Key Insights

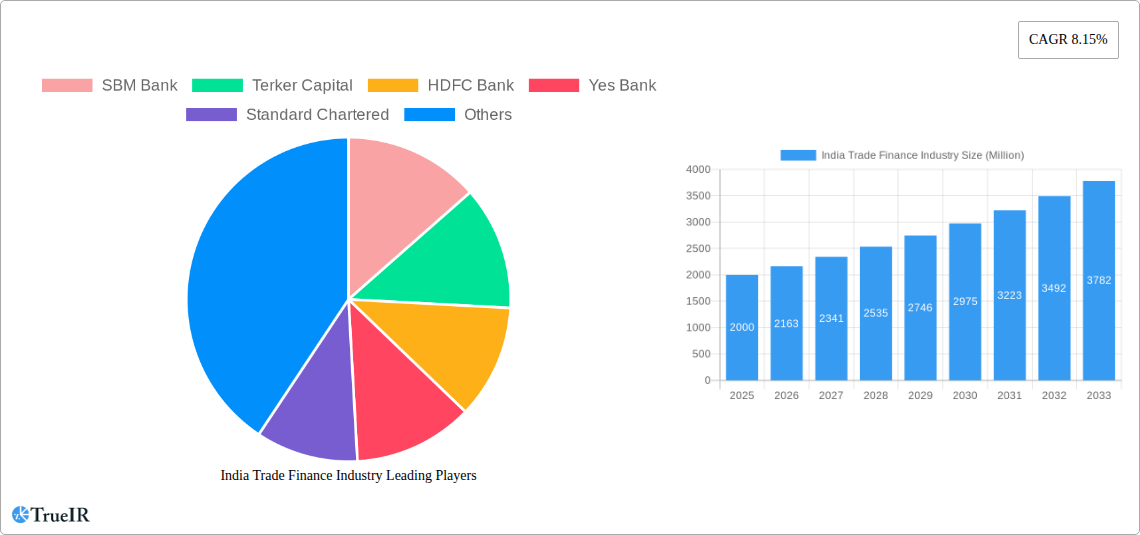

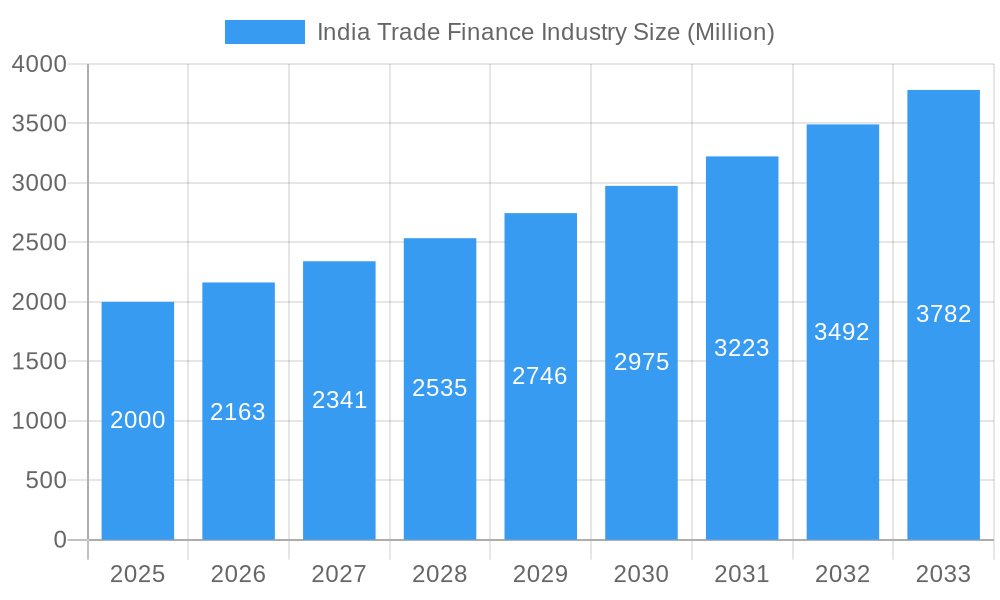

The India trade finance market, currently valued at approximately $2 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.15% from 2025 to 2033. This expansion is fueled by several key drivers. India's increasing integration into global trade, coupled with the government's initiatives to promote exports and ease the doing of business, are significantly boosting demand for trade finance solutions. The rise of e-commerce and digitalization within the financial sector is further streamlining processes and accelerating transaction volumes. Growing cross-border trade, particularly in sectors like pharmaceuticals, technology, and textiles, contributes to the increasing need for diverse financial instruments such as letters of credit, export financing, and supply chain finance. While challenges such as geopolitical instability and fluctuating exchange rates pose potential restraints, the overall outlook for the Indian trade finance market remains optimistic. Leading players like SBM Bank, Terker Capital, HDFC Bank, Yes Bank, Standard Chartered, Kotak Mahindra Bank, Federal Bank, Bank of Baroda, Citi Bank, and HSBC, among others, are strategically positioned to capitalize on this growth trajectory by expanding their product offerings and enhancing technological capabilities. The market is likely to see increased competition, and consolidation could occur amongst smaller players.

India Trade Finance Industry Market Size (In Billion)

The market segmentation within India's trade finance landscape is complex, encompassing various industries and transaction types. A likely key segment is the financing of small and medium-sized enterprises (SMEs), which represent a large portion of India's export activity but frequently face challenges accessing traditional trade finance options. Therefore, niche solutions catering to their specific needs are expected to grow. Further segmentation likely includes various types of trade finance instruments, such as letters of credit, guarantees, and factoring, which may exhibit varying growth rates. Geographical differences may also influence the growth rate of the market with certain regions experiencing more rapid expansion than others based on their economic activity and trade focus. This necessitates a granular understanding of these segments and their individual growth drivers to effectively navigate this dynamic market.

India Trade Finance Industry Company Market Share

India Trade Finance Industry Report: 2019-2033

This comprehensive report offers an in-depth analysis of the dynamic India Trade Finance Industry, providing crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data from the historical period (2019-2024) to present a robust and future-oriented perspective. The report analyzes market size, growth, key players, and emerging trends, providing a 360-degree view of this rapidly evolving sector.

India Trade Finance Industry Market Structure & Competitive Landscape

The Indian trade finance market exhibits a moderately concentrated structure, with a few large players like HDFC Bank, ICICI Bank, and State Bank of India commanding significant market share. However, the presence of numerous smaller banks and specialized finance companies fosters competition. The industry is witnessing considerable innovation driven by the adoption of fintech solutions, blockchain technology, and digitalization initiatives. Stringent regulatory oversight by the Reserve Bank of India (RBI) profoundly shapes industry practices and risk management. While traditional trade finance methods still dominate, the emergence of digital platforms and supply chain finance solutions represent key substitutes. The market displays diverse end-user segmentation, catering to a wide spectrum of importers, exporters, and businesses across various sectors. M&A activity, though not extremely high, is ongoing, with larger institutions strategically acquiring smaller players to expand their market reach and service offerings. Based on available data, the concentration ratio (CR4) for the period 2019-2024 is estimated to be around xx%, suggesting a moderately concentrated market. The volume of M&A transactions in the sector during the same period was approximately xx Million USD.

India Trade Finance Industry Market Trends & Opportunities

The India Trade Finance Industry is experiencing robust growth, fueled by the nation's expanding international trade and increasing reliance on global supply chains. The market size is estimated to reach xx Million USD by 2025 and is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is significantly propelled by technological advancements, particularly the integration of digital platforms and AI-driven solutions for streamlined processes and risk mitigation. Evolving consumer preferences towards more efficient and transparent trade finance solutions are driving innovation. Competitive dynamics remain intense, with banks and fintech companies vying for market share by offering customized products, competitive pricing, and enhanced digital experiences. Market penetration rates for digital trade finance solutions are increasing steadily, reaching an estimated xx% in 2024 and projected to reach xx% by 2033.

Dominant Markets & Segments in India Trade Finance Industry

The dominant segments within the Indian trade finance market are driven by several factors.

- Export-oriented sectors: Pharmaceuticals, textiles, and IT services are leading segments due to high export volumes and reliance on trade finance solutions.

- Import-heavy industries: Energy, manufacturing, and agriculture depend significantly on trade finance for importing raw materials and capital goods.

- Geographical concentration: Major metropolitan hubs like Mumbai, Delhi, and Chennai continue to dominate the market due to higher economic activity and business concentration.

These segments enjoy robust growth owing to supportive government policies aimed at boosting exports and strengthening international trade. Significant investments in infrastructure development further facilitate trade flows, fueling demand for trade finance services.

India Trade Finance Industry Product Analysis

Product innovations in the India trade finance industry center around digitalization and technological advancements. These include blockchain-based solutions for enhanced security and transparency, AI-driven platforms for risk assessment and credit scoring, and cloud-based systems for improved operational efficiency. These innovations aim to streamline processes, reduce transaction costs, and enhance the overall customer experience. The market fit for these products is strong, given the increasing demand for efficient and transparent trade finance solutions among businesses of all sizes.

Key Drivers, Barriers & Challenges in India Trade Finance Industry

Key Drivers: The primary drivers are the robust growth of India's foreign trade, government initiatives to promote ease of doing business, and the accelerating adoption of digital technologies. The recent introduction of the RBI's new foreign exchange mechanism in July 2022, facilitating transactions in Indian rupees, is a significant boost.

Challenges: Key barriers include regulatory complexities associated with cross-border transactions, supply chain disruptions impacting trade flows, and intense competition from both established banks and emerging fintech companies. The impact of these challenges is estimated to be a xx% reduction in overall market growth in 2024, according to industry reports.

Growth Drivers in the India Trade Finance Industry Market

Continued growth is anticipated due to increasing government support for trade and investment, coupled with the expansion of digital infrastructure and the adoption of fintech solutions. The growing focus on sustainable and responsible trade finance will further fuel market growth.

Challenges Impacting India Trade Finance Industry Growth

Challenges include navigating complex regulatory environments, managing geopolitical risks and supply chain vulnerabilities, and sustaining competitiveness in a rapidly evolving digital landscape. These factors could potentially restrain growth by xx% over the next 5 years if not adequately addressed.

Key Players Shaping the India Trade Finance Industry Market

- SBM Bank

- Terker Capital

- HDFC Bank

- Yes Bank

- Standard Chartered

- Kotak Mahindra Bank

- Federal Bank

- Bank of Baroda

- CITI Bank

- HSBC List Not Exhaustive

Significant India Trade Finance Industry Industry Milestones

- July 2022: The Reserve Bank of India (RBI) introduced a new foreign exchange mechanism to promote international trade using Indian Rupees (INR), significantly impacting market dynamics by reducing reliance on USD.

- December 2022: MUFG Bank's INR 450 crore (USD 54.3 Million) sustainable trade finance facility for Tata Power highlights the growing focus on sustainable finance within the industry.

Future Outlook for India Trade Finance Industry Market

The India Trade Finance Industry is poised for continued expansion, driven by robust economic growth, supportive government policies, and the increasing adoption of innovative financial technologies. Strategic opportunities abound for players who can effectively leverage digitalization, strengthen risk management capabilities, and cater to the evolving needs of businesses in a globalized marketplace. The market's potential is considerable, particularly in areas like sustainable finance and supply chain finance.

India Trade Finance Industry Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Others

-

2. Application

- 2.1. Domestic

- 2.2. International

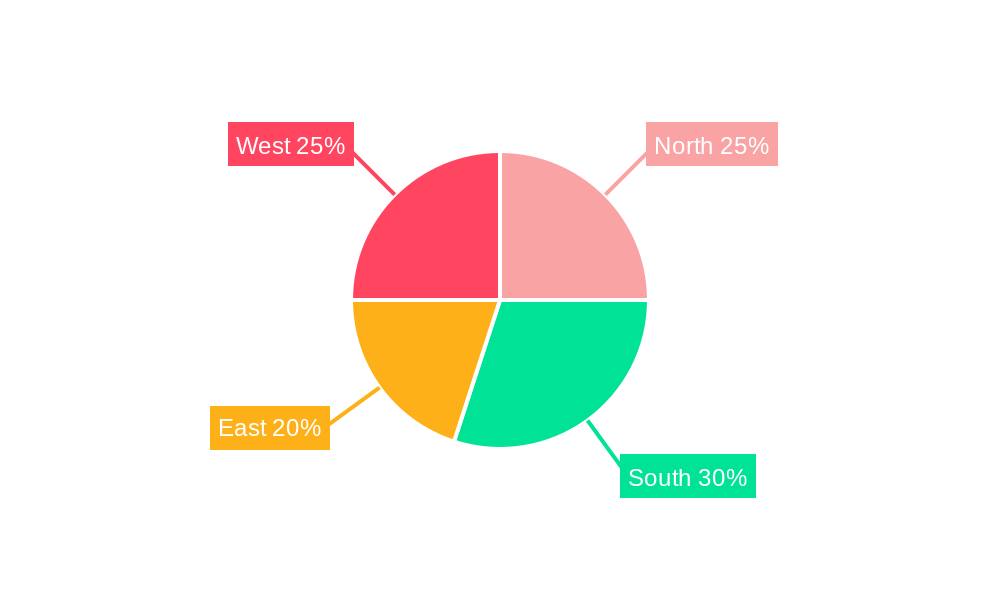

India Trade Finance Industry Segmentation By Geography

- 1. India

India Trade Finance Industry Regional Market Share

Geographic Coverage of India Trade Finance Industry

India Trade Finance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitalization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Trade Finance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SBM Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Terker Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yes Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Standard Chartered

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kotak Mahindra Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Federal Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank of Baroda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CITI Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HSBC**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SBM Bank

List of Figures

- Figure 1: India Trade Finance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Trade Finance Industry Share (%) by Company 2025

List of Tables

- Table 1: India Trade Finance Industry Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 2: India Trade Finance Industry Volume Billion Forecast, by Service Provider 2020 & 2033

- Table 3: India Trade Finance Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Trade Finance Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 5: India Trade Finance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Trade Finance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Trade Finance Industry Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 8: India Trade Finance Industry Volume Billion Forecast, by Service Provider 2020 & 2033

- Table 9: India Trade Finance Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: India Trade Finance Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: India Trade Finance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Trade Finance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Trade Finance Industry?

The projected CAGR is approximately 8.15%.

2. Which companies are prominent players in the India Trade Finance Industry?

Key companies in the market include SBM Bank, Terker Capital, HDFC Bank, Yes Bank, Standard Chartered, Kotak Mahindra Bank, Federal Bank, Bank of Baroda, CITI Bank, HSBC**List Not Exhaustive.

3. What are the main segments of the India Trade Finance Industry?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitalization is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: A new foreign exchange mechanism has been introduced by the Reserve Bank of India (RBI) to stabilize the Indian economy and promote increased international trade. According to a public statement made on July 11th, the system will make it easier for international trade transactions to be made in Indian rupees (INR). Indian importers and exporters can now use their own currency instead of US dollars to pay for transactions. This arrangement needs to be approved by banks first.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Trade Finance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Trade Finance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Trade Finance Industry?

To stay informed about further developments, trends, and reports in the India Trade Finance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence