Key Insights

The global investment banking sector is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.6%. This robust expansion, forecasted from 2025 to 2033, is underpinned by escalating merger and acquisition (M&A) activity across technology and healthcare, alongside increased private equity and venture capital investments. Evolving global financial markets and the imperative for advanced risk management strategies further fuel this upward trajectory. Despite potential headwinds from regulatory shifts and economic volatility, the industry's inherent adaptability will likely ensure continued development. Key service segments including M&A advisory, underwriting, and sales & trading offer diversified revenue potential, while leading firms like JPMorgan Chase & Co, Goldman Sachs, and Morgan Stanley are strategically leveraging technological innovation.

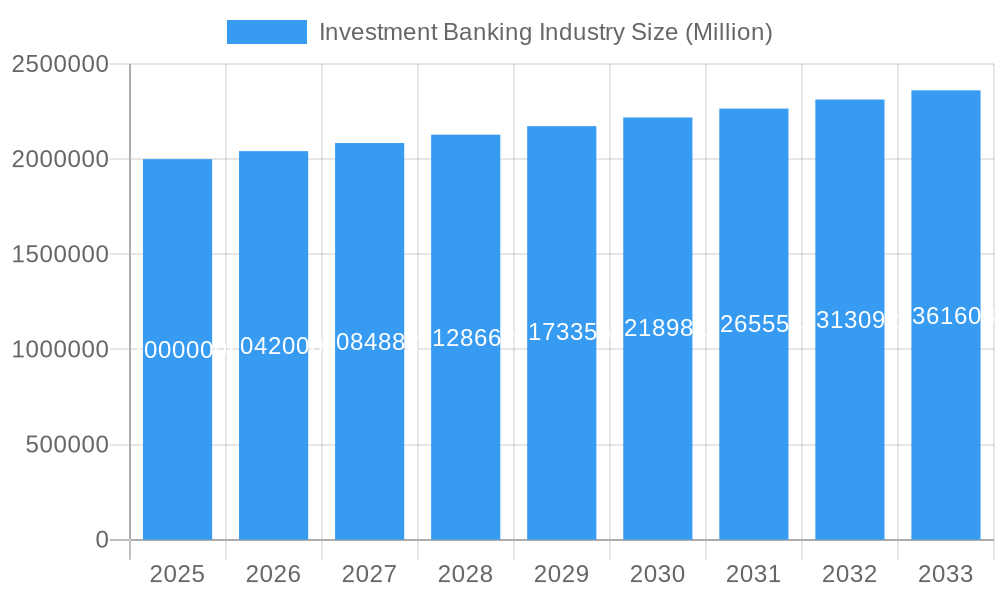

Investment Banking Industry Market Size (In Billion)

The market is expected to grow from an estimated $150.49 billion in the base year 2025, reaching substantial valuations by 2033. North America and Europe will remain dominant regions, though Asia and other emerging markets are anticipated to contribute significantly to future growth. Macroeconomic stability, regulatory clarity, and advancements in financial technology will be critical determinants of the industry's long-term success. Continuous adaptation to market dynamics and proactive client need anticipation are paramount.

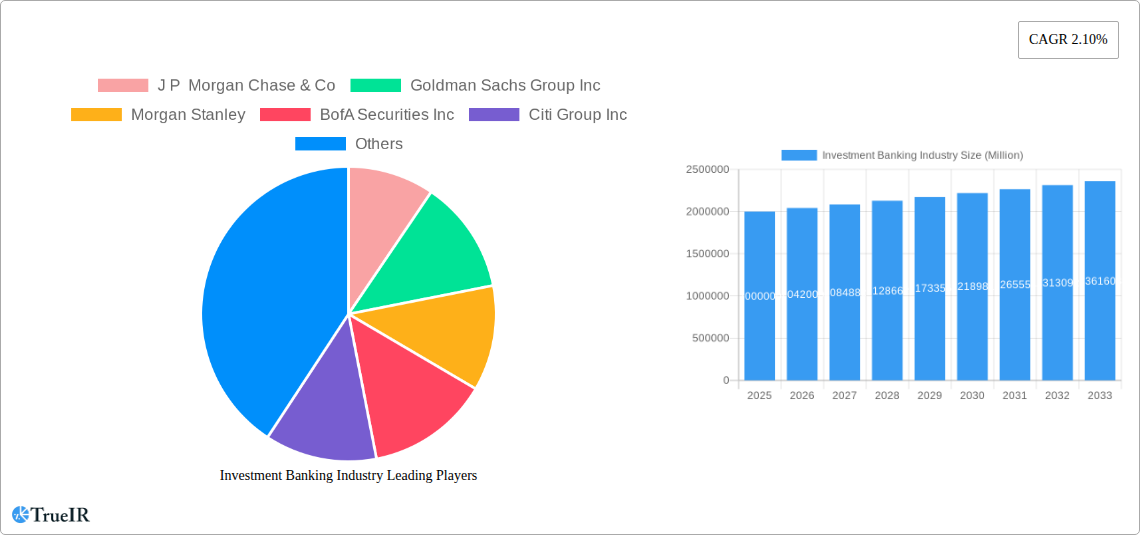

Investment Banking Industry Company Market Share

Global Investment Banking Market Analysis: 2025-2033 Outlook

This report delivers a comprehensive analysis of the global investment banking market, detailing key trends and growth opportunities between 2025 and 2033. It covers a historical analysis from 2019-2024, with 2025 serving as the base year. The report includes insights into major industry players such as JPMorgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, and Cowen Inc.

Investment Banking Industry Market Structure & Competitive Landscape

The global investment banking industry exhibits a concentrated market structure, dominated by a few multinational giants. The Herfindahl-Hirschman Index (HHI) for the top 10 players in 2024 is estimated at xx, indicating a moderately concentrated market. Innovation drivers include advancements in fintech, AI-powered trading algorithms, and blockchain technology. Regulatory impacts, such as increased capital requirements and stricter compliance standards (e.g., Dodd-Frank), significantly influence market dynamics. Product substitutes are limited, with the primary competition stemming from alternative financing sources and direct lending platforms.

End-user segmentation primarily consists of corporations seeking capital, governments issuing debt, and high-net-worth individuals seeking investment management services. Mergers and acquisitions (M&A) activity remains a significant force, with a total M&A volume in the investment banking sector reaching approximately xx Million in 2024.

- Market Concentration: High, with a few major players holding significant market share.

- Innovation Drivers: Fintech advancements, AI, Blockchain.

- Regulatory Impacts: Increased capital requirements, stricter compliance standards.

- M&A Trends: Continued consolidation and strategic acquisitions.

Investment Banking Industry Market Trends & Opportunities

The global investment banking market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. This growth is fueled by several factors, including increasing global trade, rising infrastructure investments across emerging economies, and the continuous need for sophisticated financial services. Technological shifts towards digitalization and automation are transforming the industry landscape, enhancing efficiency and creating new opportunities for innovative business models. Consumer preferences are shifting towards personalized investment solutions and transparent fee structures. Competitive dynamics are shaped by aggressive competition among established players and the rise of fintech disruptors. Market penetration rates are highest in developed economies, with significant expansion potential in emerging markets. The increasing complexities in global financial markets, coupled with the need for sophisticated risk management, are further fueling the market growth.

Dominant Markets & Segments in Investment Banking Industry

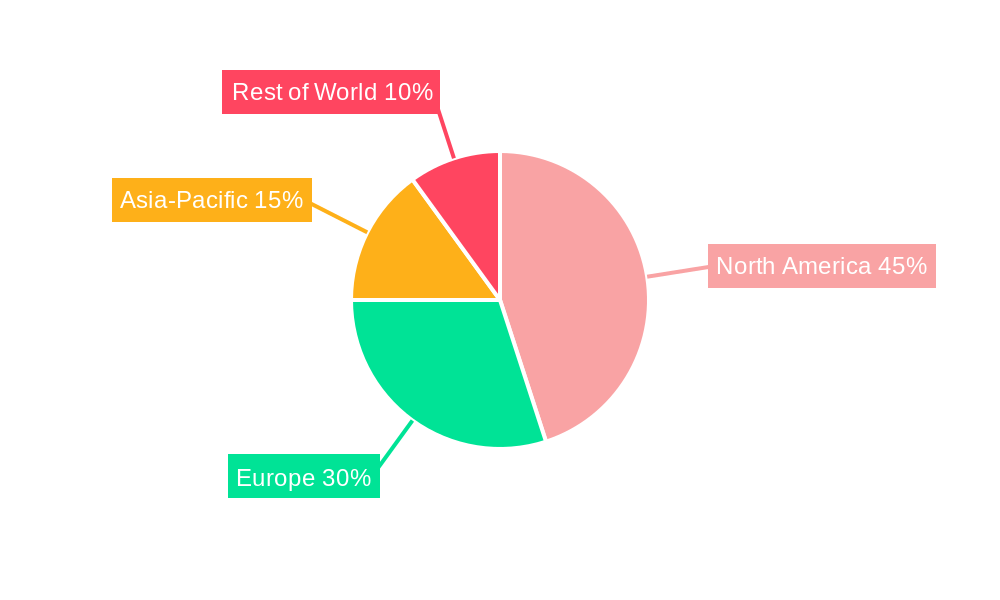

North America currently dominates the global investment banking market, driven by a robust financial sector, high capital availability, and an active M&A landscape. The United States, in particular, remains a leading hub for investment banking activities.

Key Growth Drivers in North America:

- Well-established financial infrastructure.

- High concentration of publicly listed companies.

- Active venture capital and private equity investment.

- Strong regulatory framework (with ongoing reforms).

- A large pool of skilled professionals.

Key Growth Drivers in Asia-Pacific:

- Rapid economic growth in several countries.

- Increasing foreign direct investment.

- Government initiatives promoting infrastructure development.

- Growing middle class with increasing investable wealth.

While North America maintains a leading position, the Asia-Pacific region is experiencing rapid growth, driven by economic expansion and infrastructure development initiatives. Europe also maintains a significant market share.

Investment Banking Industry Product Analysis

Product innovation is focused on developing sophisticated financial products tailored to specific client needs, leveraging technological advancements like AI and machine learning for risk assessment, portfolio optimization, and algorithmic trading. These innovations offer improved efficiency, reduced costs, and enhanced risk management capabilities, providing a competitive advantage in the market. The focus is on providing customized solutions, including bespoke structured products and specialized advisory services, to cater to the diverse needs of a global clientele.

Key Drivers, Barriers & Challenges in Investment Banking Industry

Key Drivers: Technological advancements (AI, blockchain), global economic growth, increasing cross-border M&A activity, and favorable regulatory environments in some regions are propelling market growth. For example, the adoption of AI-driven risk management solutions is improving efficiency and reducing costs.

Challenges: Stringent regulatory compliance requirements (e.g., increased capital reserves and reporting mandates) impose significant costs and operational complexity. Supply chain disruptions (e.g., cybersecurity breaches) can lead to operational inefficiencies and reputational damage, impacting profitability. Increased competition from both established players and fintech startups exerts pressure on profit margins.

Growth Drivers in the Investment Banking Industry Market

The growth of the investment banking industry is driven primarily by technological advancements, macroeconomic factors, and supportive regulatory environments in certain regions. AI-driven solutions are streamlining operations, improving efficiency, and creating new opportunities. Economic expansion and increased M&A activity directly fuel demand for investment banking services.

Challenges Impacting Investment Banking Industry Growth

Regulatory hurdles, including stricter compliance standards and increased capital requirements, pose significant challenges. Supply chain vulnerabilities, especially related to cybersecurity, threaten operational stability. Intense competition from established players and emerging fintech firms puts downward pressure on pricing and profitability.

Key Players Shaping the Investment Banking Industry Market

Significant Investment Banking Industry Milestones

- 2020: Increased adoption of digital platforms and remote working models due to the COVID-19 pandemic.

- 2021: A surge in SPAC (Special Purpose Acquisition Company) activity.

- 2022: Rising interest rates and increased market volatility impacted deal flow.

- 2023: Continued growth in sustainable finance and ESG (Environmental, Social, and Governance) investing.

Future Outlook for Investment Banking Industry Market

The future of the investment banking industry is marked by significant opportunities for growth, driven by technological advancements, rising global M&A activity, and the expanding market for sustainable finance. Strategic partnerships and acquisitions will continue to reshape the competitive landscape. The increasing adoption of AI and machine learning will further enhance efficiency and create new revenue streams. Market potential remains substantial, particularly in emerging markets.

Investment Banking Industry Segmentation

-

1. Product Types

- 1.1. Mergers & Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capital Markets

- 1.4. Syndicated Loans and Others

Investment Banking Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Latin America

-

2. EMEA

- 2.1. Europe

- 2.2. Russia

- 2.3. United Kingdom

- 2.4. Middle East

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. Others

-

4. Australasia

- 4.1. Australia

- 4.2. New Zealand

Investment Banking Industry Regional Market Share

Geographic Coverage of Investment Banking Industry

Investment Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. 2019 - The Year of Mega Deals yet with Lesser M&A Volume

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 5.1.1. Mergers & Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capital Markets

- 5.1.4. Syndicated Loans and Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. EMEA

- 5.2.3. Asia

- 5.2.4. Australasia

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 6. Americas Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 6.1.1. Mergers & Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capital Markets

- 6.1.4. Syndicated Loans and Others

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 7. EMEA Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 7.1.1. Mergers & Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capital Markets

- 7.1.4. Syndicated Loans and Others

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 8. Asia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 8.1.1. Mergers & Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capital Markets

- 8.1.4. Syndicated Loans and Others

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 9. Australasia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 9.1.1. Mergers & Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capital Markets

- 9.1.4. Syndicated Loans and Others

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 J P Morgan Chase & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goldman Sachs Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Morgan Stanley

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BofA Securities Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citi Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Barclays Investment Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Credit Suisse Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Bank AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wells Fargo & Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RBC Capital Markets

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jefferies Group LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Blackstone Group Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cowen Inc**List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 J P Morgan Chase & Co

List of Figures

- Figure 1: Global Investment Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Americas Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 3: Americas Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 4: Americas Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Americas Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: EMEA Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 7: EMEA Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 8: EMEA Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: EMEA Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 11: Asia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 12: Asia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australasia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 15: Australasia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 16: Australasia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Australasia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 2: Global Investment Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 4: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Latin America Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 9: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Russia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Middle East Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 15: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Others Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 20: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Australia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Banking Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Investment Banking Industry?

Key companies in the market include J P Morgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, Cowen Inc**List Not Exhaustive.

3. What are the main segments of the Investment Banking Industry?

The market segments include Product Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

2019 - The Year of Mega Deals yet with Lesser M&A Volume.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Banking Industry?

To stay informed about further developments, trends, and reports in the Investment Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence