Key Insights

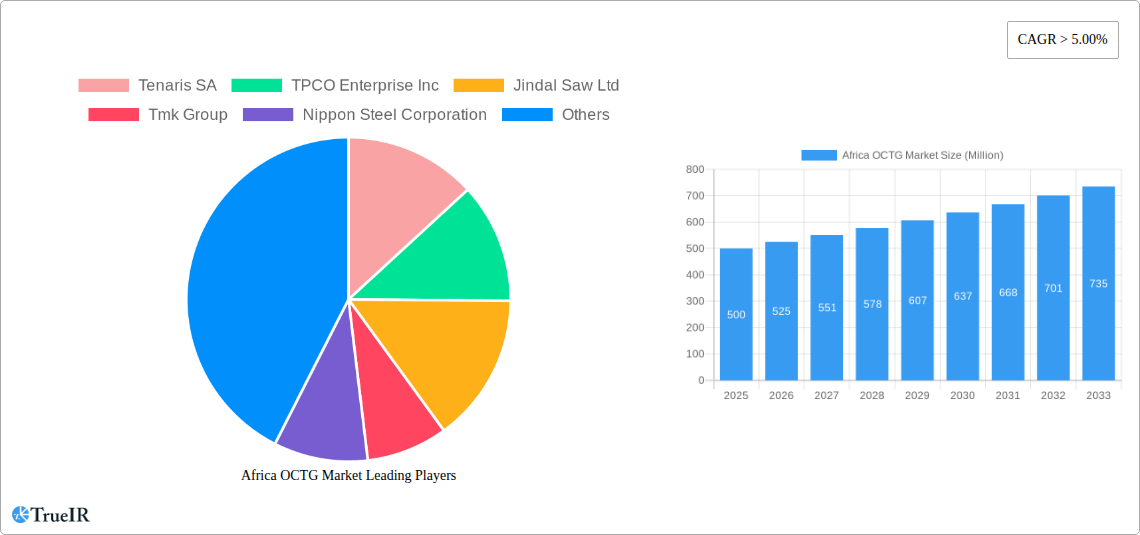

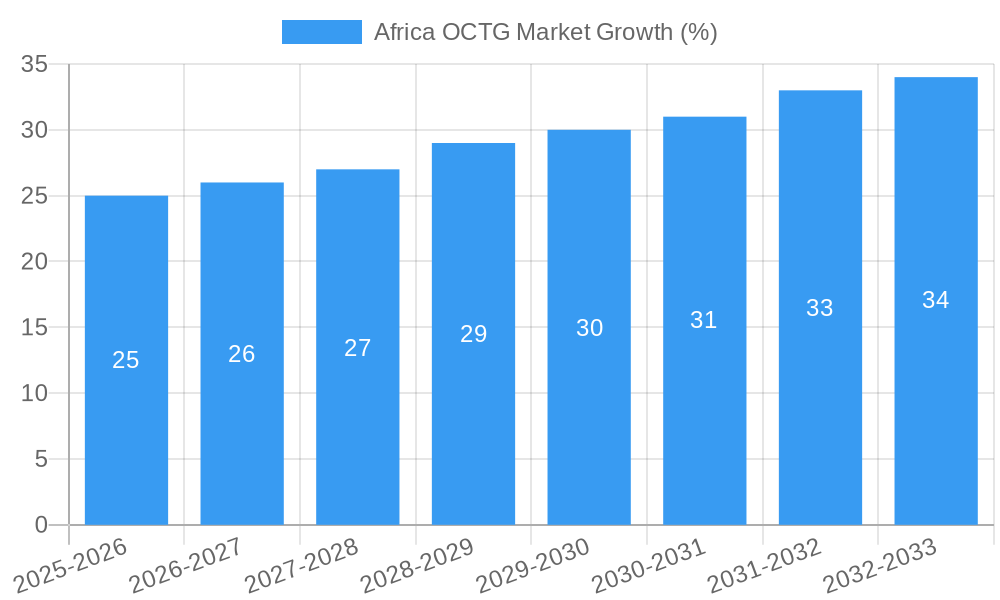

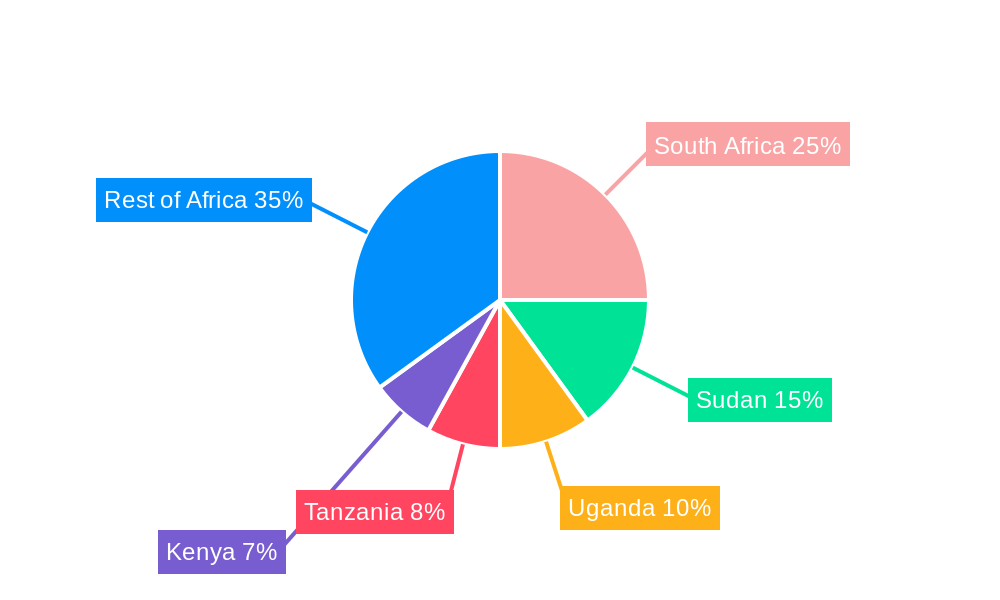

The Africa Oil Country Tubular Goods (OCTG) market, valued at an estimated $500 million in 2025, is projected to experience robust growth, exceeding a 5% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing oil and gas exploration and production activities across the continent, particularly in countries like South Africa, Sudan, and Uganda, fuel demand for OCTG. Secondly, significant investments in infrastructure development, including pipeline construction and refinery upgrades, further bolster market growth. The premium grade segment dominates the market due to its superior performance and durability in challenging environments. However, the API grade segment is also experiencing growth, driven by cost-conscious projects and increasing competition. Leading players like Tenaris SA, TPCO Enterprise Inc, and Jindal Saw Ltd are vying for market share, leveraging their established presence and technological advancements. Challenges include fluctuating oil prices, geopolitical instability in some regions, and potential infrastructure bottlenecks. Nevertheless, the long-term outlook for the African OCTG market remains positive, with sustained growth expected throughout the forecast period.

The competitive landscape is characterized by both international and regional players. International companies benefit from advanced technologies and established supply chains, while regional players cater to specific local needs and project requirements. The market is witnessing a rise in partnerships and collaborations to address logistical challenges and access local expertise. The expansion of existing oil fields and the exploration of new reserves are expected to drive further demand for OCTG in the coming years. Furthermore, the growing emphasis on energy security and the increasing adoption of sustainable practices in the oil and gas industry will also shape the market's trajectory. Governments are incentivizing investment in the sector to boost economic development and diversify energy sources. This favorable regulatory environment coupled with growing demand will continue to fuel market expansion.

Africa OCTG Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Africa Oil Country Tubular Goods (OCTG) market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth potential. The study incorporates rigorous data analysis and expert insights to deliver actionable intelligence for informed decision-making. High-growth segments like Premium Grade and API Grade OCTGs are thoroughly examined, alongside key players like Tenaris SA, TPCO Enterprise Inc, Jindal Saw Ltd, TMK Group, Nippon Steel Corporation, Vallourec SA, National-Oilwell Varco Inc, and ArcelorMittal SA (list not exhaustive).

Africa OCTG Market Market Structure & Competitive Landscape

The Africa OCTG market exhibits a moderately concentrated structure, with a few major international players and several regional players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market. Innovation drivers include the development of high-strength, corrosion-resistant OCTGs to withstand harsh operating conditions. Regulatory impacts, such as import tariffs and local content requirements, significantly influence market access. Product substitutes, such as composite materials, pose a limited threat currently, but their potential for future growth should be monitored. End-user segmentation is primarily driven by the upstream oil and gas sector, with further differentiation by well type (onshore/offshore) and application. Mergers and acquisitions (M&A) activity in the African OCTG market remains modest, with xx transactions recorded between 2019 and 2024, primarily focused on expanding regional presence and acquiring specialized technologies.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: High-strength, corrosion-resistant OCTGs.

- Regulatory Impacts: Import tariffs, local content requirements.

- Product Substitutes: Limited threat from composite materials.

- End-User Segmentation: Upstream oil and gas, onshore/offshore wells.

- M&A Activity: xx transactions between 2019 and 2024.

Africa OCTG Market Market Trends & Opportunities

The Africa OCTG market is projected to experience robust growth, driven by increasing oil and gas exploration and production activities across the continent. The market size is estimated to be xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological advancements, such as the adoption of advanced manufacturing techniques and improved coatings, enhance product performance and efficiency. Consumer preferences are shifting towards high-quality, reliable OCTGs, necessitating manufacturers to meet stringent quality standards and provide comprehensive after-sales services. Competitive dynamics are shaped by pricing strategies, product differentiation, and the ability to cater to diverse customer needs across various African markets. Market penetration rates vary across different regions and segments, reflecting the diverse levels of exploration and production activity.

Dominant Markets & Segments in Africa OCTG Market

Nigeria and Angola are currently the dominant markets in the African OCTG sector, driven by substantial investments in oil and gas infrastructure projects and relatively stable regulatory environments. Premium Grade OCTGs hold a larger market share than API Grade due to the demand for superior performance in challenging operating conditions.

- Nigeria: Key growth drivers include ongoing exploration activities and government support for the energy sector.

- Angola: Strong growth is fueled by investments in deepwater projects and upgrades to existing infrastructure.

- Premium Grade OCTGs: Higher market share driven by demand for superior performance and durability.

- API Grade OCTGs: Significant market share driven by cost-effectiveness and suitability for standard applications.

Africa OCTG Market Product Analysis

The market features a range of OCTG products, including seamless and welded pipes, varying in diameter, wall thickness, and grade. Technological advancements focus on enhancing corrosion resistance, strength, and longevity. Competitive advantages stem from superior product quality, efficient supply chain management, and customized solutions to meet specific customer needs. The market shows a growing trend toward specialized OCTGs designed for extreme conditions, such as high-pressure and high-temperature wells.

Key Drivers, Barriers & Challenges in Africa OCTG Market

Key Drivers: Increasing oil and gas exploration and production activity, government support for energy sector development, and improving infrastructure are key drivers. Investment in deepwater projects significantly influences demand.

Challenges: Political instability in certain regions, supply chain disruptions, and fluctuating oil prices create challenges. Regulatory complexities and infrastructure limitations can restrict growth.

Growth Drivers in the Africa OCTG Market Market

The market is propelled by increasing investment in oil and gas exploration and production, supportive government policies, and infrastructure development across various African nations. Technological advancements in OCTG manufacturing, including improved materials and coatings, further stimulate demand.

Challenges Impacting Africa OCTG Market Growth

Challenges include volatile oil prices, geopolitical instability, and inconsistent regulatory frameworks across different countries. Supply chain disruptions and limited access to skilled labor can also hamper growth.

Key Players Shaping the Africa OCTG Market Market

- Tenaris SA

- TPCO Enterprise Inc

- Jindal Saw Ltd

- TMK Group

- Nippon Steel Corporation

- Vallourec SA

- National-Oilwell Varco Inc

- ArcelorMittal SA

Significant Africa OCTG Market Industry Milestones

- 2021: Launch of a new high-strength OCTG by Tenaris SA.

- 2022: Acquisition of a regional OCTG manufacturer by Vallourec SA.

- 2023: Implementation of new safety regulations impacting OCTG manufacturing.

- 2024: Significant investment in OCTG manufacturing capacity in Nigeria.

Future Outlook for Africa OCTG Market Market

The Africa OCTG market is poised for sustained growth, driven by ongoing exploration activities and increasing energy demand. Opportunities exist for companies to invest in new manufacturing capacity, develop innovative products, and establish strong partnerships with regional players. The market's future depends on continued investment in infrastructure, political stability, and favorable regulatory environments.

Africa OCTG Market Segmentation

-

1. Grade

- 1.1. Premium Grade

- 1.2. API Grade

-

2. Geography

- 2.1. Nigeria

- 2.2. Angola

- 2.3. Algeria

- 2.4. Rest of Africa

Africa OCTG Market Segmentation By Geography

- 1. Nigeria

- 2. Angola

- 3. Algeria

- 4. Rest of Africa

Africa OCTG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing

- 3.3. Market Restrains

- 3.3.1. 4.; High Exploration Cost

- 3.4. Market Trends

- 3.4.1. Premium Grade OCTG to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Premium Grade

- 5.1.2. API Grade

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Angola

- 5.2.3. Algeria

- 5.2.4. Rest of Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Angola

- 5.3.3. Algeria

- 5.3.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Nigeria Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Premium Grade

- 6.1.2. API Grade

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Angola

- 6.2.3. Algeria

- 6.2.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Angola Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Premium Grade

- 7.1.2. API Grade

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Angola

- 7.2.3. Algeria

- 7.2.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Algeria Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Premium Grade

- 8.1.2. API Grade

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Angola

- 8.2.3. Algeria

- 8.2.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Rest of Africa Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Premium Grade

- 9.1.2. API Grade

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Angola

- 9.2.3. Algeria

- 9.2.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. South Africa Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa OCTG Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Tenaris SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 TPCO Enterprise Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jindal Saw Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Tmk Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Nippon Steel Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Vallourec SA*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 National-Oilwell Varco Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ArcelorMittal SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Tenaris SA

List of Figures

- Figure 1: Africa OCTG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa OCTG Market Share (%) by Company 2024

List of Tables

- Table 1: Africa OCTG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa OCTG Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 3: Africa OCTG Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Africa OCTG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa OCTG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa OCTG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa OCTG Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 13: Africa OCTG Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Africa OCTG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Africa OCTG Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 16: Africa OCTG Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Africa OCTG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Africa OCTG Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 19: Africa OCTG Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa OCTG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa OCTG Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 22: Africa OCTG Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa OCTG Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa OCTG Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Africa OCTG Market?

Key companies in the market include Tenaris SA, TPCO Enterprise Inc, Jindal Saw Ltd, Tmk Group, Nippon Steel Corporation, Vallourec SA*List Not Exhaustive, National-Oilwell Varco Inc, ArcelorMittal SA.

3. What are the main segments of the Africa OCTG Market?

The market segments include Grade, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing.

6. What are the notable trends driving market growth?

Premium Grade OCTG to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Exploration Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa OCTG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa OCTG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa OCTG Market?

To stay informed about further developments, trends, and reports in the Africa OCTG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence