Key Insights

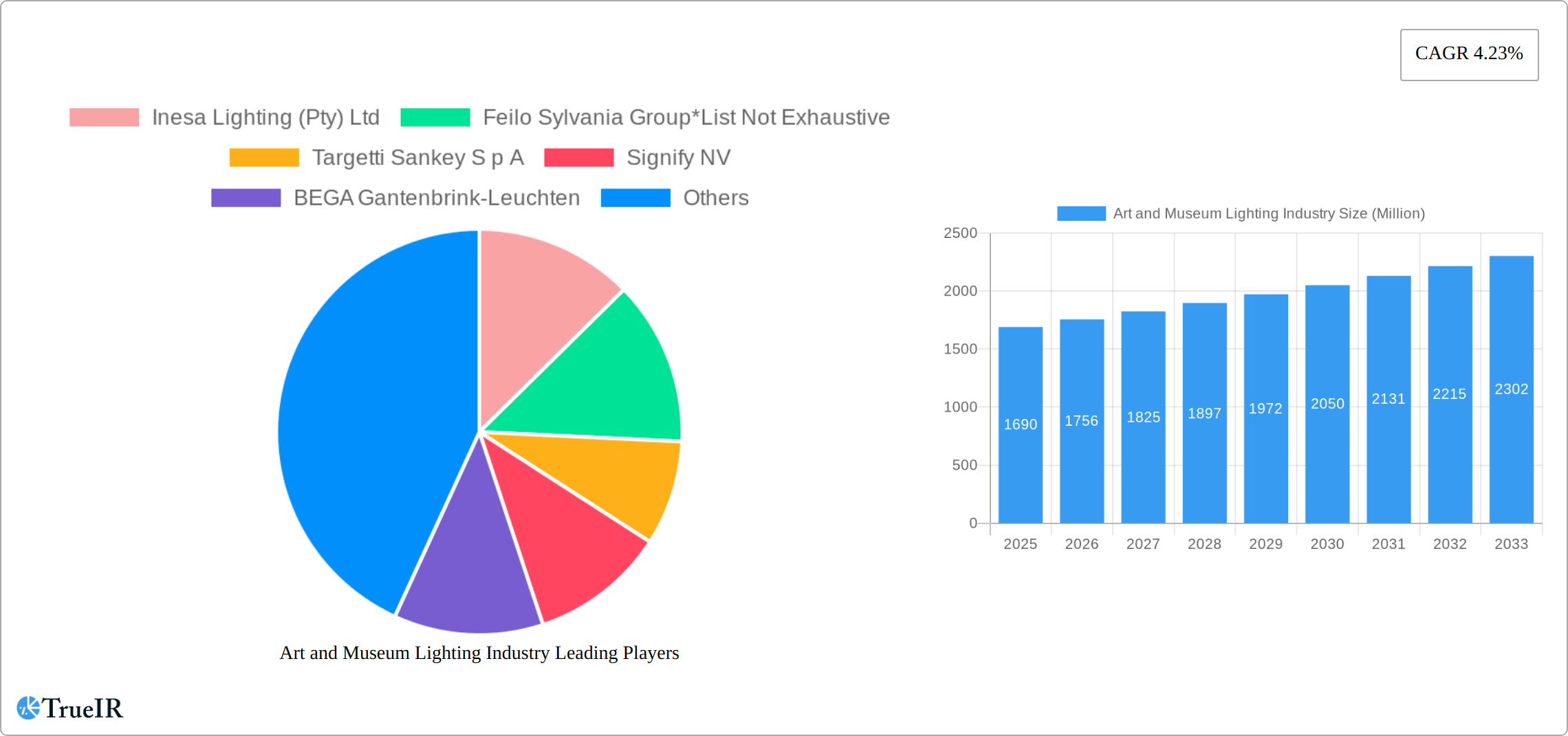

The art and museum lighting market, valued at $1.69 billion in 2025, is projected to experience steady growth, driven by the increasing number of museums and art galleries globally, coupled with a rising demand for energy-efficient and technologically advanced lighting solutions. The market's Compound Annual Growth Rate (CAGR) of 4.23% from 2025 to 2033 indicates a consistent expansion, fueled by factors such as the growing preference for LED lighting due to its energy efficiency, longer lifespan, and superior color rendering capabilities. Furthermore, advancements in lighting technologies, including smart lighting systems and dynamic lighting solutions that enhance the viewing experience of artwork, are contributing significantly to market growth. The integration of these systems also allows for improved security and environmental control within museum spaces. The market is segmented by type (LED and Non-LED) and application (indoor and outdoor), with the LED segment dominating due to its cost-effectiveness and environmental benefits. Major players like Signify NV, Acuity Brands Inc., and Osram Licht AG are driving innovation and market competition. Regional growth is expected to vary, with North America and Europe maintaining substantial market shares, while the Asia-Pacific region is poised for significant expansion driven by increasing tourism and cultural investments. Challenges include the high initial investment cost for advanced lighting systems and the need for specialized expertise in installation and maintenance. However, the long-term cost savings and enhanced visitor experience are likely to offset these initial hurdles.

Despite the positive outlook, the market faces certain restraints. The need for specialized lighting solutions tailored to specific artwork requirements necessitates higher production costs. Moreover, stringent regulations concerning energy consumption and environmental impact in certain regions add complexity to the market. However, the ongoing technological advancements within the industry, coupled with increased awareness about the importance of preserving artwork through appropriate lighting, will likely mitigate these challenges and sustain the market's positive growth trajectory. The focus on customized solutions, tailored to different artwork types and exhibition spaces, will create opportunities for niche players and increase market segmentation. This includes the development of lighting solutions addressing the unique needs of sensitive historical artifacts. The integration of smart technology and data analytics is also expected to become increasingly crucial in optimizing energy use and extending the life of installations.

Art and Museum Lighting Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Art and Museum Lighting Industry, offering invaluable insights into market trends, competitive dynamics, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic sector. The global market value is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033. The report leverages high-volume keywords like "LED Museum Lighting," "Art Gallery Lighting Solutions," and "Outdoor Museum Lighting," to ensure maximum search engine visibility.

Art and Museum Lighting Industry Market Structure & Competitive Landscape

The Art and Museum Lighting industry exhibits a moderately concentrated market structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include advancements in LED technology, particularly in color rendering index (CRI) and energy efficiency, as well as the development of smart lighting solutions for museums and galleries. Regulatory impacts, such as energy efficiency standards and building codes, significantly influence market dynamics. Product substitutes, such as traditional halogen and fluorescent lighting, are gradually being replaced by energy-efficient LED alternatives. End-user segmentation includes museums, art galleries, historical sites, and private collections. Mergers and acquisitions (M&A) activity has been relatively moderate, with xx major deals reported between 2019 and 2024, totaling an estimated $xx Million in value.

- Market Concentration: Moderately concentrated, with HHI estimated at xx.

- Innovation Drivers: Advancements in LED technology, smart lighting solutions.

- Regulatory Impacts: Energy efficiency standards, building codes.

- Product Substitutes: Halogen and fluorescent lighting.

- End-User Segmentation: Museums, art galleries, historical sites, private collections.

- M&A Trends: Moderate activity, xx major deals totaling $xx Million (2019-2024).

Art and Museum Lighting Industry Market Trends & Opportunities

The Art and Museum Lighting market is experiencing robust growth, driven by several key factors. The market size is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of energy-efficient LED lighting solutions, coupled with a rising demand for aesthetically pleasing and technologically advanced lighting systems in museums and art galleries. Technological advancements, such as the integration of IoT (Internet of Things) capabilities and smart controls, are transforming the industry. Consumer preferences are shifting towards sustainable and energy-saving options, further driving the demand for LED lighting. Competitive dynamics are marked by ongoing innovation, product differentiation, and strategic partnerships. Market penetration rates for LED lighting are steadily increasing, particularly in developed regions. The rising focus on heritage preservation and the growing number of museums and art galleries globally also contribute to market expansion.

Dominant Markets & Segments in Art and Museum Lighting Industry

The North American region currently dominates the Art and Museum Lighting market, followed by Europe. Within these regions, major countries like the United States, Germany, and the United Kingdom showcase significant market shares. The LED segment holds the largest market share within the "By Type" category, driven by its energy efficiency, longevity, and superior color rendering capabilities. The "Indoor" application segment dominates the "By Application" category, due to the extensive use of lighting in museum interiors.

- Leading Region: North America

- Leading Countries: United States, Germany, United Kingdom

- Dominant Segment (By Type): LED

- Dominant Segment (By Application): Indoor

Key Growth Drivers:

- Increased government funding for cultural heritage preservation: Initiatives promoting energy efficiency and sustainable infrastructure development further support market growth.

- Rising construction of new museums and art galleries: Expanding the market with increased demand for new lighting systems.

- Technological advancements in LED technology: Constant improvements in CRI and energy efficiency leading to higher adoption rates.

Art and Museum Lighting Industry Product Analysis

The art and museum lighting industry offers a diverse range of products, from traditional spotlights and track lighting to sophisticated LED systems boasting customizable color temperatures and advanced dimming capabilities. Technological innovation is relentlessly focused on enhancing the color rendering index (CRI) for precise artwork representation, improving energy efficiency to minimize operating costs, and incorporating smart control systems for greater flexibility and streamlined management. The market strongly favors these innovative products, driven by the escalating demand for energy-efficient and aesthetically pleasing lighting solutions capable of effectively showcasing artwork while preserving its integrity. This demand is further fueled by a growing awareness of the detrimental effects of improper lighting on valuable artifacts and the increasing desire for sustainable practices within the cultural sector.

Key Drivers, Barriers & Challenges in Art and Museum Lighting Industry

Key Drivers:

Market growth is primarily driven by the widespread adoption of energy-efficient LED lighting, a heightened awareness of the crucial role of proper lighting in art preservation and conservation, and supportive government initiatives promoting sustainable technologies. The continuous rise in the number of museums and art galleries globally further accelerates market expansion. Furthermore, the increasing demand for immersive and interactive museum experiences is pushing the need for more adaptable and technologically advanced lighting systems.

Challenges:

High upfront investment costs associated with advanced lighting systems can present a significant barrier to entry for smaller museums and galleries. Supply chain disruptions and volatile raw material prices can impact product cost and availability. The industry faces intense competition from both established players and new entrants, requiring continuous innovation and adaptation. Stringent regulatory requirements related to energy efficiency and safety standards add complexity for manufacturers, necessitating compliance with diverse international and regional regulations.

Growth Drivers in the Art and Museum Lighting Industry Market

Technological advancements, especially in LED technology, are paramount drivers, offering superior energy efficiency, enhanced color rendering, and versatile control options, including dynamic lighting scenarios. Government regulations promoting energy efficiency and sustainability, coupled with increasing carbon emission reduction targets, are also major catalysts. The ongoing construction of new museums and galleries worldwide, along with renovations and expansions of existing facilities, fuels market demand. The trend towards personalized visitor experiences in museums also stimulates the demand for flexible and adaptable lighting solutions.

Challenges Impacting Art and Museum Lighting Industry Growth

High initial investment costs for advanced lighting systems, supply chain disruptions, and intense competition among market players are significant challenges. Regulatory complexities and stringent safety standards can also impede market growth.

Key Players Shaping the Art and Museum Lighting Industry Market

- Inesa Lighting (Pty) Ltd

- Feilo Sylvania Group

- Targetti Sankey S p A

- Signify NV

- BEGA Gantenbrink-Leuchten

- Acuity Brands Inc

- Lumenpulse Group

- OSRAM Licht AG

- iGuzzini illuminazione S p A

- ERCO GmbH

Significant Art and Museum Lighting Industry Industry Milestones

- July 2022: The University of Idaho’s Kibbie Dome upgraded to a Musco Lighting LED system, significantly improving energy efficiency and light quality.

- December 2022: Signify launched the Philips Hexa-bulb and O-Bulb in India, offering innovative decorative LED options.

Future Outlook for Art and Museum Lighting Industry Market

The Art and Museum Lighting market is poised for continued growth, driven by ongoing technological innovation, increasing demand for energy-efficient solutions, and the expansion of the museum and art gallery sector. Strategic partnerships, product diversification, and expansion into emerging markets present significant opportunities for market players. The market's potential remains substantial, with further growth anticipated in the coming years.

Art and Museum Lighting Industry Segmentation

-

1. Type

- 1.1. LED

- 1.2. Non-LED

-

2. Application

- 2.1. Indoor

- 2.2. Outdoor

Art and Museum Lighting Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Middle East

Art and Museum Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of LED Luminaires in Museum and Art Galleries; Growing Demand for Electing Lighting System with a Smart Control System

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about the Advantages of the LED Lights

- 3.4. Market Trends

- 3.4.1. LED Segment is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LED

- 5.1.2. Non-LED

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. LED

- 6.1.2. Non-LED

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Indoor

- 6.2.2. Outdoor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. LED

- 7.1.2. Non-LED

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Indoor

- 7.2.2. Outdoor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. LED

- 8.1.2. Non-LED

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Indoor

- 8.2.2. Outdoor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. LED

- 9.1.2. Non-LED

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Indoor

- 9.2.2. Outdoor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Asia Pacific Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Middle East Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Inesa Lighting (Pty) Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Feilo Sylvania Group*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Targetti Sankey S p A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Signify NV

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 BEGA Gantenbrink-Leuchten

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Acuity Brands Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Lumenpulse Group

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 OSRAM Licht AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 iGuzzini illuminazione S p A

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ERCO GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Inesa Lighting (Pty) Ltd

List of Figures

- Figure 1: Global Art and Museum Lighting Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Middle East Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Middle East Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Art and Museum Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Art and Museum Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Art and Museum Lighting Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Art and Museum Lighting Industry?

Key companies in the market include Inesa Lighting (Pty) Ltd, Feilo Sylvania Group*List Not Exhaustive, Targetti Sankey S p A, Signify NV, BEGA Gantenbrink-Leuchten, Acuity Brands Inc, Lumenpulse Group, OSRAM Licht AG, iGuzzini illuminazione S p A, ERCO GmbH.

3. What are the main segments of the Art and Museum Lighting Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of LED Luminaires in Museum and Art Galleries; Growing Demand for Electing Lighting System with a Smart Control System.

6. What are the notable trends driving market growth?

LED Segment is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness about the Advantages of the LED Lights.

8. Can you provide examples of recent developments in the market?

December 2022: Signify announced the launch of two uniquely shaped LED bulbs in India, Philips Hexa-bulb and O-Bulb. These hexagonal and circular bulbs can be used as decorative lights for an elegant touch to the indoor space and come with a single plug-and-play form that can be easily installed into existing LED bulb sockets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Art and Museum Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Art and Museum Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Art and Museum Lighting Industry?

To stay informed about further developments, trends, and reports in the Art and Museum Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence