Key Insights

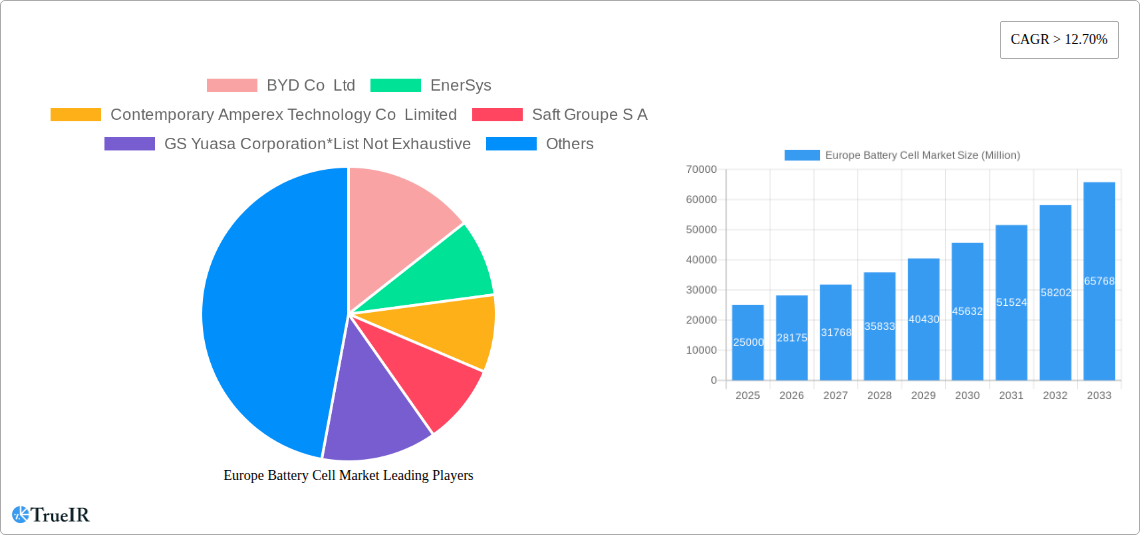

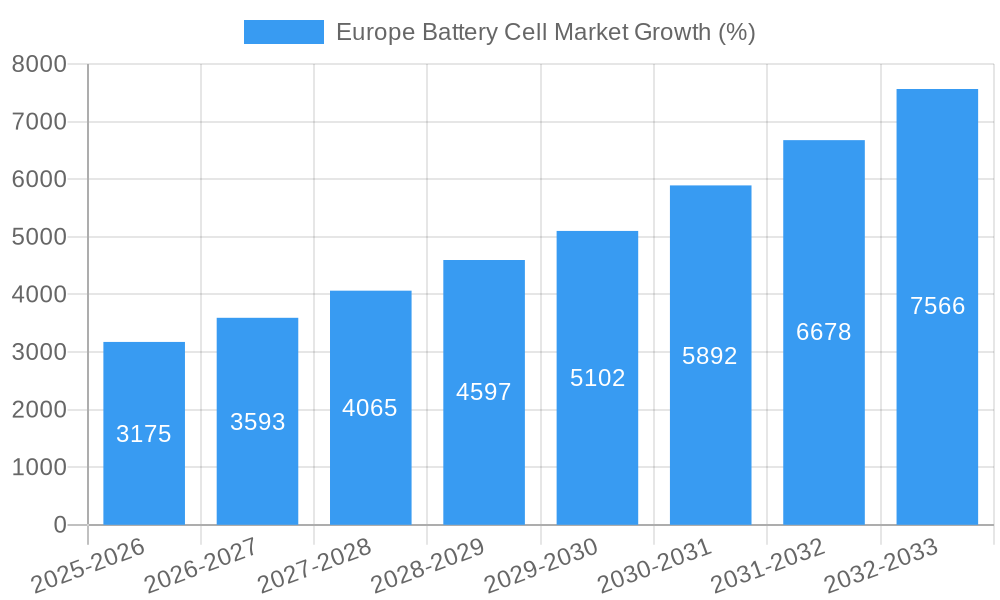

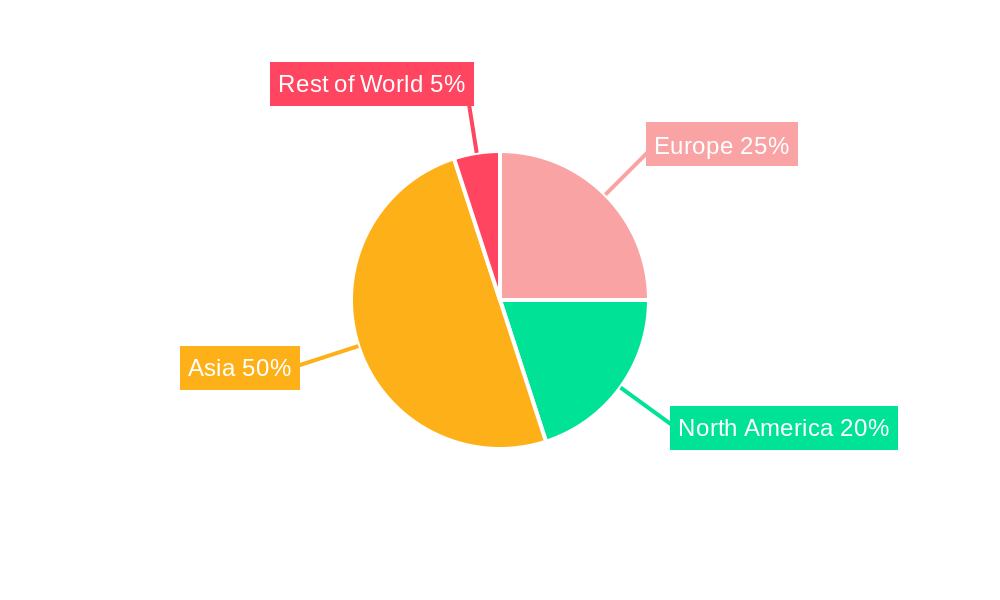

The European battery cell market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 12.70% from 2025 to 2033. This expansion is fueled by the surging demand for electric vehicles (EVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs) across the region. Furthermore, the increasing adoption of battery energy storage systems (BESS) for grid stabilization and renewable energy integration is significantly contributing to market expansion. Germany, France, the United Kingdom, and Italy are key contributors to this growth, driven by supportive government policies promoting electrification and renewable energy adoption. The market is segmented by battery type (prismatic, cylindrical, pouch) and application (automotive, industrial, portable, power tools, SLI), reflecting the diverse needs of various sectors. The dominance of automotive applications underscores the vital role battery cells play in the transition to sustainable transportation. Leading players like BYD, Contemporary Amperex Technology (CATL), LG Energy Solution, and others are investing heavily in research and development, as well as capacity expansion, to meet the rising demand. Competition is intensifying, prompting innovation in battery chemistry, cell design, and manufacturing processes to enhance performance, safety, and cost-effectiveness.

The market's growth trajectory is influenced by several factors. Stringent emission regulations driving the adoption of EVs are a primary driver. However, raw material price volatility and potential supply chain disruptions pose challenges. The ongoing advancements in battery technology, particularly in solid-state batteries, are expected to further transform the market landscape in the coming years, improving energy density and safety, ultimately influencing the market's long-term prospects. The rise of industrial applications, such as stationary energy storage and industrial power tools, will also contribute to market growth. While challenges remain, the overall outlook for the European battery cell market is exceptionally positive, poised for substantial expansion in the forecast period. The market's successful navigation of these challenges will hinge on technological advancements, strategic partnerships, and effective policy support from European governments.

Europe Battery Cell Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides a detailed analysis of the dynamic Europe Battery Cell Market, projecting robust growth from 2025 to 2033. It offers invaluable insights into market size, segmentation, key players, technological advancements, and future outlook, empowering businesses to make informed strategic decisions. The study period covers 2019-2033, with 2025 serving as the base and estimated year.

Europe Battery Cell Market Structure & Competitive Landscape

The Europe battery cell market exhibits a moderately concentrated landscape, with key players like BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited (CATL), Saft Groupe S A, GS Yuasa Corporation, Clarios, Duracell Inc, LG Energy Solution Ltd, ElringKlinger AG, and Panasonic Corporation vying for market share. However, the market is witnessing increasing participation from smaller, specialized firms, particularly in niche segments like solid-state batteries.

The market's competitive intensity is driven by factors such as technological innovation (e.g., advancements in battery chemistry, cell design, and manufacturing processes), stringent regulatory frameworks promoting sustainable energy solutions, and the emergence of substitute technologies (e.g., fuel cells). The substantial investments in electric vehicle (EV) infrastructure across Europe are further fueling competition.

End-user segmentation is dominated by the automotive sector (HEV, PHEV, EV), followed by industrial applications (motive power, stationary energy storage systems (ESS), telecom, and UPS). The market is experiencing significant M&A activity, with several large players acquiring smaller companies to gain access to new technologies and expand their market presence. While precise M&A volume data for the period is unavailable (xx Million), the qualitative observation suggests a rising trend indicating high levels of consolidation. The four-firm concentration ratio (CR4) is estimated at xx%, suggesting a moderately concentrated market.

Europe Battery Cell Market Market Trends & Opportunities

The Europe battery cell market is experiencing exponential growth, driven by the escalating demand for electric vehicles, the expansion of renewable energy infrastructure, and the growing adoption of portable electronic devices. The market size, estimated at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. This growth is fueled by several key trends:

- Technological advancements: The continuous development of higher energy density battery chemistries (e.g., solid-state batteries, lithium-sulfur batteries) and improved manufacturing techniques is enhancing battery performance and reducing costs.

- Government incentives: Numerous European countries have implemented supportive policies, including subsidies, tax breaks, and emission regulations, to encourage the adoption of electric vehicles and renewable energy storage systems.

- Rising consumer awareness: Increasing awareness regarding environmental concerns and the benefits of electric vehicles is driving consumer demand for battery-powered products.

- Shifting consumer preferences: Consumers increasingly favor environmentally friendly and sustainable products, leading to higher demand for EVs and other battery-powered devices.

- Competitive dynamics: Intense competition among manufacturers is driving innovation and price reductions, making battery cells more accessible to a wider range of consumers. Market penetration rates for EVs are steadily increasing across Europe, indicating the growing acceptance of battery technology across diverse segments.

Dominant Markets & Segments in Europe Battery Cell Market

Germany, France, and the UK represent the dominant markets within Europe, driven by robust EV adoption rates, strong government support for renewable energy, and well-established automotive industries.

Key Growth Drivers:

- Robust EV adoption policies: Stringent emission regulations and government incentives are significantly boosting EV sales.

- Growing renewable energy sector: The expansion of renewable energy sources, such as solar and wind power, is driving demand for energy storage solutions.

- Development of charging infrastructure: Investments in charging infrastructure are making EV adoption more convenient.

Dominant Segments:

- Automotive Batteries: This segment is the largest and fastest-growing, driven by the rising popularity of electric vehicles. Within this segment, the demand for lithium-ion batteries is particularly high.

- Type: Prismatic cells are currently the most dominant type, owing to their high energy density and suitability for various applications. However, cylindrical and pouch cells are experiencing significant growth, especially in portable electronics and power tools.

Europe Battery Cell Market Product Analysis

Significant product innovations are shaping the market, including advancements in battery chemistries (LFP, NMC, solid-state), cell designs (blade batteries, prismatic, cylindrical, pouch), and manufacturing processes. These improvements are enhancing energy density, lifespan, safety, and cost-effectiveness, expanding the range of applications and driving market growth. The "blade battery" introduced by BYD in 2020 exemplifies this trend, offering higher energy density and improved safety. CATL's January 2022 patent for anode-free sodium-ion batteries points to a future with enhanced energy density and cost-effectiveness. Market fit for these innovations is high, aligning with increasing demands for sustainable and high-performance energy solutions.

Key Drivers, Barriers & Challenges in Europe Battery Cell Market

Key Drivers:

- Rising demand for EVs: Government regulations and consumer preference are driving exponential growth.

- Growth of renewable energy: Increased reliance on intermittent renewable energy necessitates robust energy storage solutions.

- Technological advancements: Innovations in battery chemistry and manufacturing processes are improving performance and reducing costs.

Key Challenges:

- Supply chain disruptions: Geopolitical factors and raw material scarcity impact battery production and pricing. This is particularly evident with the limited sourcing of key materials like lithium and cobalt.

- Regulatory hurdles: Complex environmental regulations and safety standards require significant investment and compliance efforts.

- Competition: Intense competition among battery cell manufacturers results in price pressures and necessitates continuous innovation.

Growth Drivers in the Europe Battery Cell Market Market

The primary growth drivers are consistent with the above-mentioned key drivers and challenges. The strong push for electromobility in Europe, fueled by stringent emission regulations and substantial governmental investments, is a primary growth catalyst. Technological advancements resulting in improved battery performance, longer lifespans, and reduced costs further augment market expansion.

Challenges Impacting Europe Battery Cell Market Growth

The primary barriers hindering market growth include potential supply chain disruptions, especially regarding the availability and cost of raw materials, complex and evolving regulatory landscapes, and fierce competition amongst established and emerging players. These factors necessitate strategic planning and adaptation from market participants.

Key Players Shaping the Europe Battery Cell Market Market

- BYD Co Ltd

- EnerSys

- Contemporary Amperex Technology Co Limited

- Saft Groupe S A

- GS Yuasa Corporation

- Clarios

- Duracell Inc

- LG Energy Solution Ltd

- ElringKlinger AG

- Panasonic Corporation

Significant Europe Battery Cell Market Industry Milestones

- August 2021: Tesla reportedly plans to purchase BYD's "blade batteries," signifying a major endorsement of this innovative technology.

- 2020: BYD introduces its bladed battery cell, utilizing LFP chemistry and a novel form factor for enhanced safety and energy density.

- January 2022: CATL files a patent for anode-free metal battery technology, aiming to achieve densities exceeding 200 Wh/kg in next-generation sodium-ion batteries.

Future Outlook for Europe Battery Cell Market Market

The Europe battery cell market is poised for sustained growth, driven by continued technological innovation, supportive government policies, and the expanding electric vehicle market. Strategic opportunities lie in developing advanced battery chemistries, optimizing manufacturing processes, and securing a reliable supply chain for raw materials. The market's potential is significant, with opportunities for both established and emerging players to capitalize on the growing demand for sustainable and high-performance energy storage solutions.

Europe Battery Cell Market Segmentation

-

1. Type

- 1.1. Prismatic

- 1.2. Cylindrical

- 1.3. Pouch

-

2. Application

- 2.1. Automotive Batteries (HEV, PHEV, EV)

- 2.2. Industri

- 2.3. Portable Batteries (Consumer Electronics etc.)

- 2.4. Power Tools Batteries

- 2.5. SLI Batteries

- 2.6. Others

Europe Battery Cell Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Battery Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Automotive Battery Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prismatic

- 5.1.2. Cylindrical

- 5.1.3. Pouch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive Batteries (HEV, PHEV, EV)

- 5.2.2. Industri

- 5.2.3. Portable Batteries (Consumer Electronics etc.)

- 5.2.4. Power Tools Batteries

- 5.2.5. SLI Batteries

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prismatic

- 6.1.2. Cylindrical

- 6.1.3. Pouch

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive Batteries (HEV, PHEV, EV)

- 6.2.2. Industri

- 6.2.3. Portable Batteries (Consumer Electronics etc.)

- 6.2.4. Power Tools Batteries

- 6.2.5. SLI Batteries

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prismatic

- 7.1.2. Cylindrical

- 7.1.3. Pouch

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive Batteries (HEV, PHEV, EV)

- 7.2.2. Industri

- 7.2.3. Portable Batteries (Consumer Electronics etc.)

- 7.2.4. Power Tools Batteries

- 7.2.5. SLI Batteries

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prismatic

- 8.1.2. Cylindrical

- 8.1.3. Pouch

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive Batteries (HEV, PHEV, EV)

- 8.2.2. Industri

- 8.2.3. Portable Batteries (Consumer Electronics etc.)

- 8.2.4. Power Tools Batteries

- 8.2.5. SLI Batteries

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Prismatic

- 9.1.2. Cylindrical

- 9.1.3. Pouch

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive Batteries (HEV, PHEV, EV)

- 9.2.2. Industri

- 9.2.3. Portable Batteries (Consumer Electronics etc.)

- 9.2.4. Power Tools Batteries

- 9.2.5. SLI Batteries

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Prismatic

- 10.1.2. Cylindrical

- 10.1.3. Pouch

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive Batteries (HEV, PHEV, EV)

- 10.2.2. Industri

- 10.2.3. Portable Batteries (Consumer Electronics etc.)

- 10.2.4. Power Tools Batteries

- 10.2.5. SLI Batteries

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Germany Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Battery Cell Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 BYD Co Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 EnerSys

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Contemporary Amperex Technology Co Limited

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Saft Groupe S A

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 GS Yuasa Corporation*List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Clarios

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Duracell Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 LG Chem Ltd (changed to LG Energy Solution Ltd )

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 ElringKlinger AG

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Panasonic Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 BYD Co Ltd

List of Figures

- Figure 1: Europe Battery Cell Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Battery Cell Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Battery Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Battery Cell Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Europe Battery Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Battery Cell Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Battery Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Battery Cell Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 27: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 29: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 33: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 35: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 39: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 45: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 47: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Europe Battery Cell Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Europe Battery Cell Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 51: Europe Battery Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Europe Battery Cell Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 53: Europe Battery Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Europe Battery Cell Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Battery Cell Market?

The projected CAGR is approximately > 12.70%.

2. Which companies are prominent players in the Europe Battery Cell Market?

Key companies in the market include BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, Saft Groupe S A, GS Yuasa Corporation*List Not Exhaustive, Clarios, Duracell Inc, LG Chem Ltd (changed to LG Energy Solution Ltd ), ElringKlinger AG, Panasonic Corporation.

3. What are the main segments of the Europe Battery Cell Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities.

6. What are the notable trends driving market growth?

The Automotive Battery Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In August 2021, In a partnership with BYD, Tesla was reportedly going to purchase BYD's new "blade batteries'. In 2020, BYD introduced its new bladed battery cell. The new cells use Lithium iron phosphate (LFP) chemistry, but the new form factor, which looks like a blade, is the real innovation enabling a safer cell and higher energy density at the pack level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Battery Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Battery Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Battery Cell Market?

To stay informed about further developments, trends, and reports in the Europe Battery Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence