Key Insights

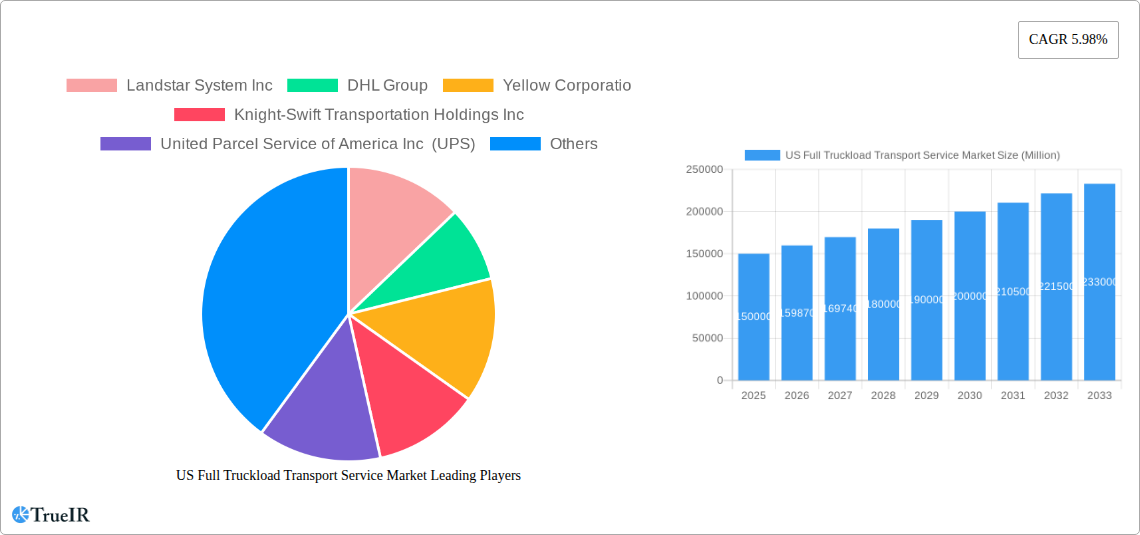

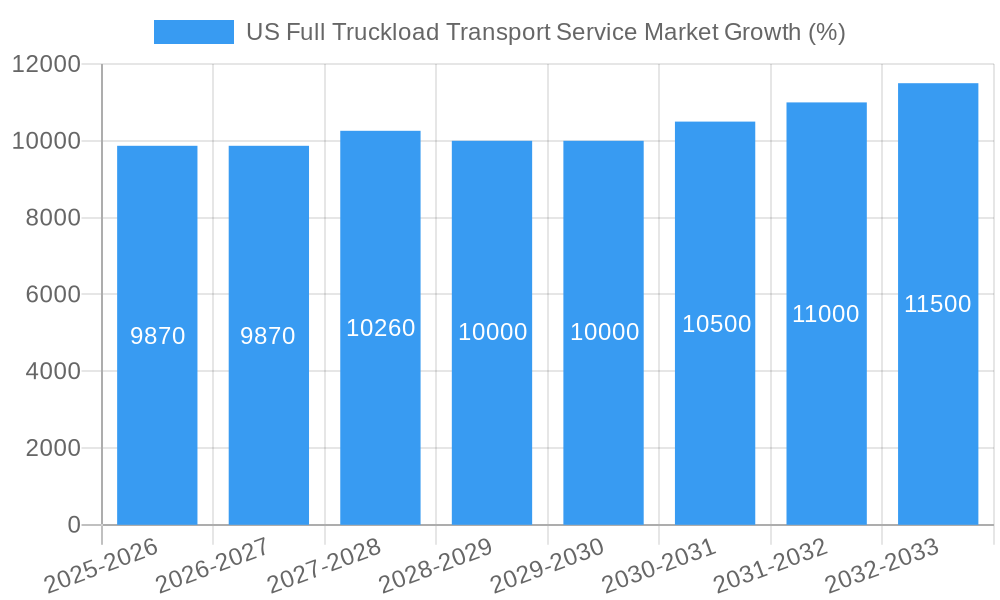

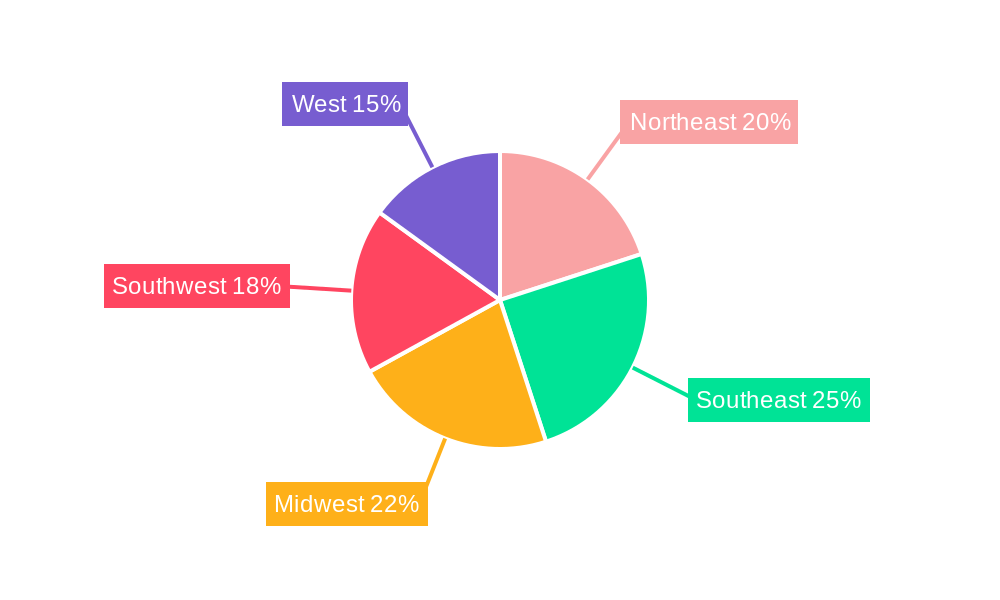

The US full truckload (FTL) transport service market, a cornerstone of the nation's logistics infrastructure, is experiencing robust growth. Driven by a consistently expanding e-commerce sector and the increasing demand for efficient supply chain solutions across various industries, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key factors. The growth of manufacturing and industrial output necessitates efficient FTL services for transporting raw materials and finished goods. The burgeoning agriculture, construction, and oil & gas sectors are also significant contributors to market demand. Furthermore, the increasing preference for just-in-time inventory management strategies among businesses further stimulates the need for reliable and timely FTL transportation. Regional variations exist, with the Southeast and West potentially demonstrating faster growth due to their robust economic activity and expanding industrial hubs. However, challenges remain. Fluctuating fuel prices and driver shortages pose significant headwinds to consistent market expansion. Government regulations on emissions and safety standards also influence operational costs and profitability.

Despite these challenges, the long-term outlook for the US FTL market remains positive. Major players like Landstar System Inc., DHL Group, and UPS are investing in technological advancements, such as route optimization software and advanced tracking systems, to enhance efficiency and competitiveness. The market is likely to witness consolidation among smaller players, leading to increased market share for larger, more established companies capable of leveraging economies of scale. The focus on sustainable transportation practices and the integration of advanced technologies will be crucial for companies seeking to maintain a strong position in this dynamic market. The diversification of the end-user industries served—including agriculture, construction, manufacturing, and oil & gas—provides resilience against fluctuations in individual sectors and contributes to the overall sustained growth.

This dynamic report provides a detailed analysis of the US Full Truckload Transport Service Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages rigorous data analysis and expert insights to illuminate market trends, competitive dynamics, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

US Full Truckload Transport Service Market Market Structure & Competitive Landscape

The US full truckload (FTL) transport service market is characterized by a moderately concentrated structure, with a few large players dominating the landscape. Key players such as Landstar System Inc, DHL Group, Yellow Corporation, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, C H Robinson, ArcBest®, J B Hunt Transport Inc, and Ryder Systems compete fiercely, driving innovation and influencing market dynamics. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

Market Concentration:

- High market share concentration among top 10 players.

- Significant regional variations in market concentration.

Innovation Drivers:

- Technological advancements such as AI-powered route optimization and predictive analytics.

- Growing adoption of telematics and IoT for enhanced fleet management.

Regulatory Impacts:

- Stringent regulations regarding driver hours of service and safety standards.

- Fluctuations in fuel prices and environmental regulations impacting operational costs.

Product Substitutes:

- Less-than-truckload (LTL) shipping for smaller shipments.

- Intermodal transportation (combining rail and trucking) for long-haul routes.

End-User Segmentation: The market caters to diverse end-user industries, including: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others. The Manufacturing and Wholesale and Retail Trade segments are currently the largest contributors to market revenue.

M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, primarily driven by companies seeking to expand their geographical reach, enhance service offerings, and achieve economies of scale. An estimated xx M&A deals were recorded between 2019 and 2024, with a total transaction value of approximately xx Million.

US Full Truckload Transport Service Market Market Trends & Opportunities

The US FTL market exhibits robust growth driven by several key trends. E-commerce expansion fuels demand for efficient last-mile delivery, prompting FTL providers to optimize their networks and invest in technological upgrades for faster and more reliable service. Furthermore, the increasing adoption of advanced technologies like AI and IoT is transforming operational efficiency, route planning, and predictive maintenance. This reduces costs, enhances on-time delivery, and improves overall customer satisfaction. The expanding manufacturing and retail sectors also underpin market growth, demanding reliable transportation solutions to manage their supply chains effectively. Supply chain disruptions experienced in recent years are prompting companies to diversify their transportation strategies, increasing reliance on FTL services for greater control and predictability.

The market’s growth is also fueled by the rising adoption of technological advancements, specifically in route optimization, predictive analytics, and telematics. These technologies enhance operational efficiency, reduce fuel consumption, and minimize transportation costs. Additionally, increasing government investments in infrastructure development and improvements in road networks are further driving market growth. The market is experiencing increased competition, leading to price pressures and a focus on differentiating services through technology and customer service excellence. This competitive landscape presents both challenges and opportunities for market participants.

The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration rates for FTL services in key end-user industries are expected to increase steadily, driven by the factors described above.

Dominant Markets & Segments in US Full Truckload Transport Service Market

The Domestic segment currently dominates the US FTL market, accounting for a significant majority of overall revenue due to high demand for intra-state and inter-state transportation. However, the International segment is showing promising growth potential, driven by increased cross-border trade and globalization.

End-User Industry Dominance:

- Manufacturing: High demand for efficient transportation of raw materials and finished goods.

- Wholesale and Retail Trade: Significant reliance on FTL for timely delivery to distribution centers and retail outlets.

Key Growth Drivers:

- Robust economic growth: Stimulates demand for goods and services, increasing freight volumes.

- E-commerce boom: Drives demand for faster and more reliable delivery solutions.

- Infrastructure investments: Improved road networks enhance transportation efficiency.

- Technological advancements: Improve route optimization, fleet management, and delivery efficiency.

US Full Truckload Transport Service Market Product Analysis

Technological innovations are reshaping the FTL landscape. Advanced telematics systems provide real-time tracking and monitoring of shipments, enhancing visibility and improving delivery predictability. AI-powered route optimization software significantly reduces fuel consumption and transit times, while predictive maintenance minimizes downtime and operational disruptions. These advancements enhance the efficiency and reliability of FTL services, attracting a broader customer base and providing a competitive advantage to providers who embrace technological change.

Key Drivers, Barriers & Challenges in US Full Truckload Transport Service Market

Key Drivers:

- Growing e-commerce and last-mile delivery demands.

- Expansion of manufacturing and industrial activities.

- Technological advancements improving efficiency and logistics.

- Increasing government infrastructure investments.

Challenges & Restraints:

- Driver shortage and high driver turnover impacting operational efficiency.

- Fluctuating fuel prices and increasing transportation costs.

- Stringent regulatory compliance requirements.

- Intense competition and price pressures. The market is estimated to experience a 5% reduction in profit margins due to competitive pressures over the next five years.

Growth Drivers in the US Full Truckload Transport Service Market Market

The market is propelled by a confluence of factors: the relentless growth of e-commerce necessitates rapid and reliable delivery solutions, boosting demand for FTL services. Technological innovations like AI-driven route optimization and real-time tracking enhance efficiency and lower costs. Government initiatives investing in infrastructure improvements further facilitate seamless transportation. Finally, the expansion of manufacturing and retail sectors fuels the need for robust and scalable FTL networks.

Challenges Impacting US Full Truckload Transport Service Market Growth

Despite significant growth potential, the market faces hurdles. A persistent driver shortage coupled with high turnover rates hampers operational efficiency. Fuel price volatility significantly impacts profitability. Stringent regulatory compliance adds to operational complexities. Finally, intense competition among established players and new entrants exerts significant price pressure, impacting profit margins.

Key Players Shaping the US Full Truckload Transport Service Market Market

- Landstar System Inc

- DHL Group

- Yellow Corporation

- Knight-Swift Transportation Holdings Inc

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- C H Robinson

- ArcBest®

- J B Hunt Transport Inc

- Ryder Systems

Significant US Full Truckload Transport Service Market Industry Milestones

- September 2023: UPS's acquisition of MNX Global Logistics expands its capabilities in time-critical logistics, strengthening its position in the healthcare sector.

- October 2023: Ryder Systems' expansion of its multiclient warehouse network enhances its capacity to serve CPG shippers, solidifying its market presence.

- February 2024: C.H. Robinson's new AI-powered appointment scheduling technology significantly improves efficiency and reduces operational costs, setting a new benchmark for innovation.

Future Outlook for US Full Truckload Transport Service Market Market

The US FTL market is poised for sustained growth, driven by continuous technological advancements, e-commerce expansion, and infrastructure improvements. Strategic partnerships and acquisitions will further consolidate market share, creating opportunities for larger players to expand their services and geographical reach. The increasing adoption of sustainable transportation practices presents both challenges and opportunities, requiring providers to adapt and innovate to remain competitive. The ongoing focus on enhancing operational efficiency and leveraging technology will play a pivotal role in shaping the market's future landscape.

US Full Truckload Transport Service Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

US Full Truckload Transport Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Full Truckload Transport Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Northeast US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Landstar System Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 DHL Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Yellow Corporatio

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Knight-Swift Transportation Holdings Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 United Parcel Service of America Inc (UPS)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Werner Enterprises

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 C H Robinson

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ArcBest®

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 J B Hunt Transport Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ryder Systems

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Landstar System Inc

List of Figures

- Figure 1: Global US Full Truckload Transport Service Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 5: North America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 6: North America US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 7: North America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 8: North America US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 11: South America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 12: South America US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 13: South America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 14: South America US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: Europe US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: Europe US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 19: Europe US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 20: Europe US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 23: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 24: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 25: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 26: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 29: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 30: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 19: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 24: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 25: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 36: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 37: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 45: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 46: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Full Truckload Transport Service Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the US Full Truckload Transport Service Market?

Key companies in the market include Landstar System Inc, DHL Group, Yellow Corporatio, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, C H Robinson, ArcBest®, J B Hunt Transport Inc, Ryder Systems.

3. What are the main segments of the US Full Truckload Transport Service Market?

The market segments include End User Industry, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Full Truckload Transport Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Full Truckload Transport Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Full Truckload Transport Service Market?

To stay informed about further developments, trends, and reports in the US Full Truckload Transport Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence