Key Insights

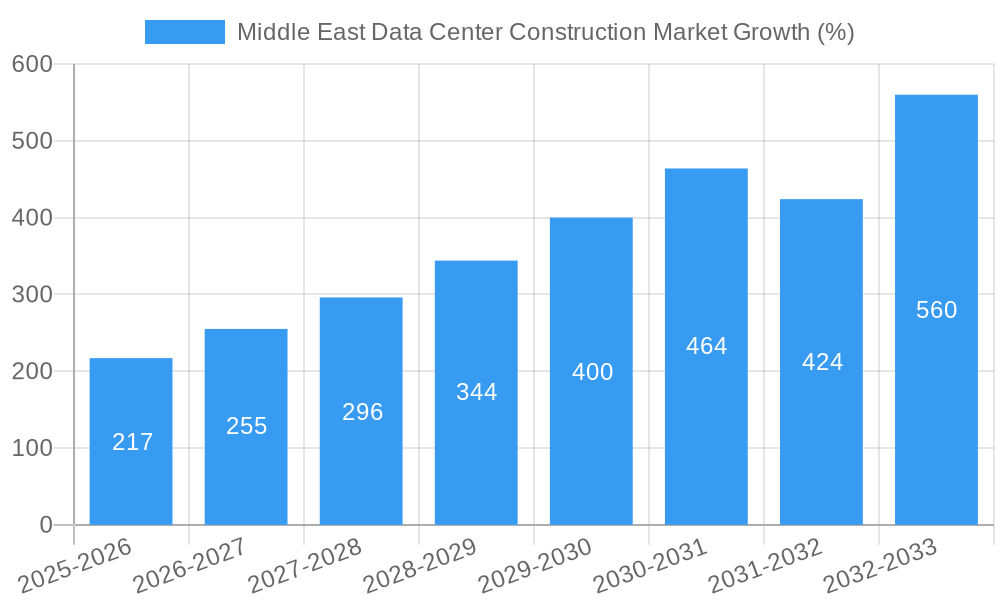

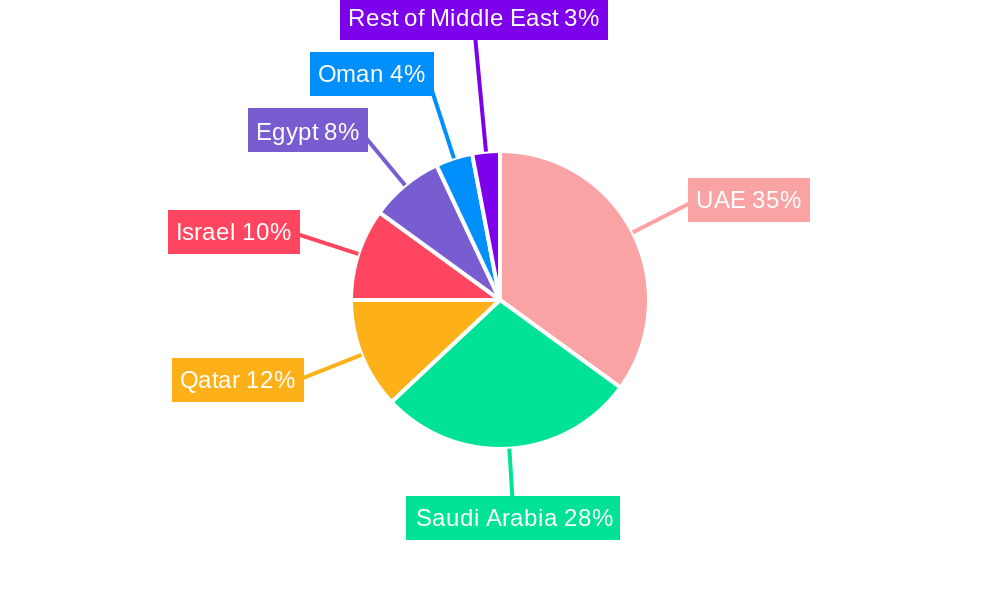

The Middle East data center construction market is experiencing robust growth, driven by the region's rapid digital transformation, increasing cloud adoption, and the burgeoning e-commerce sector. A compound annual growth rate (CAGR) of 14.74% from 2019 to 2024 indicates a significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include substantial investments in digital infrastructure by governments across the region, aiming to diversify economies and enhance citizen services. The rising demand for high-performance computing and the need for robust data storage to support burgeoning industries such as finance (BFSI), telecommunications, and healthcare are further fueling this growth. Market segmentation reveals a strong focus on large and mega data centers, reflecting the need for scalable infrastructure to accommodate the increasing data volumes. Cooling infrastructure, power distribution units (PDUs), and robust physical security systems are crucial components driving market expansion within the infrastructure segment. While the market faces some restraints, such as high initial investment costs and skilled labor shortages, the long-term growth outlook remains highly positive. The UAE, Saudi Arabia, and Qatar are leading the market, fueled by strategic initiatives to establish regional tech hubs and attract foreign investment.

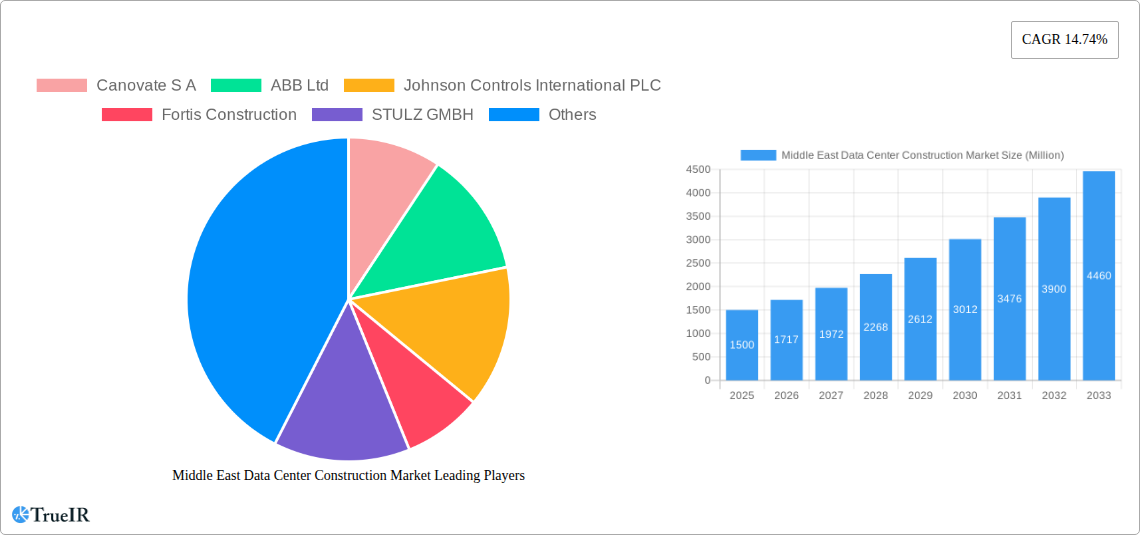

The competitive landscape is characterized by a mix of international giants and regional players. Established companies like Schneider Electric, ABB, and Johnson Controls, alongside regional specialists, are vying for market share. This competition is expected to intensify, leading to innovative solutions and improved cost-effectiveness. The growing adoption of sustainable practices, such as increased focus on energy-efficient cooling systems and renewable energy sources, will further shape the market's trajectory. The market's evolution is also expected to be shaped by ongoing technological advancements in data center design and construction, with a focus on modularity, scalability, and automation. The forecast period will likely see increased adoption of hyperscale data center models, driving even higher demand for specialized construction and infrastructure solutions.

Middle East Data Center Construction Market: A Comprehensive Report (2019-2033)

This dynamic report offers a deep dive into the burgeoning Middle East data center construction market, providing invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging a robust analysis of the period 2019-2024 (Historical Period) and projecting to 2033 (Forecast Period), with a base year of 2025 and estimated year of 2025, this comprehensive study unveils the market's structure, trends, opportunities, and challenges. The report analyzes key players such as Canovate S A, ABB Ltd, Johnson Controls International PLC, and more, offering a granular view of the competitive landscape and future growth projections. Detailed segmentation across Tier type, data center size, infrastructure components, and end-user industries ensures a 360-degree understanding of this rapidly expanding market.

Middle East Data Center Construction Market Structure & Competitive Landscape

The Middle East data center construction market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including ABB Ltd, Johnson Controls International PLC, and Schneider Electric SE, hold significant market share, driven by their extensive experience, technological capabilities, and established global presence. However, the market also witnesses increasing participation from regional players and specialized contractors, fostering a competitive yet dynamic environment.

Innovation is a key driver, fueled by the demand for energy-efficient solutions, advanced cooling technologies (e.g., liquid cooling), and enhanced security features. Regulatory frameworks, including data privacy laws and energy regulations, significantly impact market dynamics, influencing design choices and operational costs. Product substitutes, such as cloud-based solutions, present a competitive challenge, but the growing demand for localized data storage and low-latency applications counters this trend.

End-user segmentation reveals a strong contribution from the IT & Telecommunication sector, followed by BFSI (Banking, Financial Services, and Insurance) and Government entities. The market's M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily involving smaller players seeking strategic partnerships or acquisitions by larger firms seeking to expand their regional presence. This suggests a consolidating market with scope for further strategic alliances and acquisitions in the coming years.

Middle East Data Center Construction Market Trends & Opportunities

The Middle East data center construction market is experiencing robust growth, projected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is driven by several factors: the region's increasing digitalization, the surge in data traffic due to rising internet penetration and smartphone adoption, the establishment of government initiatives promoting digital transformation, and the growing adoption of cloud computing and other data-intensive technologies.

Technological advancements, such as the deployment of Artificial Intelligence (AI) and Machine Learning (ML) in data center operations and the shift towards sustainable and energy-efficient designs, further contribute to the market's growth. Consumer preferences increasingly favor highly reliable, secure, and environmentally responsible data centers, driving innovation and investment in green technologies. Competitive dynamics are shaping the market, with companies focusing on offering specialized services, innovative solutions, and strategic partnerships to gain a competitive edge. Market penetration rates for advanced cooling technologies and prefabricated modular data centers are expected to increase significantly, driven by cost-effectiveness and faster deployment times.

Dominant Markets & Segments in Middle East Data Center Construction Market

The UAE and Saudi Arabia are the dominant markets within the region, accounting for approximately xx% of the overall market value in 2025. Their strong economies, robust ICT infrastructure development, and supportive government policies significantly influence market growth. Tier III and Tier IV data centers constitute the majority of new constructions, driven by the need for high availability and resilience. Large and Mega data centers dominate the size segment, reflecting the requirements of hyperscale providers and large enterprises.

- Key Growth Drivers in Dominant Segments:

- UAE & Saudi Arabia: Government initiatives promoting digital transformation and investment in smart city projects.

- Tier III & IV Data Centers: Demand for high availability and resilience, particularly from hyperscale cloud providers.

- Large & Mega Data Centers: Growth in data traffic, cloud adoption, and the need for large-scale data processing capabilities.

- Cooling Infrastructure: Increasing concerns over energy efficiency and environmental sustainability.

- Power Infrastructure: Reliability and redundancy requirements for critical IT infrastructure.

Middle East Data Center Construction Market Product Analysis

The market showcases continuous product innovations, particularly in cooling technologies (e.g., liquid immersion cooling, adiabatic cooling) and power distribution systems (e.g., advanced PDUs with enhanced monitoring and control). These advancements focus on improving energy efficiency, reducing operational costs, and enhancing data center reliability. Prefabricated modular data centers are gaining traction due to their rapid deployment and cost-effectiveness. The market is witnessing a shift towards sustainable and environmentally friendly solutions, driven by growing awareness of carbon footprints and government regulations. The competitive advantage stems from providing efficient, secure, and sustainable solutions tailored to the specific needs of diverse customers.

Key Drivers, Barriers & Challenges in Middle East Data Center Construction Market

Key Drivers: The rapid growth of the digital economy, increasing government investments in digital infrastructure, rising adoption of cloud services, and the need for robust data security are primary drivers. The development of smart cities, expansion of 5G networks, and the burgeoning e-commerce sector further fuel market expansion.

Key Challenges: Supply chain disruptions, particularly in securing specialized equipment and skilled labor, pose a significant challenge. Regulatory complexities, including permitting processes and building codes, can create delays and increase project costs. Intense competition among contractors and the need to constantly adapt to evolving technological advancements also pose challenges to market players. The predicted impact of these challenges is an estimated xx% increase in project costs in 2026.

Growth Drivers in the Middle East Data Center Construction Market

The market's growth is propelled by technological advancements (e.g., AI-driven solutions), favorable government policies incentivizing digital infrastructure development, and the expanding digital economy. Increased investments by hyperscale cloud providers and growing data center needs across various industries further contribute to market expansion.

Challenges Impacting Middle East Data Center Construction Market Growth

Regulatory hurdles, including lengthy approval processes and complex building codes, create significant delays and increase costs. Supply chain disruptions, especially regarding specialized equipment and skilled workforce availability, constrain market growth. Furthermore, intense competition and fluctuating energy prices pose ongoing challenges to market participants.

Key Players Shaping the Middle East Data Center Construction Market

- Canovate S A

- ABB Ltd

- Johnson Controls International PLC

- Fortis Construction

- STULZ GMBH

- Delta Group

- Schneider Electric SE

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc

- Airedale International Air Conditioning Ltd

- Cummins Inc

- AECOM Limited

- Legrand

- CyrusOne Inc

- Future Digital data Systems

- Ashi & Bushnag Co Ltd

- EAE Group

- Alfa Laval AB

- Saan Zahav Ltd

Significant Middle East Data Center Construction Market Industry Milestones

- October 2022: Launch of M-VAULT 4's fourth data center building in Qatar, expanding cloud service access via Microsoft Cloud. This signifies a significant investment in cloud infrastructure within the region.

- October 2022: Agreement between Khazna Data Centers, Masdar, and EDF to build a solar PV plant powering a new data center in Masdar City. This highlights the growing focus on sustainable energy solutions within the data center sector.

Future Outlook for Middle East Data Center Construction Market

The Middle East data center construction market is poised for sustained growth, driven by ongoing digital transformation initiatives, increasing cloud adoption, and the region's expanding digital economy. Strategic opportunities abound for companies offering innovative, energy-efficient, and secure solutions. The market's potential is significant, with ample room for expansion and investment in both existing and emerging markets within the region.

Middle East Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched Solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

- 21. United Arab Emirates

- 22. Saudi Arabia

- 23. Israel

- 24. Qatar

- 25. Oman

Middle East Data Center Construction Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. Security Challenges in Data Centers; Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. End-User Outlook

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by United Arab Emirates

- 5.22. Market Analysis, Insights and Forecast - by Saudi Arabia

- 5.23. Market Analysis, Insights and Forecast - by Israel

- 5.24. Market Analysis, Insights and Forecast - by Qatar

- 5.25. Market Analysis, Insights and Forecast - by Oman

- 5.26. Market Analysis, Insights and Forecast - by Region

- 5.26.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. United Arab Emirates Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Canovate S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson Controls International PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fortis Construction

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STULZ GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Delta Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Turner Construction Co

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DPR Construction Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Caterpillar Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Airedale International Air Conditioning Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cummins Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 AECOM Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Legrand

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 CyrusOne Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Future Digital data Systems

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Ashi & Bushnag Co Ltd

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 EAE Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Alfa Laval AB

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Saan Zahav Ltd

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 Canovate S A

List of Figures

- Figure 1: Middle East Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 11: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 14: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 15: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 16: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 23: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 24: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 25: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 26: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 27: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 28: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Egypt Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Middle East Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 37: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 38: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 39: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 40: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 41: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 42: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 43: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 44: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 45: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 46: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 47: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 48: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 49: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 50: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 52: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 53: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 54: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 55: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 56: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 57: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 58: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 59: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 60: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 61: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Kuwait Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Bahrain Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Jordan Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Lebanon Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Construction Market?

The projected CAGR is approximately 14.74%.

2. Which companies are prominent players in the Middle East Data Center Construction Market?

Key companies in the market include Canovate S A, ABB Ltd, Johnson Controls International PLC, Fortis Construction, STULZ GMBH, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Airedale International Air Conditioning Ltd, Cummins Inc, AECOM Limited, Legrand, CyrusOne Inc, Future Digital data Systems, Ashi & Bushnag Co Ltd, EAE Group, Alfa Laval AB, Saan Zahav Ltd.

3. What are the main segments of the Middle East Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users, United Arab Emirates, Saudi Arabia, Israel, Qatar, Oman.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

End-User Outlook.

7. Are there any restraints impacting market growth?

Security Challenges in Data Centers; Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

October 2022: Mohamed bin Ali bin Mohamed Al-Mannai, Minister of Communications and Information Technology, launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence