Key Insights

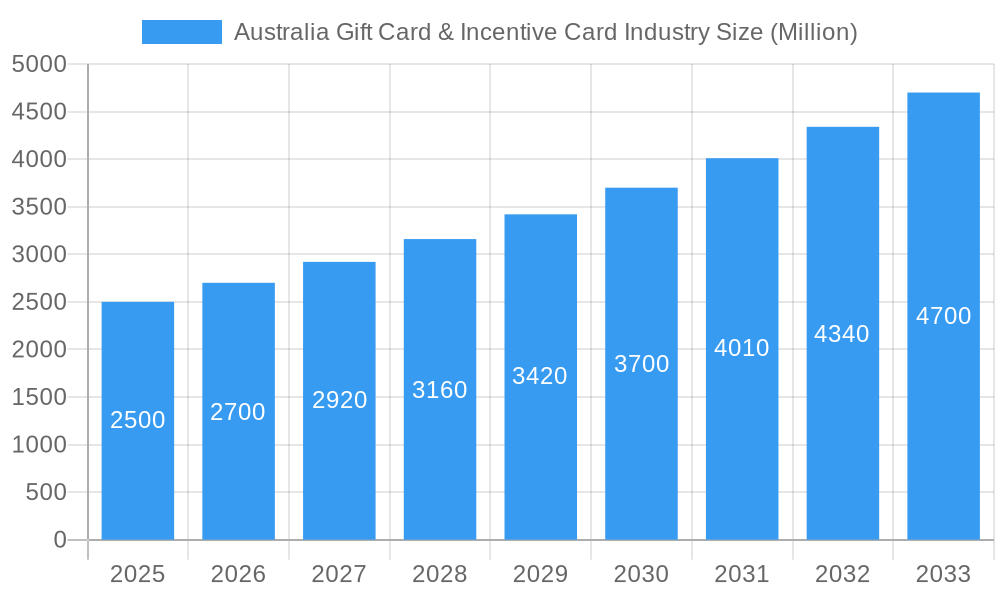

The Australian gift card and incentive card market is poised for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 9.6% between 2025 and 2033. This robust growth is attributed to heightened consumer spending on experiences and the escalating adoption of digital gift cards. The convenience and versatility of digital platforms, alongside the surge in e-commerce, are key drivers of market penetration. Additionally, businesses are increasingly utilizing incentive programs for employee and customer rewards, fueling demand for corporate gift cards. While major players like Wesfarmers, Woolworths, and Coles hold significant market share, a dynamic landscape is characterized by numerous smaller and niche providers. Potential economic headwinds are a consideration, yet the inherent appeal of gift cards as gifts and rewards underpins projected continued growth. Market segmentation encompasses diverse card denominations, types (physical and digital), and target audiences (individual and corporate).

Australia Gift Card & Incentive Card Industry Market Size (In Billion)

Sustained consumer confidence and the ongoing shift to digital channels are critical for market success. Strategic retail partnerships are essential for distribution, with expansion into online marketplaces being a vital element. Intensified competition is anticipated, prompting existing players to invest in technology and innovation to enhance user experience and broaden offerings. Market consolidation through acquisitions by larger entities to secure market share is also a possibility. Furthermore, evolving regulatory frameworks, particularly concerning gift card expiry dates and consumer protection, will shape market dynamics. Success will depend on adaptability to changing consumer preferences, technological advancements, and economic fluctuations. Strategic marketing, promotions, and exceptional customer service will be paramount for sustained market growth.

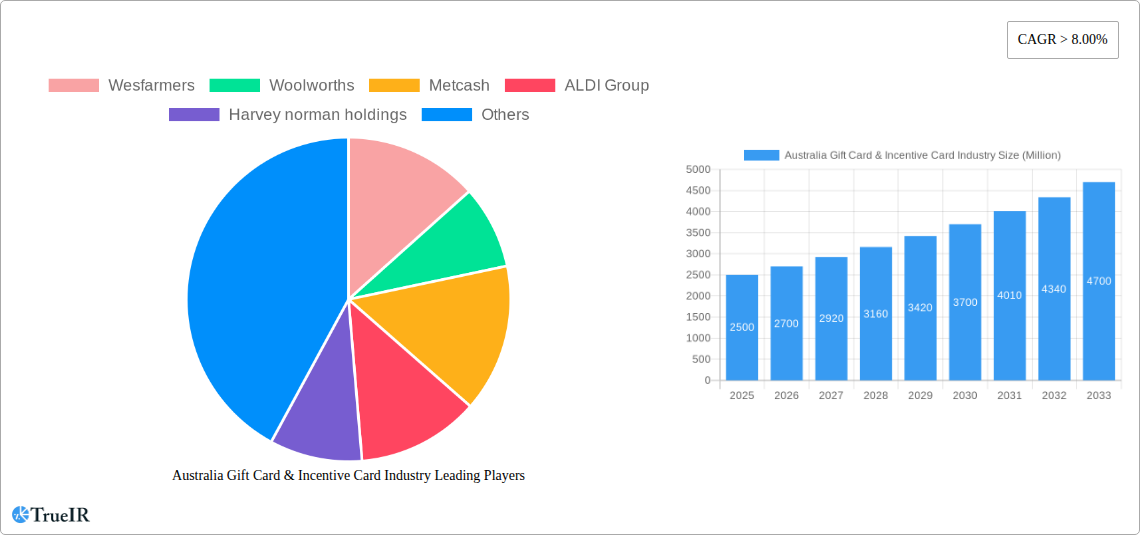

Australia Gift Card & Incentive Card Industry Company Market Share

Australia Gift Card & Incentive Card Industry Market Analysis: 2019-2033

This comprehensive report offers an in-depth analysis of the Australian gift card and incentive card market, providing essential insights for businesses, investors, and stakeholders. Spanning the period from 2019 to 2033, with a specific focus on 2025 as the base year, this report details market trends, competitive landscapes, and future growth prospects. The market is projected to reach $8.22 billion by 2033, presenting substantial opportunities across various market segments.

Australia Gift Card & Incentive Card Industry Market Structure & Competitive Landscape

The Australian gift card and incentive card market exhibits a moderately concentrated structure. Major players like Wesfarmers, Woolworths, Metcash, and Coles hold significant market share, but a considerable number of smaller players and niche providers also contribute to the overall market volume. The industry is characterized by intense competition, particularly amongst large retailers who leverage their existing customer bases and extensive distribution networks. Innovation drivers include the introduction of digital gift cards, loyalty programs integrated with gift card functionalities, and personalized incentive schemes. Regulatory impacts, primarily focused on consumer protection and preventing fraud, significantly shape business practices. Product substitutes, such as experiences and cash, exert a level of competitive pressure. The market comprises various end-user segments, including individuals (for gifting occasions), corporations (for employee rewards), and businesses (for promotional activities). M&A activity in recent years has remained relatively low at xx Million annually, indicating a moderate consolidation trend, though recent strategic partnerships showcase a trend toward collaborative growth.

- Market Concentration: Moderate, with significant players holding substantial market share, but fragmented at lower ends.

- Innovation Drivers: Digital gift cards, integrated loyalty programs, personalized incentives.

- Regulatory Impacts: Consumer protection regulations, fraud prevention measures.

- Product Substitutes: Cash, experiences, other forms of incentives.

- End-User Segmentation: Individuals, corporations, businesses.

- M&A Trends: Relatively low activity at xx Million annually, with a focus on strategic partnerships.

Australia Gift Card & Incentive Card Industry Market Trends & Opportunities

The Australian gift card and incentive card market is experiencing robust growth, driven by increasing consumer spending, the rise of e-commerce, and the adoption of digital gift cards and mobile payments. The market size is estimated at xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by evolving consumer preferences towards convenience and digital solutions, a shift facilitated by technological advancements in payment systems and mobile wallets. The market penetration rate for digital gift cards is steadily increasing, while the traditional physical gift card segment continues to maintain a significant share. Competitive dynamics involve both price competition and differentiation through innovative features, loyalty programs, and personalized offerings. This creates significant opportunities for companies to expand their market share by leveraging technological advances and catering to the evolving preferences of Australian consumers.

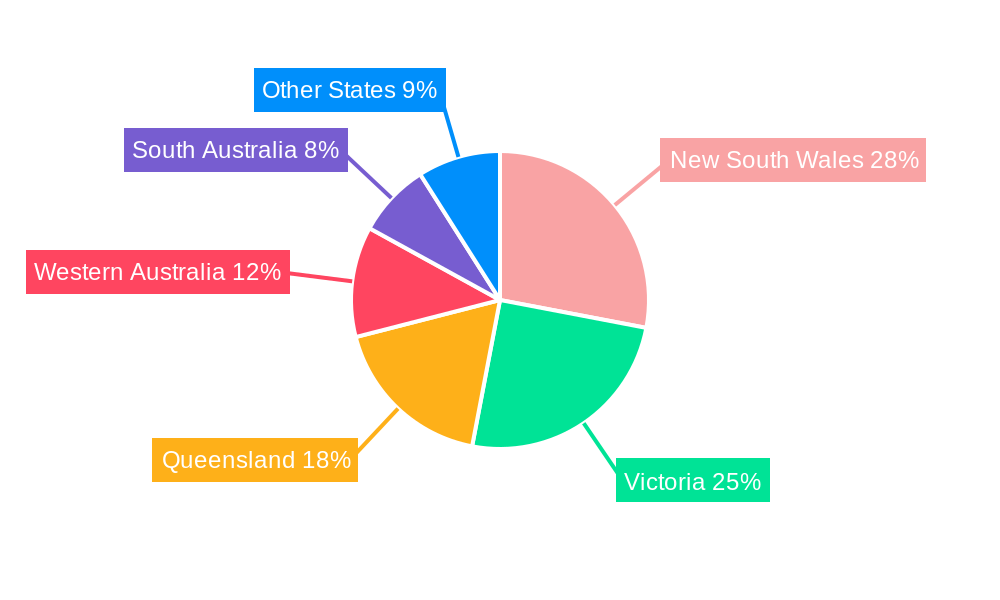

Dominant Markets & Segments in Australia Gift Card & Incentive Card Industry

The Australian gift card and incentive card market is dominated by the major metropolitan areas, driven by higher consumer spending and denser populations. While growth is seen across all states and territories, New South Wales and Victoria account for the largest share of market revenue due to higher population density and increased consumer purchasing power. The retail segment remains the most dominant, benefiting from high consumer traffic and the widespread availability of gift cards across various retail categories.

- Key Growth Drivers:

- High consumer spending in major metropolitan areas.

- Increasing adoption of digital platforms.

- Robust growth of e-commerce.

- Market Dominance: NSW and VIC due to population density and higher purchasing power.

- The retail segment holds the most significant revenue share.

Australia Gift Card & Incentive Card Industry Product Analysis

The Australian gift card and incentive card market offers a diverse range of products, from traditional physical gift cards to digital and mobile options, catering to various consumer preferences and purchasing behaviors. Innovative features such as personalized messaging, e-gift card delivery options, and integration with loyalty programs enhance user experience and market appeal. Competitive advantage is largely derived from brand recognition, distribution networks, and the innovative features offered within specific digital or mobile platforms. The market is continuously evolving, with new functionalities and partnerships driving further advancements in product offerings.

Key Drivers, Barriers & Challenges in Australia Gift Card & Incentive Card Industry

Key Drivers:

The market's growth is propelled by increased consumer spending, the rise of e-commerce and digital payments, and the growing popularity of experiential gifts. Government initiatives promoting digital transactions also contribute positively.

Challenges & Restraints:

Significant challenges include increasing competition, the potential for fraud and security breaches, and evolving consumer preferences. Supply chain disruptions can impact availability, while regulatory complexities around consumer protection add compliance costs. The overall impact of these challenges is estimated to reduce market growth by approximately xx Million annually.

Growth Drivers in the Australia Gift Card & Incentive Card Industry Market

Key growth drivers include the increasing adoption of digital gift cards and mobile payments, rising consumer spending, expanding e-commerce, and strategic partnerships between retailers and technology providers. Government initiatives promoting cashless transactions further accelerate growth.

Challenges Impacting Australia Gift Card & Incentive Card Industry Growth

Challenges include regulatory complexities, increasing fraud risks, and competition from other forms of gifting. Supply chain disruptions and fluctuations in consumer spending can negatively impact market growth. Maintaining consumer trust and ensuring secure transactions are critical to mitigate risks.

Key Players Shaping the Australia Gift Card & Incentive Card Industry Market

- Wesfarmers

- Woolworths

- Metcash

- ALDI Group

- Harvey Norman Holdings

- JB Hi-Fi

- Apple

- Gift Pay

- The Good Guys

- Coles

- Australia Post

- Blackhawk Network

- iChoose

- Karta

- (List Not Exhaustive)

Significant Australia Gift Card & Incentive Card Industry Industry Milestones

- June 2022: Metcash Limited announced a long-term lease agreement for a new distribution center, enhancing its operational efficiency and capacity.

- December 2022: Wesfarmers OneDigital and The Walt Disney Company launched a bundled subscription service, integrating OnePass rewards with Disney+, strengthening the Wesfarmers ecosystem and increasing the appeal of its retail brands.

Future Outlook for Australia Gift Card & Incentive Card Industry Market

The Australian gift card and incentive card market is poised for continued growth, driven by ongoing technological advancements, shifting consumer preferences towards digital solutions, and the expanding e-commerce landscape. Strategic partnerships and innovative product offerings are expected to fuel market expansion, creating opportunities for both established players and new entrants. The market's potential for sustained growth remains high, with further expansion anticipated throughout the forecast period.

Australia Gift Card & Incentive Card Industry Segmentation

-

1. Consumer

- 1.1. Individual

-

1.2. Corporate

- 1.2.1. Small scale

- 1.2.2. Mid-tier

- 1.2.3. Large enterprise

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-gift card

- 3.2. Physical card

Australia Gift Card & Incentive Card Industry Segmentation By Geography

- 1. Australia

Australia Gift Card & Incentive Card Industry Regional Market Share

Geographic Coverage of Australia Gift Card & Incentive Card Industry

Australia Gift Card & Incentive Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Digital Wallet Adoption in Australia is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Gift Card & Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.1.2.1. Small scale

- 5.1.2.2. Mid-tier

- 5.1.2.3. Large enterprise

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-gift card

- 5.3.2. Physical card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wesfarmers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Woolworths

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Metcash

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALDI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harvey norman holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jb Hi-Fi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apple

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gift pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The good guys

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coles

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Australia post

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Blackhawk network

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ichoose

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Karta**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Wesfarmers

List of Figures

- Figure 1: Australia Gift Card & Incentive Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Gift Card & Incentive Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 2: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 6: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Gift Card & Incentive Card Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Australia Gift Card & Incentive Card Industry?

Key companies in the market include Wesfarmers, Woolworths, Metcash, ALDI Group, Harvey norman holdings, Jb Hi-Fi, Apple, Gift pay, The good guys, Coles, Australia post, Blackhawk network, ichoose, Karta**List Not Exhaustive.

3. What are the main segments of the Australia Gift Card & Incentive Card Industry?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.22 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Digital Wallet Adoption in Australia is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Wesfarmers OneDigital and The Walt Disney Company announced an exclusive new subscription bundle combining Disney+ and OnePass for $14.99 a month.OnePass provides benefits across Wesfarmers retail brands, including free delivery on eligible purchases from Kmart, Target, Catch, and Bunnings Warehouse, as well as exclusive deals and in-store savings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Gift Card & Incentive Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Gift Card & Incentive Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Gift Card & Incentive Card Industry?

To stay informed about further developments, trends, and reports in the Australia Gift Card & Incentive Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence