Key Insights

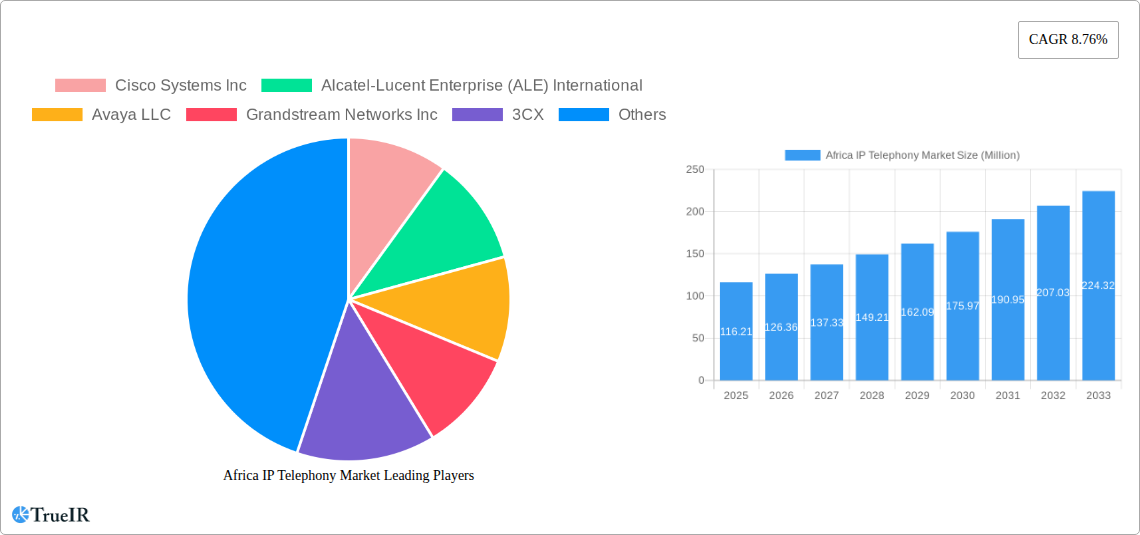

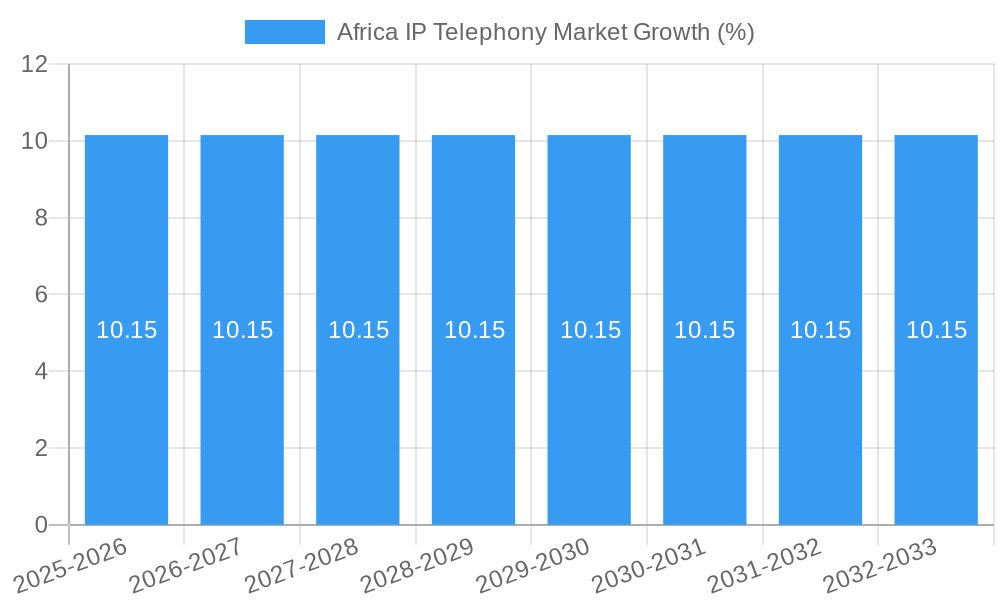

The Africa IP Telephony market is experiencing robust growth, projected to reach a substantial size and maintain a healthy Compound Annual Growth Rate (CAGR) of 8.76% from 2025 to 2033. This expansion is fueled by several key factors. Increasing internet penetration and mobile network infrastructure development across the continent are creating a favorable environment for IP telephony adoption. Businesses are increasingly embracing cloud-based solutions, drawn to their cost-effectiveness, scalability, and enhanced features compared to traditional PSTN systems. The rising demand for advanced communication tools, such as unified communications and collaboration platforms, is also driving market growth. Furthermore, the expanding presence of multinational corporations and the growth of small and medium-sized enterprises (SMEs) in Africa are contributing to the increased demand for reliable and efficient communication systems. The market is witnessing a shift towards feature-rich IP PBX systems offering functionalities like video conferencing, call recording, and mobile integration, boosting its appeal to businesses of all sizes.

However, challenges remain. High initial investment costs associated with the implementation of IP telephony infrastructure, particularly in less developed regions, can be a barrier to entry for some businesses. Furthermore, the lack of skilled professionals to install, manage, and maintain these systems in certain areas could hinder wider market penetration. Addressing these hurdles through targeted training programs, government support for infrastructure development, and strategic partnerships between telecom operators and technology providers will be crucial for sustained growth. Major players like Cisco, Alcatel-Lucent Enterprise, Avaya, and others are actively competing in this dynamic market, offering a diverse range of solutions tailored to the specific needs of African businesses. The ongoing evolution of technology and the integration of innovative communication services will continue to shape the future trajectory of the Africa IP Telephony market.

Africa IP Telephony Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Africa IP Telephony Market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this study delves into market structure, competitive dynamics, growth drivers, challenges, and future outlook. We leverage extensive data and analysis to provide a detailed understanding of this rapidly evolving market.

Africa IP Telephony Market Market Structure & Competitive Landscape

The African IP Telephony market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller, niche operators. The market concentration ratio (CR4) is estimated at xx% in 2025, indicating a competitive landscape with room for both established players and emerging entrants. Innovation is a key driver, with companies continually investing in new technologies such as VoIP, cloud-based solutions, and unified communications. Regulatory landscapes vary significantly across African nations, impacting market entry and operations. Product substitution pressure is moderate, with traditional telephony systems gradually being replaced by more flexible and cost-effective IP solutions. The end-user segment is diverse, encompassing businesses of all sizes, government agencies, and individuals. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total estimated M&A volume of xx Million USD during the historical period (2019-2024). This activity is expected to increase as larger players consolidate their market share and smaller companies seek strategic partnerships.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: VoIP, cloud-based solutions, unified communications.

- Regulatory Impacts: Vary significantly across African nations.

- Product Substitutes: Traditional telephony systems.

- End-User Segmentation: Businesses (SMEs, large enterprises), government, individuals.

- M&A Trends: Moderate activity (xx Million USD, 2019-2024), expected to increase.

Africa IP Telephony Market Market Trends & Opportunities

The Africa IP Telephony market is experiencing significant growth, driven by increasing mobile penetration, expanding internet access, and the rising adoption of cloud-based communication services. The market size is estimated at xx Million USD in 2025 and is projected to reach xx Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Market penetration rates are increasing steadily, particularly in urban areas, as businesses and consumers seek more efficient and affordable communication solutions. The shift towards cloud-based IP telephony is a major trend, offering scalability, flexibility, and cost-effectiveness. Consumer preferences are shifting towards integrated communication platforms that combine voice, video, and messaging functionalities. Competitive dynamics are intense, with established players facing competition from agile startups offering innovative solutions. This trend is further fueled by technological advancements, including the rollout of 5G networks, which will enhance connectivity and enable more sophisticated IP telephony applications.

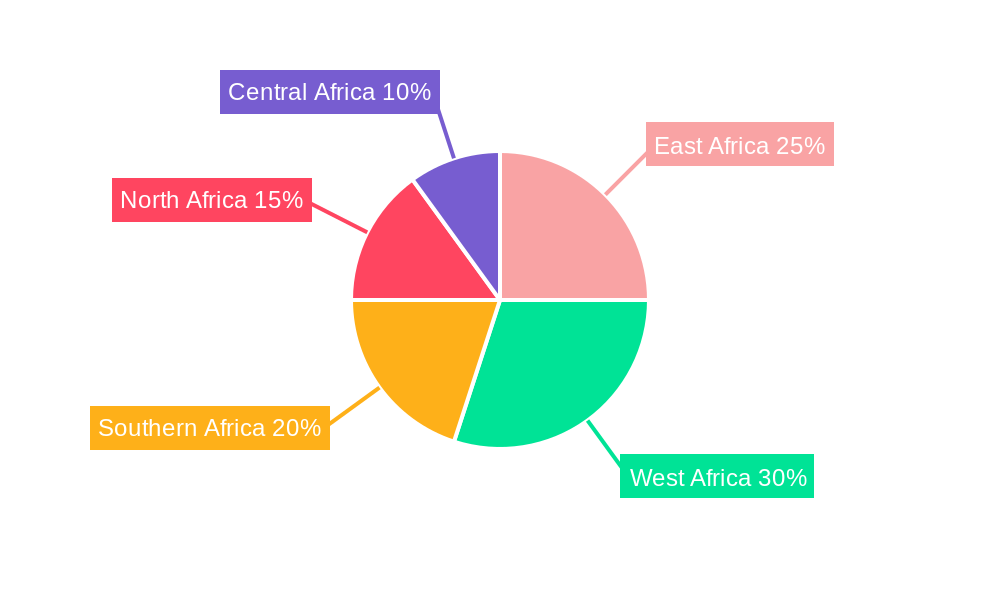

Dominant Markets & Segments in Africa IP Telephony Market

The dominant markets and segments within the African IP Telephony market are characterized by variations in infrastructure development, regulatory environments, and economic conditions. South Africa, followed by Nigeria and Kenya, represent leading markets due to their relatively advanced infrastructure and higher levels of internet penetration. Within these markets, the enterprise segment is a significant contributor to growth, fueled by the rising demand for unified communications solutions.

- Key Growth Drivers (South Africa): Advanced infrastructure, high internet penetration, strong business environment.

- Key Growth Drivers (Nigeria): Large population, growing SME sector, increasing mobile adoption.

- Key Growth Drivers (Kenya): Rising mobile money adoption, expanding internet access, government initiatives.

Africa IP Telephony Market Product Analysis

The Africa IP Telephony market features a diverse range of products, encompassing traditional IP PBXs, cloud-based solutions, and unified communications platforms. Recent innovations focus on enhancing features like video conferencing, mobile integration, and advanced call management. These products aim to provide businesses and individuals with flexible, scalable, and cost-effective communication solutions adapted to the specific needs of the African market. Key competitive advantages include reliability, ease of use, affordability, and integration with existing systems.

Key Drivers, Barriers & Challenges in Africa IP Telephony Market

Key Drivers: The rapid expansion of mobile and internet infrastructure, coupled with increasing government initiatives to promote digitalization, are key drivers of growth in the African IP Telephony market. The rising demand for efficient communication solutions among businesses and individuals fuels further market expansion. Falling costs of IP telephony equipment and services contribute to wider adoption.

Challenges: Challenges include inconsistent infrastructure across the continent, varying regulatory frameworks among countries, and a persistent digital divide between urban and rural areas. These challenges impede market growth and penetration, particularly in underserved regions. Furthermore, cybersecurity concerns and a lack of skilled workforce pose significant barriers.

Growth Drivers in the Africa IP Telephony Market Market

Growth is fueled by increasing mobile penetration, expanding internet access, and rising demand for advanced communication solutions, particularly among businesses. Government initiatives promoting digitalization and infrastructure investments are further accelerating market expansion. The decreasing cost of IP telephony systems is increasing accessibility.

Challenges Impacting Africa IP Telephony Market Growth

Significant challenges include infrastructure gaps across various regions, inconsistent regulatory frameworks across countries, and a skilled workforce shortage, all hindering market expansion. The digital divide between urban and rural areas continues to limit market penetration in less developed regions. Security concerns and power instability in some areas further constrain adoption.

Key Players Shaping the Africa IP Telephony Market Market

- Cisco Systems Inc

- Alcatel-Lucent Enterprise (ALE) International

- Avaya LLC

- Grandstream Networks Inc

- 3CX

- Google Inc

- Logitech South Africa

- Yealink SA

- Comms Partner (Pty) Ltd

- AVICOM

- Unify (Mitel)

Significant Africa IP Telephony Market Industry Milestones

- May 2024: Launch of the Next-Gen Infrastructure Company (NGIC) in Ghana, aiming to democratize 5G services, significantly impacting future IP telephony infrastructure and capabilities.

- April 2024: Unveiling of the MTN Group and Huawei Technology Innovation Lab, focusing on 5G and related technologies, strengthening the technological foundation for advanced IP telephony services.

Future Outlook for Africa IP Telephony Market Market

The Africa IP Telephony market holds significant promise for future growth. Continued infrastructure development, increasing mobile and internet penetration, and rising demand for advanced communication solutions will drive market expansion. Strategic investments in 5G technology and the development of innovative solutions tailored to the specific needs of the African market will further enhance opportunities for growth. The market is poised for significant expansion, driven by both technological advancements and the increasing demand for reliable and efficient communication services.

Africa IP Telephony Market Segmentation

-

1. Enterprise Size

- 1.1. Small an

- 1.2. Large Enterprises (more than 500 employees)

Africa IP Telephony Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa IP Telephony Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.3. Market Restrains

- 3.3.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.4. Market Trends

- 3.4.1. Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa IP Telephony Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small an

- 5.1.2. Large Enterprises (more than 500 employees)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alcatel-Lucent Enterprise (ALE) International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avaya LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grandstream Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3CX

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Logitech South Africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yealink SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Comms Partner (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVICOM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unify (Mitel)*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Africa IP Telephony Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa IP Telephony Market Share (%) by Company 2024

List of Tables

- Table 1: Africa IP Telephony Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa IP Telephony Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 4: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2019 & 2032

- Table 5: Africa IP Telephony Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa IP Telephony Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 8: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2019 & 2032

- Table 9: Africa IP Telephony Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa IP Telephony Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Nigeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Nigeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Egypt Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Kenya Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ethiopia Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Morocco Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ghana Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Algeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Algeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Tanzania Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Tanzania Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Ivory Coast Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Ivory Coast Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa IP Telephony Market?

The projected CAGR is approximately 8.76%.

2. Which companies are prominent players in the Africa IP Telephony Market?

Key companies in the market include Cisco Systems Inc, Alcatel-Lucent Enterprise (ALE) International, Avaya LLC, Grandstream Networks Inc, 3CX, Google Inc, Logitech South Africa, Yealink SA, Comms Partner (Pty) Ltd, AVICOM, Unify (Mitel)*List Not Exhaustive.

3. What are the main segments of the Africa IP Telephony Market?

The market segments include Enterprise Size .

4. Can you provide details about the market size?

The market size is estimated to be USD 116.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

6. What are the notable trends driving market growth?

Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

8. Can you provide examples of recent developments in the market?

May 2024: Ascend Digital, K-NET, Radisys, Nokia, and Tech Mahindra, in collaboration with the Government of Ghana and MNOs (mobile network operators) AT Ghana and Telecel Ghana, unveiled their joint venture, the Next-Gen Infrastructure Company (NGIC). This strategic partnership aims to democratize 5G mobile broadband services in Ghana. NGIC secured its 5G license and is slated to roll out 5G services nationwide in Ghana by the end of 2024, with plans for subsequent expansion into other African regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa IP Telephony Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa IP Telephony Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa IP Telephony Market?

To stay informed about further developments, trends, and reports in the Africa IP Telephony Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence