Key Insights

The IT staffing industry, valued at $118.95 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 3.66% from 2025 to 2033. This growth is fueled by several key factors. The increasing reliance on technology across diverse sectors, including telecom, BFSI (Banking, Financial Services, and Insurance), healthcare, manufacturing, and retail, necessitates a constant influx of skilled IT professionals. Businesses are increasingly outsourcing their IT needs, preferring flexible staffing solutions to manage fluctuating project demands and specialized skill requirements. Furthermore, the ongoing digital transformation across industries is creating a surge in demand for software developers, testers, systems analysts, technical support professionals, networking and security experts, driving significant growth within these specific skill segments. Competition among staffing firms is high, with major players like Consulting Solutions International Inc, Kforce Inc, and TEKsystems Inc vying for market share. However, the industry also faces challenges such as the global talent shortage, particularly for niche skill sets, leading to increased competition for qualified candidates and potentially higher staffing costs. This scarcity of talent, coupled with evolving technological landscapes, may present a restraint to unchecked industry expansion.

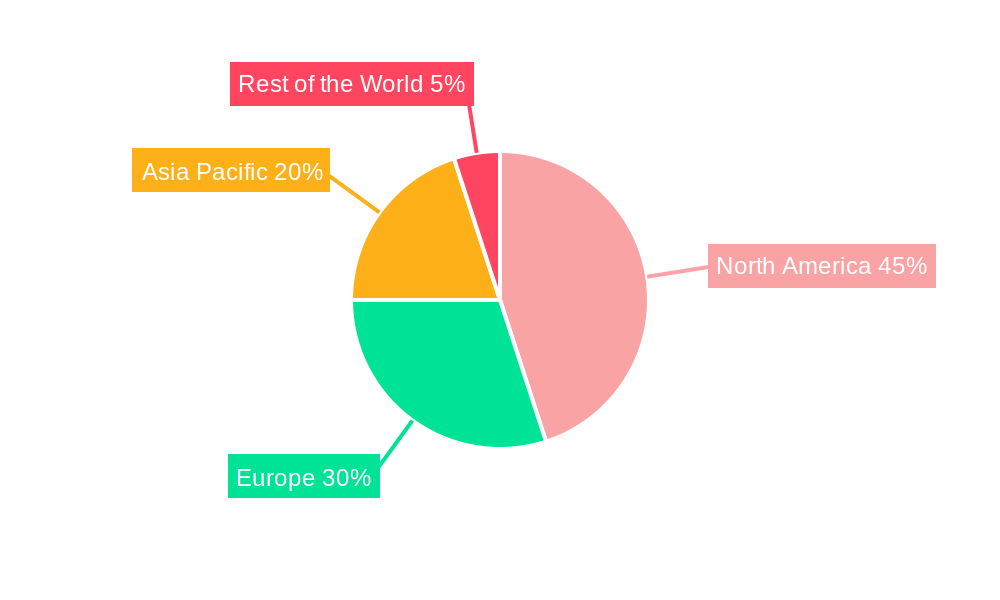

The North American market currently holds a significant share of the global IT staffing market, largely due to its advanced technological infrastructure and robust demand from various industries. However, the Asia-Pacific region is expected to witness substantial growth in the coming years, driven by rapid technological adoption and economic expansion in countries like India and China. European markets are also experiencing consistent growth, fueled by digital transformation initiatives within various sectors. The overall market is characterized by a blend of large multinational firms and smaller specialized agencies, reflecting the diverse needs of clients across various sizes and industries. Successful firms in this competitive landscape will need to effectively manage talent acquisition, training, and retention to remain competitive and meet the evolving needs of their clients. Strategic partnerships with educational institutions and proactive investment in upskilling existing staff will also be crucial for long-term success.

IT Staffing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the IT staffing industry, projecting a market value exceeding $XX Million by 2033. We analyze market structure, competitive dynamics, key trends, and future growth prospects, covering the period from 2019 to 2033 (Study Period), with a focus on 2025 (Base Year and Estimated Year) and forecasting to 2033 (Forecast Period). The historical period covered is 2019-2024.

IT Staffing Industry Market Structure & Competitive Landscape

The IT staffing industry exhibits a moderately concentrated market structure, with several large players vying for market share. Concentration ratios, while varying by segment, suggest a competitive landscape influenced by both established multinational corporations and smaller, specialized firms. Innovation is a key driver, with continuous advancements in technology and service offerings shaping the competitive arena. Regulatory impacts, such as labor laws and data privacy regulations, significantly influence operational costs and strategies. Product substitutes, including in-house recruitment and freelance platforms, represent ongoing competitive challenges. The industry is characterized by a diverse end-user segmentation, encompassing various sectors and skill sets, adding complexity to competitive dynamics.

Mergers and acquisitions (M&A) activity significantly shapes the industry landscape, with large players often acquiring smaller firms to expand their service offerings and geographic reach. Recent M&A activity (e.g., ASGN Incorporated's acquisition of Iron Vine Security) exemplifies this trend. We estimate that M&A volume will reach approximately XX Million deals in the forecast period, driven primarily by the consolidation among major players.

- Key Players: Consulting Solutions International Inc, Kforce Inc, ASGN Incorporated, MATRIX Resources Inc, TEKsystems Inc (Allegis Group Holdings Inc), Randstad NV, NTT DATA Corporation, Artech Information Systems LLC, Insight Global LLC, Beacon Hill Staffing Group (List Not Exhaustive).

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately concentrated market.

- M&A Volume (2025-2033): Estimated at XX Million deals.

IT Staffing Industry Market Trends & Opportunities

The IT staffing market is experiencing robust growth, driven by the increasing demand for skilled IT professionals across diverse industries. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period, reaching a value exceeding $XX Million by 2033. Technological advancements, such as cloud computing, artificial intelligence, and cybersecurity, are major drivers, creating a surge in demand for specialized skills. Evolving consumer preferences, toward greater flexibility and remote work options, are further shaping the market. Competitive dynamics are intensifying, with companies focusing on differentiation through specialized services, advanced technologies, and strategic partnerships. Market penetration rates are expected to reach XX% by 2033, driven by the rising adoption of IT solutions across various industries.

Dominant Markets & Segments in IT Staffing Industry

The North American region currently dominates the IT staffing market, followed by Europe and Asia-Pacific. Within segments, Software Developers, Testers, and Networking and Security Experts represent the highest-growth areas. The BFSI (Banking, Financial Services, and Insurance) and Healthcare sectors exhibit the strongest demand.

- Leading Region: North America

- Fastest-Growing Skill Sets: Software Developers, Testers, Networking and Security Experts

- High-Demand End-User Industries: BFSI, Healthcare

Key Growth Drivers:

- BFSI: Increasing digitalization and regulatory compliance requirements.

- Healthcare: Expanding telehealth services and electronic health record adoption.

- Software Developers: High demand for custom software development and application maintenance.

- Networking and Security Experts: Growing concerns regarding cybersecurity threats and data breaches.

IT Staffing Industry Product Analysis

The IT staffing industry offers a range of services, from temporary staffing to permanent placement, specialized recruitment, and managed services programs. Technological advancements such as AI-powered recruitment tools and predictive analytics are enhancing efficiency and effectiveness. The market is witnessing a shift towards specialized services catering to specific niche skills and technologies, aligning with the evolving needs of end-users. These specialized services offer a competitive advantage by providing tailored solutions and in-depth industry expertise.

Key Drivers, Barriers & Challenges in IT Staffing Industry

Key Drivers:

- Technological advancements: The continuous evolution of technology fuels the demand for skilled IT professionals.

- Economic growth: A robust global economy drives increased investment in IT infrastructure and services.

- Government policies: Initiatives promoting digital transformation and technological advancements create opportunities.

Key Challenges:

- Skills gap: A persistent shortage of qualified IT professionals poses a major challenge.

- Supply chain disruptions: Global events can impact the availability of skilled resources.

- Competition: Intense competition among staffing firms necessitates innovative strategies for growth.

Growth Drivers in the IT Staffing Industry Market

Technological advancements, economic growth in key sectors, and government initiatives supporting digital transformation are primary growth drivers. Increased adoption of cloud computing, big data analytics, and artificial intelligence creates significant demand for specialized skills.

Challenges Impacting IT Staffing Industry Growth

The IT staffing industry faces challenges like a global talent shortage, supply chain disruptions impacting workforce availability, and intense competition requiring continuous innovation and adaptation.

Key Players Shaping the IT Staffing Industry Market

- Consulting Solutions International Inc

- Kforce Inc

- ASGN Incorporated

- MATRIX Resources Inc

- TEKsystems Inc (Allegis Group Holdings Inc)

- Randstad NV

- NTT DATA Corporation

- Artech Information Systems LLC

- Insight Global LLC

- Beacon Hill Staffing Group

Significant IT Staffing Industry Milestones

- October 2022: ASGN Incorporated acquires Iron Vine Security, expanding its cybersecurity capabilities and adding approximately 230 specialists.

- July 2022: Major IT companies in India (Tata Consulting Services, Wipro, Infosys, and HCL Technologies) hire 59,700 IT professionals, signaling robust growth in the region.

- January 2022: Kelly Services partners with Toyota, launching the "Kelly 33 Second Chances" project, promoting diversity, equity, and inclusion initiatives.

Future Outlook for IT Staffing Industry Market

The IT staffing industry is poised for continued growth, driven by the ongoing digital transformation across various sectors. Strategic partnerships, technological innovation, and specialized service offerings will play a crucial role in shaping future market dynamics. The industry's ability to address the skills gap and adapt to evolving technological advancements will determine its long-term success. The market anticipates sustained growth with significant opportunities for expansion in emerging technologies and underserved markets.

IT Staffing Industry Segmentation

-

1. Skill Set

- 1.1. Software Developer

- 1.2. Testers

- 1.3. Systems Analyst

- 1.4. Technical Support Professionals

- 1.5. Networking and Security Experts

- 1.6. Other Skill Sets

-

2. End-user Industry

- 2.1. Telecom

- 2.2. BFSI

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Retail

- 2.6. Other End-user Industries

IT Staffing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

IT Staffing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The emergence of Technologies(AI and IoT); Increasing Outsourcing of HR activities

- 3.3. Market Restrains

- 3.3.1. Talent Shortages in Specific Technologies

- 3.4. Market Trends

- 3.4.1. Software Developers Segment Expected to Generate Considerable Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Skill Set

- 5.1.1. Software Developer

- 5.1.2. Testers

- 5.1.3. Systems Analyst

- 5.1.4. Technical Support Professionals

- 5.1.5. Networking and Security Experts

- 5.1.6. Other Skill Sets

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Telecom

- 5.2.2. BFSI

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Retail

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Skill Set

- 6. North America IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Skill Set

- 6.1.1. Software Developer

- 6.1.2. Testers

- 6.1.3. Systems Analyst

- 6.1.4. Technical Support Professionals

- 6.1.5. Networking and Security Experts

- 6.1.6. Other Skill Sets

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Telecom

- 6.2.2. BFSI

- 6.2.3. Healthcare

- 6.2.4. Manufacturing

- 6.2.5. Retail

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Skill Set

- 7. Europe IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Skill Set

- 7.1.1. Software Developer

- 7.1.2. Testers

- 7.1.3. Systems Analyst

- 7.1.4. Technical Support Professionals

- 7.1.5. Networking and Security Experts

- 7.1.6. Other Skill Sets

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Telecom

- 7.2.2. BFSI

- 7.2.3. Healthcare

- 7.2.4. Manufacturing

- 7.2.5. Retail

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Skill Set

- 8. Asia Pacific IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Skill Set

- 8.1.1. Software Developer

- 8.1.2. Testers

- 8.1.3. Systems Analyst

- 8.1.4. Technical Support Professionals

- 8.1.5. Networking and Security Experts

- 8.1.6. Other Skill Sets

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Telecom

- 8.2.2. BFSI

- 8.2.3. Healthcare

- 8.2.4. Manufacturing

- 8.2.5. Retail

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Skill Set

- 9. Rest of the World IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Skill Set

- 9.1.1. Software Developer

- 9.1.2. Testers

- 9.1.3. Systems Analyst

- 9.1.4. Technical Support Professionals

- 9.1.5. Networking and Security Experts

- 9.1.6. Other Skill Sets

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Telecom

- 9.2.2. BFSI

- 9.2.3. Healthcare

- 9.2.4. Manufacturing

- 9.2.5. Retail

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Skill Set

- 10. North America IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World IT Staffing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Consulting Solutions International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Kforce Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 ASGN Incorporated

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 MATRIX Resources Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 TEKsystems Inc (Allegis Group Holdings Inc )

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Randstad NV

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NTT DATA Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Artech Information Systems LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Insight Global LLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Beacon Hill Staffing Group*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Consulting Solutions International Inc

List of Figures

- Figure 1: Global IT Staffing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 11: North America IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 12: North America IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 17: Europe IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 18: Europe IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 23: Asia Pacific IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 24: Asia Pacific IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World IT Staffing Industry Revenue (Million), by Skill Set 2024 & 2032

- Figure 29: Rest of the World IT Staffing Industry Revenue Share (%), by Skill Set 2024 & 2032

- Figure 30: Rest of the World IT Staffing Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World IT Staffing Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World IT Staffing Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World IT Staffing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IT Staffing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 3: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global IT Staffing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: IT Staffing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 14: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 17: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 20: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global IT Staffing Industry Revenue Million Forecast, by Skill Set 2019 & 2032

- Table 23: Global IT Staffing Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global IT Staffing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Staffing Industry?

The projected CAGR is approximately 3.66%.

2. Which companies are prominent players in the IT Staffing Industry?

Key companies in the market include Consulting Solutions International Inc, Kforce Inc, ASGN Incorporated, MATRIX Resources Inc, TEKsystems Inc (Allegis Group Holdings Inc ), Randstad NV, NTT DATA Corporation, Artech Information Systems LLC, Insight Global LLC, Beacon Hill Staffing Group*List Not Exhaustive.

3. What are the main segments of the IT Staffing Industry?

The market segments include Skill Set, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.95 Million as of 2022.

5. What are some drivers contributing to market growth?

The emergence of Technologies(AI and IoT); Increasing Outsourcing of HR activities.

6. What are the notable trends driving market growth?

Software Developers Segment Expected to Generate Considerable Demand.

7. Are there any restraints impacting market growth?

Talent Shortages in Specific Technologies.

8. Can you provide examples of recent developments in the market?

October 2022 - ASGN Incorporated, one of the leading providers of IT services and solutions in the commercial and government sectors, including technology and creative digital marketing, announced the acquisition of Iron Vine Security, one of the leading cybersecurity company designs, implements, and executes cybersecurity programs for federal customers. ECS Federal, LLC, ASGN's Federal Government Segment, will integrate Iron Vine's staff of approximately 230 specialists.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Staffing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Staffing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Staffing Industry?

To stay informed about further developments, trends, and reports in the IT Staffing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence