Key Insights

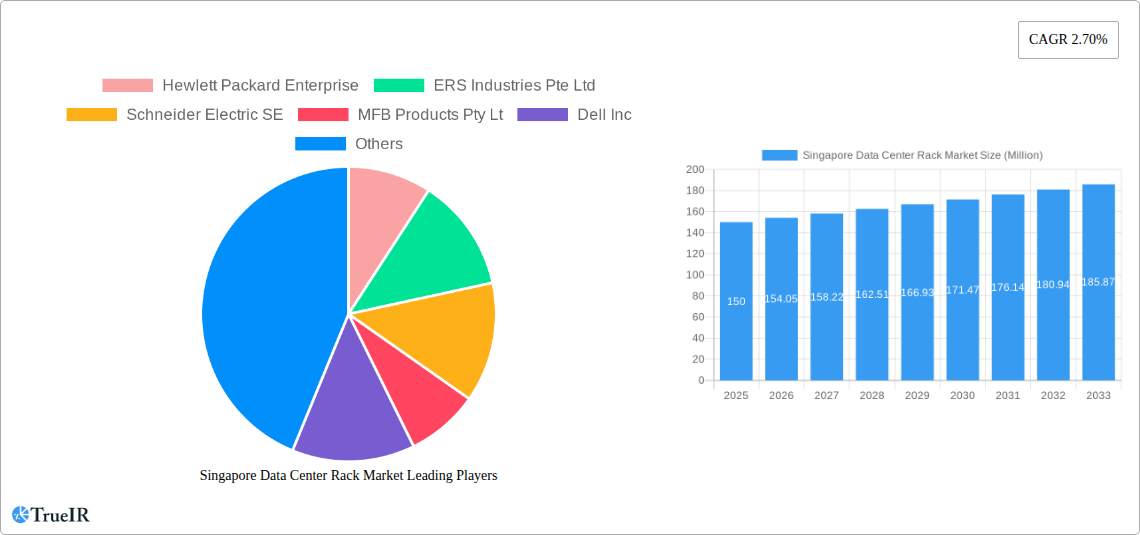

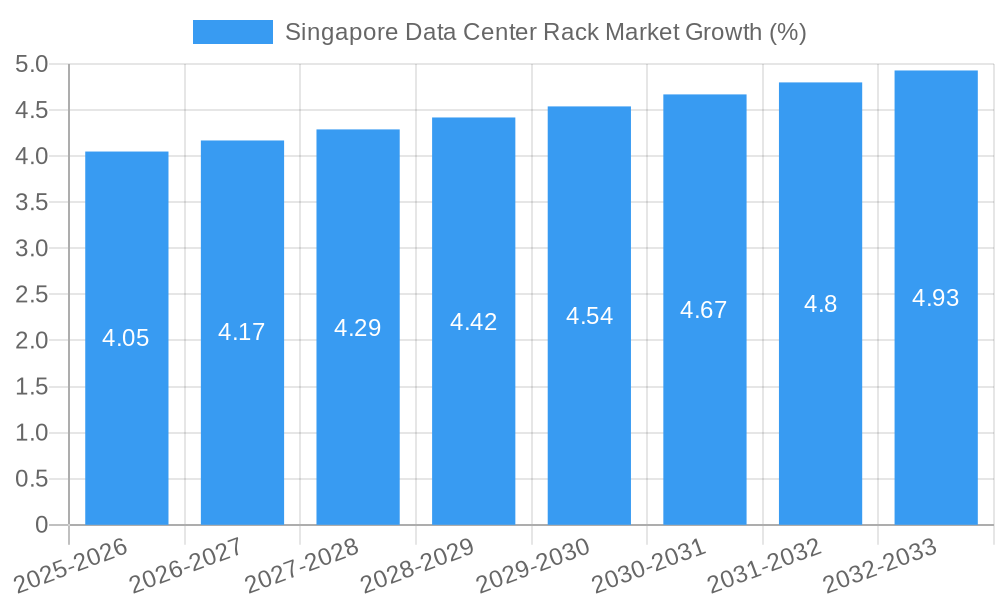

The Singapore data center rack market, valued at approximately $150 million in 2025, is projected to experience steady growth, driven by the nation's robust digital economy and increasing demand for cloud computing and data storage. A compound annual growth rate (CAGR) of 2.70% from 2025 to 2033 indicates a gradual but consistent expansion. Key drivers include the government's initiatives to promote digitalization, the flourishing fintech sector, and the rising adoption of 5G technology, all necessitating enhanced data center infrastructure. The market is segmented by rack size (quarter, half, and full racks) and end-user sectors, with IT & telecommunications, BFSI (Banking, Financial Services, and Insurance), and government sectors being major contributors. The prevalence of hyperscale data centers and colocation facilities further fuels the demand for data center racks. While competition amongst established players like Hewlett Packard Enterprise, Dell Inc., and Schneider Electric SE is intense, opportunities exist for specialized vendors catering to niche requirements within specific segments. The relatively small size of the Singapore market, however, could potentially limit overall growth compared to larger regional markets.

The forecast period of 2025-2033 suggests a continuous expansion of the Singapore data center rack market. Full rack solutions are expected to dominate due to their capacity and efficiency benefits for larger deployments. However, the increasing popularity of micro data centers and edge computing may lead to a growth in demand for smaller rack sizes like quarter and half racks in the coming years. Potential restraints include the high initial investment costs associated with data center infrastructure and the need for skilled professionals for installation and maintenance. Nevertheless, government incentives and ongoing investments in digital infrastructure are poised to mitigate these challenges and support sustained market expansion. Furthermore, increasing adoption of sustainable data center practices, such as improved energy efficiency, is expected to influence future market trends.

Singapore Data Center Rack Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore data center rack market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. Key market segments, dominant players, and future growth opportunities are meticulously examined.

Singapore Data Center Rack Market Structure & Competitive Landscape

The Singapore data center rack market exhibits a moderately concentrated structure. While a handful of multinational corporations dominate, several regional players contribute significantly, creating a competitive environment. The market is characterized by ongoing innovation in rack technology, driven by the demand for higher density, energy efficiency, and advanced management capabilities. Stringent regulatory frameworks concerning data security and environmental sustainability influence market players' strategies. Product substitutes, such as cloud-based solutions, exert some competitive pressure, though on-premise data centers remain crucial for many businesses due to latency requirements and data sovereignty concerns. End-user segmentation reveals strong demand from the IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Government sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a focus on strengthening market share and technological capabilities. In 2024, the estimated M&A volume was approximately xx Million USD. The four-firm concentration ratio is estimated at 45%, indicating moderate concentration.

- Key Market Drivers: Technological advancements, increasing data volume, stringent data security regulations, government initiatives promoting digitalization.

- Key Challenges: Competition from cloud providers, rising energy costs, skilled labor shortages.

- M&A Trends: Consolidation among smaller players, strategic acquisitions by larger players to enhance technological portfolios.

- End-User Segmentation: IT & Telecommunication (40%), BFSI (25%), Government (15%), Media & Entertainment (10%), Other (10%). (Percentages are approximate based on 2024 market estimates).

Singapore Data Center Rack Market Market Trends & Opportunities

The Singapore data center rack market is experiencing robust growth, driven by the nation's status as a leading technology hub in Southeast Asia. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the 2025-2033 forecast period. This growth is fueled by increasing data center deployments across various sectors, particularly in IT & Telecommunication and BFSI. Technological shifts towards higher-density racks, improved cooling solutions, and AI-powered management systems are reshaping the market. Consumers increasingly prioritize energy efficiency and sustainability, creating opportunities for vendors offering environmentally friendly solutions. Competitive dynamics are characterized by innovation, strategic partnerships, and a focus on value-added services. Market penetration rates for advanced rack technologies are expected to grow significantly in the coming years.

Dominant Markets & Segments in Singapore Data Center Rack Market

The Full Rack segment dominates the Singapore data center rack market by size, accounting for approximately 60% of the total market share in 2024, followed by Half Rack and Quarter Rack. This dominance stems from the higher capacity and scalability offered by full-rack solutions, catering to the needs of large enterprises and data-intensive applications.

By Rack Size:

- Full Rack: High demand from large enterprises and data centers.

- Half Rack: Suitable for medium-sized businesses with moderate IT infrastructure needs.

- Quarter Rack: Popular for smaller businesses and individual deployments.

By End User:

- IT & Telecommunication: Largest segment driven by expanding digital infrastructure and cloud services.

- BFSI: Strong demand for secure and reliable data center solutions.

- Government: Investments in digital transformation initiatives and e-governance.

- Media & Entertainment: Growth fueled by increasing streaming content and digital media consumption.

- Other End Users: Includes healthcare, education, and retail sectors.

Key Growth Drivers: Singapore's robust digital economy, government support for digital infrastructure development, and increasing adoption of cloud-based services.

Singapore Data Center Rack Market Product Analysis

The market showcases continuous product innovations, focusing on higher density, improved cooling, and advanced management capabilities. New rack designs incorporate features like integrated power distribution units (PDUs), intelligent thermal management, and remote monitoring capabilities. These advancements enhance efficiency, reduce operational costs, and improve data center uptime. The market also sees a significant shift towards modular and scalable solutions, allowing organizations to easily adapt to fluctuating IT needs. This adaptability coupled with enhanced security features creates a competitive advantage for vendors.

Key Drivers, Barriers & Challenges in Singapore Data Center Rack Market

Key Drivers: The increasing adoption of cloud computing and the burgeoning demand for data storage and processing are major catalysts for the Singapore data center rack market. Government initiatives encouraging digital transformation are also playing a significant role, alongside the growing use of AI and big data analytics which requires robust data center infrastructure. Foreign investment in Singapore's tech sector further accelerates market expansion.

Key Barriers & Challenges: The primary challenge lies in the intensifying competition among vendors, particularly from global players offering cost-competitive solutions. Supply chain disruptions and rising energy costs can significantly impact profitability. Regulatory compliance and stringent environmental standards present operational complexities and increase investment costs. These factors can collectively influence market growth trajectories. For example, a prolonged supply chain disruption in 2024 led to a xx% increase in product prices, impacting overall market growth.

Growth Drivers in the Singapore Data Center Rack Market Market

The expansion of Singapore’s digital economy, fueled by government initiatives like the Smart Nation initiative, significantly boosts demand for data center infrastructure. The increasing adoption of cloud computing and the proliferation of IoT devices necessitate robust data storage and processing capabilities, further driving market expansion. The rise of big data analytics and the need for high-performance computing also contribute significantly to market growth.

Challenges Impacting Singapore Data Center Rack Market Growth

Supply chain disruptions can lead to delays in procurement and increase costs, impacting market expansion. Strict environmental regulations, including energy efficiency standards, add complexity and cost to operations. Competition from established international players and the emergence of new technologies continuously pose challenges to market growth.

Key Players Shaping the Singapore Data Center Rack Market Market

- Hewlett Packard Enterprise

- ERS Industries Pte Ltd

- Schneider Electric SE

- MFB Products Pty Lt

- Dell Inc

- Black Box Corporation

- Vertiv Group Corp

- Raritan Inc

- Eaton Corporation

Significant Singapore Data Center Rack Market Industry Milestones

- September 2022: Equinix, Inc. partnered with the Centre for Energy Research & Technology (CERT) at the National University of Singapore to explore hydrogen as a green fuel source for data centers, signaling a shift towards sustainable practices.

- May 2022: HGC Global Communications partnered with Digital Realty to enhance edge connectivity for OTT customers in Singapore, highlighting the growing importance of edge computing.

Future Outlook for Singapore Data Center Rack Market Market

The Singapore data center rack market is poised for sustained growth, driven by the country's commitment to digitalization and its strategic location as a regional technology hub. Opportunities exist for vendors offering innovative, energy-efficient, and sustainable solutions. The increasing adoption of 5G and the growth of edge computing will create further demand for advanced rack technologies. The market's future hinges on addressing supply chain challenges and adapting to evolving technological advancements.

Singapore Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

Singapore Data Center Rack Market Segmentation By Geography

- 1. Singapore

Singapore Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Dominance of the 5G Network; Fiber Connectivity Network Expansion in the Country

- 3.3. Market Restrains

- 3.3.1. Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Media and Entertainment Expected to Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERS Industries Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MFB Products Pty Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black Box Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vertiv Group Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Raritan Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise

List of Figures

- Figure 1: Singapore Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: Singapore Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Singapore Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 7: Singapore Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Singapore Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Data Center Rack Market?

The projected CAGR is approximately 2.70%.

2. Which companies are prominent players in the Singapore Data Center Rack Market?

Key companies in the market include Hewlett Packard Enterprise, ERS Industries Pte Ltd, Schneider Electric SE, MFB Products Pty Lt, Dell Inc, Black Box Corporation, Vertiv Group Corp, Raritan Inc, Eaton Corporation.

3. What are the main segments of the Singapore Data Center Rack Market?

The market segments include Rack Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Dominance of the 5G Network; Fiber Connectivity Network Expansion in the Country.

6. What are the notable trends driving market growth?

Media and Entertainment Expected to Hold the Major Share.

7. Are there any restraints impacting market growth?

Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

September 2022: Equinix, Inc. announced a partnership with the Centre for Energy Research & Technology (CERT) under the National University of Singapore's (NUS) College of Design and Engineering to explore technologies that enable the use of hydrogen as a green fuel source for mission-critical data center infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Singapore Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence