Key Insights

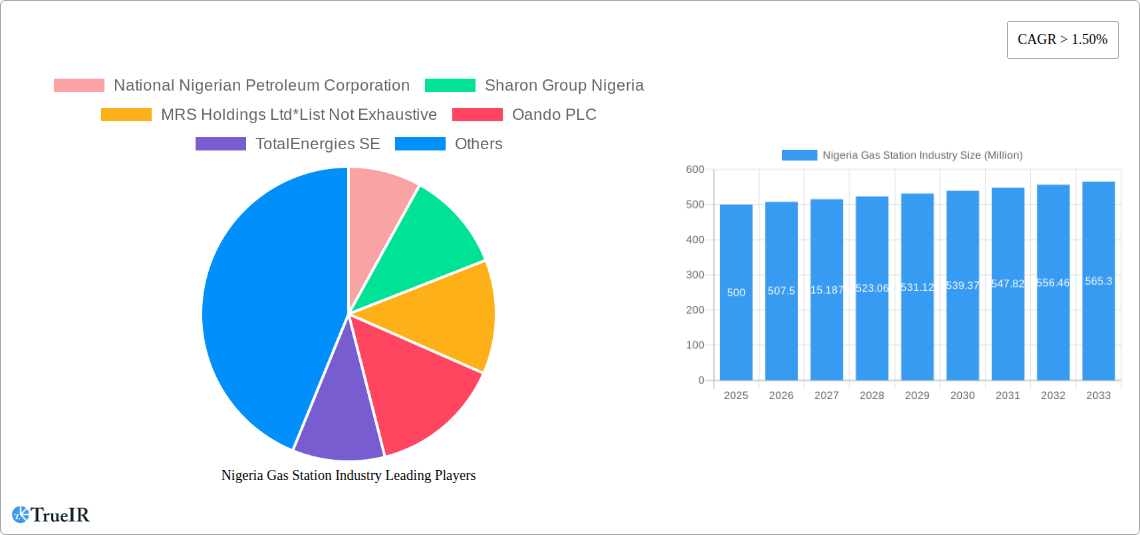

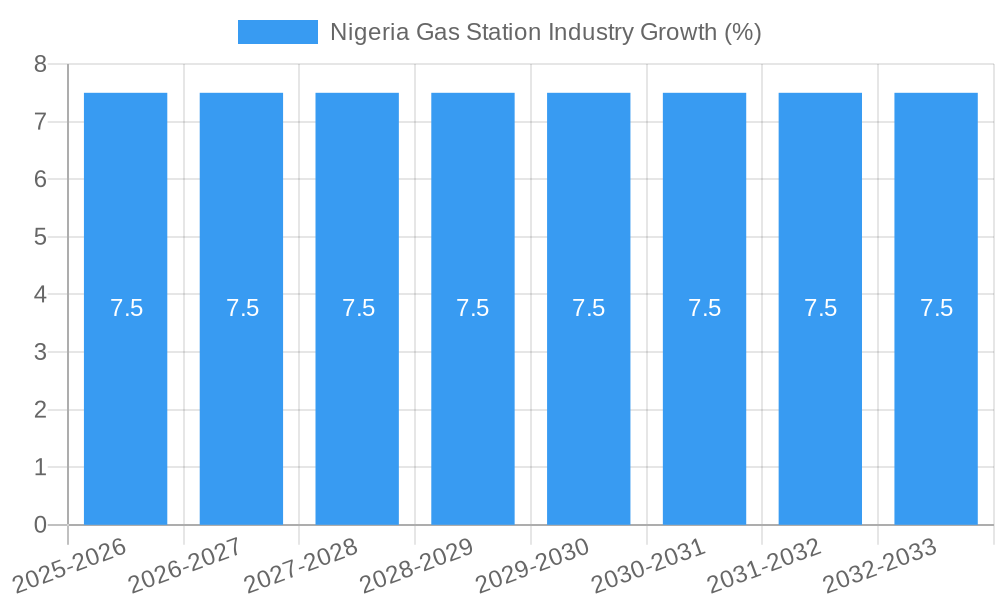

The Nigerian gas station industry, characterized by a substantial market size and robust growth trajectory, presents a compelling investment landscape. While precise market size figures for 2019-2024 aren't provided, a CAGR exceeding 1.5% from 2025 to 2033, coupled with the industry's value being measured in millions, indicates significant market potential. Key drivers include Nigeria's burgeoning automotive sector, increasing urbanization leading to higher fuel consumption, and the nation's expanding economy fueling transportation needs. Trends such as the adoption of digital payment systems at gas stations, increasing demand for higher-quality fuels, and a focus on environmental sustainability (e.g., the potential rise of electric vehicle charging stations at certain locations) are reshaping the industry. Restraints, however, might include infrastructural limitations in certain regions, price volatility of petroleum products influenced by global market fluctuations, and potential regulatory changes impacting the sector. The market is segmented into transportation, storage, and LNG terminals, indicating diverse avenues for growth and specialization. Major players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited, dominate the market, although smaller independent players also contribute. The geographical focus is solely Nigeria, reflecting the report's specific scope.

The forecast period of 2025-2033 suggests significant opportunities for expansion within the Nigerian gas station industry. The continuous growth in vehicle ownership, coupled with infrastructural developments and government initiatives aimed at improving transportation networks, is expected to further propel market expansion. However, market participants need to navigate challenges like fuel price fluctuations and maintain a competitive edge by embracing technological advancements and addressing environmental concerns. The segment-wise analysis reveals that the transportation segment holds the largest share, given the reliance on fuel-powered vehicles. The growth in the storage and LNG terminal segments will largely depend on the expansion of gas infrastructure and the development of related industries. The competitive landscape suggests potential mergers, acquisitions, and strategic partnerships as market players strive to maintain their position and capitalize on emerging opportunities.

Nigeria Gas Station Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Nigerian gas station industry, offering invaluable insights for investors, industry players, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's dynamics, competitive landscape, and future growth trajectory. Expect detailed analysis of market size (in Millions), CAGR, and key trends impacting the sector's evolution.

Nigeria Gas Station Industry Market Structure & Competitive Landscape

The Nigerian gas station market exhibits a moderately concentrated structure, with key players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited holding significant market share. However, the presence of numerous smaller independent operators contributes to a competitive landscape. The industry is characterized by significant M&A activity, as evidenced by recent transactions:

- Ardova PLC's acquisition of Enyo Retail and Supply Limited (November 2021): This deal added 90 filling stations and 100,000 customers, significantly boosting Ardova's market presence.

- Rainoil Limited's acquisition of 61% stake in Eterna Oil PLC (November 2021): This strategic move enhanced Rainoil's influence within the sector.

These acquisitions highlight the consolidation trend and the pursuit of economies of scale within the market. Regulatory influences from the Department of Petroleum Resources (DPR) significantly impact operations, with occasional station closures and reopenings affecting market supply. Product substitution remains limited due to government regulations on fuel quality. The market is segmented by end-users, primarily encompassing transportation (private and commercial vehicles), and increasingly focused on storage solutions and LNG terminal operations. The 2025 market concentration ratio is estimated at xx%, indicating a moderately concentrated market with opportunities for both established players and new entrants. The total M&A volume for the period 2019-2024 is estimated at xx Million.

Nigeria Gas Station Industry Market Trends & Opportunities

The Nigerian gas station industry is projected to witness robust growth from 2025 to 2033, driven by factors such as expanding vehicle ownership, rising disposable incomes, and increasing urbanization. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. Technological advancements, such as the adoption of digital payment systems and loyalty programs, are transforming consumer preferences and improving operational efficiency. The market penetration rate of digital payment systems in gas stations is estimated at xx% in 2025, projected to grow to xx% by 2033. The increasing demand for cleaner fuels, coupled with government initiatives promoting renewable energy sources, presents opportunities for investment in alternative fuel infrastructure. However, persistent challenges such as infrastructure deficits, fuel price volatility, and regulatory complexities continue to impact market growth.

Dominant Markets & Segments in Nigeria Gas Station Industry

The transportation segment dominates the Nigerian gas station market, accounting for approximately xx% of total revenue in 2025. Growth in this segment is primarily driven by:

- Rising Vehicle Ownership: A steadily growing vehicle population fuels the demand for fuel retail.

- Expanding Road Network: Ongoing infrastructure development improves accessibility to gas stations across the country.

- Government Policies: Government support for transportation infrastructure and fuel subsidies indirectly bolsters the industry's growth.

While the storage and LNG terminal segments are relatively smaller, they show promising growth potential, particularly with investments in energy infrastructure. The Lagos and Abuja regions represent the most lucrative markets due to high population density and commercial activity.

Nigeria Gas Station Industry Product Analysis

The Nigerian gas station industry offers a range of petroleum products, predominantly petrol, diesel, and kerosene. Recent innovations focus on improving fuel quality, efficiency of dispensing systems, and customer experience through the integration of digital technologies. The competitive advantage is increasingly determined by location, service quality, pricing strategies, and brand reputation. Technological advancements in fuel dispensing and payment systems, alongside loyalty programs, are shaping customer preferences and improving convenience.

Key Drivers, Barriers & Challenges in Nigeria Gas Station Industry

Key Drivers:

- Rising vehicle ownership and urbanization are boosting fuel demand.

- Government investments in infrastructure enhance accessibility to gas stations.

- Technological advancements in fuel dispensing and payment systems are improving operational efficiency and customer experience.

Challenges:

- Supply chain disruptions due to infrastructure gaps and logistics issues can lead to intermittent fuel shortages and price volatility.

- Stringent regulatory frameworks and licensing procedures pose entry barriers for new players.

- Intense competition among established players puts pressure on margins. This competition is estimated to have reduced profit margins by xx% in 2024 compared to 2019.

Growth Drivers in the Nigeria Gas Station Industry Market

The Nigerian gas station market's growth is fueled by rising urbanization, increased vehicle ownership, and infrastructure development. Government policies focused on improving transportation networks and fuel subsidies also stimulate demand. Furthermore, the adoption of digital payment systems and loyalty programs enhances customer experience and contributes to market expansion.

Challenges Impacting Nigeria Gas Station Industry Growth

The industry faces challenges like fuel price volatility, supply chain disruptions, and regulatory complexities. Infrastructure gaps, particularly in transportation and storage, hinder efficient distribution. The intense competition among established players limits profitability and necessitates continuous investments to maintain market share.

Key Players Shaping the Nigeria Gas Station Industry Market

- National Nigerian Petroleum Corporation

- Sharon Group Nigeria

- MRS Holdings Ltd

- Oando PLC

- TotalEnergies SE

- Almoner Petroleum and Gas Limited

Significant Nigeria Gas Station Industry Industry Milestones

- November 2021: Ardova PLC acquires Enyo Retail and Supply Limited, adding 90 filling stations and 100,000 customers.

- November 2021: Rainoil Limited acquires a 61% stake in Eterna Oil PLC.

- August 2021: DPR reopens five filling stations previously closed by LASBCA.

Future Outlook for Nigeria Gas Station Industry Market

The Nigerian gas station industry is poised for continued growth, driven by increasing urbanization, rising vehicle ownership, and infrastructural improvements. Strategic opportunities lie in expanding into underserved markets, adopting digital technologies, and investing in alternative fuel infrastructure. The market's potential is significant, with opportunities for both established players and new entrants to capitalize on the expanding demand for fuel and related services.

Nigeria Gas Station Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Gas Station Industry Segmentation By Geography

- 1. Niger

Nigeria Gas Station Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure

- 3.4. Market Trends

- 3.4.1. Smuggling of Crude Oil and Refined Products is expected to Restrain the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Gas Station Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Nigerian Petroleum Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharon Group Nigeria

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MRS Holdings Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oando PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almoner Petroleum and Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 National Nigerian Petroleum Corporation

List of Figures

- Figure 1: Nigeria Gas Station Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Gas Station Industry Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 15: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 19: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Gas Station Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Nigeria Gas Station Industry?

Key companies in the market include National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd*List Not Exhaustive, Oando PLC, TotalEnergies SE, Almoner Petroleum and Gas Limited.

3. What are the main segments of the Nigeria Gas Station Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products.

6. What are the notable trends driving market growth?

Smuggling of Crude Oil and Refined Products is expected to Restrain the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, Energy firm Ardova PLC announced the completion of a complete acquisition of Enyo Retail and Supply Limited. The takeover of Enyo Retail and Supply Limited has automatically transferred the 90 filling stations and about 100,000 customers maintained by Enyo's former owner to the Ardova Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Gas Station Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Gas Station Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Gas Station Industry?

To stay informed about further developments, trends, and reports in the Nigeria Gas Station Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence