Key Insights

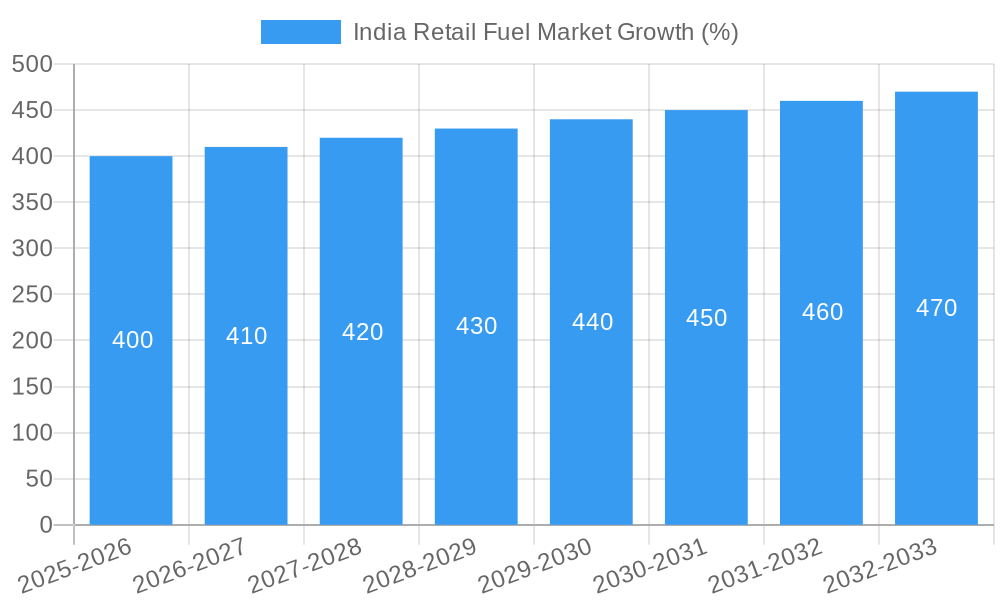

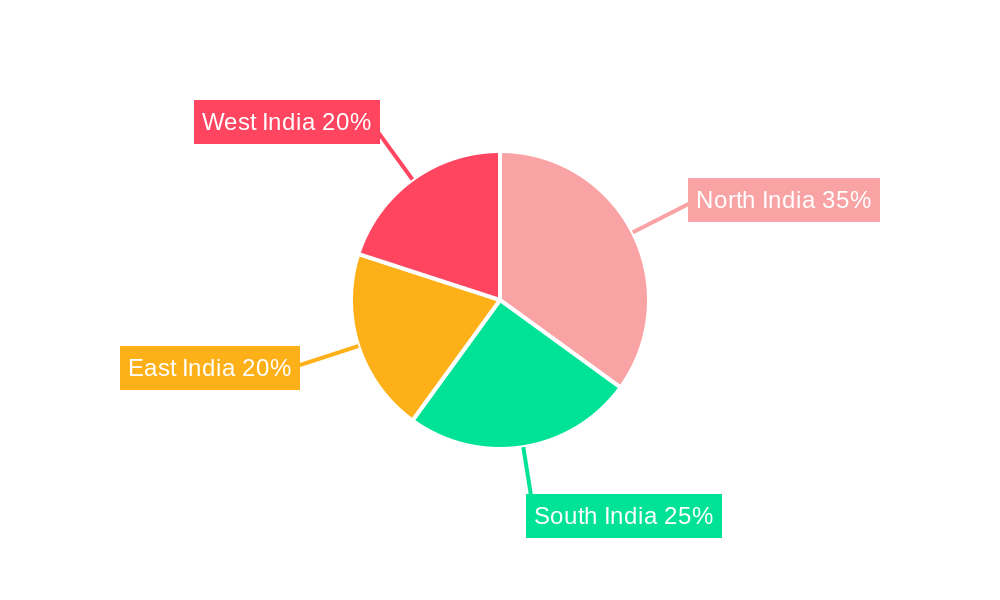

The India retail fuel market, valued at approximately ₹15 trillion (estimated based on common market sizing methodologies and available data points) in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 2.62% from 2025 to 2033. This growth is driven by several key factors. India's expanding economy and increasing vehicle ownership, particularly in the burgeoning middle class, fuel robust demand for gasoline and diesel. Furthermore, government initiatives focused on infrastructure development and improving road connectivity across the country contribute significantly to market expansion. The shift towards more fuel-efficient vehicles and the adoption of cleaner fuels, though present, are currently less impactful on the overall market growth compared to the demand drivers mentioned above. Regional variations exist; North and West India, with higher vehicle density and economic activity, are expected to dominate market share.

However, the market faces challenges. Fluctuations in global crude oil prices pose a significant risk, impacting fuel pricing and profitability for retailers. The increasing focus on electric vehicles and alternative energy sources presents a long-term threat to traditional fuel consumption. Government regulations concerning emission standards and environmental protection also necessitate investments in upgrading infrastructure and refining processes. The competitive landscape is dominated by large public sector undertakings (PSUs) like Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum, alongside private players such as Reliance Industries and Nayara Energy, each vying for market share through strategic pricing, branding, and network expansion. The segmentation of the market based on ownership (Public Sector Undertakings vs. Private) and end-user (Public Sector vs. Private Sector) reveals diverse dynamics, emphasizing the importance of tailored strategies for different segments.

India Retail Fuel Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic India Retail Fuel Market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this research delves into market structure, competitive dynamics, growth drivers, and future projections. The report leverages extensive data analysis and incorporates recent industry developments to offer a robust and actionable forecast.

India Retail Fuel Market Structure & Competitive Landscape

The Indian retail fuel market is characterized by a complex interplay of public and private sector players, significant regulatory influence, and evolving consumer preferences. Market concentration is moderately high, with a few large players dominating the landscape. Public Sector Undertakings (PSUs) like Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, and Hindustan Petroleum Corporation Limited hold a substantial market share, while private players such as Reliance Industries Limited, Shell PLC, TotalEnergies SA, and Nayara Energy Limited are aggressively expanding their presence.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: The push for cleaner fuels (E20 blending), technological advancements in fuel delivery and retail infrastructure, and increasing digitalization are key innovation drivers.

- Regulatory Impacts: Government policies on fuel pricing, ethanol blending mandates, and environmental regulations significantly shape market dynamics.

- Product Substitutes: The emergence of electric vehicles and alternative fuels presents a long-term challenge to conventional fuels. However, their current market penetration remains low.

- End-User Segmentation: The market is broadly segmented into Public Sector and Private Sector end-users, with the public sector having a larger share due to government vehicles and infrastructure.

- M&A Trends: The past five years have witnessed xx mergers and acquisitions (M&A) deals in the Indian retail fuel sector, primarily focused on enhancing distribution networks and optimizing operations.

India Retail Fuel Market Market Trends & Opportunities

The Indian retail fuel market exhibits substantial growth potential, driven by rising vehicle ownership, expanding infrastructure, and increasing economic activity. The market size is projected to reach xx Million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts, like the adoption of digital payment systems and automated fuel dispensing, are enhancing operational efficiency and customer experience. Consumer preferences are increasingly shifting towards cleaner fuels and convenient retail experiences. The competitive landscape is characterized by intense rivalry among existing players and the entry of new entrants, leading to price competition and innovative offerings. Market penetration rates for various fuel types are also evolving, with petrol maintaining a dominant share but facing gradual erosion due to diesel and alternative fuel growth. The government's push for ethanol blending presents a significant opportunity for players who can adapt quickly to this shift.

Dominant Markets & Segments in India Retail Fuel Market

The Indian retail fuel market is geographically diverse, with significant variations in consumption patterns across different regions. However, major metropolitan areas and rapidly developing states contribute most significantly to overall market volume.

- Dominant Ownership Segment: Public Sector Undertakings (PSUs) currently dominate the market share due to their extensive network and established presence.

- Dominant End-User Segment: The Public Sector consumes a significant proportion of retail fuel due to its vast fleet of vehicles and infrastructure needs.

- Key Growth Drivers:

- Infrastructure Development: Ongoing investments in road networks and transportation infrastructure are fueling fuel demand.

- Economic Growth: India's robust economic growth translates into higher vehicle ownership and fuel consumption.

- Government Policies: Government initiatives promoting ethanol blending and the expansion of the retail fuel network are crucial growth catalysts.

The dominance of PSUs can be attributed to their well-established infrastructure, extensive retail network, and government support. However, private players are challenging this dominance through strategic acquisitions, technological innovations, and aggressive marketing campaigns.

India Retail Fuel Market Product Analysis

The Indian retail fuel market offers a range of products, primarily petrol and diesel, with increasing focus on ethanol blends. Technological advancements are leading to the introduction of improved fuel formulations with enhanced performance and lower emissions. The market is witnessing growing demand for cleaner fuels, particularly with the government's push for E20 fuel. Competitive advantages are increasingly driven by factors like pricing strategies, distribution network efficiency, brand loyalty, and innovative retail offerings, including loyalty programs and value-added services.

Key Drivers, Barriers & Challenges in India Retail Fuel Market

Key Drivers: Technological advancements (e.g., digital payment systems, automated fuel dispensing), economic growth (increasing vehicle ownership), and supportive government policies (e.g., ethanol blending mandates) are driving market expansion.

Challenges: Regulatory complexities (e.g., fuel pricing regulations, environmental standards), supply chain disruptions (e.g., fluctuating crude oil prices, logistical challenges), and intense competition from both established and new market entrants pose significant hurdles. These challenges impact profitability and market share, especially for smaller players.

Growth Drivers in the India Retail Fuel Market Market

The Indian retail fuel market's growth is primarily fueled by rising disposable incomes leading to higher vehicle ownership and increased fuel consumption. Government initiatives, such as the promotion of ethanol blending, improve fuel efficiency, and the expansion of the retail fuel network, further stimulate growth. Technological advancements in fuel dispensing and payment systems also contribute significantly.

Challenges Impacting India Retail Fuel Market Growth

Significant challenges include volatile crude oil prices impacting fuel costs and profitability, strict environmental regulations increasing compliance costs, and intense competition within the market leading to price wars and reduced margins. Supply chain disruptions and infrastructure limitations in certain regions further constrain growth.

Key Players Shaping the India Retail Fuel Market Market

- Shell PLC

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Indian Oil Corporation Ltd

Significant India Retail Fuel Market Industry Milestones

- February 2023: Launch of E20 fuel across 11 states and union territories, aiming for 20% ethanol blending by 2025. This significantly impacts market dynamics by promoting cleaner fuels and driving investment in ethanol production.

- February 2023: Jio-bp starts selling E20 gasoline, expanding consumer choice and accelerating the adoption of ethanol blends.

- December 2022: Indian Oil Corporation (IOCL) partners with Reliance Jio to connect 7,200 sites using SD-WAN, showcasing a move towards enhanced digitalization and operational efficiency in the sector.

Future Outlook for India Retail Fuel Market Market

The Indian retail fuel market is poised for continued growth, driven by sustained economic expansion, rising vehicle ownership, and ongoing government support for infrastructure development and cleaner fuel initiatives. Strategic investments in renewable energy sources and technological advancements will further shape the market's trajectory. The increasing adoption of electric vehicles presents both challenges and opportunities, requiring companies to adapt their strategies and invest in new technologies to maintain competitiveness.

India Retail Fuel Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End User

- 2.1. Public Sector

- 2.2. Private Sector

India Retail Fuel Market Segmentation By Geography

- 1. India

India Retail Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Public Sector Undertakings Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Public Sector

- 5.2.2. Private Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shell PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TotalEnergies SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hindustan Petroleum Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Reliance Industries Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bharat Petroleum Corp Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nayara Energy Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Indian Oil Corporation Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Shell PLC

List of Figures

- Figure 1: India Retail Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Retail Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: India Retail Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 3: India Retail Fuel Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2019 & 2032

- Table 5: India Retail Fuel Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2019 & 2032

- Table 7: India Retail Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 9: India Retail Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 11: North India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 13: South India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 15: East India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 17: West India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 19: India Retail Fuel Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 20: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2019 & 2032

- Table 21: India Retail Fuel Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2019 & 2032

- Table 23: India Retail Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail Fuel Market?

The projected CAGR is approximately 2.62%.

2. Which companies are prominent players in the India Retail Fuel Market?

Key companies in the market include Shell PLC, TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Indian Oil Corporation Ltd.

3. What are the main segments of the India Retail Fuel Market?

The market segments include Ownership, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

The Public Sector Undertakings Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: The Government of India announced the launch of E20 fuel across 11 states and union territories at 84 retail outlets in India. The Indian government aims to achieve 20% blending of ethanol with petrol by 2025 in the country. The step was taken to control the environmental emission from conventional fuels and progress towards a greener fuel economy. Oil marketing companies (OMC), including HPCL, have set up plants to accomplish the goal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail Fuel Market?

To stay informed about further developments, trends, and reports in the India Retail Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence