Key Insights

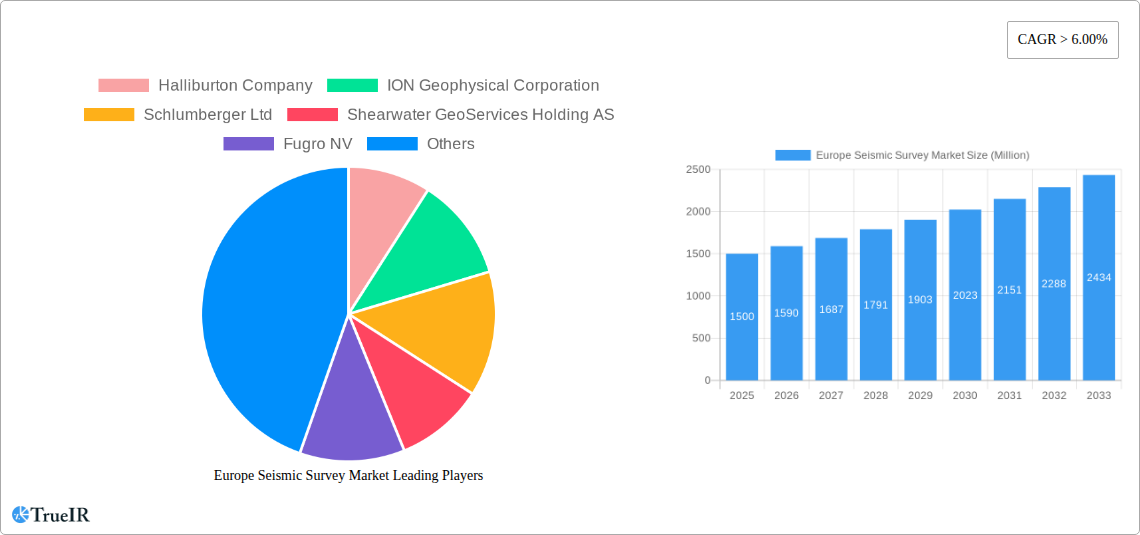

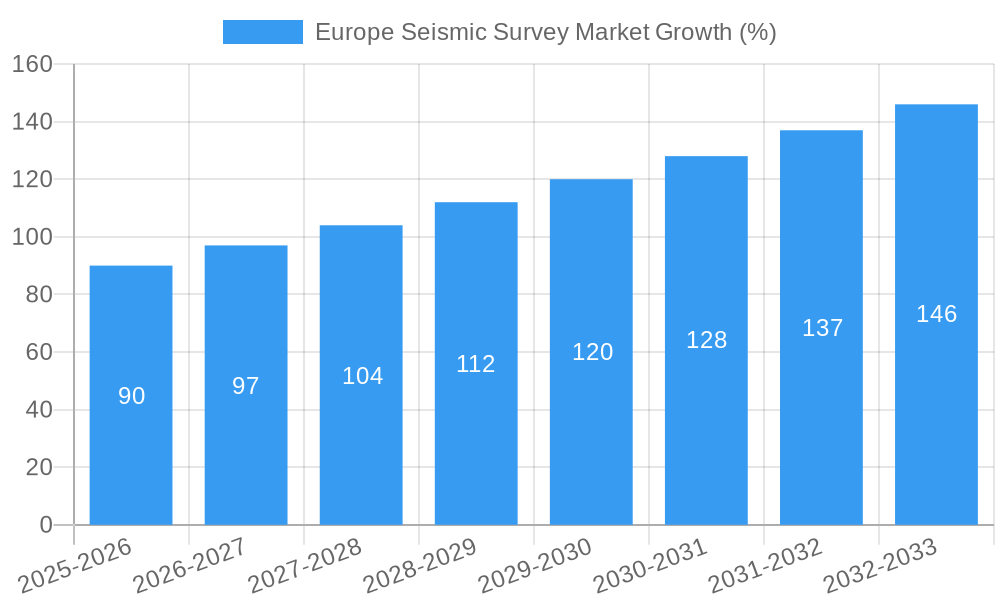

The European seismic survey market is experiencing robust growth, driven by increasing exploration and production activities in the region's mature and frontier oil and gas fields. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2033 signifies a sustained demand for seismic data acquisition and interpretation services. This growth is fueled by the need for accurate subsurface imaging to optimize drilling locations, reduce exploration risks, and enhance reservoir characterization. Technological advancements, such as the adoption of advanced seismic imaging techniques like 3D and 4D seismic surveys, are further boosting market expansion. Furthermore, stringent government regulations concerning environmental impact assessments and resource optimization are driving the adoption of sophisticated seismic surveying techniques. The market is segmented by survey type (2D, 3D, 4D), acquisition method (marine, land), and end-user (oil & gas exploration companies, research institutions). Major players like Halliburton, Schlumberger, and Fugro are actively investing in research and development to maintain their competitive edge. The competitive landscape is marked by ongoing mergers and acquisitions, strategic partnerships, and technological innovations.

Despite the positive growth trajectory, the European seismic survey market faces certain challenges. Fluctuations in oil and gas prices can significantly impact exploration budgets and consequently affect market demand. Geopolitical uncertainties and regulatory changes in different European regions can also create uncertainties. However, the long-term outlook for the market remains optimistic due to the consistent need for reliable subsurface information and the ongoing exploration efforts focused on both conventional and unconventional hydrocarbon resources. The increasing focus on carbon capture, utilization, and storage (CCUS) projects also presents a significant opportunity for the seismic survey market, as these projects require detailed subsurface information for site selection and monitoring. The market is expected to witness a sustained period of growth, driven by technological innovations and the enduring need for efficient and sustainable resource management.

Europe Seismic Survey Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Europe Seismic Survey Market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period 2019-2033, with a focus on 2025, this comprehensive study meticulously examines market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report leverages extensive primary and secondary research to deliver actionable intelligence, helping businesses navigate the complexities of this evolving market and capitalize on emerging opportunities. The market is expected to reach xx Million by 2033, showcasing substantial growth potential.

Europe Seismic Survey Market Structure & Competitive Landscape

The Europe Seismic Survey market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Key players, including Halliburton Company, ION Geophysical Corporation, Schlumberger Ltd, Shearwater GeoServices Holding AS, Fugro NV, SAExploration Holdings Inc, and CGG SA, dominate the landscape, driving innovation and shaping market dynamics. However, the market is not without smaller, specialized players catering to niche segments.

Innovation is a key driver, with continuous advancements in seismic acquisition technologies (e.g., multi-component seismic, ocean bottom nodes) enhancing data quality and efficiency. Regulatory frameworks, particularly concerning environmental impact assessments and offshore operations, play a significant role in shaping market access and operational costs. Product substitution is minimal, as seismic surveys remain an indispensable tool for hydrocarbon exploration and reservoir characterization. The market is segmented primarily by end-users (e.g., oil and gas exploration companies, research institutions), with the oil and gas sector dominating.

Mergers and acquisitions (M&A) activity has been moderate in recent years. The total value of M&A transactions in the European seismic survey market between 2019 and 2024 is estimated at xx Million. These deals primarily involve consolidations within the industry and acquisitions of specialized technology firms, reflecting an ongoing trend towards vertical integration and technological advancement.

Europe Seismic Survey Market Market Trends & Opportunities

The European seismic survey market is experiencing consistent growth, driven by increasing exploration activity, particularly in offshore regions. The market size is estimated at xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising global energy demand, ongoing exploration for new hydrocarbon reserves, and advancements in seismic imaging technologies leading to enhanced accuracy and efficiency.

Technological shifts towards advanced seismic imaging techniques, such as full-waveform inversion (FWI) and improved processing algorithms, have significantly improved the resolution and accuracy of subsurface imaging. These improvements directly translate into better exploration success rates, driving demand for advanced seismic survey services. Moreover, the industry is witnessing a shift towards sustainable and environmentally conscious practices, leading to investments in technologies that minimize environmental impact.

Competitive dynamics are characterized by intense competition among major players, particularly in bidding for large-scale exploration projects. The market penetration rate of advanced seismic technologies is increasing steadily, with a significant portion of exploration projects now incorporating these technologies. This trend is expected to continue, driving further growth in the market. The competitive landscape is also influenced by factors such as pricing strategies, technological innovation, and geographical expansion.

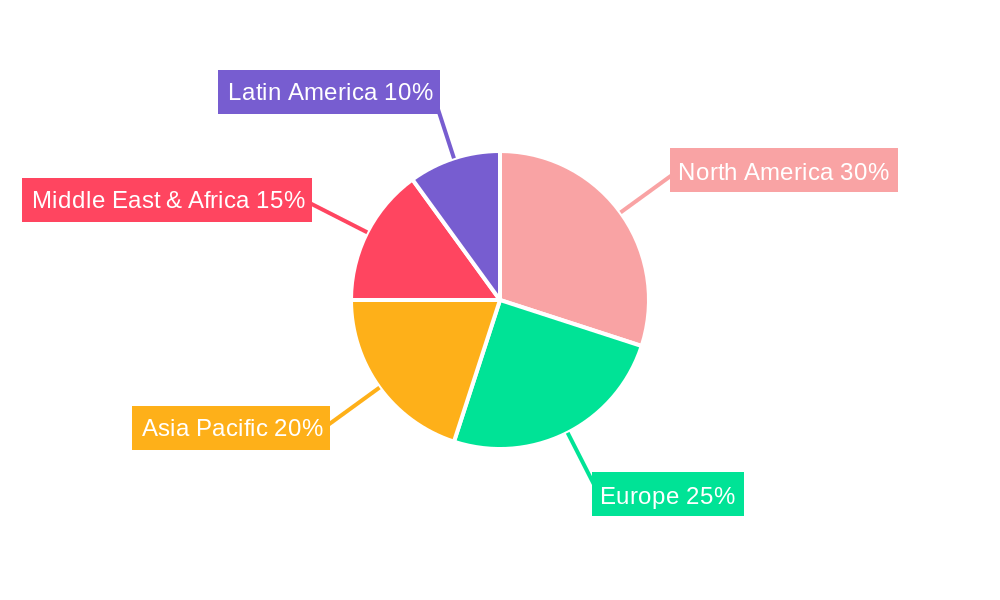

Dominant Markets & Segments in Europe Seismic Survey Market

The North Sea region, encompassing the UK, Norway, and Denmark, is the dominant market for seismic surveys in Europe. This dominance is primarily attributed to significant hydrocarbon reserves located in the region, ongoing exploration efforts, and supportive government policies.

- Key Growth Drivers in the North Sea:

- Significant hydrocarbon reserves.

- Continued investment in offshore exploration and production.

- Favorable regulatory environment for exploration and production activities.

- Advanced infrastructure supporting offshore seismic operations.

Other key European markets include the Norwegian Continental Shelf, which benefits from robust governmental support for exploration, and the UK sector. The market is segmented primarily by the type of seismic survey (e.g., 2D, 3D, 4D) with 3D surveys dominating due to their enhanced resolution capabilities. The offshore segment constitutes a larger share of the market compared to onshore surveys owing to the concentration of hydrocarbon reserves in offshore areas.

Europe Seismic Survey Market Product Analysis

The market offers a range of seismic survey products and services, including 2D, 3D, and 4D seismic acquisition, processing, and interpretation. Technological advancements have led to the development of advanced techniques like full-waveform inversion (FWI) and advanced processing algorithms, significantly improving the accuracy and resolution of subsurface imaging. These innovations are driving market growth by allowing for more efficient and effective exploration of hydrocarbon reserves. The market is also seeing the adoption of autonomous and remotely operated vessels (ROVs) for data acquisition, optimizing operational efficiency and safety. This shift towards improved technologies and operational efficiencies are improving the overall market fit and enhancing competitiveness.

Key Drivers, Barriers & Challenges in Europe Seismic Survey Market

Key Drivers: The primary driver is the continuous need to discover and develop new hydrocarbon reserves to meet global energy demand. Government policies promoting energy security and exploration activities provide additional support. Technological advancements, such as improved seismic imaging technologies, enhance exploration efficiency and success rates, further driving market growth. The transition towards cleaner energy sources creates opportunities for carbon capture storage (CCS) projects, requiring extensive seismic surveys.

Key Challenges: Regulatory hurdles, particularly environmental regulations and permitting processes, can delay projects and increase costs. Supply chain disruptions, such as equipment shortages and skilled labor limitations, create operational challenges and impact project timelines. Fluctuating oil and gas prices impact exploration budgets and investment decisions, influencing demand for seismic survey services. Intense competition among established players and emerging technological disruptors adds pressure on pricing and profitability.

Growth Drivers in the Europe Seismic Survey Market Market

The market is driven by a combination of factors, including the continuous exploration for hydrocarbons in both onshore and offshore regions, advancements in seismic imaging technologies leading to increased accuracy and efficiency, and supportive government policies aiming to enhance energy security. Furthermore, the growing focus on carbon capture and storage (CCS) projects presents significant opportunities for seismic surveys to locate suitable geological formations.

Challenges Impacting Europe Seismic Survey Market Growth

The market faces several challenges, including stringent environmental regulations increasing operational costs and complexities, fluctuating oil and gas prices impacting exploration budgets, and intense competition among established players. Supply chain issues, such as the availability of specialized equipment and skilled labor, can disrupt project timelines and increase costs.

Key Players Shaping the Europe Seismic Survey Market Market

- Halliburton Company

- ION Geophysical Corporation

- Schlumberger Ltd

- Shearwater GeoServices Holding AS

- Fugro NV

- SAExploration Holdings Inc

- CGG SA *List Not Exhaustive

Significant Europe Seismic Survey Market Industry Milestones

- 2022: Shell PLC made the final investment decision to develop the Jackdaw gas field in the British North Sea, significantly boosting exploration activity in the region and increasing demand for seismic survey services.

Future Outlook for Europe Seismic Survey Market Market

The European seismic survey market is poised for continued growth, driven by persistent demand for hydrocarbons, technological advancements in seismic imaging, and increased exploration activities. The focus on carbon capture and storage (CCS) projects will provide further impetus to the market, opening up new avenues for seismic survey applications. Strategic alliances and technological collaborations are expected to further shape the market dynamics, leading to new innovations and improved efficiency. The market is anticipated to reach xx Million by 2033, with a sustained CAGR of xx%.

Europe Seismic Survey Market Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. Norway

- 3.2. United Kingdom

- 3.3. Others

Europe Seismic Survey Market Segmentation By Geography

- 1. Norway

- 2. United Kingdom

- 3. Others

Europe Seismic Survey Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand of the Offshore Oil and Gas Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Norway

- 5.3.2. United Kingdom

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.4.2. United Kingdom

- 5.4.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Norway Europe Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Norway

- 6.3.2. United Kingdom

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Norway

- 7.3.2. United Kingdom

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Others Europe Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Norway

- 8.3.2. United Kingdom

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Halliburton Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ION Geophysical Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Schlumberger Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Shearwater GeoServices Holding AS

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fugro NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SAExploration Holdings Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 CGG SA

*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Halliburton Company

List of Figures

- Figure 1: Global Europe Seismic Survey Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Norway Europe Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 3: Norway Europe Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 4: Norway Europe Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 5: Norway Europe Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 6: Norway Europe Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Norway Europe Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Norway Europe Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Norway Europe Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: United Kingdom Europe Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 11: United Kingdom Europe Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 12: United Kingdom Europe Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 13: United Kingdom Europe Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 14: United Kingdom Europe Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: United Kingdom Europe Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: United Kingdom Europe Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 17: United Kingdom Europe Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Others Europe Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 19: Others Europe Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 20: Others Europe Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 21: Others Europe Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 22: Others Europe Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Others Europe Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Others Europe Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Others Europe Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Seismic Survey Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global Europe Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Global Europe Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Europe Seismic Survey Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Europe Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Global Europe Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 8: Global Europe Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Europe Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Europe Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 11: Global Europe Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 12: Global Europe Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Europe Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Europe Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Global Europe Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: Global Europe Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Europe Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seismic Survey Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Europe Seismic Survey Market?

Key companies in the market include Halliburton Company, ION Geophysical Corporation, Schlumberger Ltd, Shearwater GeoServices Holding AS, Fugro NV, SAExploration Holdings Inc, CGG SA *List Not Exhaustive.

3. What are the main segments of the Europe Seismic Survey Market?

The market segments include Service, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand of the Offshore Oil and Gas Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, Shell PLC made final investment decision to develop the Jackdaw gas field in the British North Sea, which is expected to meet the high demand of natural gas in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seismic Survey Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seismic Survey Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seismic Survey Market?

To stay informed about further developments, trends, and reports in the Europe Seismic Survey Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence