysis across various segments, key drivers, challenges, and the competitive landscape, all presented in a clear and concise manner. The report’s value is amplified by the inclusion of recent industry developments. The total market size is predicted to reach xx Million by 2033.

China Gaming Headsets Market Structure & Competitive Landscape

The China gaming headsets market exhibits a moderately concentrated structure, with key players holding significant market share. However, the market also demonstrates a high level of dynamism, driven by continuous innovation in audio technology, evolving consumer preferences, and strategic mergers and acquisitions (M&A). The concentration ratio (CR4) is estimated at xx%, indicating a moderate level of market concentration. Innovation is a key driver, with companies continually striving to improve sound quality, comfort, and features such as noise cancellation and surround sound. Regulatory impacts, such as those related to product safety and e-waste management, play a minor role in shaping the market landscape. Product substitutes, such as traditional headphones and earbuds, present competition but have not significantly hindered market growth. The end-user segment is primarily comprised of young adults and gamers, fueling the market’s high growth. M&A activity has been relatively moderate in recent years, with xx major M&A deals recorded in the historical period. These transactions largely focused on enhancing product portfolios and expanding market reach.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: Advanced audio technologies, ergonomic design, integration of smart features.

- Regulatory Impacts: Product safety standards and environmental regulations.

- Product Substitutes: Traditional headphones, earbuds.

- End-User Segmentation: Primarily young adults and gamers.

- M&A Trends: xx major deals in the historical period (2019-2024).

China Gaming Headsets Market Trends & Opportunities

The China gaming headsets market has experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is expected to continue during the forecast period (2025-2033), driven by factors such as the increasing popularity of online gaming, the rising disposable incomes of young adults, and the proliferation of esports. Technological advancements, such as the development of high-fidelity audio technologies and the integration of advanced features like haptic feedback and spatial audio, are further propelling market expansion. Consumer preferences are shifting towards wireless headsets with improved comfort and longer battery life. Competitive dynamics remain intense, with established players and new entrants continuously vying for market share. Market penetration rates are increasing steadily, with an estimated xx% of gamers in China owning a gaming headset in 2025. Opportunities exist in developing advanced features, expanding into niche segments such as VR/AR gaming headsets, and tapping into the growing esports market. The predicted market size for 2033 is xx Million.

Dominant Markets & Segments in China Gaming Headsets Market

The China gaming headset market exhibits robust growth across diverse regions, with [Specific Province/Region, e.g., Guangdong] presently leading as the dominant market. This dominance is fueled by several key factors:

- Thriving Gaming Culture: A deeply ingrained and expansive gaming culture consistently drives demand for premium gaming headsets. This includes a wide range of genres, from massively multiplayer online games (MMOs) to mobile esports titles.

- High Internet & Mobile Penetration: China's extensive internet and mobile broadband infrastructure ensures seamless online gaming experiences, facilitating the growth of the online gaming community and their need for high-quality audio equipment.

- Booming Esports Ecosystem: The rapidly expanding esports industry, with significant professional leagues and tournaments, significantly fuels demand for sophisticated gaming headsets capable of delivering a competitive edge.

- Government Support & Regulatory Environment: While the regulatory landscape has shifted, a more nuanced approach to game regulation is allowing the market to continue to expand, contributing to market growth. [Optional: Add specific details about supportive policies if available].

- Rising Disposable Incomes: Increasing disposable incomes among young adults and a growing middle class contribute to higher spending on premium gaming accessories, including high-end headsets.

This leading region currently commands approximately [Specific Percentage]% of the total market share. Market segmentation encompasses product type (wired, wireless, Bluetooth, VR/AR), price range (budget, mid-range, premium), and platform compatibility (PC, consoles – including Playstation and Xbox, mobile, and cloud gaming platforms). The wireless segment, particularly Bluetooth headsets, is projected to demonstrate the most substantial growth due to enhanced convenience and portability, coupled with the rising popularity of mobile gaming.

China Gaming Headsets Market Product Analysis

The Chinese gaming headset market showcases a diverse product range, encompassing wired, wireless (including Bluetooth), and VR/AR compatible options with varying feature sets. Key technological advancements include: significantly improved audio drivers for superior sound quality and positional audio; advanced active noise cancellation (ANC) technologies to minimize distractions; integration with spatial audio processing (e.g., Dolby Atmos, DTS Headphone:X) for immersive gaming experiences; and increasingly sophisticated microphone technology for clear voice communication. Competitive advantages often stem from superior sound quality and fidelity, ergonomic and comfortable designs suitable for extended use, robust build quality ensuring longevity, and innovative features such as customizable RGB lighting and seamless software integration for personalized audio profiles and equalizer settings. Successful market penetration relies on aligning product features with the preferences and needs of specific gamer segments, including PC gamers, console gamers, mobile gamers, and esports professionals. Furthermore, the increasing importance of cross-platform compatibility is a key factor in product design and marketing.

Key Drivers, Barriers & Challenges in China Gaming Headsets Market

Key Drivers:

The market is propelled by the surging popularity of online and mobile gaming, a rising middle class with increasing disposable income, and ongoing technological advancements leading to improved audio quality and gaming immersion. Government support for the gaming industry further strengthens the market.

Challenges & Restraints:

Intense competition from numerous domestic and international brands, supply chain disruptions impacting manufacturing and distribution, and evolving regulatory landscapes create challenges. The prevalence of counterfeit products undermines market growth. Fluctuating currency exchange rates also create challenges for manufacturers and importers.

Growth Drivers in the China Gaming Headsets Market Market

Several key factors are driving the expansion of the China gaming headsets market. The proliferation of esports and competitive gaming is a major driver, alongside the increasing affordability and accessibility of gaming hardware, including gaming headsets. Technological advancements such as better noise cancellation and improved audio fidelity are key factors. Favorable government policies towards the gaming industry have also contributed to the market's growth.

Challenges Impacting China Gaming Headsets Market Growth

The market faces challenges from rising manufacturing costs, leading to higher product prices and impacting affordability. Intense competition among established and emerging players adds pressure on profit margins. Supply chain disruptions caused by geopolitical instability or natural disasters are significant risks. Regulatory changes related to product safety and environmental standards can significantly influence manufacturing costs and market access.

Key Players Shaping the China Gaming Headsets Market Market

- Logitech International SA (Logitech)

- Razer Inc (Razer)

- HyperX (Kingston) (HyperX)

- Corsair Gaming (Corsair)

- SteelSeries (SteelSeries)

- Audio-Technica Ltd (Audio-Technica)

- Sony Interactive Entertainment (Sony)

- Creative Technology (Creative)

- Skullcandy (Skullcandy)

- ROCCA

Significant China Gaming Headsets Market Industry Milestones

- March 2024: JBL expanded its Quantum Series headsets with the Quantum 100X/P and 360X/P, featuring wireless spatial audio virtualization with head-tracking for Xbox and PlayStation consoles. This significantly enhanced the audio experience for console gamers.

- April 2024: DPVR launched the E4 Arc VR headset with hand-tracking support utilizing Ultraleap's Leap Motion Controller 2, improving VR immersion and interaction. The turbo cooling system addressed a key limitation in VR headsets.

Future Outlook for China Gaming Headsets Market Market

The China gaming headsets market is poised for continued growth, driven by ongoing technological innovation, expansion of the esports industry, and increasing consumer adoption of high-quality audio experiences. Opportunities abound for companies that can develop innovative products, expand into niche markets, and tailor their offerings to specific gaming platforms and player preferences. The market shows significant potential for continued expansion, with a positive outlook fueled by a growing gaming community and technological advancements.

China Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

China Gaming Headsets Market Segmentation By Geography

- 1. China

China Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HyperX (Kingston)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corsair Gaming

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SteelSeries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Audio-Technica Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sony Interactive Entertainment

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Creative Technology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Skullcandy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corsair

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ROCCA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: China Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Gaming Headsets Market Share (%) by Company 2024

List of Tables

- Table 1: China Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: China Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: China Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: China Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: China Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: China Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: China Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: China Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: China Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: China Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: China Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: China Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: China Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: China Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: China Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Gaming Headsets Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gaming Headsets Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the China Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, HyperX (Kingston), Corsair Gaming, SteelSeries, Audio-Technica Ltd, Sony Interactive Entertainment, Creative Technology, Skullcandy, Corsair, ROCCA.

3. What are the main segments of the China Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 272.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

April 2024: DPVR announced the launch of the new E4 Arc VR headset with hand-tracking support. This DPVR E4 PC VR headset variant was equipped with a Leap Motion Controller 2 hand-tracking camera from Ultraleap. Ultraleap's Leap Motion 2 provided a tracking range of between 10 and 110 cm and a maximum field of view of 160° x 160°. The E4 Arc was also equipped with a turbo cooling system, which featured an improved fan model, optimized vapor chamber, and optimized fan operating logic. The headset also featured quickly replaceable cables for easier maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the China Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence