Key Insights

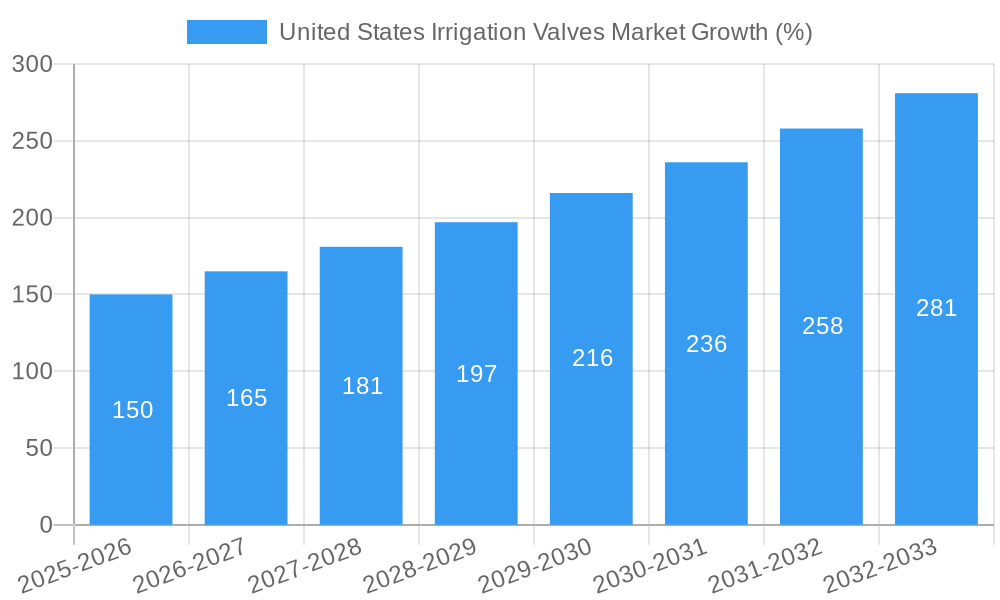

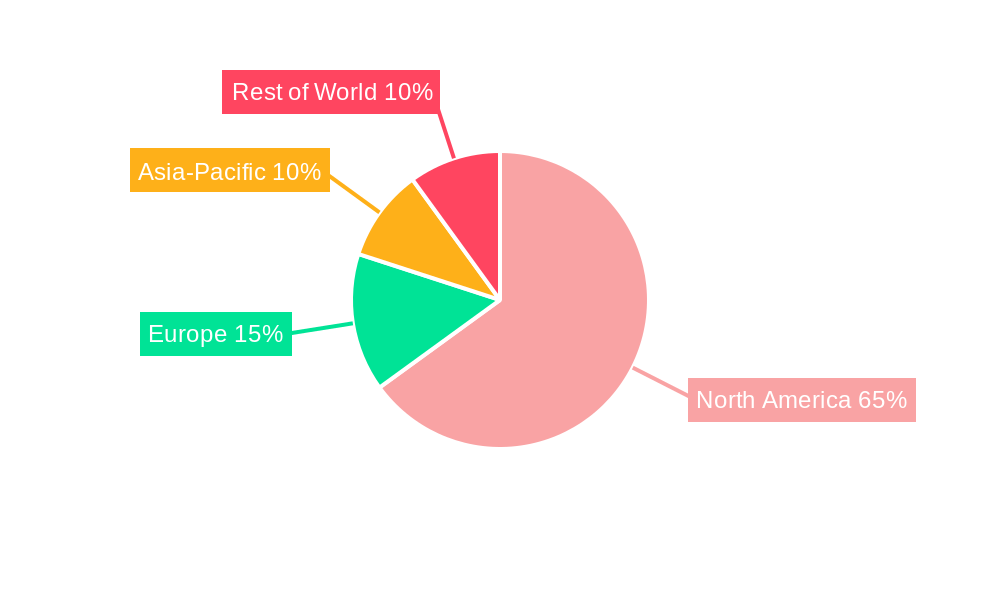

The United States irrigation valves market is experiencing robust growth, driven by several key factors. The increasing adoption of precision irrigation techniques, aimed at optimizing water usage and enhancing crop yields, is a significant driver. Farmers are increasingly embracing water-efficient irrigation systems, including drip irrigation and micro-sprinklers, which rely heavily on efficient and reliable valves. Furthermore, government initiatives promoting water conservation and sustainable agricultural practices are bolstering market expansion. Technological advancements in valve design, such as the introduction of smart valves with remote monitoring capabilities and automated control systems, are also contributing to growth. These smart valves improve water management, reduce labor costs, and enhance overall irrigation efficiency. The rising demand for improved water resource management, particularly in drought-prone regions across the US, is further fueling market expansion. While precise market sizing data for 2019-2024 is unavailable, we can infer substantial growth based on the stated forecast period (2025-2033) and the strong industry trends outlined above. A reasonable estimate, considering the market's current trajectory and projected CAGR, would place the 2024 market size at a figure significantly below the 2025 estimate but showing year-over-year growth. The market is segmented by valve type (ball valves, butterfly valves, gate valves, etc.), material (plastic, metal, etc.), and application (agricultural, municipal, industrial). The agricultural segment currently dominates, however, the municipal and industrial sectors are showing potential for future growth as water conservation becomes increasingly important across various industries.

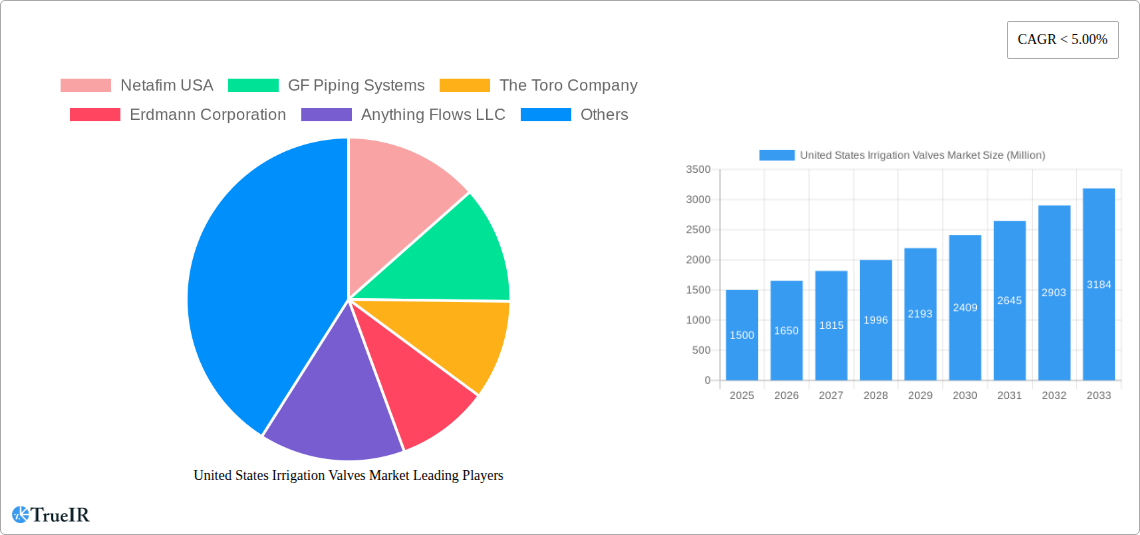

The forecast period of 2025-2033 suggests continued positive growth for the US irrigation valves market. This growth is projected to be fueled by ongoing advancements in smart irrigation technologies, increasing awareness of water scarcity, and the continuous expansion of precision agriculture. The market is likely to see consolidation among key players, with larger companies acquiring smaller firms to gain a competitive edge. Moreover, increasing investment in research and development will lead to the development of more efficient and durable irrigation valves, further stimulating market expansion. The market will likely witness increased competition, driving innovation and price optimization. A strategic focus on sustainable materials and environmentally friendly manufacturing processes will also play a crucial role in shaping the future trajectory of this market.

United States Irrigation Valves Market: A Comprehensive Report (2019-2033)

This dynamic report offers an in-depth analysis of the United States Irrigation Valves Market, providing crucial insights for stakeholders across the agricultural and non-agricultural sectors. With a detailed examination of market size, segmentation, competitive landscape, and future projections, this report is an invaluable resource for strategic decision-making. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report’s data-driven approach leverages high-volume keywords, ensuring maximum visibility and engagement within the industry.

United States Irrigation Valves Market Market Structure & Competitive Landscape

The United States irrigation valves market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated to be around xx, indicating a moderately consolidated market. Innovation is a key driver, with companies continually developing new valve types, materials, and automation technologies to enhance efficiency and water conservation. Stringent environmental regulations, particularly regarding water usage, significantly impact market dynamics, pushing companies to develop more sustainable solutions. Plastic valves are emerging as strong substitutes for metal valves in certain applications due to their cost-effectiveness and lighter weight. The market is further segmented by end-user: agricultural and non-agricultural applications.

Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total of xx M&A deals recorded between 2019 and 2024, valued at approximately $xx Million. These activities often involve companies seeking to expand their product portfolios, geographical reach, or technological capabilities. Key M&A trends include:

- Consolidation among valve manufacturers to achieve economies of scale.

- Acquisitions of smaller, specialized companies by larger players to access niche technologies or markets.

- Strategic partnerships to leverage complementary strengths and expand market reach.

The competitive landscape is characterized by intense competition among established players, including Netafim USA, GF Piping Systems, The Toro Company, Erdmann Corporation, Anything Flows LLC, BERMAD CS Ltd, ACE PUMP CORPORATION, Dorot, TVI, and Raven Industries Inc. These companies compete primarily on the basis of product quality, pricing, technological innovation, and distribution networks.

United States Irrigation Valves Market Market Trends & Opportunities

The U.S. irrigation valves market is experiencing robust growth, driven by several key factors. The market size was estimated at $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by a confluence of factors:

- Increasing demand for water-efficient irrigation solutions, particularly in arid and semi-arid regions, due to growing water scarcity.

- Technological advancements, such as the adoption of smart irrigation systems and automated valves, which enhance efficiency and reduce water waste.

- Rising agricultural production and expansion of irrigated farmland, particularly in high-value crop cultivation.

- Government initiatives and subsidies promoting water conservation and efficient irrigation practices.

- Growing adoption of precision irrigation technologies to optimize water usage and improve crop yields.

The market penetration rate for advanced irrigation technologies, including smart valves and automated control systems, is steadily increasing, although it still remains relatively low in certain segments. This presents significant growth opportunities for innovative companies offering advanced solutions. Competitive dynamics are characterized by intense competition among established players, along with the emergence of new entrants offering technologically advanced products and services.

Dominant Markets & Segments in United States Irrigation Valves Market

The agricultural application segment dominates the U.S. irrigation valves market, accounting for approximately xx% of total market revenue in 2024. Within the agricultural sector, the Western region exhibits the strongest growth, driven by large-scale irrigation projects and a high concentration of high-value crops.

- Key Growth Drivers for the Agricultural Segment:

- Expansion of irrigated farmland to meet growing food demand.

- Government incentives and subsidies supporting water-efficient irrigation technologies.

- Increasing adoption of precision irrigation techniques to optimize water usage.

- Development of drought-resistant crops reducing water demand.

The plastic valve segment is witnessing faster growth compared to the metal valve segment due to its lower cost, lighter weight, and corrosion resistance. The automatic valve segment is also experiencing rapid expansion, fueled by growing adoption of smart irrigation systems and automation technologies.

- Dominant Segments:

- By Region: West (due to large-scale agricultural operations and arid climate)

- By Material Type: Plastic Valves (due to cost-effectiveness and durability)

- By Valve Type: Automatic Valves (due to technological advancements and water-efficiency gains)

- By Application: Agricultural Applications (due to high demand for water-efficient irrigation in farming)

United States Irrigation Valves Market Product Analysis

Product innovation is a crucial driver in the irrigation valves market, with companies continuously introducing new valve designs, materials, and control systems. Recent advancements include the development of smart valves with integrated sensors and remote control capabilities, enhancing irrigation efficiency and reducing water waste. These valves offer features such as flow monitoring, pressure regulation, and automatic shut-off mechanisms. The focus is on developing products that are more durable, reliable, and easier to install and maintain, while simultaneously promoting water conservation and reducing operational costs. The market fit for these innovations is strong, driven by the increasing adoption of precision irrigation and smart agriculture practices.

Key Drivers, Barriers & Challenges in United States Irrigation Valves Market

Key Drivers:

The market is driven by factors such as the increasing need for water conservation, technological advancements in irrigation systems, rising agricultural production, and government regulations promoting water efficiency. For example, the ongoing drought in several parts of the U.S. has increased the demand for water-efficient irrigation technologies. Furthermore, advancements in sensor technology and automation have made smart irrigation systems more affordable and accessible to farmers.

Key Challenges & Restraints:

High initial investment costs for advanced irrigation systems can be a barrier for some farmers. Supply chain disruptions, particularly those related to raw materials, can impact production and pricing. Furthermore, the regulatory landscape varies across states, creating challenges for companies seeking to expand their operations. Intense competition among established players also puts pressure on profit margins. These challenges lead to a slightly slower than projected market growth.

Growth Drivers in the United States Irrigation Valves Market Market

The growth of the U.S. irrigation valves market is being propelled by increasing water scarcity across the country, prompting farmers and other stakeholders to adopt water-efficient technologies. Furthermore, the rising adoption of precision agriculture and smart farming practices is driving demand for advanced irrigation systems equipped with smart valves and automated controls. Government incentives and supportive policies further encourage the adoption of these technologies, while technological innovations are continually enhancing the efficiency and capabilities of irrigation valves.

Challenges Impacting United States Irrigation Valves Market Growth

Key challenges include the high upfront cost of advanced irrigation systems, which can limit adoption among smaller farmers. Supply chain vulnerabilities and fluctuations in raw material prices impact the cost and availability of irrigation valves. Additionally, a fragmented regulatory landscape across various states poses challenges in terms of standardization and compliance. Finally, intense competition and the continuous introduction of new products can put pressure on profitability.

Key Players Shaping the United States Irrigation Valves Market Market

- Netafim USA

- GF Piping Systems

- The Toro Company

- Erdmann Corporation

- Anything Flows LLC

- BERMAD CS Ltd

- ACE PUMP CORPORATION

- Dorot

- TVI

- Raven Industries Inc

Significant United States Irrigation Valves Market Industry Milestones

- July 2021: A.R.I. and Dorot merge to form Aquestia, expanding the market for automatic hydraulic control valves.

- January 2022: Netafim U.S.A. partners with Bayer to launch the Precise Defense program, improving almond tree irrigation efficiency.

- May 2022: Netafim U.S.A. expands its U.S. manufacturing presence, enhancing FlexNet production and delivery.

Future Outlook for United States Irrigation Valves Market Market

The U.S. irrigation valves market is poised for continued growth, driven by long-term trends such as increasing water scarcity, the growing adoption of precision agriculture, and government initiatives promoting water conservation. Strategic opportunities exist for companies that can develop innovative, cost-effective, and sustainable irrigation solutions tailored to the specific needs of various agricultural and non-agricultural applications. The market is expected to see significant expansion, particularly in the segments of smart irrigation technologies and water-efficient valve solutions.

United States Irrigation Valves Market Segmentation

-

1. Material Type

- 1.1. Metal Valves

- 1.2. Plastic Valves

-

2. Valve Type

- 2.1. Ball Valve

- 2.2. Butterfly Valve

- 2.3. Globe Valve

- 2.4. Automatic Valves

-

3. Application

- 3.1. Agricultural Applications

- 3.2. Non-agricultural applications

United States Irrigation Valves Market Segmentation By Geography

- 1. United States

United States Irrigation Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects

- 3.3. Market Restrains

- 3.3.1. Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge

- 3.4. Market Trends

- 3.4.1. Plastic Valves to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Irrigation Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metal Valves

- 5.1.2. Plastic Valves

- 5.2. Market Analysis, Insights and Forecast - by Valve Type

- 5.2.1. Ball Valve

- 5.2.2. Butterfly Valve

- 5.2.3. Globe Valve

- 5.2.4. Automatic Valves

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Agricultural Applications

- 5.3.2. Non-agricultural applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Netafim USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GF Piping Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Toro Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Erdmann Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anything Flows LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BERMAD CS Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACE PUMP CORPORATION

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dorot

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TVI

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Raven Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Netafim USA

List of Figures

- Figure 1: United States Irrigation Valves Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Irrigation Valves Market Share (%) by Company 2024

List of Tables

- Table 1: United States Irrigation Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Irrigation Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Irrigation Valves Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2019 & 2032

- Table 5: United States Irrigation Valves Market Revenue Million Forecast, by Valve Type 2019 & 2032

- Table 6: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2019 & 2032

- Table 7: United States Irrigation Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: United States Irrigation Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Irrigation Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: United States Irrigation Valves Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 12: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2019 & 2032

- Table 13: United States Irrigation Valves Market Revenue Million Forecast, by Valve Type 2019 & 2032

- Table 14: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2019 & 2032

- Table 15: United States Irrigation Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: United States Irrigation Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Irrigation Valves Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Irrigation Valves Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the United States Irrigation Valves Market?

Key companies in the market include Netafim USA, GF Piping Systems, The Toro Company, Erdmann Corporation, Anything Flows LLC, BERMAD CS Ltd, ACE PUMP CORPORATION, Dorot, TVI, Raven Industries Inc.

3. What are the main segments of the United States Irrigation Valves Market?

The market segments include Material Type, Valve Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects.

6. What are the notable trends driving market growth?

Plastic Valves to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge.

8. Can you provide examples of recent developments in the market?

May 2022 - Netafim U.S.A., a subsidiary of Netafim Ltd., and the provider of precision irrigation solutions such as irrigation valves, sprinklers, etc., expanded its manufacturing presence in the United States. FlexNet, the company's innovative, high-performance, flexible, lightweight piping solution for above- and below-ground drip irrigation systems, would be manufacturing its products in Fresno, California. Netafim has invested in local manufacturing to produce and deliver FlexNet to customers across the Americas more efficiently and provide growers with more custom configuration options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Irrigation Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Irrigation Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Irrigation Valves Market?

To stay informed about further developments, trends, and reports in the United States Irrigation Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence