Key Insights

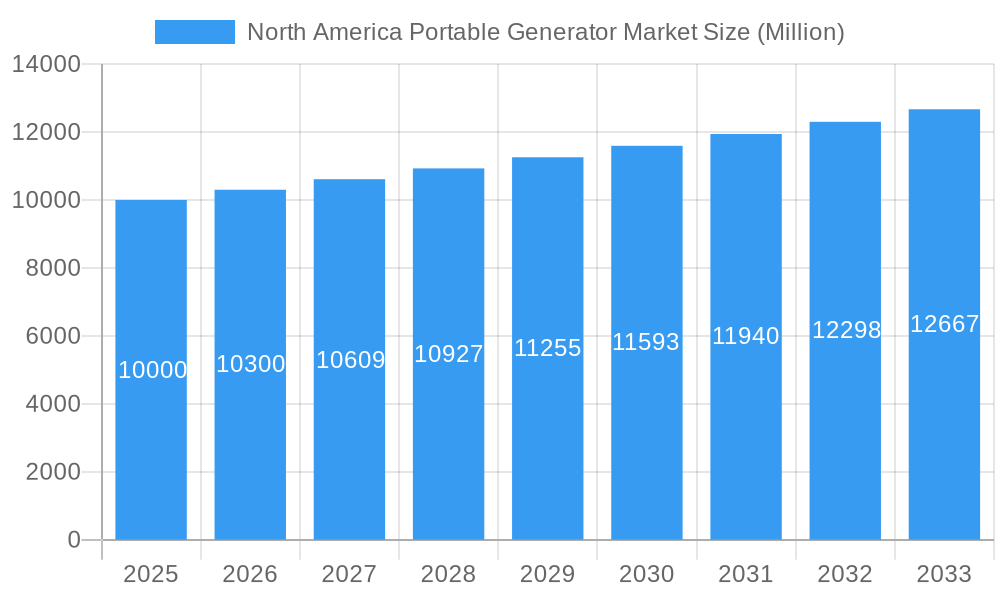

The North American portable generator market is projected to reach $4.8 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This expansion is driven by escalating demand for reliable backup power solutions due to increased extreme weather events, impacting residential and commercial sectors. Growth is also supported by expanding construction and industrial activities, alongside rising adoption for recreational purposes like camping and off-grid living.

North America Portable Generator Market Market Size (In Billion)

The market is segmented by power rating (below 5 kW, 5-10 kW, above 10 kW), fuel type (gas, diesel, others), and end-user (residential, commercial, industrial). Gas-powered generators currently lead due to cost-effectiveness, while diesel models are gaining traction in industrial applications for their durability and power. The residential sector holds a substantial market share, though commercial and industrial demand is expected to influence future market dynamics.

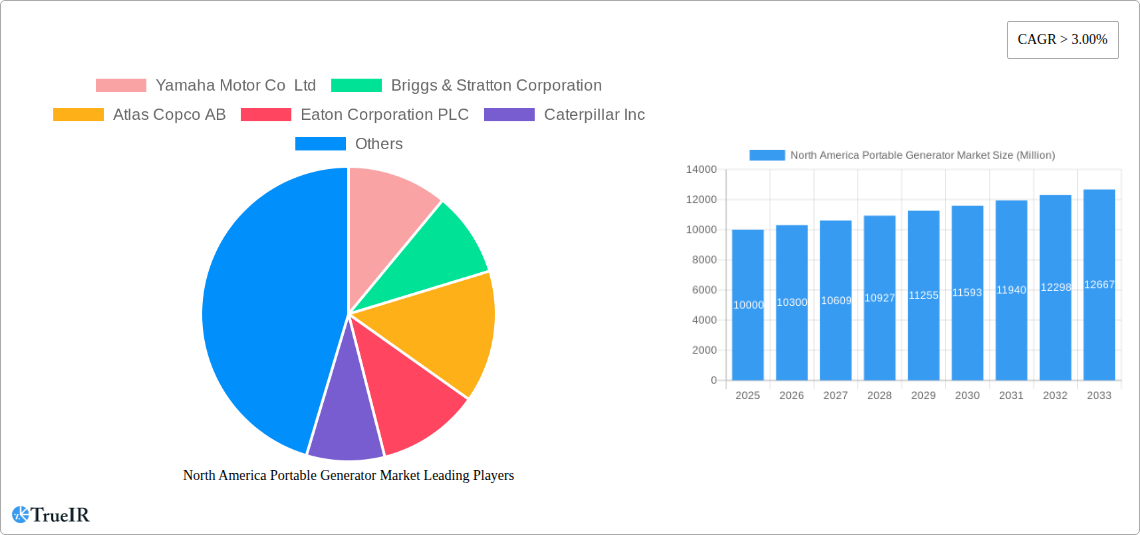

North America Portable Generator Market Company Market Share

Key market players, including Generac Holdings Inc., Kohler Power Systems, and Briggs & Stratton Corporation, are competing through innovation, product diversification, and acquisitions. However, challenges such as rising raw material costs, stringent emission regulations, and competition from alternative power sources like solar and battery backups persist.

Despite these challenges, the North American portable generator market offers significant investment potential. Sustained growth is anticipated, necessitating strategic partnerships, R&D investments in fuel efficiency and emission reduction, and expansion into new market segments. Advanced features such as smart controls and remote monitoring will appeal to environmentally conscious consumers. Long-term adaptation to advancements in battery technology and renewable energy is crucial for continued success. Market growth will remain closely linked to extreme weather event frequency and infrastructure development.

North America Portable Generator Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America portable generator market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages rigorous data analysis and expert insights to illuminate current market dynamics and future growth trajectories. The report is enriched with high-volume keywords to enhance search visibility and engagement.

North America Portable Generator Market Structure & Competitive Landscape

The North America portable generator market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of numerous smaller players indicates a competitive landscape. The market concentration ratio (CR4) is estimated at xx% in 2025, reflecting the influence of leading brands like Generac Holdings Inc, Kohler Power Systems, and Briggs & Stratton Corporation. Innovation is a key driver, with ongoing efforts to improve fuel efficiency, reduce emissions, and enhance portability. Regulatory impacts, primarily focused on emission standards and safety regulations, influence product design and manufacturing processes. Product substitutes, such as uninterruptible power supplies (UPS) and solar power systems, pose a moderate competitive threat, particularly in niche segments. End-user segmentation reveals significant demand from residential, commercial, and industrial sectors, each with specific needs and preferences. M&A activity in the sector remains moderate; the number of completed mergers and acquisitions averaged xx per year during the historical period (2019-2024), with larger players strategically acquiring smaller companies to expand their product portfolios or access new technologies.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: Fuel efficiency, emission reduction, enhanced portability.

- Regulatory Impacts: Emission standards, safety regulations.

- Product Substitutes: UPS systems, solar power systems.

- End-User Segmentation: Residential, commercial, industrial.

- M&A Activity: Average xx transactions annually (2019-2024).

North America Portable Generator Market Trends & Opportunities

The North America portable generator market is experiencing robust growth, fueled by increasing demand for reliable backup power solutions. The market size reached an estimated value of xx Million in 2025 and is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological advancements, such as the incorporation of inverter technology for cleaner power output and improved fuel efficiency, are driving market expansion. Consumer preferences are shifting towards quieter, more fuel-efficient, and environmentally friendly generators. Intense competition among established players and new entrants is leading to product innovation and price reductions, further stimulating market growth. Market penetration rates are highest in the residential segment, while commercial and industrial sectors show strong growth potential.

Dominant Markets & Segments in North America Portable Generator Market

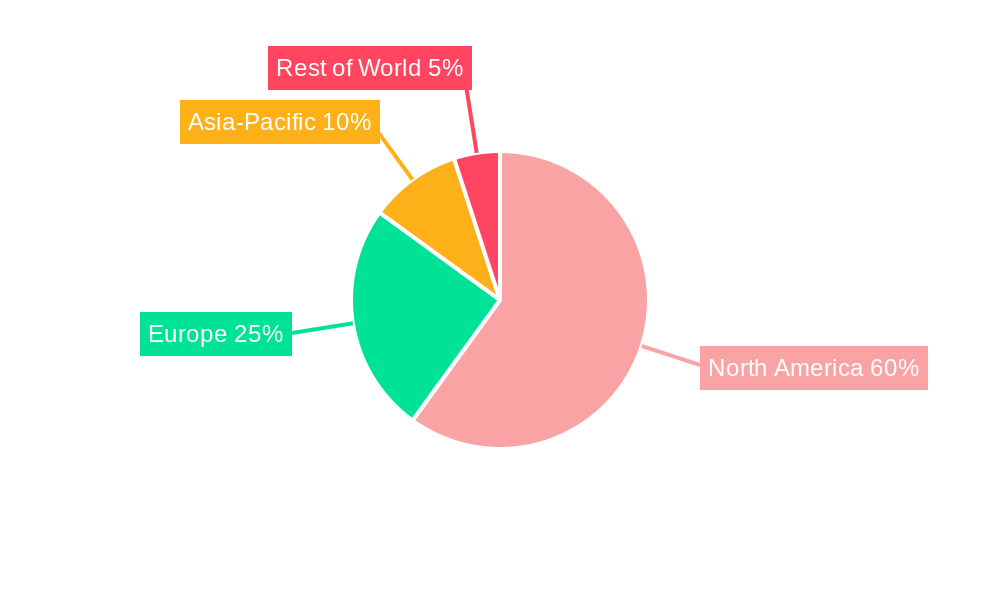

The largest segment within the North America portable generator market is the residential sector, driven by increasing concerns about power outages and the desire for reliable backup power during natural disasters or power grid failures. Within power rating, the 5-10 kW segment holds the largest market share, catering to a broad range of residential and small commercial applications. Gas-powered generators continue to dominate the fuel type segment due to their affordability and wide availability. Geographically, the United States holds the largest market share, followed by Canada and Mexico.

- Key Growth Drivers (Residential Segment): Increasing frequency of power outages, rising awareness of backup power needs, affordability of gas-powered generators.

- Key Growth Drivers (5-10 kW Segment): Versatility across residential and small commercial applications, balanced power output, relatively affordable price point.

- Key Growth Drivers (Gas Fuel Type Segment): Low cost, readily available fuel, established infrastructure.

- Geographic Dominance: United States, followed by Canada and Mexico.

North America Portable Generator Market Product Analysis

The North America portable generator market is characterized by a diverse range of products, encompassing varying power ratings, fuel types, and features. Recent innovations focus on enhanced portability, quieter operation, and improved fuel efficiency through inverter technology. Generators with smart features, such as remote monitoring capabilities and integrated safety systems, are gaining popularity. The market fit of these advanced products hinges on consumer willingness to pay a premium for added convenience and features. The ongoing development of hydrogen fuel cell generators, as demonstrated by MIT's prototype, presents a promising avenue for future innovation.

Key Drivers, Barriers & Challenges in North America Portable Generator Market

Key Drivers:

- Growing frequency and severity of power outages due to extreme weather events.

- Rising demand for backup power in residential, commercial, and industrial settings.

- Technological advancements leading to improved fuel efficiency and quieter operation.

- Government initiatives promoting energy security and resilience.

Challenges:

- Fluctuating raw material prices (e.g., steel, aluminum) impacting manufacturing costs.

- Stringent emission regulations requiring manufacturers to adopt advanced emission control technologies.

- Intense competition leading to price pressures and reduced profit margins.

- Supply chain disruptions causing delays in production and delivery.

Growth Drivers in the North America Portable Generator Market Market

The North America portable generator market is driven primarily by increasing concerns regarding power outages, particularly due to extreme weather events. Technological advancements, such as improved fuel efficiency and quieter operation, are also key drivers. Government regulations promoting energy independence and resilience are indirectly boosting market growth. Furthermore, the rising adoption of generators in the commercial and industrial sectors is expected to contribute significantly to market expansion.

Challenges Impacting North America Portable Generator Market Growth

The market faces challenges from fluctuating raw material costs impacting production expenses. Stringent emission regulations necessitate costly technological upgrades, affecting profitability. The intense competition within the industry creates price pressures. Moreover, global supply chain disruptions can cause significant delays in production and delivery, leading to reduced availability and affecting overall market growth.

Key Players Shaping the North America Portable Generator Market Market

Significant North America Portable Generator Market Industry Milestones

- January 2022: Honda announces plans to begin selling its new EU32i portable generator in North America (and Europe initially).

- February 2022: MIT Lincoln Laboratory demonstrates a portable hydrogen fuel generator prototype for the US Marine Corps.

Future Outlook for North America Portable Generator Market Market

The North America portable generator market is poised for continued growth, driven by escalating concerns about power reliability and the increasing frequency of extreme weather events. Strategic opportunities exist for manufacturers to innovate in areas such as fuel efficiency, quieter operation, and smart features. The potential for hydrogen fuel cell technology presents a significant long-term growth catalyst, although its market penetration will depend on technological advancements and infrastructure development. The market's growth will be shaped by the balance between consumer demand, technological innovation, and regulatory pressures.

North America Portable Generator Market Segmentation

-

1. Power Rating

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. Fuel Type

- 2.1. Gas

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Portable Generator Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Portable Generator Market Regional Market Share

Geographic Coverage of North America Portable Generator Market

North America Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding Natural Gas as a Clean and Reliable Fuel4.; Increasing Concerns Over Diesel Maintenance and Refueling Issues

- 3.3. Market Restrains

- 3.3.1 Lack of Gas Grid Connectivity Via Pipeline

- 3.3.2 Resulting in Hindered Fuel Supply

- 3.4. Market Trends

- 3.4.1. Diesel Fuel Type Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gas

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. United States North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gas

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Canada North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gas

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Rest of North America North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gas

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Yamaha Motor Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Briggs & Stratton Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Atlas Copco AB

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eaton Corporation PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Caterpillar Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cummins Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kohler Power Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Wacker Neuson SE

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Generac Holdings Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 General Electric Company*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: North America Portable Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 2: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 3: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 5: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: North America Portable Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Portable Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 12: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 13: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 15: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 22: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 23: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 24: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 25: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 32: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 33: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 34: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 35: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Portable Generator Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Portable Generator Market?

Key companies in the market include Yamaha Motor Co Ltd, Briggs & Stratton Corporation, Atlas Copco AB, Eaton Corporation PLC, Caterpillar Inc, Cummins Inc, Kohler Power Systems, Wacker Neuson SE, Generac Holdings Inc, General Electric Company*List Not Exhaustive.

3. What are the main segments of the North America Portable Generator Market?

The market segments include Power Rating, Fuel Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding Natural Gas as a Clean and Reliable Fuel4.; Increasing Concerns Over Diesel Maintenance and Refueling Issues.

6. What are the notable trends driving market growth?

Diesel Fuel Type Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Gas Grid Connectivity Via Pipeline. Resulting in Hindered Fuel Supply.

8. Can you provide examples of recent developments in the market?

In February 2022, the Massachusetts Institute of Technology (MIT) Lincoln Laboratory conducted a demonstration for the USMC regarding the portable hydrogen fuel generator. This prototype device converts aluminum into hydrogen fuel by reacting with water in any form, even urine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Portable Generator Market?

To stay informed about further developments, trends, and reports in the North America Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence