Key Insights

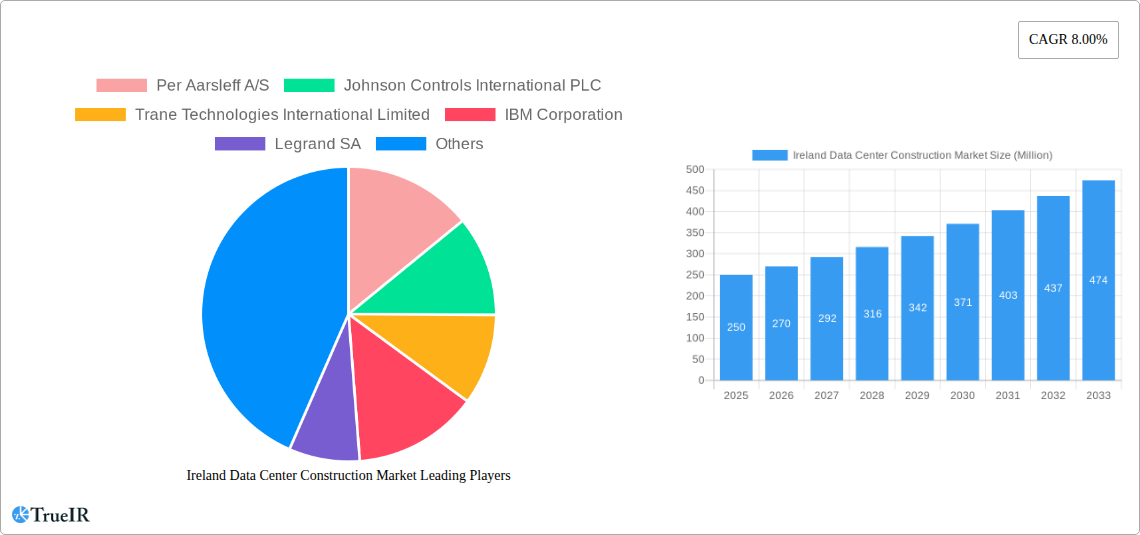

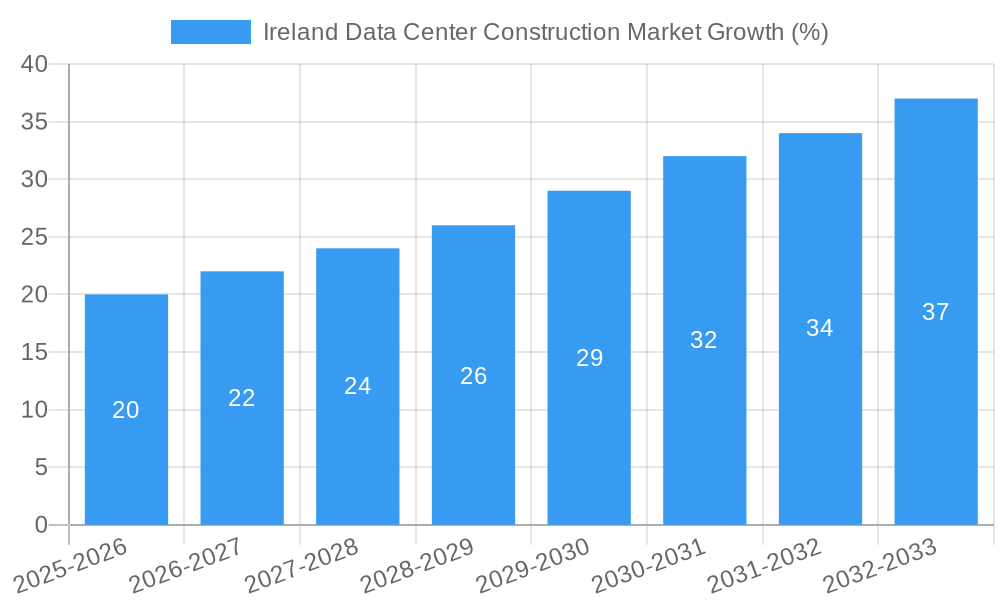

The Ireland data center construction market is experiencing robust growth, fueled by increasing demand for cloud services, big data analytics, and the expansion of digital infrastructure. The market's Compound Annual Growth Rate (CAGR) of 8.00% from 2019-2024 suggests a healthy trajectory, projected to continue through 2033. Key drivers include government initiatives promoting digitalization, the presence of major multinational technology companies in Ireland, and a favorable business environment attracting foreign investment. Growth is segmented across various infrastructure components, including power distribution units (PDUs), racks and cabinets, servers, networking equipment, and cooling infrastructure. The IT & telecommunication sector is a significant end-user, followed by BFSI (Banking, Financial Services, and Insurance) and government entities. While the market enjoys strong momentum, potential restraints include the rising costs of land and construction materials, potential energy constraints, and the need for skilled labor. The market is further stratified by data center size (small to massive) and tier type (Tier 1 and others), with larger facilities driving a significant portion of the construction activity. Companies like Schneider Electric, IBM, and Johnson Controls are major players, competing on the basis of technological innovation, service offerings, and project management expertise.

The forecast for the Ireland data center construction market is positive, with continued expansion anticipated across all segments. However, successful navigation of the market requires strategic adaptation to evolving technological advancements, regulatory changes, and sustainability concerns. The increasing emphasis on energy efficiency and environmentally responsible data center designs presents opportunities for companies specializing in sustainable solutions. Furthermore, the market's success will hinge on overcoming challenges related to workforce development and ensuring a robust supply chain to support the anticipated growth. This suggests a significant need for collaboration between industry stakeholders, government agencies, and educational institutions to cultivate talent and bolster the infrastructure required to sustain the market's upward trajectory.

Ireland Data Center Construction Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Ireland Data Center Construction Market, offering invaluable insights for investors, industry professionals, and strategic planners. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis and expert insights to illuminate the current market landscape and predict future growth trajectories. The report covers a market expected to reach xx Million by 2033, presenting a compelling investment opportunity within the rapidly expanding Irish data center ecosystem.

Ireland Data Center Construction Market Structure & Competitive Landscape

The Irish data center construction market exhibits a moderately concentrated structure, with a handful of multinational corporations and established local players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive market. Innovation is a key driver, with companies constantly striving to improve efficiency, sustainability, and security within data center infrastructure. Stringent regulatory frameworks, particularly regarding energy consumption and data security, significantly impact market dynamics. Product substitution is limited, given the specialized nature of data center construction, although there is some competition between different cooling technologies and power infrastructure solutions.

End-User Segmentation: The IT & Telecommunication sector currently commands the largest share (xx%), followed by BFSI (xx%) and Government (xx%). Other end-users, including Healthcare and others, contribute a smaller but growing percentage.

M&A Activity: The historical period (2019-2024) witnessed xx major mergers and acquisitions in the Irish data center construction sector, largely driven by the consolidation of smaller companies by larger international players. This trend is expected to continue, with a projected xx M&A deals during the forecast period (2025-2033).

Key Market Players: The market includes major international players like Johnson Controls, Schneider Electric, and Arup, alongside several established Irish firms, showcasing both international competition and local expertise. The interplay between these large and small companies drives innovation, creating a balanced market environment.

Ireland Data Center Construction Market Market Trends & Opportunities

The Ireland Data Center Construction Market is experiencing robust growth, fueled by increasing demand for cloud services, the expansion of digital infrastructure, and government initiatives to bolster the country's position as a leading European tech hub. The market size is projected to grow at a CAGR of xx% from 2025 to 2033, reaching an estimated xx Million by 2033. Technological advancements, such as the adoption of modular data center designs, AI-powered energy management systems, and improved cooling technologies, are reshaping the sector. Consumer preference is shifting towards sustainable and energy-efficient data center solutions, prompting increased adoption of green technologies. Intense competition is driving innovation and pushing down prices, yet profitable margins are maintained through specialization and value-added services. Market penetration rates for advanced technologies like liquid cooling are increasing steadily, reflecting industry-wide shifts towards greater efficiency and scalability.

Dominant Markets & Segments in Ireland Data Center Construction Market

The Dublin region remains the dominant market for data center construction in Ireland, driven by its established infrastructure, proximity to major telecommunication networks, and skilled workforce.

Key Growth Drivers:

- Government Initiatives: Government policies and tax incentives supporting the tech sector are instrumental in attracting investment.

- Robust Telecommunications Infrastructure: Ireland boasts a high-quality fiber-optic network, facilitating data center operations.

- Strategic Location: Ireland’s geographical location provides access to major European markets.

- Growing Cloud Adoption: The increasing adoption of cloud services by businesses fuels demand.

Dominant Segments:

- Infrastructure: Cooling Infrastructure is a dominant segment, currently holding xx% of the market share, followed by Power Infrastructure (xx%) and Racks and Cabinets (xx%).

- End-User: The IT & Telecommunication sector dominates the end-user segment.

- Data Center Size: Medium and Large-sized data centers constitute the majority of the market.

Ireland Data Center Construction Market Product Analysis

The market witnesses continuous product innovation, particularly in cooling technologies (e.g., liquid cooling, free air cooling) and power distribution units (PDUs). These innovations focus on enhancing energy efficiency, reducing operational costs, and improving data center reliability. Products are differentiated based on features like power capacity, scalability, and sustainability credentials. Competitive advantages are driven by technology leadership, efficient supply chains, and strong customer relationships.

Key Drivers, Barriers & Challenges in Ireland Data Center Construction Market

Key Drivers:

- Increasing Digitalization: The growing reliance on digital technologies across various sectors is a primary driver.

- Government Support: Government incentives and policies support data center development.

- Improved Connectivity: Ireland’s strong telecommunications infrastructure attracts investment.

Key Challenges:

- Supply Chain Disruptions: Global supply chain issues impact the availability of critical components, leading to potential project delays and increased costs. This impact is estimated at xx Million annually.

- Regulatory Hurdles: Complex permitting processes and environmental regulations can slow down project timelines and increase costs.

- Skill Shortages: A shortage of skilled labor can constrain project execution and increase labor costs.

Growth Drivers in the Ireland Data Center Construction Market Market

The market is propelled by increased demand from hyperscale providers and cloud service companies, alongside a favorable regulatory environment and substantial government support. Ireland's strategic location and strong digital infrastructure are key attractions for international investment. Technological advancements, such as the increased adoption of AI-powered management systems, also contribute significantly to market growth.

Challenges Impacting Ireland Data Center Construction Market Growth

Regulatory complexity concerning planning permissions and environmental regulations pose a challenge, potentially leading to project delays and increased costs. Supply chain bottlenecks, particularly affecting specialized equipment, impact project timelines and budget estimations. Intense competition amongst existing and new entrants creates pricing pressure and demands differentiation.

Key Players Shaping the Ireland Data Center Construction Market Market

- Per Aarsleff A/S

- Johnson Controls International PLC

- Trane Technologies International Limited

- IBM Corporation

- Legrand SA

- Callaghan Engineering

- ALFA LAVAL AB

- Schneider Electric SE

- DPR CONSTRUCTION INC

- Arup Group Limited

- Kirby Group Engineering

- Coolair Equipment Ltd

- AECOM

- Coromatic AB Sweden

- Bouygues Construction

Significant Ireland Data Center Construction Market Industry Milestones

- September 2019: CyrusOne commenced construction of its first data center campus in Dublin, adding 74MW of capacity.

- January 2022: An unnamed company announced new data center construction in North and South Dublin, scheduled for completion in 2023 and 2024, respectively. This demonstrates continued investment and expansion within the Irish market.

Future Outlook for Ireland Data Center Construction Market Market

The Irish data center construction market is poised for continued expansion, driven by sustained demand from cloud providers and the ongoing digital transformation. Strategic opportunities exist for companies specializing in sustainable and energy-efficient solutions. The market's growth potential is significant, offering attractive prospects for both domestic and international players. The projected market size of xx Million by 2033 indicates substantial potential for investment and growth within this sector.

Ireland Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Panels and Components

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Panels and Components

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Panels and Components

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Ireland Data Center Construction Market Segmentation By Geography

- 1. Ireland

Ireland Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Developments Fuelling Data Center Investments; Growing Cloud Servce adoption; Green Data Centers rising awarness of Carbon-Neutrality leading to Infrastructure upgrades

- 3.3. Market Restrains

- 3.3.1. Security Challenges Impacting Growth of Data Centers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Panels and Components

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Panels and Components

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Panels and Components

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Per Aarsleff A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trane Technologies International Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Callaghan Engineering

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALFA LAVAL AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DPR CONSTRUCTION INC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arup Group Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kirby Group Engineering

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Coolair Equipment Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AECOM

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Coromatic AB Sweden

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bouygues Construction

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Per Aarsleff A/S

List of Figures

- Figure 1: Ireland Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ireland Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Ireland Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ireland Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Ireland Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 4: Ireland Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 5: Ireland Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 6: Ireland Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 7: Ireland Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 8: Ireland Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 9: Ireland Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 10: Ireland Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2019 & 2032

- Table 11: Ireland Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: Ireland Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 13: Ireland Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 14: Ireland Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 15: Ireland Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 16: Ireland Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 17: Ireland Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 18: Ireland Data Center Construction Market Volume K Unit Forecast, by Racks 2019 & 2032

- Table 19: Ireland Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 20: Ireland Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 21: Ireland Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 22: Ireland Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 23: Ireland Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 26: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 27: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 28: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 29: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 30: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 31: Ireland Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Ireland Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 33: Ireland Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 34: Ireland Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 35: Ireland Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 36: Ireland Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 37: Ireland Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 38: Ireland Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 39: Ireland Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 40: Ireland Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 41: Ireland Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 42: Ireland Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 43: Ireland Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 44: Ireland Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 45: Ireland Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Ireland Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Ireland Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 48: Ireland Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 49: Ireland Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 50: Ireland Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 51: Ireland Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 52: Ireland Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 53: Ireland Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 54: Ireland Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2019 & 2032

- Table 55: Ireland Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 56: Ireland Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 57: Ireland Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 58: Ireland Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 59: Ireland Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 60: Ireland Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 61: Ireland Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 62: Ireland Data Center Construction Market Volume K Unit Forecast, by Racks 2019 & 2032

- Table 63: Ireland Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 64: Ireland Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 65: Ireland Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 66: Ireland Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 67: Ireland Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 68: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 69: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 70: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 71: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 72: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 73: Ireland Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 74: Ireland Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 75: Ireland Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 76: Ireland Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 77: Ireland Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 78: Ireland Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 79: Ireland Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 80: Ireland Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 81: Ireland Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 82: Ireland Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 83: Ireland Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 84: Ireland Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 85: Ireland Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 86: Ireland Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 87: Ireland Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Ireland Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland Data Center Construction Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Ireland Data Center Construction Market?

Key companies in the market include Per Aarsleff A/S, Johnson Controls International PLC, Trane Technologies International Limited, IBM Corporation, Legrand SA, Callaghan Engineering, ALFA LAVAL AB, Schneider Electric SE, DPR CONSTRUCTION INC, Arup Group Limited, Kirby Group Engineering, Coolair Equipment Ltd , AECOM, Coromatic AB Sweden, Bouygues Construction.

3. What are the main segments of the Ireland Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5G Developments Fuelling Data Center Investments; Growing Cloud Servce adoption; Green Data Centers rising awarness of Carbon-Neutrality leading to Infrastructure upgrades.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

Security Challenges Impacting Growth of Data Centers.

8. Can you provide examples of recent developments in the market?

January 2022: The company announced its new construction development in North and South Dublin, which is expected to be operational in 2023 and 2024, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Ireland Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence