Key Insights

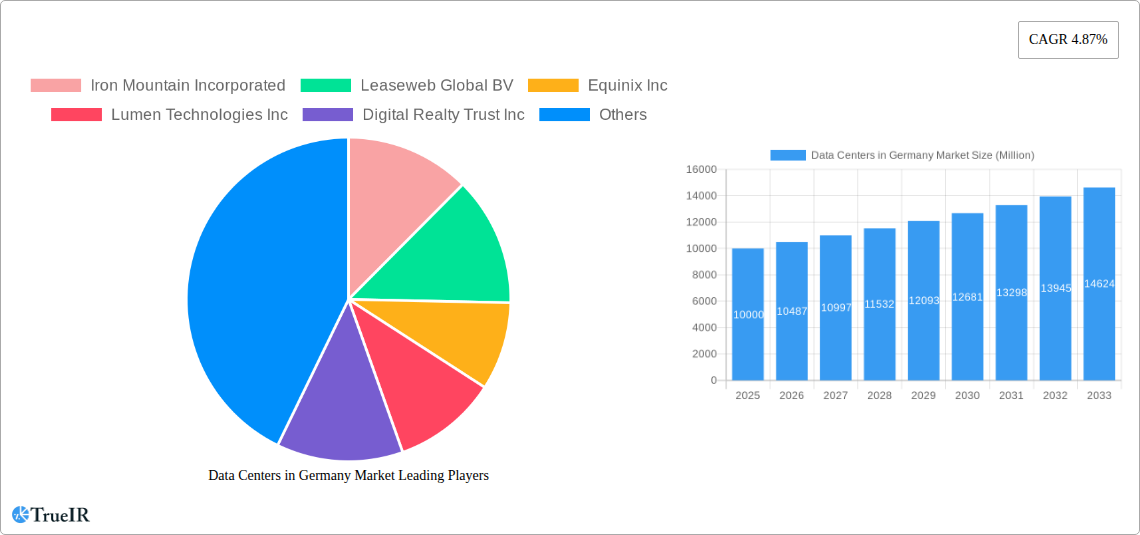

The German data center market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.87% from 2025 to 2033. This growth is fueled by several key drivers: the increasing adoption of cloud computing and digital transformation initiatives across various industries, the surging demand for data storage and processing capabilities, and the strategic location of Germany as a digital hub within Europe. Frankfurt, as a major hotspot, benefits significantly from robust digital infrastructure and its connectivity to key European and global networks. Market segmentation reveals a diverse landscape, with significant demand across various data center sizes (from small to massive), tiered services (Tier 1 to Tier 4), and utilization levels (utilized and non-utilized). The major players—Iron Mountain, Leaseweb, Equinix, Lumen Technologies, Digital Realty, Vantage Data Centers, CyrusOne, Telehouse, Noris Network, Global Switch, NTT, and GlobalConnect—are competing intensely, driving innovation and investment in advanced data center technologies. Growth is further supported by government initiatives promoting digital infrastructure development and attracting international investment in the sector.

However, the market's expansion is not without its challenges. Rising energy costs, stringent environmental regulations demanding energy efficiency in data center operations, and the potential for skills shortages in the IT sector pose significant restraints. Nevertheless, the overall outlook remains positive, with the continued growth of the digital economy expected to offset these challenges. The market's geographic distribution shows strong concentration in key regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, reflecting established digital infrastructure and business activity. Future growth will likely be further driven by increasing adoption of edge computing, the expansion of 5G networks, and the ongoing demand for high-performance computing resources. This will necessitate continued investment in sustainable data center solutions and skilled workforce development to capitalize on the opportunities presented by this dynamic market.

Data Centers in Germany Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning German data center market, offering invaluable insights for investors, industry professionals, and strategists. Analyzing the market from 2019 to 2033, with a focus on 2025, this report unveils key trends, competitive landscapes, and future growth projections. The study covers a range of crucial aspects, including market segmentation by absorption, hotspot location, data center size, and tier type, providing a granular understanding of this rapidly evolving sector. With a detailed analysis of major players like Equinix, Digital Realty, and Vantage Data Centers, alongside emerging players, this report is an indispensable resource for navigating the complexities of the German data center landscape.

Data Centers in Germany Market Structure & Competitive Landscape

The German data center market exhibits a moderately concentrated structure, with a few major players controlling a significant portion of the market share. While precise concentration ratios require further calculation, the presence of large global players alongside established domestic providers suggests a level of competition balanced with established market dominance. The market is characterized by continuous innovation, driven by the increasing demand for high-capacity, low-latency data centers to support cloud computing, the Internet of Things (IoT), and big data analytics. Regulatory changes, particularly concerning data privacy and security (GDPR), are significant factors influencing market dynamics. Product substitutes, such as edge computing solutions, are increasingly prevalent, adding another dimension to the competitive landscape. The market is heavily segmented by end-user type, with hyperscalers, cloud providers, and enterprises accounting for the majority of demand. Mergers and acquisitions (M&A) activity has been notable in recent years, with approximately xx Million USD in M&A transactions recorded in the past five years. This demonstrates the strategic importance of the German market and the ongoing consolidation efforts. This trend is expected to continue driven by the need for expansion and scale within the market.

- Key Market Drivers: Technological advancements, increasing data consumption, stringent data privacy regulations.

- Key Challenges: Competition, energy costs, land availability, skilled labor shortages.

- End-User Segmentation: Hyperscalers (xx%), Cloud Providers (xx%), Enterprises (xx%), Other (xx%).

Data Centers in Germany Market Trends & Opportunities

The German data center market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This growth is fueled by several key trends. The rise of cloud computing and the increasing adoption of digital technologies across all sectors are significant drivers. Furthermore, Germany's strong economic performance and its position as a key European hub for technology are also contributing factors. The market is witnessing a shift towards larger, more efficient data centers, with hyperscalers increasingly driving demand for massive facilities. Consumer preferences are shifting towards enhanced security, reliability, and sustainability. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants vying for market share. Market penetration of cloud services is expected to reach xx% by 2033, indicating substantial growth opportunities in the data center sector. The increasing demand for edge computing and the adoption of innovative technologies, such as AI and Machine Learning, also present significant growth opportunities. Frankfurt continues to be a leading hub, attracting significant investment. Challenges include land scarcity and energy costs.

Dominant Markets & Segments in Data Centers in Germany Market

The Frankfurt region remains the dominant hotspot for data center development in Germany, accounting for approximately xx% of the market, owing to its strong infrastructure, established talent pool, and favorable regulatory environment. Other significant regions include Munich and Berlin.

- Key Growth Drivers in Frankfurt: Superior connectivity, established ecosystem, access to skilled labor.

- Key Growth Drivers in Rest of Germany: Growing digitalization in smaller cities, government incentives for regional development.

In terms of segment dominance:

- Absorption: Utilized capacity dominates the market, with a significant portion attributed to hyperscalers and cloud providers. Non-utilized capacity represents a potential for future growth.

- Data Center Size: Large and Mega data centers are experiencing the strongest growth, driven by the needs of hyperscalers and large enterprises.

- Tier Type: Tier III and Tier IV facilities are in high demand due to their reliability and redundancy.

Other End User Market: The 'Other End User' segment exhibits consistent growth, encompassing various industries such as finance, healthcare, and manufacturing, all increasingly reliant on data center infrastructure.

Data Centers in Germany Market Product Analysis

The German data center market is characterized by a focus on high-density, energy-efficient solutions. Innovations include advanced cooling technologies, modular designs, and increased use of renewable energy sources. Products are tailored to meet the specific requirements of different customer segments, ranging from colocation services for small businesses to custom-built solutions for hyperscalers. Competitive advantages are driven by factors such as location, connectivity, reliability, and pricing. The growing adoption of sustainable practices and environmentally friendly technologies offers significant competitive advantages.

Key Drivers, Barriers & Challenges in Data Centers in Germany Market

Key Drivers:

- The ongoing digital transformation across various sectors in Germany is a significant driver.

- Government support for digital infrastructure development provides an important push.

- The rising demand for cloud services and related data storage needs.

Key Challenges:

- Securing sufficient land and power supplies for new developments pose a major challenge. Land scarcity in key regions contributes to increased costs.

- Regulatory complexities, particularly concerning data privacy and energy regulations, can add to investment uncertainty. These complexities result in additional time and financial burdens for projects.

- Intense competition from established players and new entrants adds pressure on margins.

Growth Drivers in the Data Centers in Germany Market Market

The robust growth of the German data center market is fueled by several key factors. The increasing digitalization of the German economy, driven by both public and private sector investment, fuels the demand for reliable data center infrastructure. Government initiatives aimed at improving digital infrastructure, such as providing incentives for sustainable data center development, further propel growth. The rise of cloud computing and related services significantly increases reliance on large-scale data centers, sustaining market expansion.

Challenges Impacting Data Centers in Germany Market Growth

Several factors hinder the growth of Germany’s data center market. Land scarcity in desirable locations, especially around major cities, restricts expansion and drives up costs. The substantial energy consumption of data centers makes securing a sustainable and reliable power supply a critical concern. Intense competition from both domestic and international players creates a highly competitive environment. Furthermore, navigating complex regulatory frameworks related to data privacy and environmental regulations adds another layer of challenge.

Key Players Shaping the Data Centers in Germany Market Market

- Iron Mountain Incorporated

- Leaseweb Global BV

- Equinix Inc

- Lumen Technologies Inc

- Digital Realty Trust Inc

- Vantage Data Centers LLC

- CyrusOne Inc

- Telehouse (KDDI Corporation)

- Noris Network AG

- Global Switch Holdings Limited

- NTT Ltd

- GlobalConnect AB

Significant Data Centers in Germany Market Industry Milestones

- November 2022: Vantage Data Centers announced the delivery of three new facilities in Berlin and Frankfurt, expanding its presence significantly and adding substantial capacity to the market.

- November 2022: Lumen Technologies Inc announced plans to sell its EMEA operations, indicating a shift in strategic focus for the company within the European data center market.

- January 2023: CyrusOne's acquisition of an office complex in Frankfurt for conversion into a data center campus signals the growing demand for data center space and significant investment into the German market.

Future Outlook for Data Centers in Germany Market Market

The German data center market is poised for continued strong growth, driven by increasing digitalization, supportive government policies, and rising demand for cloud services. Strategic opportunities exist for providers to capitalize on the expanding market by investing in sustainable and scalable solutions. The increasing focus on data security and privacy will also create opportunities for providers offering robust security measures. The market's future is bright, with considerable potential for further expansion and innovation.

Data Centers in Germany Market Segmentation

-

1. Hotspot

- 1.1. Frankfurt

- 1.2. Rest of Germany

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Data Centers in Germany Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Centers in Germany Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Frankfurt

- 5.1.2. Rest of Germany

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. Frankfurt

- 6.1.2. Rest of Germany

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.4.2. By Colocation Type

- 6.4.2.1. Hyperscale

- 6.4.2.2. Retail

- 6.4.2.3. Wholesale

- 6.4.3. By End User

- 6.4.3.1. BFSI

- 6.4.3.2. Cloud

- 6.4.3.3. E-Commerce

- 6.4.3.4. Government

- 6.4.3.5. Manufacturing

- 6.4.3.6. Media & Entertainment

- 6.4.3.7. Telecom

- 6.4.3.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. Frankfurt

- 7.1.2. Rest of Germany

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.4.2. By Colocation Type

- 7.4.2.1. Hyperscale

- 7.4.2.2. Retail

- 7.4.2.3. Wholesale

- 7.4.3. By End User

- 7.4.3.1. BFSI

- 7.4.3.2. Cloud

- 7.4.3.3. E-Commerce

- 7.4.3.4. Government

- 7.4.3.5. Manufacturing

- 7.4.3.6. Media & Entertainment

- 7.4.3.7. Telecom

- 7.4.3.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. Frankfurt

- 8.1.2. Rest of Germany

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.4.2. By Colocation Type

- 8.4.2.1. Hyperscale

- 8.4.2.2. Retail

- 8.4.2.3. Wholesale

- 8.4.3. By End User

- 8.4.3.1. BFSI

- 8.4.3.2. Cloud

- 8.4.3.3. E-Commerce

- 8.4.3.4. Government

- 8.4.3.5. Manufacturing

- 8.4.3.6. Media & Entertainment

- 8.4.3.7. Telecom

- 8.4.3.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. Frankfurt

- 9.1.2. Rest of Germany

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.4.2. By Colocation Type

- 9.4.2.1. Hyperscale

- 9.4.2.2. Retail

- 9.4.2.3. Wholesale

- 9.4.3. By End User

- 9.4.3.1. BFSI

- 9.4.3.2. Cloud

- 9.4.3.3. E-Commerce

- 9.4.3.4. Government

- 9.4.3.5. Manufacturing

- 9.4.3.6. Media & Entertainment

- 9.4.3.7. Telecom

- 9.4.3.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. Frankfurt

- 10.1.2. Rest of Germany

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.4.2. By Colocation Type

- 10.4.2.1. Hyperscale

- 10.4.2.2. Retail

- 10.4.2.3. Wholesale

- 10.4.3. By End User

- 10.4.3.1. BFSI

- 10.4.3.2. Cloud

- 10.4.3.3. E-Commerce

- 10.4.3.4. Government

- 10.4.3.5. Manufacturing

- 10.4.3.6. Media & Entertainment

- 10.4.3.7. Telecom

- 10.4.3.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. North Rhine-Westphalia Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 12. Bavaria Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 13. Baden-Württemberg Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 14. Lower Saxony Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 15. Hesse Data Centers in Germany Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Iron Mountain Incorporated

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Leaseweb Global BV

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Equinix Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Lumen Technologies Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Digital Realty Trust Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 CyrusOne Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Telehouse (KDDI Corporation)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Noris Network AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Global Switch Holdings Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 NTT Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GlobalConnect AB

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Iron Mountain Incorporated

List of Figures

- Figure 1: Global Data Centers in Germany Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Germany Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Germany Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Data Centers in Germany Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 5: North America Data Centers in Germany Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 6: North America Data Centers in Germany Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 7: North America Data Centers in Germany Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 8: North America Data Centers in Germany Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 9: North America Data Centers in Germany Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 10: North America Data Centers in Germany Market Revenue (Million), by Absorption 2024 & 2032

- Figure 11: North America Data Centers in Germany Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 12: North America Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Data Centers in Germany Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 15: South America Data Centers in Germany Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 16: South America Data Centers in Germany Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 17: South America Data Centers in Germany Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 18: South America Data Centers in Germany Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 19: South America Data Centers in Germany Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 20: South America Data Centers in Germany Market Revenue (Million), by Absorption 2024 & 2032

- Figure 21: South America Data Centers in Germany Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 22: South America Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Data Centers in Germany Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 25: Europe Data Centers in Germany Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 26: Europe Data Centers in Germany Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 27: Europe Data Centers in Germany Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 28: Europe Data Centers in Germany Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 29: Europe Data Centers in Germany Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 30: Europe Data Centers in Germany Market Revenue (Million), by Absorption 2024 & 2032

- Figure 31: Europe Data Centers in Germany Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 32: Europe Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Data Centers in Germany Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 35: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 36: Middle East & Africa Data Centers in Germany Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 37: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 38: Middle East & Africa Data Centers in Germany Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Data Centers in Germany Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Data Centers in Germany Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 45: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 46: Asia Pacific Data Centers in Germany Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 47: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 48: Asia Pacific Data Centers in Germany Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 49: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 50: Asia Pacific Data Centers in Germany Market Revenue (Million), by Absorption 2024 & 2032

- Figure 51: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 52: Asia Pacific Data Centers in Germany Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Centers in Germany Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Global Data Centers in Germany Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North Rhine-Westphalia Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Bavaria Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Baden-Württemberg Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Lower Saxony Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Hesse Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 14: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 15: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 16: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 17: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 22: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 23: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 25: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 30: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 31: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 44: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 45: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 46: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 47: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Turkey Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Israel Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: GCC Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: North Africa Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Africa Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Middle East & Africa Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Data Centers in Germany Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 55: Global Data Centers in Germany Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 56: Global Data Centers in Germany Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 57: Global Data Centers in Germany Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 58: Global Data Centers in Germany Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: China Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: India Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: ASEAN Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Oceania Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific Data Centers in Germany Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Centers in Germany Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Data Centers in Germany Market?

Key companies in the market include Iron Mountain Incorporated, Leaseweb Global BV, Equinix Inc, Lumen Technologies Inc, Digital Realty Trust Inc, Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE, CyrusOne Inc, Telehouse (KDDI Corporation), Noris Network AG, Global Switch Holdings Limited, NTT Ltd, GlobalConnect AB.

3. What are the main segments of the Data Centers in Germany Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2023: CyrusOne acquired an office complex in Frankfurt, Germany, planning to turn it into a data center campus. The investment group Corum had sold the Europark office complex in Frankfurt for EUR 95 million (USD 102.3 million), before confirming that CyrusOne was the buyer.November 2022: Lumen announced plans to sell its EMEA operations to Colt Technology Services. The communications company announced entering into an exclusive arrangement for the proposed sale of Lumen's Europe, Middle East, and Africa (EMEA) business to Colt for USD 1.8 billion. The deal was set to close as early as late 2023.November 2022: Vantage Data Centers announced delivering three new facilities in Berlin and Frankfurt and opening a new German office in Raunheim. Vantage welcomed a second data center on its 25-acre (10-hectare) Berlin I campus. The two-story, 130,000 square foot (12,000 square meters) facility offered 16MW of IT capacity to hyperscalers and large cloud providers. Once fully developed, the expanding campus would include 4 data centers totaling 56MW and 474,000 square feet (44,000 square meters).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Centers in Germany Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Centers in Germany Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Centers in Germany Market?

To stay informed about further developments, trends, and reports in the Data Centers in Germany Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence