Key Insights

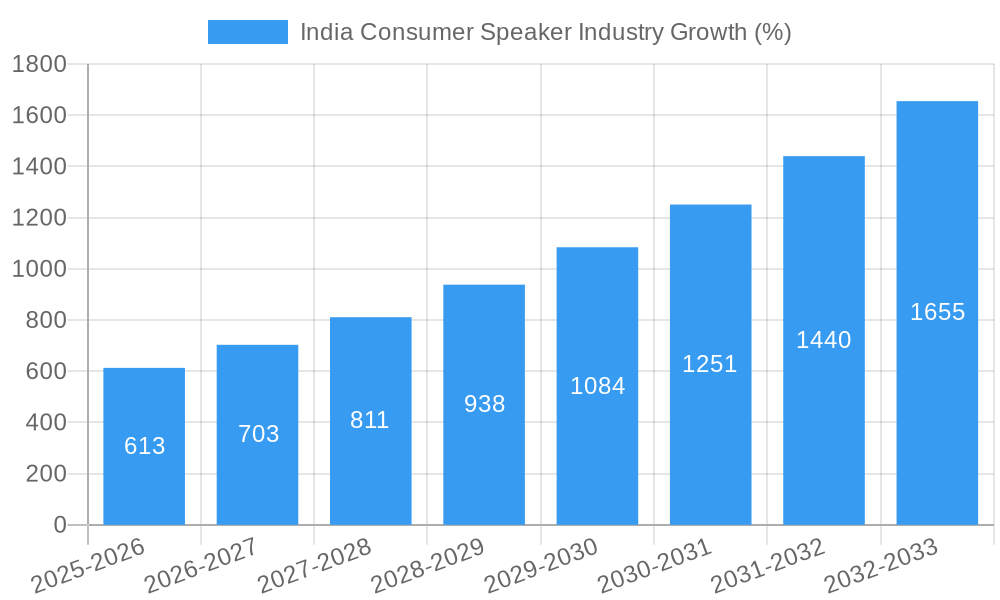

The India consumer speaker market, valued at approximately ₹50 billion (estimated based on common market sizes for similar product categories in India and the provided CAGR) in 2025, exhibits robust growth potential. A compound annual growth rate (CAGR) of 12.26% from 2025 to 2033 projects significant expansion, driven primarily by increasing disposable incomes, rising smartphone penetration, and a growing preference for high-quality audio experiences among Indian consumers. The popularity of streaming services and online entertainment further fuels market growth. The market is segmented by device type, with wireless speakers, including soundbars, hi-fi systems, and other audio systems, dominating the landscape. Key players like Amazon, Bose, JBL, and Boat compete intensely, showcasing the market's dynamism. However, challenges remain, including price sensitivity among consumers, particularly in rural areas, and the potential impact of counterfeit products. Regional variations exist, with North and South India likely representing larger market segments due to higher population density and economic activity. The growth trajectory indicates a considerable opportunity for established brands and new entrants alike, with a focus on innovation, affordability, and targeted marketing campaigns crucial for success.

The forecast period (2025-2033) anticipates continuous growth, propelled by technological advancements in speaker technology (e.g., improved sound quality, portability, and smart features) and the increasing adoption of smart home ecosystems. Growth will also be fueled by targeted marketing initiatives capitalizing on the increasing demand for immersive audio experiences. The continued expansion of e-commerce platforms will provide wider reach, further supporting market expansion. However, potential challenges including fluctuations in raw material prices and increasing competition could influence overall market dynamics. Careful market segmentation targeting specific consumer preferences and demographics will be crucial for companies seeking to capitalize on this expanding market.

India Consumer Speaker Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic India consumer speaker market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, growth drivers, challenges, and future outlook, making it an essential resource for industry stakeholders, investors, and researchers. The report leverages extensive data analysis to project a robust market expansion, highlighting key segments and influential players. Expect a deep dive into the booming wireless speaker segment and the impact of innovative product launches from major players such as Boat, Sony, and UBON.

India Consumer Speaker Industry Market Structure & Competitive Landscape

The Indian consumer speaker market exhibits a moderately concentrated structure, with a few dominant players alongside a large number of smaller, niche brands. The market’s Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, suggesting a moderately competitive landscape. Key innovation drivers include advancements in Bluetooth technology, improved sound quality, integration with smart home devices, and the introduction of new form factors like portable wireless speakers and soundbars. Regulatory impacts, primarily related to import duties and standards compliance, influence pricing and product availability. Product substitutes include headphones and other personal audio devices. The end-user segment comprises diverse demographics, including individual consumers, businesses, and educational institutions. M&A activity has been relatively moderate, with xx million in deal value recorded between 2019 and 2024. Significant consolidation is not anticipated in the near future.

- Market Concentration: Moderately concentrated, with HHI estimated at xx in 2025.

- Innovation Drivers: Bluetooth technology advancements, improved sound quality, smart home integration, new form factors.

- Regulatory Impacts: Import duties, standards compliance.

- Product Substitutes: Headphones, other personal audio devices.

- End-User Segmentation: Individuals, businesses, educational institutions.

- M&A Trends: Moderate activity, xx million in deal value (2019-2024).

India Consumer Speaker Industry Market Trends & Opportunities

The Indian consumer speaker market is experiencing significant growth, driven by rising disposable incomes, increasing smartphone penetration, and a growing preference for high-quality audio experiences. The market size is projected to reach xx million in 2025, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts, such as the adoption of advanced audio codecs like aptX and LDAC, are enhancing sound quality and user experience. Consumer preferences are increasingly leaning toward portable, wireless speakers with enhanced features like water resistance and long battery life. Competitive dynamics are characterized by price competition, product differentiation, and strategic partnerships. Market penetration rates are steadily increasing, particularly in urban areas.

Dominant Markets & Segments in India Consumer Speaker Industry

The wireless speaker segment dominates the Indian consumer speaker market, accounting for xx% of total revenue in 2025. This dominance is fueled by the convenience and portability offered by wireless technology. Within the wireless speaker category, portable Bluetooth speakers have shown particularly strong growth. The traditional wireless segment comprising soundbars, Hi-Fi systems, and other audio systems holds a smaller, yet significant, share of the market. Urban areas are the leading markets due to higher disposable incomes and greater consumer awareness.

- Wireless Speakers: Dominating segment (xx% of revenue in 2025), driven by convenience and portability. Growth fuelled by increasing smartphone penetration and preference for high-quality audio.

- Traditional Wireless Speakers (Soundbars, Hi-Fi systems etc.): Significant but smaller market share, driven by home entertainment upgrades and audiophile demand.

Key Growth Drivers (Wireless Speakers):

- Rising disposable incomes.

- Increased smartphone and smart home device penetration.

- Growing preference for convenient and portable audio solutions.

- Increasing demand for high-quality audio.

India Consumer Speaker Industry Product Analysis

Product innovation is a key driver in the Indian consumer speaker market. Manufacturers are focusing on developing speakers with enhanced sound quality, longer battery life, improved water and dust resistance, and seamless integration with smart devices. Competitive advantages are achieved through superior audio technology, unique designs, and attractive pricing. The market is witnessing the introduction of smart speakers with voice assistants, and the integration of advanced features like noise cancellation and spatial audio.

Key Drivers, Barriers & Challenges in India Consumer Speaker Industry

Key Drivers: Rising disposable incomes, increasing smartphone penetration, growing demand for high-quality audio, and government initiatives promoting digitalization drive market growth. Technological advancements in audio processing and wireless connectivity enhance product appeal.

Challenges: Intense competition, fluctuating raw material prices, and the vulnerability of supply chains to geopolitical factors pose significant challenges. Regulatory compliance and the evolving consumer preferences demand ongoing product and business model adaptation. Counterfeit products also negatively impact the market.

Growth Drivers in the India Consumer Speaker Industry Market

The Indian consumer speaker market is primarily driven by the burgeoning middle class, escalating demand for high-quality audio experiences, and technological breakthroughs in wireless connectivity and audio processing. Government initiatives promoting digital India and the increasing affordability of smart devices further accelerate growth.

Challenges Impacting India Consumer Speaker Industry Growth

Significant challenges facing the industry include import dependence on components, intense competition from both domestic and international brands, and the risk of counterfeit products. Supply chain disruptions and fluctuations in raw material prices create price volatility, impacting market dynamics.

Key Players Shaping the India Consumer Speaker Industry Market

- Amazon Retail India Private Limited

- Intex Technologies

- Google India Private Limited

- Bose Corporation

- Skullcandy Inc.

- Fenda Audio India Private Limited

- Zebronics India Pvt Ltd

- HARMAN International India Pvt Ltd (JBL)

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Sony India Private Limited

- GN Audio A/S (Jabra)

- Koninklijke Philips NV

- Imagine Marketing Pvt Ltd (Boat)

Significant India Consumer Speaker Industry Industry Milestones

- July 2022: UBON launches the HULK SP-180 wireless speaker, priced at INR 2,499, featuring deep bass and a long battery life. This launch expands the budget-friendly segment.

- June 2022: BoAt introduces the Stone 135 portable Bluetooth speaker, priced at INR 799, focusing on water resistance and affordability. This strengthens BoAt's position in the budget market.

- January 2022: Sony launches SRS-NS7 and SRS-NB10 wireless neckband speakers, featuring Dolby Atmos support and 360 Spatial Sound, targeting a premium segment. This illustrates the move towards high-quality audio experiences.

Future Outlook for India Consumer Speaker Industry Market

The Indian consumer speaker market is poised for sustained growth, driven by increasing affordability, expanding internet penetration, and the ongoing development of innovative audio technologies. The market will witness further penetration of wireless speakers, particularly portable Bluetooth models. Companies will focus on product differentiation through superior sound quality, unique features, and brand building initiatives. Growth opportunities are substantial, with significant potential for expansion in both urban and rural markets.

India Consumer Speaker Industry Segmentation

-

1. Type of Device

-

1.1. Wireless Speakers

- 1.1.1. Smart Speakers

- 1.1.2. Traditional Wireless Speakers

- 1.2. Soundbars

- 1.3. Hi-Fi Systems

- 1.4. Others Audio Systems

-

1.1. Wireless Speakers

India Consumer Speaker Industry Segmentation By Geography

- 1. India

India Consumer Speaker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Novelty Factor Around Technology; The Shift in Consumer Behavior; Accelerating Adoption of Voice Interfaces In India

- 3.3. Market Restrains

- 3.3.1. Increasing Preference for Live Person Interaction

- 3.4. Market Trends

- 3.4.1. Demand for Wireless Speakers to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Consumer Speaker Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Wireless Speakers

- 5.1.1.1. Smart Speakers

- 5.1.1.2. Traditional Wireless Speakers

- 5.1.2. Soundbars

- 5.1.3. Hi-Fi Systems

- 5.1.4. Others Audio Systems

- 5.1.1. Wireless Speakers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North India India Consumer Speaker Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Consumer Speaker Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Consumer Speaker Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Consumer Speaker Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Amazon Retail India Private Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intex Technologies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Google India Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bose Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Skullcandy in

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fenda Audio India Private Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zebronics India Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 HARMAN International India Pvt Ltd (JBL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Samsung Electronics Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Xiaomi Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sony India Private Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 GN Audio A/S (Jabra)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Koninklijke Philips NV

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Imagine Marketing Pvt Ltd (Boat)

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Amazon Retail India Private Limited

List of Figures

- Figure 1: India Consumer Speaker Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Consumer Speaker Industry Share (%) by Company 2024

List of Tables

- Table 1: India Consumer Speaker Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Consumer Speaker Industry Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Consumer Speaker Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: India Consumer Speaker Industry Volume Million Forecast, by Type of Device 2019 & 2032

- Table 5: India Consumer Speaker Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Consumer Speaker Industry Volume Million Forecast, by Region 2019 & 2032

- Table 7: India Consumer Speaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Consumer Speaker Industry Volume Million Forecast, by Country 2019 & 2032

- Table 9: North India India Consumer Speaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Consumer Speaker Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 11: South India India Consumer Speaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Consumer Speaker Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: East India India Consumer Speaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Consumer Speaker Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: West India India Consumer Speaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Consumer Speaker Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: India Consumer Speaker Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 18: India Consumer Speaker Industry Volume Million Forecast, by Type of Device 2019 & 2032

- Table 19: India Consumer Speaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Consumer Speaker Industry Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Consumer Speaker Industry?

The projected CAGR is approximately 12.26%.

2. Which companies are prominent players in the India Consumer Speaker Industry?

Key companies in the market include Amazon Retail India Private Limited, Intex Technologies, Google India Private Limited, Bose Corporation, Skullcandy in, Fenda Audio India Private Limited, Zebronics India Pvt Ltd, HARMAN International India Pvt Ltd (JBL), Samsung Electronics Co Ltd, Xiaomi Corporation, Sony India Private Limited, GN Audio A/S (Jabra), Koninklijke Philips NV, Imagine Marketing Pvt Ltd (Boat).

3. What are the main segments of the India Consumer Speaker Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Novelty Factor Around Technology; The Shift in Consumer Behavior; Accelerating Adoption of Voice Interfaces In India.

6. What are the notable trends driving market growth?

Demand for Wireless Speakers to Grow Significantly.

7. Are there any restraints impacting market growth?

Increasing Preference for Live Person Interaction.

8. Can you provide examples of recent developments in the market?

July 2022 - UBON, an Indian gadget accessory and consumer electronics brand, has recently launched the HULK SP-180 wireless speaker, which is priced at INR 2,499. HULK SP-180 incorporates deep bass, an in-built phone stand, and 1800 mAh of battery backup. It also features 4 hours of non-stop playtime, USB charging, and an inbuilt microphone port.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Consumer Speaker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Consumer Speaker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Consumer Speaker Industry?

To stay informed about further developments, trends, and reports in the India Consumer Speaker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence