Key Insights

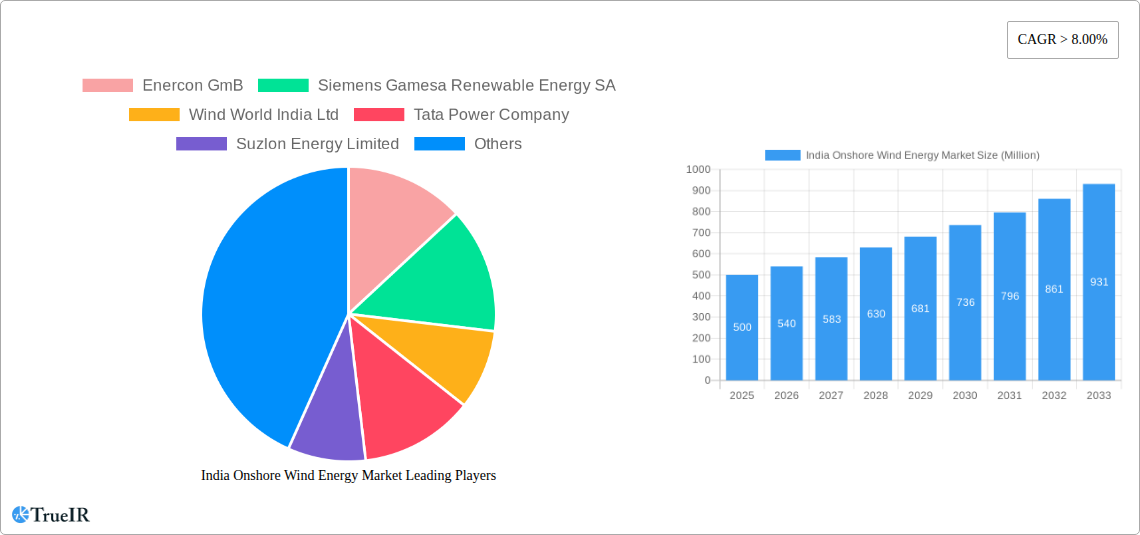

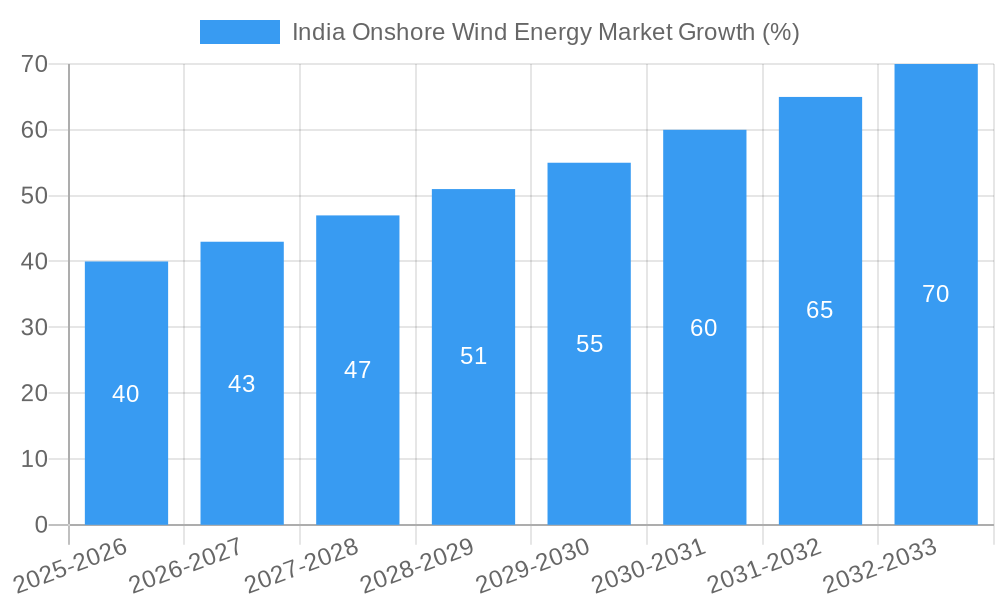

The India onshore wind energy market is experiencing robust growth, driven by the government's ambitious renewable energy targets and increasing electricity demand. With a CAGR exceeding 8% and a market size currently in the hundreds of millions (exact figure unavailable but estimated based on global trends and regional data), the sector presents significant investment opportunities. The market is segmented by turbine capacity, with the 2-3 MW segment currently dominating at 55%, indicating a preference for projects with moderate scale and potentially lower upfront costs. However, the >3 MW segment is growing at a faster rate (estimated to be slightly higher than 8% CAGR), reflecting a trend towards larger, more efficient wind farms. Key players like Enercon, Siemens Gamesa, and Suzlon are actively shaping the market landscape, competing on technology, pricing, and project execution. Government policies promoting domestic manufacturing and grid infrastructure development further support the market's expansion.

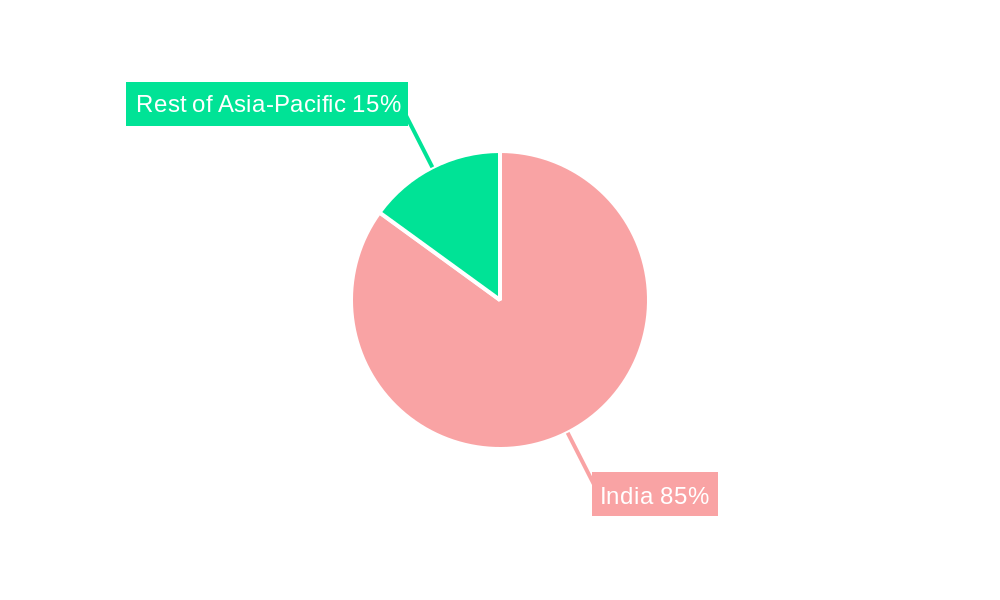

The Asia-Pacific region, particularly India, China, and other South Asian countries, is a major contributor to the global onshore wind energy market. India's favorable wind resources, coupled with supportive government regulations and initiatives such as the National Wind-Solar Hybrid Policy, are crucial drivers. Challenges remain, including land acquisition complexities, grid integration issues, and the intermittent nature of wind power. However, technological advancements, such as improved turbine designs and energy storage solutions, are mitigating these challenges. The forecast period of 2025-2033 anticipates sustained growth, fueled by continuous policy support and increasing private sector participation. This growth trajectory is likely to be influenced by global energy transition trends and India's commitment to achieving its renewable energy targets. The market's future hinges on consistent policy implementation, technological advancements, and the effective resolution of logistical challenges.

This comprehensive report provides an in-depth analysis of the India onshore wind energy market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025-2033.

India Onshore Wind Energy Market Structure & Competitive Landscape

The Indian onshore wind energy market exhibits a moderately concentrated structure, with key players like Suzlon Energy Limited, Tata Power Company, Enercon GmB, Siemens Gamesa Renewable Energy SA, and Vestas Wind Systems AS holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating moderate competition. Innovation is driven by the need for higher efficiency turbines, improved grid integration technologies, and cost reduction strategies. Government regulations, including feed-in tariffs and renewable energy mandates, significantly influence market dynamics. Product substitutes, such as solar power, pose some competitive pressure, but the unique advantages of wind power in specific geographical locations maintain its relevance. End-user segmentation largely comprises utility-scale projects and some smaller commercial and industrial installations. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, totaling approximately xx Million USD in value. These transactions primarily involve consolidation among smaller players and strategic partnerships for project development.

India Onshore Wind Energy Market Market Trends & Opportunities

The Indian onshore wind energy market is experiencing substantial growth, driven by increasing energy demand, government support for renewable energy, and declining technology costs. The market size, which stood at xx Million USD in 2024, is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx%. This growth is fueled by technological advancements leading to increased turbine capacity and efficiency. Consumer preference for cleaner energy sources is also bolstering the market's expansion. However, challenges remain in terms of land acquisition, grid infrastructure limitations, and ensuring consistent policy support. The market penetration rate of wind energy in the overall electricity mix is currently at xx% and is anticipated to rise to xx% by 2033. Competitive dynamics are characterized by a mix of established players and emerging companies striving to capture a share of this rapidly evolving market. Key opportunities lie in developing projects in underserved regions, leveraging innovative financing models, and focusing on hybrid energy solutions combining wind with solar or storage technologies.

Dominant Markets & Segments in India Onshore Wind Energy Market

The dominant segment within the Indian onshore wind energy market is the 2-3 MW turbine capacity segment, currently accounting for 55.0% of the market. This is primarily due to the mature technology, cost-effectiveness, and suitability for various geographical locations. The >3 MW segment accounts for the remaining 45.0%, and is experiencing rapid growth owing to the increasing demand for higher capacity projects and the associated economies of scale.

Key Growth Drivers for 2-3 MW Segment:

- Established technology and availability of components.

- Cost-effectiveness compared to larger turbines.

- Suitability for diverse wind resources.

- Favorable government policies and incentives.

Key Growth Drivers for >3 MW Segment:

- Economies of scale leading to lower cost per unit of electricity.

- Higher power output, leading to reduced land requirements.

- Technological advancements leading to improved efficiency and reliability.

- Growing demand for large-scale wind power projects.

The states of Tamil Nadu, Gujarat, Karnataka, and Maharashtra are the leading markets for onshore wind energy in India. This dominance is driven by factors such as higher wind speeds, available land, supportive government policies, and established grid infrastructure. However, the market is expanding into other states as well, especially those with untapped wind resources and conducive policy environments.

India Onshore Wind Energy Market Product Analysis

Technological advancements in turbine design, blade technology, and control systems are driving product innovation in the Indian onshore wind energy market. These advancements lead to improved energy conversion efficiency, higher capacity factors, and reduced operational costs. The market offers a range of turbine sizes and designs catering to various wind resource conditions and project requirements. Competitive advantages are determined by factors such as turbine efficiency, cost-competitiveness, service capabilities, and project execution expertise. The trend toward larger turbine capacities is gaining momentum, with manufacturers focusing on developing and deploying turbines with capacities exceeding 3 MW to optimize land use and project economics.

Key Drivers, Barriers & Challenges in India Onshore Wind Energy Market

Key Drivers: The market is propelled by the Indian government's ambitious renewable energy targets, increasing demand for electricity, decreasing costs of wind energy technology, and favorable policies like feed-in tariffs and tax benefits. Technological advancements in turbine design, blade technology, and grid integration further contribute to market expansion. Financial incentives from the government and the private sector are also playing a key role in stimulating investment in wind energy projects.

Key Barriers and Challenges: Land acquisition challenges, grid infrastructure limitations (especially in remote areas), and the intermittent nature of wind power pose significant obstacles. Regulatory complexities and bureaucratic procedures can cause project delays and increase costs. Supply chain vulnerabilities and dependency on imported components present risks. Furthermore, competition from other renewable energy sources, like solar, necessitates continuous cost reductions and technological improvements to maintain market competitiveness. These challenges can collectively reduce the profitability and growth of the market. A lack of skilled labor is also proving to be an increasing barrier to rapid growth.

Growth Drivers in the India Onshore Wind Energy Market Market

Government policies promoting renewable energy, increasing electricity demand, decreasing technology costs, and advancements in turbine technology are key growth drivers. The availability of suitable locations with sufficient wind speeds further contributes to the market's expansion. Successful projects and reduced LCOE (Levelized Cost of Energy) enhance investor confidence, leading to increased investment in new projects.

Challenges Impacting India Onshore Wind Energy Market Growth

Land acquisition difficulties, grid integration constraints, and regulatory hurdles present significant challenges. Intermittency of wind power and the need for energy storage solutions are also major factors hindering market growth. The dependence on imports for certain components creates vulnerabilities in the supply chain. Competition from other renewable energy sources and the need for continual cost reduction put continuous pressure on market players.

Key Players Shaping the India Onshore Wind Energy Market Market

- Enercon GmB

- Siemens Gamesa Renewable Energy SA

- Wind World India Ltd

- Tata Power Company

- Suzlon Energy Limited

- Envision Group

- Inox Wind limited

- Vestas Wind Systems AS

- General Electric Company

Significant India Onshore Wind Energy Market Industry Milestones

- October 2022: Suzlon Group secures a 144.9 MW wind power project order from the Aditya Birla Group, demonstrating continued demand for wind energy.

- May 2022: India's Minister for Power and New & Renewable Energy announces plans for 30,000 MW of offshore wind power capacity, signaling a broader commitment to renewable energy.

- October 2021: GE Renewable Energy secures an 810 MW onshore wind turbine order from JSW Energy Ltd, highlighting the scale of large-scale project development.

Future Outlook for India Onshore Wind Energy Market Market

The Indian onshore wind energy market is poised for sustained growth, driven by supportive government policies, increasing energy demand, and technological advancements. Strategic opportunities exist in developing projects in underserved regions, leveraging innovative financing models, and exploring hybrid energy solutions. The market's expansion is anticipated to continue, propelled by the country's commitment to achieving its renewable energy goals. The focus will increasingly shift toward larger turbine capacities, improved grid integration, and cost-effective energy storage solutions to enhance the reliability and efficiency of wind power generation.

India Onshore Wind Energy Market Segmentation

- 1. Onshore

- 2. Offshore

India Onshore Wind Energy Market Segmentation By Geography

- 1. India

India Onshore Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. China India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Enercon GmB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens Gamesa Renewable Energy SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wind World India Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Power Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Suzlon Energy Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Envision Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Inox Wind limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vestas Wind Systems AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General Electric Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Enercon GmB

List of Figures

- Figure 1: India Onshore Wind Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Onshore Wind Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 3: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 5: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 7: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 9: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

- Table 11: China India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 13: Japan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 15: India India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 17: South Korea India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 19: Taiwan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 21: Australia India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 25: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 26: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 27: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 28: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 29: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Onshore Wind Energy Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Onshore Wind Energy Market?

Key companies in the market include Enercon GmB, Siemens Gamesa Renewable Energy SA, Wind World India Ltd, Tata Power Company, Suzlon Energy Limited, Envision Group, Inox Wind limited, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the India Onshore Wind Energy Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Wind Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Suzlon Group secured new order to develop 144.9 MW wind power projects located at sites in Gujarat and Madhya Pradesh for the Aditya Birla Group. As a part of the contract, the company will install around 69 units of wind turbine generators (Wind Turbines) with a Hybrid Lattice Tubular (HLT) tower with a rated capacity of 2.1 MW each. It is expected to commence operations by the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Onshore Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Onshore Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Onshore Wind Energy Market?

To stay informed about further developments, trends, and reports in the India Onshore Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence