Key Insights

The Turkish health and medical insurance market, currently valued at approximately $XX million (replace XX with a reasonable estimate based on available data and regional market comparisons), is experiencing robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 2.50%. This expansion is fueled by several key drivers. Rising healthcare costs, coupled with an increasing awareness of the importance of health insurance among the Turkish population, are significantly boosting demand. Government initiatives aimed at improving healthcare access and coverage, along with the expanding middle class with greater disposable income, further contribute to market growth. The market is segmented by product type (Private Health Insurance (PMI) and Public/Social Security Schemes), coverage term (short-term and long-term), and distribution channels (brokers/agents, banks, direct sales, companies, and other channels). Private health insurance is projected to witness particularly strong growth due to its ability to provide wider coverage and more personalized healthcare options than public schemes. The increasing preference for digital distribution channels, especially online sales, is also reshaping the competitive landscape.

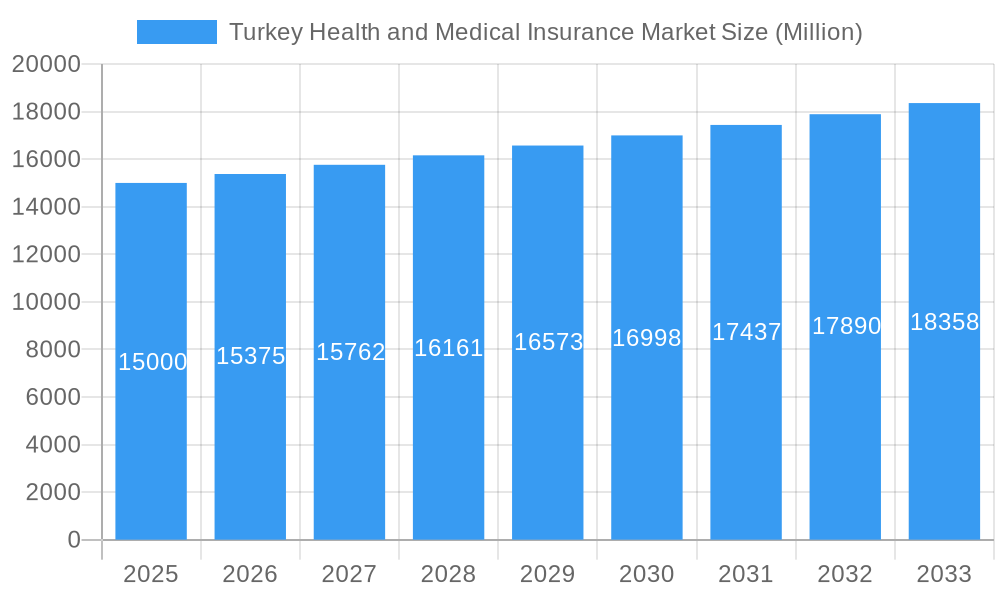

Turkey Health and Medical Insurance Market Market Size (In Billion)

However, the market faces certain restraints. These include regulatory challenges, affordability concerns for a substantial portion of the population, and the potential for adverse selection within private insurance schemes. Despite these challenges, the long-term outlook for the Turkish health and medical insurance market remains positive. The continued rise in healthcare costs, the growing demand for comprehensive coverage, and the government's commitment to enhancing the healthcare infrastructure suggest a sustained upward trajectory in the market's size and value during the forecast period (2025-2033). The presence of established international players such as Allianz, AXA, and Mapfre alongside domestic giants like Anadolu Insurance and Aksigorta underscores the market's attractiveness and potential for both domestic and foreign investment. Growth is expected to be particularly strong in urban areas and among higher income demographics.

Turkey Health and Medical Insurance Market Company Market Share

Turkey Health and Medical Insurance Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Turkey health and medical insurance market, offering invaluable insights for investors, insurers, and healthcare professionals. With a detailed examination of market structure, trends, and future projections, this report is your essential guide to navigating this rapidly evolving landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Turkey Health and Medical Insurance Market Structure & Competitive Landscape

The Turkish health and medical insurance market is characterized by a mix of private and public players, with a moderate level of market concentration. While precise concentration ratios require further analysis, preliminary data suggests a relatively fragmented market with several large players and numerous smaller competitors. The market is driven by factors such as increasing health awareness, rising disposable incomes, and the expanding elderly population. However, regulatory changes and economic fluctuations pose significant challenges. Product substitution is limited, with private health insurance primarily supplementing public schemes rather than replacing them. End-user segmentation is primarily based on age, income, and employment status, influencing the choice between public and private coverage.

The market has witnessed notable M&A activity in recent years. For instance, the 2022 sale of Oman Insurance's Turkish operations to VHV Reasürans reflects broader consolidation trends. While precise figures on M&A volume are unavailable (xx Million USD), the ongoing trend suggests further consolidation is likely in the coming years. Innovation drivers include technological advancements in telehealth, data analytics, and personalized medicine, potentially reshaping delivery models and creating new revenue streams. Regulatory impacts are significant, impacting pricing, product offerings, and market access.

Turkey Health and Medical Insurance Market Trends & Opportunities

The Turkey health and medical insurance market exhibits robust growth, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is projected to reach xx Million USD by 2033, driven by rising healthcare expenditure, expanding coverage under public schemes, and growing demand for private health insurance. Technological shifts, such as the increasing adoption of telehealth and digital health solutions, are transforming the industry landscape, leading to improved accessibility and efficiency. Consumer preferences are shifting towards comprehensive coverage, personalized plans, and convenient access to healthcare services. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, particularly in the digital health space. Market penetration rates for private health insurance are expected to increase gradually, though remain significantly below developed nations, presenting considerable opportunities for expansion.

Dominant Markets & Segments in Turkey Health and Medical Insurance Market

By Product Type: Private Health Insurance (PMI) is experiencing faster growth than Public/Social Security Schemes, driven by increasing affordability and awareness. The PMI segment is projected to dominate the market share within the forecast period.

By Term of Coverage: Long-term policies are gaining traction, reflecting consumers’ increasing need for sustained healthcare protection. However, short-term plans are expected to maintain their relevance, fulfilling the demands of specific life stages or temporary needs.

By Channel of Distribution: Brokers/Agents currently hold a dominant position in the market, facilitating sales across all segments. Banks are playing an increasingly significant role in distribution, leveraging their customer base. Direct sales and sales through companies are also gaining traction.

Key Growth Drivers:

- Increasing healthcare awareness among the population

- Government initiatives to expand health insurance coverage

- Rising disposable incomes and improved living standards

- Technological advancements in healthcare delivery and insurance services

The Istanbul region, due to its large population and economic activity, is likely to remain the dominant market within Turkey.

Turkey Health and Medical Insurance Market Product Analysis

The Turkish health insurance market offers a range of products, from basic coverage under public schemes to comprehensive private health insurance plans tailored to individual needs. Recent innovations include digital platforms for policy management, claims processing, and telehealth consultations. These digital enhancements are improving the accessibility, efficiency, and affordability of healthcare services. The market is characterized by competitive pricing strategies and value-added services such as wellness programs and preventative healthcare initiatives to attract customers.

Key Drivers, Barriers & Challenges in Turkey Health and Medical Insurance Market

Key Drivers: The market's growth is fueled by rising healthcare costs, an aging population, increasing health awareness, and government policies promoting health insurance coverage. Technological advancements, like telehealth and data analytics, also contribute to efficiency and market expansion.

Challenges: Regulatory complexities, including pricing regulations and licensing requirements, can hinder market expansion. Supply chain issues, particularly concerning access to pharmaceuticals and medical equipment, can impact service delivery. Intense competition among existing players, particularly from established international insurers, presents ongoing challenges. The fluctuating Turkish Lira poses financial uncertainties and influences investment decisions.

Growth Drivers in the Turkey Health and Medical Insurance Market Market

The rising prevalence of chronic diseases, coupled with an aging population, necessitates broader healthcare coverage. Government support for health insurance initiatives and investment in healthcare infrastructure further stimulate market growth. Technological advancements such as telemedicine and digital health solutions are also crucial drivers of growth and efficiency.

Challenges Impacting Turkey Health and Medical Insurance Market Growth

High inflation and currency fluctuations pose financial risks. Regulatory uncertainty, including changes in healthcare policies and reimbursement rates, may impact the profitability of insurance providers. The fragmented nature of the market and intense competition among players create hurdles for smaller firms.

Key Players Shaping the Turkey Health and Medical Insurance Market Market

- Solar Insurance

- Allianz Turkiye

- Aksigorta

- Groupama Insurance

- Eureko Insurance

- AXA Insurance - Insurance Turkey's Trusted Brand

- Mapfre Insurance

- Anadolu Insurance

- ACIBADEM HEALTH GROUP

- Yapi Kredi Insurance

- Sompo Japan

List Not Exhaustive

Significant Turkey Health and Medical Insurance Market Industry Milestones

- June 2022: Oman Insurance Company sells its Turkish operations to VHV Reasürans, signaling consolidation within the market.

- September 2023: Cigna Healthcare launches a new health benefits plan for seniors, indicating a focus on the growing elderly population segment.

Future Outlook for Turkey Health and Medical Insurance Market Market

The Turkish health and medical insurance market is poised for continued growth, driven by a combination of demographic shifts, economic development, and technological advancements. The increasing affordability of private health insurance, coupled with government initiatives to expand coverage, will fuel further market expansion. Strategic partnerships between insurers and healthcare providers, as well as investment in digital health solutions, will be key to success in this dynamic market. The market presents significant opportunities for both established players and new entrants, particularly those leveraging innovative technologies and data-driven insights.

Turkey Health and Medical Insurance Market Segmentation

-

1. Product Type

- 1.1. Private Health Insurance (PMI)

- 1.2. Public/Social Security Schemes

-

2. Term of Coverage

- 2.1. Short-term

- 2.2. Long-term

-

3. Channel of Distribution

- 3.1. Brokers/Agents

- 3.2. Banks

- 3.3. Direct

- 3.4. Companies

- 3.5. Other Channels of Distribution

Turkey Health and Medical Insurance Market Segmentation By Geography

- 1. Turkey

Turkey Health and Medical Insurance Market Regional Market Share

Geographic Coverage of Turkey Health and Medical Insurance Market

Turkey Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Healthcare Services with ageing population; Government Healthcare Initiative increasing access to healthcare

- 3.3. Market Restrains

- 3.3.1. Economic fluctuations in turkey affecting the market.; Existing Regional differences in healthcare facilities affecting the market.

- 3.4. Market Trends

- 3.4.1. Rise In Private Health Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Private Health Insurance (PMI)

- 5.1.2. Public/Social Security Schemes

- 5.2. Market Analysis, Insights and Forecast - by Term of Coverage

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.3.1. Brokers/Agents

- 5.3.2. Banks

- 5.3.3. Direct

- 5.3.4. Companies

- 5.3.5. Other Channels of Distribution

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7. France Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Europe Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Solar Insurance

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Allianz Turkiye

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Aksigorta

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Groupama Insurance

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Eureko Insurance

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AXA Insurance - Insurance Turkey's Trusted Brand

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mapfre Insurance

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Anadolu Insurance

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ACIBADEM HEALTH GROUP

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Yapi Kredi Insurance**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sompo Japan

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Solar Insurance

List of Figures

- Figure 1: Turkey Health and Medical Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey Health and Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Term of Coverage 2020 & 2033

- Table 4: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 5: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: France Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Italy Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Netherlands Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Term of Coverage 2020 & 2033

- Table 15: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 16: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Health and Medical Insurance Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Turkey Health and Medical Insurance Market?

Key companies in the market include Solar Insurance, Allianz Turkiye, Aksigorta, Groupama Insurance, Eureko Insurance, AXA Insurance - Insurance Turkey's Trusted Brand, Mapfre Insurance, Anadolu Insurance, ACIBADEM HEALTH GROUP, Yapi Kredi Insurance**List Not Exhaustive, Sompo Japan.

3. What are the main segments of the Turkey Health and Medical Insurance Market?

The market segments include Product Type, Term of Coverage, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Healthcare Services with ageing population; Government Healthcare Initiative increasing access to healthcare.

6. What are the notable trends driving market growth?

Rise In Private Health Insurance.

7. Are there any restraints impacting market growth?

Economic fluctuations in turkey affecting the market.; Existing Regional differences in healthcare facilities affecting the market..

8. Can you provide examples of recent developments in the market?

In June 2022, Oman Insurance Company announced completing the sale of its insurance operations in Turkey to VHV Reasürans, Istanbul/Turkey, a company of VHV Group, Hannover/Germany. The deal resembles Oman Insurance's transformation and simplification strategy with the objective of focusing the company's resources on specific markets and segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Turkey Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence