Key Insights

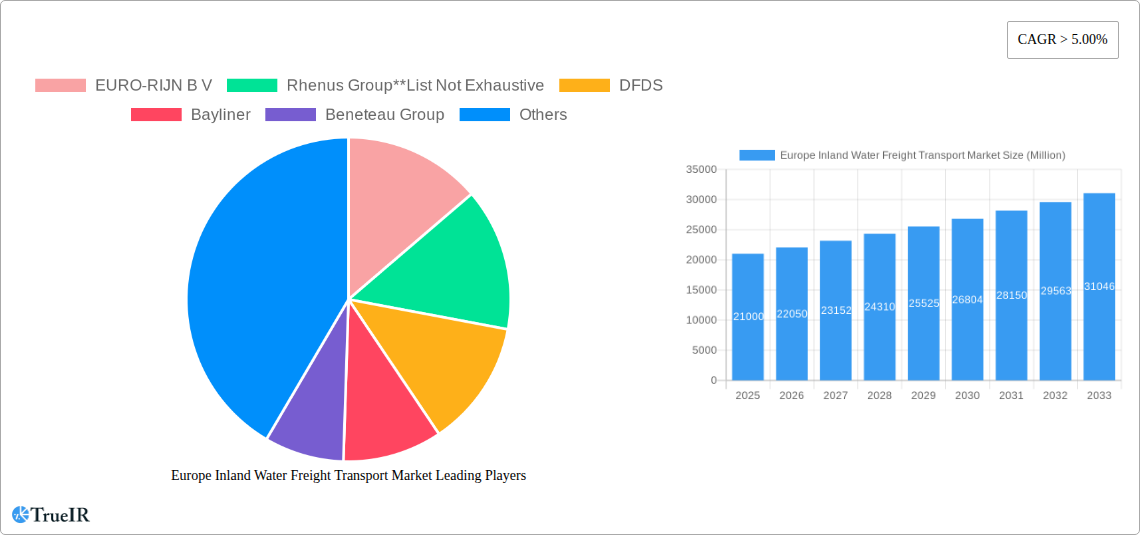

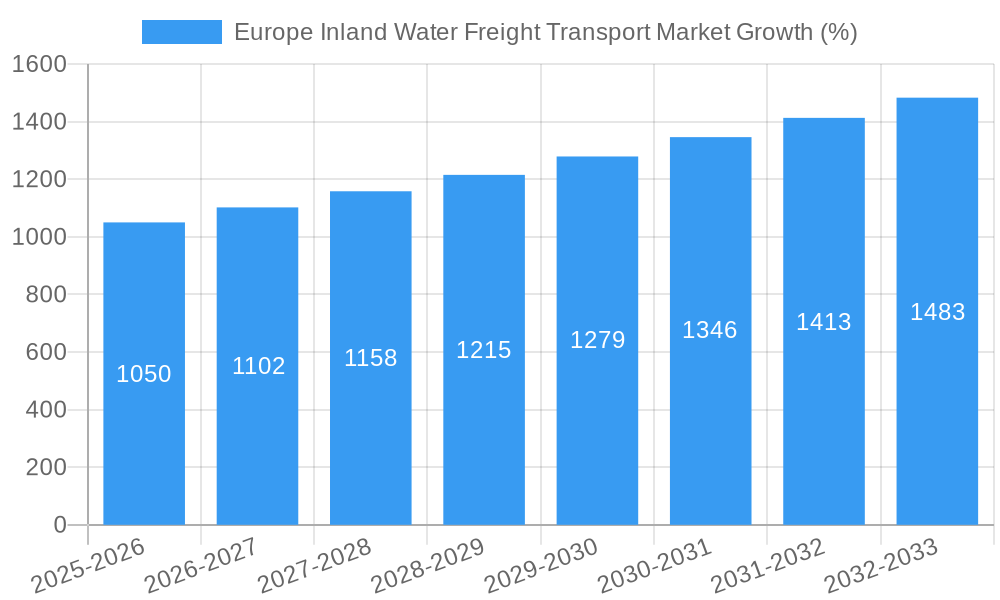

The Europe Inland Water Freight Transport Market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing environmental concerns are pushing businesses to adopt more sustainable transportation solutions, with inland waterways offering a significantly lower carbon footprint compared to road or rail. Secondly, growing e-commerce and the resulting demand for efficient and cost-effective logistics are boosting the market. Furthermore, government initiatives promoting waterway infrastructure development and modernization in key European nations like Germany, France, and the Netherlands are contributing to market expansion. The market is segmented by transportation type (liquid and dry bulk) and vessel type (cargo ships, container ships, tankers, and others). While precise market sizing data for 2025 isn't provided, a reasonable estimation, considering the stated CAGR and a plausible base year value (estimating a 2019 market size of €15 Billion, adjusted for inflation and growth to 2025), would place the 2025 market size in the range of €20-€22 billion. This reflects the steady growth trajectory anticipated for the market.

However, the market also faces certain restraints. Fluctuations in fuel prices and economic downturns can impact freight volumes. Furthermore, limitations in waterway infrastructure in certain regions and the seasonal variations in water levels can affect operational efficiency and capacity. Despite these challenges, the long-term outlook for the Europe Inland Water Freight Transport Market remains positive, driven by the aforementioned growth drivers and the ongoing efforts to enhance waterway infrastructure and operational capabilities across the continent. Key players like EURO-RIJN B.V., Rhenus Group, DFDS, and CMA CGM Group are strategically positioned to capitalize on these opportunities, further shaping the market landscape. Competition is expected to intensify, with an increased focus on innovation and service differentiation.

Europe Inland Water Freight Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Inland Water Freight Transport Market, covering the period 2019-2033. It offers crucial insights into market size, growth drivers, competitive dynamics, and future trends, equipping businesses with the knowledge needed to navigate this evolving sector. The report leverages extensive data analysis and incorporates key industry developments to forecast market performance through 2033. This detailed study covers various segments including liquid bulk transportation, dry bulk transportation, and diverse vessel types like cargo ships, container ships, and tankers. Key players like EURO-RIJN B V, Rhenus Group, DFDS, and others are profiled, highlighting their market strategies and contributions.

Europe Inland Water Freight Transport Market Market Structure & Competitive Landscape

The European inland water freight transport market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Several large players dominate certain segments, particularly in liquid bulk transportation, while smaller companies cater to niche markets or regional operations. The market is influenced by several factors:

- Innovation Drivers: Technological advancements in vessel design (e.g., hybrid propulsion systems, automated navigation), and logistics optimization software are driving efficiency and sustainability. Rhenus Group’s investment in sustainable barge units exemplifies this trend.

- Regulatory Impacts: EU policies promoting sustainable transportation, including the EUR 22.5 Million (USD 23.91 Million) Dutch scheme to shift freight from road to inland waterways, significantly influence market growth. Stringent environmental regulations are also impacting the types of vessels and fuels used.

- Product Substitutes: Road and rail transport remain major competitors, although inland waterways offer cost and environmental advantages for certain types of freight and distances.

- End-User Segmentation: The market is served by a diverse range of end-users, including manufacturing, agricultural, and energy industries, each with specific transportation needs.

- M&A Trends: The M&A activity in the sector has been moderate over the past five years, with an estimated xx number of deals annually. Consolidation is expected to continue as companies seek to expand their market share and service offerings.

Europe Inland Water Freight Transport Market Market Trends & Opportunities

The European inland water freight transport market is experiencing steady growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

Market size in 2025 is estimated at xx Million, increasing to xx Million by 2033. Technological advancements, particularly in vessel design and logistics management, are improving efficiency and reducing operational costs. The growing emphasis on sustainability, driven by both regulatory pressure and consumer demand, is creating opportunities for companies offering eco-friendly solutions, such as the Rhenus Group's investment in hybrid barge units. Increased investment in infrastructure development, including waterway modernization and port expansion, will further boost the sector's capacity and efficiency. Competitive dynamics are characterized by ongoing consolidation and increasing collaboration among players, leading to optimized logistics networks and improved service offerings. Market penetration rates for inland waterway transport are expected to rise gradually, primarily at the expense of road transport, particularly for bulk commodities over medium to long distances.

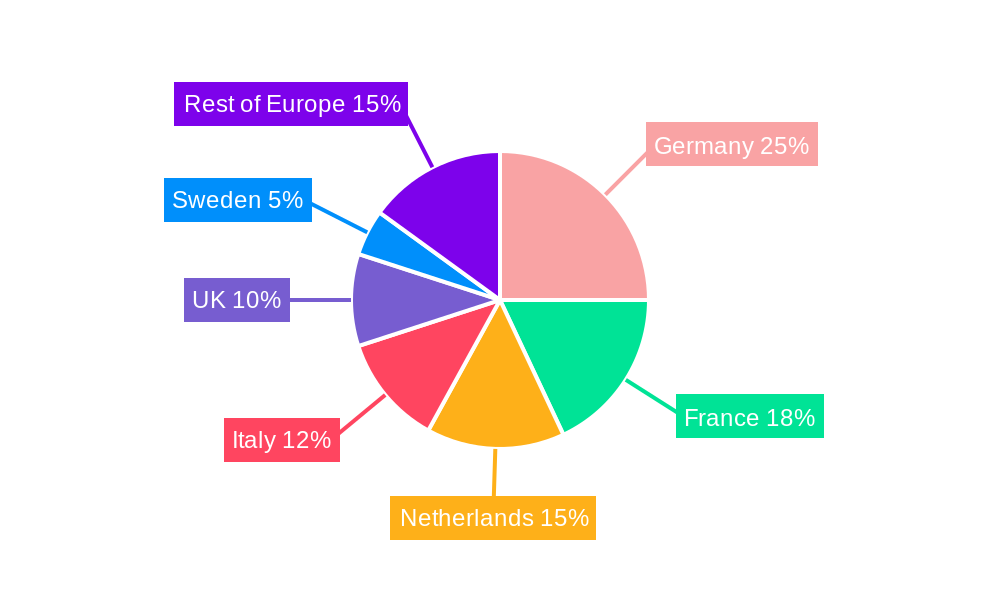

Dominant Markets & Segments in Europe Inland Water Freight Transport Market

The Rhine River corridor remains the dominant market within the European inland water freight transport sector. Germany, Netherlands, and France are key countries driving market growth, benefiting from established infrastructure and high industrial activity.

Key Growth Drivers:

- Extensive and well-developed river networks: The Rhine, Danube, and other major waterways provide efficient transport routes for various commodities.

- Favorable government policies: EU initiatives promoting sustainable transport and reducing reliance on road transport are beneficial to the sector.

- Strong industrial base: High industrial output in countries along major waterways fuels demand for inland water freight transport.

- Cost-effectiveness: Inland waterways often offer lower transport costs compared to road or rail, particularly for bulk goods.

Segment Dominance:

- Type of Transportation: Liquid bulk transportation currently holds a larger market share due to the efficient handling of large volumes of commodities like oil and chemicals. However, dry bulk transportation is expected to see significant growth.

- Vessel Type: Cargo ships and barges dominate, given their suitability for bulk commodities and river navigation. Container ships are becoming increasingly prevalent, driven by the need for efficient handling of smaller, packaged goods.

Europe Inland Water Freight Transport Market Product Analysis

Technological advancements are significantly influencing the product landscape. Hybrid and electric propulsion systems are gaining traction due to stringent environmental regulations and rising fuel costs. Innovations in vessel design, such as improved cargo handling systems and optimized hull designs, enhance efficiency and reduce operational costs. The market is seeing increasing adoption of digital technologies for vessel tracking, route optimization, and cargo management, leading to improved operational efficiency and transparency. The focus is shifting toward sustainable and efficient solutions to meet the growing demands of environmentally conscious customers and regulatory bodies.

Key Drivers, Barriers & Challenges in Europe Inland Water Freight Transport Market

Key Drivers:

- Growing demand for sustainable transportation: Government regulations and consumer preferences are driving the adoption of eco-friendly inland waterways.

- Cost-effectiveness: Inland water transport is often a more cost-effective solution compared to road or rail for bulk goods.

- Infrastructure improvements: Investments in waterway modernization and port expansion are enhancing the sector’s capacity.

Key Challenges:

- Seasonal variations in water levels: Fluctuations in water levels can disrupt operations and affect transportation schedules. This impacts reliability and can increase costs.

- Limited accessibility: Inland waterways are not accessible to all regions, restricting their application for certain types of freight and transportation routes. This limits market reach and potential growth.

- Competition from other modes of transport: Road and rail transport continue to compete with inland water transport for freight, especially for time-sensitive deliveries.

Growth Drivers in the Europe Inland Water Freight Transport Market Market

Growth is fueled by rising demand for sustainable logistics, favorable government policies (e.g., the Dutch scheme), technological advancements (e.g., hybrid barges), and infrastructure investments. These factors are driving increased efficiency, reduced emissions, and cost-effectiveness, making inland water freight an increasingly attractive option.

Challenges Impacting Europe Inland Water Freight Transport Market Growth

Challenges include navigating complex regulations, ensuring sufficient water levels for consistent operations, mitigating competition from other transport modes, and addressing infrastructure limitations in certain regions. Overcoming these challenges requires strategic collaboration among stakeholders and sustained investments.

Key Players Shaping the Europe Inland Water Freight Transport Market Market

- EURO-RIJN B V

- Rhenus Group

- DFDS

- Bayliner

- Beneteau Group

- EUROPEAN CRUISE SERVICE

- MSC Mediterranean Shipping Company S A

- Construction Navale Bordeaux

- MEYER WERFT GmbH & Co KG

- CMA CGM Group

Significant Europe Inland Water Freight Transport Market Industry Milestones

- October 2022: The European Commission approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support shifting freight from road to inland waterways and rail, boosting the sector’s sustainability and competitiveness.

- June 2022: Rhenus PartnerShip announced its investment in sustainable articulated push barge units, demonstrating a commitment to environmentally friendly operations and setting a precedent for the industry.

Future Outlook for Europe Inland Water Freight Transport Market Market

The European inland water freight transport market is poised for continued growth, driven by strong government support for sustainable transport, technological innovations, and infrastructure enhancements. Strategic opportunities exist for companies focusing on environmentally friendly solutions and efficient logistics optimization. The market's potential for expansion is considerable, particularly in regions with developing infrastructure and increased demand for sustainable transportation.

Europe Inland Water Freight Transport Market Segmentation

-

1. Type of Transportation

- 1.1. Liquid Bulk Transportation

- 1.2. Dry Bulk Transportation

-

2. Vessel Type

- 2.1. Cargo Ships

- 2.2. Container Ships

- 2.3. Tankers

- 2.4. Other Vessel Types

Europe Inland Water Freight Transport Market Segmentation By Geography

- 1. Netherland

- 2. Germany

- 3. Begium

- 4. France

- 5. Romania

- 6. Bulgaria

- 7. Rest of Europe

Europe Inland Water Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Digitization of inland-waterway transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 5.1.1. Liquid Bulk Transportation

- 5.1.2. Dry Bulk Transportation

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Cargo Ships

- 5.2.2. Container Ships

- 5.2.3. Tankers

- 5.2.4. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherland

- 5.3.2. Germany

- 5.3.3. Begium

- 5.3.4. France

- 5.3.5. Romania

- 5.3.6. Bulgaria

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6. Netherland Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6.1.1. Liquid Bulk Transportation

- 6.1.2. Dry Bulk Transportation

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Cargo Ships

- 6.2.2. Container Ships

- 6.2.3. Tankers

- 6.2.4. Other Vessel Types

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7.1.1. Liquid Bulk Transportation

- 7.1.2. Dry Bulk Transportation

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Cargo Ships

- 7.2.2. Container Ships

- 7.2.3. Tankers

- 7.2.4. Other Vessel Types

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8. Begium Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8.1.1. Liquid Bulk Transportation

- 8.1.2. Dry Bulk Transportation

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Cargo Ships

- 8.2.2. Container Ships

- 8.2.3. Tankers

- 8.2.4. Other Vessel Types

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9.1.1. Liquid Bulk Transportation

- 9.1.2. Dry Bulk Transportation

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Cargo Ships

- 9.2.2. Container Ships

- 9.2.3. Tankers

- 9.2.4. Other Vessel Types

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10. Romania Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10.1.1. Liquid Bulk Transportation

- 10.1.2. Dry Bulk Transportation

- 10.2. Market Analysis, Insights and Forecast - by Vessel Type

- 10.2.1. Cargo Ships

- 10.2.2. Container Ships

- 10.2.3. Tankers

- 10.2.4. Other Vessel Types

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11. Bulgaria Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11.1.1. Liquid Bulk Transportation

- 11.1.2. Dry Bulk Transportation

- 11.2. Market Analysis, Insights and Forecast - by Vessel Type

- 11.2.1. Cargo Ships

- 11.2.2. Container Ships

- 11.2.3. Tankers

- 11.2.4. Other Vessel Types

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12.1.1. Liquid Bulk Transportation

- 12.1.2. Dry Bulk Transportation

- 12.2. Market Analysis, Insights and Forecast - by Vessel Type

- 12.2.1. Cargo Ships

- 12.2.2. Container Ships

- 12.2.3. Tankers

- 12.2.4. Other Vessel Types

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 13. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 EURO-RIJN B V

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Rhenus Group**List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 DFDS

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Bayliner

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Beneteau Group

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 EUROPEAN CRUISE SERVICE

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 MSC Mediterranean Shipping Company S A

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Construction Navale Bordeaux

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 MEYER WERFT GmbH & Co KG

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 CMA CGM Group

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 EURO-RIJN B V

List of Figures

- Figure 1: Europe Inland Water Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Inland Water Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 3: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 4: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 14: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 15: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 17: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 18: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 20: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 21: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 23: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 24: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 26: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 27: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 29: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 30: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 32: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 33: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inland Water Freight Transport Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Inland Water Freight Transport Market?

Key companies in the market include EURO-RIJN B V, Rhenus Group**List Not Exhaustive, DFDS, Bayliner, Beneteau Group, EUROPEAN CRUISE SERVICE, MSC Mediterranean Shipping Company S A, Construction Navale Bordeaux, MEYER WERFT GmbH & Co KG, CMA CGM Group.

3. What are the main segments of the Europe Inland Water Freight Transport Market?

The market segments include Type of Transportation, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Digitization of inland-waterway transport.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2022: The European Commission (EC) has approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support the shifting of freight transport from road to inland waterways and rail. The new scheme is part of an initiative to encourage a greener mode of transport. Designed to run until the end of January 2026, the scheme will enable shippers and logistics operators to secure non-refundable grants for cutting down external costs, including pollution, noise, congestion, and accidents, using inland waterways and rail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inland Water Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inland Water Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inland Water Freight Transport Market?

To stay informed about further developments, trends, and reports in the Europe Inland Water Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence