Key Insights

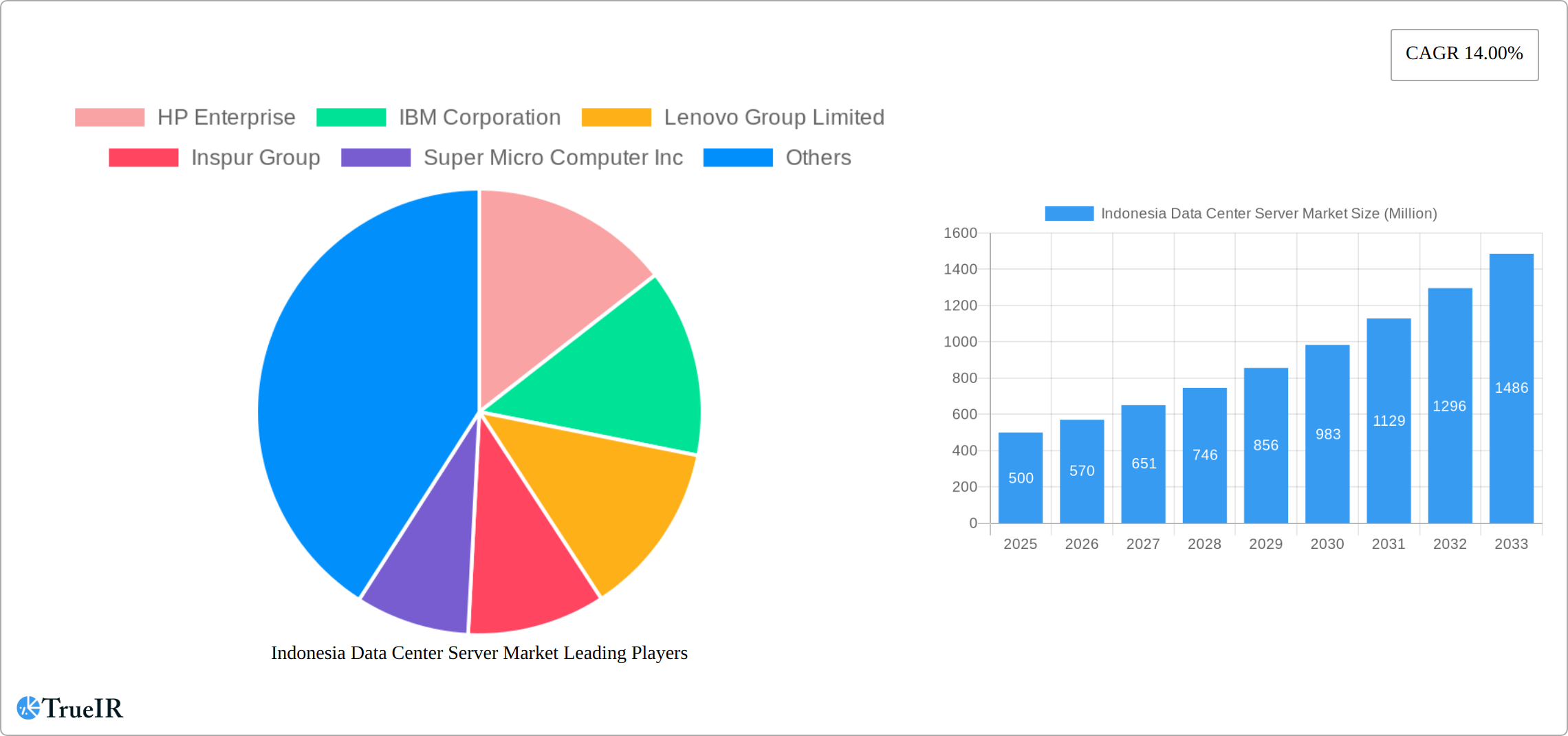

The Indonesia Data Center Server market is experiencing robust growth, projected to reach a significant market size by 2033. Driven by the expanding digital economy, increasing cloud adoption, and government initiatives promoting digital infrastructure development, the market is expected to maintain a Compound Annual Growth Rate (CAGR) of 14.00% during the forecast period (2025-2033). Key segments driving this growth include blade and rack servers, largely fueled by the needs of the IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Government sectors. The increasing demand for high-performance computing and data storage solutions within these sectors is a major catalyst. While challenges such as infrastructure limitations and potential economic fluctuations could act as restraints, the overall market outlook remains positive. Major players like HP Enterprise, IBM, Lenovo, and others are actively competing in this market, investing in advanced technologies and expanding their presence to cater to the growing demand. The market's segmentation by form factor (blade, rack, tower) allows for tailored solutions to meet diverse customer requirements, contributing to market dynamism and further propelling growth. The substantial growth in the Indonesian economy and its rising internet penetration rates ensure a continued surge in data center server demand throughout the forecast period.

The strong performance of the Indonesian data center server market is closely linked to the nation's broader economic development and technological advancement. The increasing adoption of cloud computing services by businesses of all sizes, coupled with the expanding digitalization efforts of the Indonesian government, have created a strong foundation for sustained market expansion. Specific industry trends, such as the rising preference for energy-efficient server technologies and the increasing adoption of edge computing solutions, are also influencing market dynamics. The competitive landscape, characterized by both global and local players, fosters innovation and ensures a competitive pricing structure beneficial to consumers. By focusing on strategic partnerships and technological innovation, companies are positioning themselves for long-term success within this dynamic and growing market.

Indonesia Data Center Server Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Indonesia data center server market, offering invaluable insights for stakeholders across the IT infrastructure landscape. From market sizing and segmentation to competitive analysis and future projections, this study offers a 360-degree view of this rapidly evolving sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and includes detailed analysis of key market drivers, challenges, and opportunities. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Indonesia Data Center Server Market Market Structure & Competitive Landscape

The Indonesian data center server market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a competitive yet not overly fragmented market. Innovation is a key driver, with continuous advancements in server technologies such as AI optimization, energy efficiency, and enhanced processing power pushing market growth. Regulatory frameworks concerning data sovereignty and cybersecurity are increasingly impacting market dynamics, influencing vendor strategies and investment decisions. While direct product substitutes are limited, alternative cloud computing solutions present some degree of competition. M&A activity in the Indonesian data center sector has been relatively low in recent years, with a total transaction volume of approximately xx Million in the past five years. End-user segmentation demonstrates strong demand from the IT & Telecommunication sector, followed by the BFSI and Government sectors.

- Market Concentration: Moderately concentrated, with HHI of xx in 2025.

- Innovation Drivers: AI optimization, energy efficiency, enhanced processing power.

- Regulatory Impacts: Data sovereignty, cybersecurity regulations.

- Product Substitutes: Cloud computing services.

- End-User Segmentation: IT & Telecommunication > BFSI > Government > Media & Entertainment > Other End-User.

- M&A Trends: Relatively low activity, xx Million total transaction volume (past five years).

Indonesia Data Center Server Market Market Trends & Opportunities

The Indonesian data center server market is experiencing robust growth, driven by the burgeoning digital economy and increasing adoption of cloud-based services. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reflecting strong demand from various sectors. Technological advancements, particularly in areas like edge computing and 5G infrastructure development, are fueling market expansion. Consumer preferences are shifting towards higher performance, energy-efficient servers, and cloud-ready solutions. The competitive landscape is dynamic, with both established players and emerging vendors vying for market share. Market penetration rates are expected to increase significantly, particularly in regions with underdeveloped IT infrastructure. The increasing adoption of hybrid cloud models presents significant opportunities for server vendors.

Dominant Markets & Segments in Indonesia Data Center Server Market

The Jakarta region currently dominates the Indonesian data center server market, driven by its strong concentration of businesses, advanced infrastructure, and access to skilled labor. Within the form factor segment, rack servers hold the largest market share, followed by blade servers and tower servers. The IT & Telecommunication sector is the leading end-user segment, accounting for a significant portion of total demand.

- Key Growth Drivers (Jakarta): Advanced infrastructure, skilled labor, business concentration.

- Key Growth Drivers (Rack Servers): Cost-effectiveness, scalability, suitability for various applications.

- Key Growth Drivers (IT & Telecommunication): Expanding digital infrastructure, growing demand for data processing and storage.

Indonesia Data Center Server Market Product Analysis

The Indonesian data center server market showcases a diverse range of products, including blade, rack, and tower servers, each catering to specific needs. Key innovations focus on improving energy efficiency, enhancing processing power, and facilitating seamless integration with cloud platforms. The competitive advantage lies in providing customized solutions tailored to client requirements, offering robust after-sales support, and ensuring seamless integration with existing IT infrastructure. The market favors server solutions with strong security features, energy-efficient designs, and scalability.

Key Drivers, Barriers & Challenges in Indonesia Data Center Server Market

Key Drivers:

- Rapid growth of the digital economy.

- Government initiatives promoting digital transformation.

- Increasing adoption of cloud computing and data centers.

- Expansion of 5G and related technologies.

Challenges:

- High initial investment costs for data centers.

- Power infrastructure limitations in certain regions.

- Skilled labor shortages.

- Competition from international and domestic vendors.

Growth Drivers in the Indonesia Data Center Server Market Market

The Indonesian data center server market growth is propelled by government investments in digital infrastructure, the expansion of 5G networks, and a rising demand for cloud-based services across various sectors. Economic growth and increased internet penetration are further driving market expansion. Government regulations promoting data localization are also creating opportunities for domestic server vendors.

Challenges Impacting Indonesia Data Center Server Market Growth

Challenges include inconsistent power supply in certain regions, potentially high energy costs, and a need for further development of the local talent pool. Regulatory uncertainties and complex import processes can also hinder growth. Furthermore, competition from established global players presents a significant challenge for smaller Indonesian vendors.

Key Players Shaping the Indonesia Data Center Server Market Market

- HP Enterprise

- IBM Corporation

- Lenovo Group Limited

- Inspur Group

- Super Micro Computer Inc

- Fujitsu Limited

- Dell Inc

- Huawei Technologies Co Ltd

- Kingston Technology Corporation

- Hitachi Ltd

Significant Indonesia Data Center Server Market Industry Milestones

- June 2023: Kingston Technology announced the release of its 32GB and 16GB Server Premier DDR5 memory, enhancing server performance and efficiency.

- August 2023: Hewlett Packard Enterprise announced phoenixNAP's expansion of its Bare Metal Cloud platform with HPE ProLiant RL300 Gen11 servers, boosting AI inferencing and cloud gaming capabilities.

Future Outlook for Indonesia Data Center Server Market Market

The Indonesian data center server market is poised for sustained growth, driven by the country's digital transformation initiatives, rising adoption of cloud services, and increasing demand for high-performance computing. Strategic investments in data center infrastructure, coupled with favorable government policies, will create significant opportunities for both established and emerging players. The market's potential for expansion is substantial, with significant growth predicted in the coming years.

Indonesia Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Indonesia Data Center Server Market Segmentation By Geography

- 1. Indonesia

Indonesia Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of FTTx (Fibre to the X) Connectivity and 5G Deployment; Adoption for Online Banking Services

- 3.3. Market Restrains

- 3.3.1. High CaPex for Building Data Center Along With Security Challenges

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 HP Enterprise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inspur Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Super Micro Computer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujitsu Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kingston Technology Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HP Enterprise

List of Figures

- Figure 1: Indonesia Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: Indonesia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Indonesia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Indonesia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 7: Indonesia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Indonesia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Data Center Server Market?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Indonesia Data Center Server Market?

Key companies in the market include HP Enterprise, IBM Corporation, Lenovo Group Limited, Inspur Group, Super Micro Computer Inc, Fujitsu Limited, Dell Inc, Huawei Technologies Co Ltd, Kingston Technology Corporation, Hitachi Ltd*List Not Exhaustive.

3. What are the main segments of the Indonesia Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of FTTx (Fibre to the X) Connectivity and 5G Deployment; Adoption for Online Banking Services.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Growth.

7. Are there any restraints impacting market growth?

High CaPex for Building Data Center Along With Security Challenges.

8. Can you provide examples of recent developments in the market?

August 2023 - Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from AmpereComputing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Data Center Server Market?

To stay informed about further developments, trends, and reports in the Indonesia Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence