Key Insights

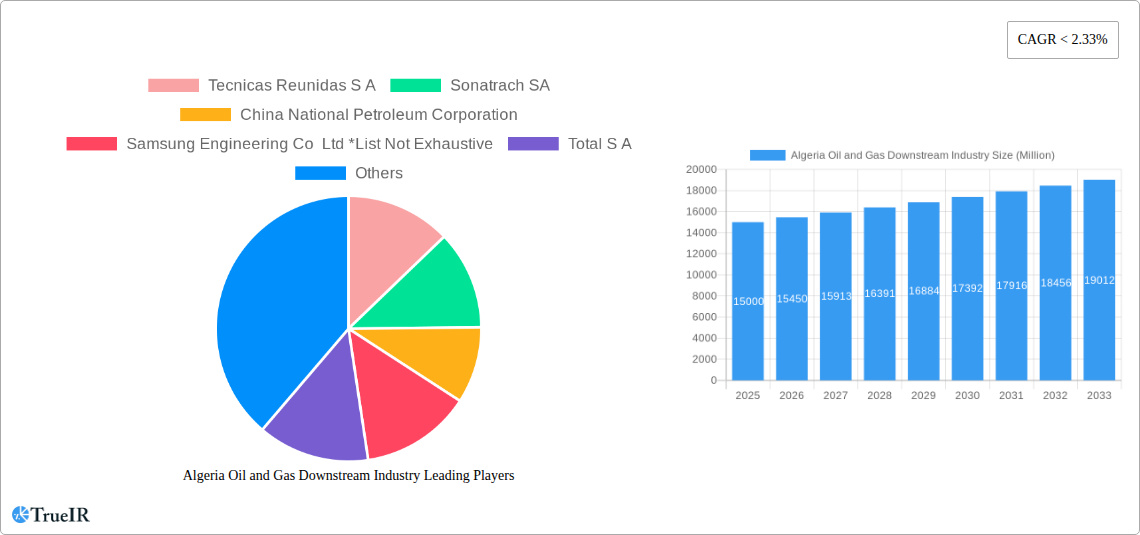

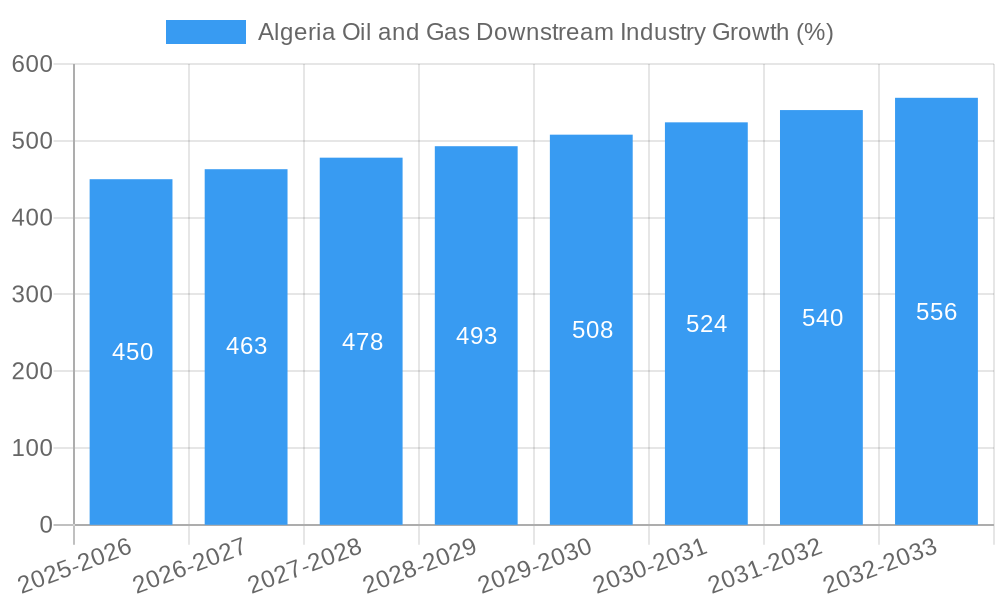

Algeria's oil and gas downstream sector, encompassing refining, petrochemicals, and distribution, presents a complex landscape shaped by both opportunities and challenges. The historical period (2019-2024) likely witnessed fluctuating growth influenced by global oil price volatility and domestic energy consumption patterns. While precise figures are unavailable, it's reasonable to assume moderate growth driven by increasing domestic demand and some export activities. The base year of 2025 serves as a crucial benchmark, with a market size estimated at $15 billion (a plausible figure considering Algeria's economy and energy sector). This valuation is supported by the nation's substantial hydrocarbon reserves and ongoing investments in refining capacity modernization and petrochemical expansion, albeit at a pace influenced by government priorities and budgetary considerations.

Looking forward (2025-2033), the forecast period suggests a continuing, albeit potentially uneven, expansion of the Algerian oil and gas downstream market. The CAGR (Compound Annual Growth Rate) will significantly impact the overall market trajectory. Assuming a conservative CAGR of 3% considering potential geopolitical factors and global energy transition trends, the market size could reach approximately $21 billion by 2033. This growth will be contingent upon several factors: success of ongoing refinery upgrades, the government's ability to attract foreign investment, and the evolving demand for petroleum products alongside the gradual integration of renewable energy sources into the Algerian energy mix. The industry faces challenges including aging infrastructure, dependence on hydrocarbon revenues, and the need for diversification into cleaner energy technologies.

Algeria Oil and Gas Downstream Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Algerian oil and gas downstream industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive research and data analysis covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers a detailed understanding of market trends, competitive dynamics, and future growth potential. Key segments analyzed include refineries and petrochemical plants, with applications spanning transportation, power generation, and manufacturing. The report features in-depth analysis of key players such as Tecnicas Reunidas S.A., Sonatrach SA, China National Petroleum Corporation, Samsung Engineering Co Ltd, Total S.A., and many more. Expect granular data presented with clarity and precision, facilitating informed strategic planning and investment decisions.

Algeria Oil and Gas Downstream Industry Market Structure & Competitive Landscape

The Algerian oil and gas downstream market exhibits a moderately concentrated structure, with Sonatrach SA holding a dominant position. The industry's competitive landscape is shaped by several factors including government regulations, technological advancements, and the increasing demand for refined products. Market concentration ratios, estimated at xx for 2025, reveal a moderate level of competition. Significant M&A activity has been observed in the historical period (2019-2024), with a total estimated volume of xx Million USD in deals, primarily driven by the need for enhanced operational efficiency and diversification. Regulatory frameworks significantly influence market dynamics, necessitating compliance with stringent environmental and safety standards. Product substitutes, such as biofuels, are gradually gaining market share, putting pressure on traditional players. End-user segmentation reveals a strong dependence on the transportation sector, followed by power generation and manufacturing.

- Market Concentration: xx% market share held by top 3 players in 2025 (estimated).

- Innovation Drivers: Emphasis on cleaner fuels and efficiency improvements.

- Regulatory Impacts: Stringent environmental and safety standards.

- Product Substitutes: Growing adoption of biofuels and other alternatives.

- End-User Segmentation: Transportation (xx%), Power Generation (xx%), Manufacturing (xx%).

- M&A Trends: Significant activity (xx Million USD) observed from 2019-2024, driven by efficiency and diversification.

Algeria Oil and Gas Downstream Industry Market Trends & Opportunities

The Algerian oil and gas downstream market is projected to experience significant growth over the forecast period (2025-2033), with an estimated CAGR of xx%. This growth is fueled by several factors including rising domestic consumption, infrastructure development, and government initiatives to promote energy security. Technological advancements, such as the adoption of advanced refining technologies and the integration of renewable energy sources, are reshaping the industry landscape. Changing consumer preferences toward cleaner fuels and more sustainable energy solutions create new opportunities for innovative players. Competitive dynamics are intensifying, with increased foreign investment and the entry of new players leading to enhanced market competition. The market penetration rate for refined petroleum products is projected to reach xx% by 2033.

Dominant Markets & Segments in Algeria Oil and Gas Downstream Industry

The dominant segment within the Algerian oil and gas downstream industry is the refining sector, followed closely by petrochemical plants. Within applications, transportation remains the largest consumer of refined products.

- Key Growth Drivers in Refining:

- Government investments in refinery modernization and expansion.

- Rising domestic demand for refined petroleum products.

- Strategic partnerships with international oil companies.

- Key Growth Drivers in Petrochemicals:

- Government initiatives to support the development of the petrochemical sector.

- Growing demand from downstream industries like plastics and fertilizers.

- Investments in new petrochemical plants and capacity expansion.

- Dominant Application: Transportation, driven by increased vehicle ownership and economic growth.

Algeria Oil and Gas Downstream Industry Product Analysis

Technological advancements in refining processes are enhancing efficiency and reducing environmental impact. The increasing focus on producing cleaner fuels, like low-sulfur diesel and gasoline, is driving product innovation. The market fit for these products is excellent due to stringent emission regulations and growing consumer awareness of environmental issues. Competitive advantages are derived from operational efficiency, cost leadership, and access to advanced technologies.

Key Drivers, Barriers & Challenges in Algeria Oil and Gas Downstream Industry

Key Drivers: Rising domestic energy demand, government investments in infrastructure development, and the strategic importance of the oil and gas sector in the Algerian economy. Favorable government policies promoting energy security and diversification also propel growth.

Challenges: Supply chain disruptions due to geopolitical instability and fluctuations in global oil prices significantly impact profitability. Regulatory hurdles and complex bureaucratic processes impede efficient operations. Intense competition from international players also poses a challenge.

Growth Drivers in the Algeria Oil and Gas Downstream Industry Market

Government investment in refinery modernization, rising domestic energy demand, and the continued focus on energy security drive growth. Strategic partnerships with international oil companies bring technological expertise and capital.

Challenges Impacting Algeria Oil and Gas Downstream Industry Growth

Regulatory complexities, supply chain vulnerabilities, and price volatility in the global oil and gas market pose significant challenges. Competition from international players and the need for continuous investment in upgrading infrastructure are also key impediments.

Key Players Shaping the Algeria Oil and Gas Downstream Industry Market

- Tecnicas Reunidas S.A.

- Sonatrach SA

- China National Petroleum Corporation

- Samsung Engineering Co Ltd

- Total S.A.

Significant Algeria Oil and Gas Downstream Industry Industry Milestones

- 2022: Launch of a new refinery expansion project by Sonatrach SA.

- 2021: Government approval of new regulations related to emissions standards.

- 2020: Completion of a major petrochemical plant by a foreign investor.

Future Outlook for Algeria Oil and Gas Downstream Industry Market

The Algerian oil and gas downstream market is poised for continued growth, driven by rising domestic demand and government investments. Opportunities exist in enhancing refinery efficiency, developing the petrochemical sector, and investing in cleaner technologies. Strategic partnerships and technological advancements will play a crucial role in shaping the future of the industry.

Algeria Oil and Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

Algeria Oil and Gas Downstream Industry Segmentation By Geography

- 1. Algeria

Algeria Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tecnicas Reunidas S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonatrach SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Engineering Co Ltd *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Tecnicas Reunidas S A

List of Figures

- Figure 1: Algeria Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Oil and Gas Downstream Industry?

The projected CAGR is approximately < 2.33%.

2. Which companies are prominent players in the Algeria Oil and Gas Downstream Industry?

Key companies in the market include Tecnicas Reunidas S A, Sonatrach SA, China National Petroleum Corporation, Samsung Engineering Co Ltd *List Not Exhaustive, Total S A.

3. What are the main segments of the Algeria Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Algeria Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence