Key Insights

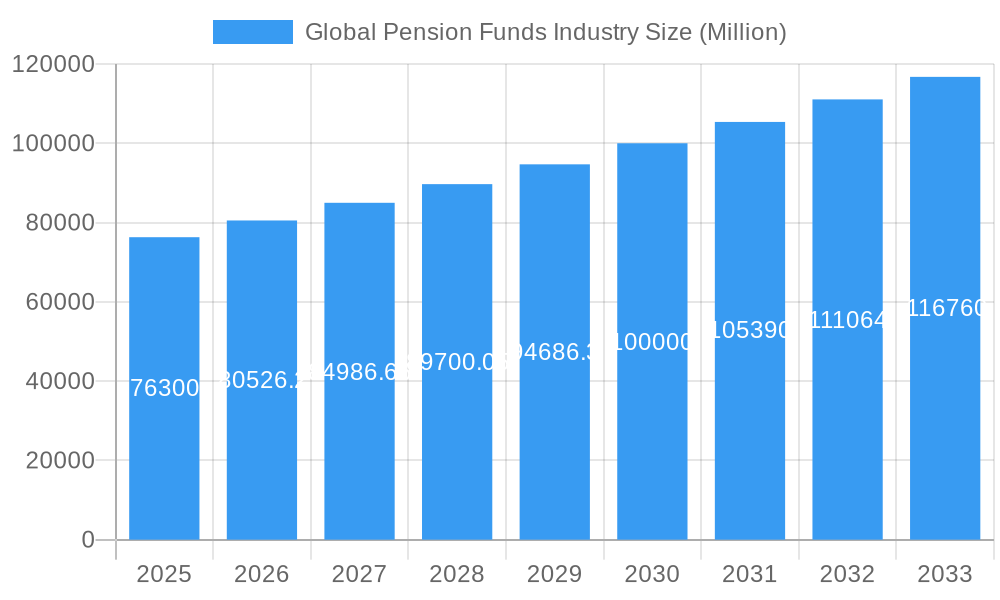

The global pension funds industry, currently valued at $76.30 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.40% from 2025 to 2033. This expansion is driven by several key factors. Increasing life expectancy and declining birth rates globally necessitate larger and more robust pension systems to support an aging population. Furthermore, rising awareness of the need for retirement security among individuals and governments is fueling demand for professional pension fund management. Government initiatives promoting private pension plans and favorable regulatory environments in several regions also contribute to the market's positive trajectory. The industry is segmented by plan type, including Distributed Contribution, Distributed Benefit, Reserved Fund, and Hybrid plans, each catering to distinct risk appetites and retirement objectives. Major players such as CalPERS, CPPIB, GPIF, and TRS are shaping market dynamics through their investment strategies and global reach. Geographic expansion is also a significant growth driver, with North America and Europe currently dominating the market, while Asia-Pacific and other regions present substantial untapped potential.

Global Pension Funds Industry Market Size (In Billion)

The industry faces certain challenges, however. Market volatility and fluctuating investment returns pose risks to pension fund performance. Increasing regulatory scrutiny and compliance costs can affect profitability. Additionally, ensuring adequate funding levels to meet future obligations remains a crucial concern for many pension funds. Despite these headwinds, the long-term outlook for the global pension funds industry remains positive. Innovation in investment strategies, the adoption of technology to enhance efficiency and transparency, and the ongoing need for secure retirement solutions all point towards sustained growth in the coming years. The industry's continued evolution will likely involve increased diversification of asset classes, greater focus on ESG (Environmental, Social, and Governance) investing, and the integration of advanced analytics to improve risk management and investment returns.

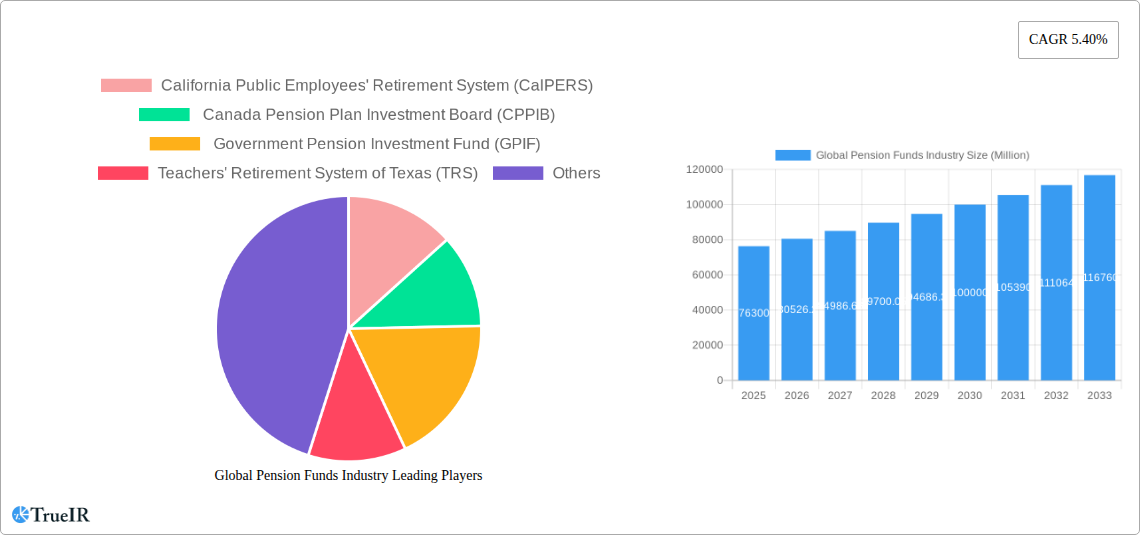

Global Pension Funds Industry Company Market Share

Global Pension Funds Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the global pension funds industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate current market trends and project future growth trajectories. The global market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Global Pension Funds Industry Market Structure & Competitive Landscape

The global pension funds industry is characterized by a complex interplay of factors influencing its structure and competitive dynamics. Market concentration is moderate, with a few dominant players such as California Public Employees' Retirement System (CalPERS), Canada Pension Plan Investment Board (CPPIB), Government Pension Investment Fund (GPIF), and Teachers' Retirement System of Texas (TRS) commanding significant market share. However, a large number of smaller, regional, and specialized funds contribute to a diverse landscape.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in portfolio management, risk assessment, and data analytics are key drivers of innovation. The adoption of AI and machine learning is transforming investment strategies and operational efficiency.

- Regulatory Impacts: Stringent regulatory frameworks governing investment practices, risk management, and transparency significantly impact the industry. Compliance costs and evolving regulations present both challenges and opportunities.

- Product Substitutes: While traditional defined benefit and defined contribution plans remain dominant, alternative investment vehicles like exchange-traded funds (ETFs) and private equity are gaining traction.

- End-User Segmentation: The industry caters to a broad spectrum of end-users, including individual retirees, public sector employees, and private sector workers. Segmentation varies significantly by geography and regulatory frameworks.

- M&A Trends: The past five years have witnessed a moderate volume of mergers and acquisitions (M&A), with xx deals recorded in the period 2019-2024, driven primarily by consolidation and expansion strategies among large players.

Global Pension Funds Industry Market Trends & Opportunities

The global pension funds industry is experiencing significant transformations driven by demographic shifts, technological advancements, and evolving investor preferences. Market size growth is projected to be robust, driven by factors such as increasing global aging population and rising demand for retirement savings solutions. The penetration rate of pension funds is expected to increase by xx% over the forecast period, reaching xx% by 2033. Technological shifts are reshaping investment strategies, risk management, and customer service. Artificial intelligence (AI), machine learning (ML), and big data analytics are being increasingly adopted for improved investment decision-making, fraud detection, and enhanced operational efficiency. Furthermore, the rising popularity of sustainable and responsible investing (SRI) is influencing investment allocations toward environmentally friendly and socially conscious initiatives. The increasing adoption of ESG (environmental, social, and governance) factors in investment decisions is creating new opportunities for funds focusing on responsible investment strategies. Competitive dynamics are intensifying as traditional players face competition from fintech companies offering innovative digital solutions and robo-advisors.

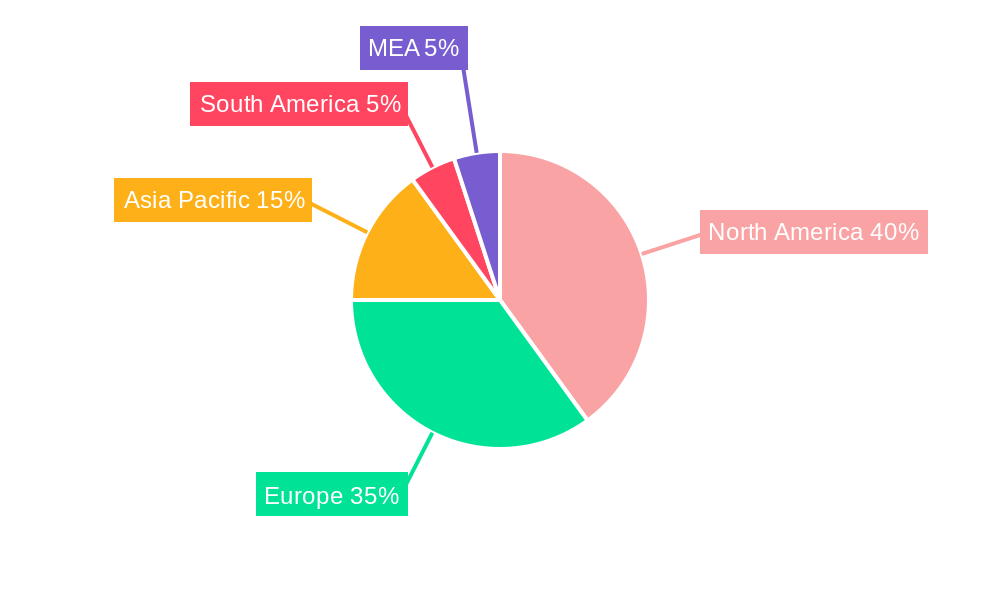

Dominant Markets & Segments in Global Pension Funds Industry

The North American market currently dominates the global pension funds industry, accounting for approximately xx Million in 2025. However, the Asia-Pacific region is projected to experience the highest growth rate over the forecast period. This growth is driven by increasing government initiatives to improve pension coverage, coupled with economic development and the expanding middle class.

- By Plan Type:

- Defined Benefit (DB): Remains significant, particularly in developed markets. Growth is constrained by funding challenges.

- Defined Contribution (DC): Experiencing faster growth globally, driven by increased individual responsibility for retirement savings.

- Reserved Funds: Steady growth due to government initiatives to bolster retirement security.

- Hybrid: Growing adoption with a blend of DB and DC features to balance risk and benefits.

Key Growth Drivers:

- Government Policies: Government regulations and incentives significantly influence the growth of pension funds across different regions.

- Economic Growth: A strong economy fosters higher contribution rates and increased investment returns.

- Infrastructure Development: Large-scale infrastructure projects create investment opportunities for pension funds.

Global Pension Funds Industry Product Analysis

Pension funds offer a range of products and services, including defined benefit plans, defined contribution plans, and various investment options within those frameworks. Technological advancements like AI-powered portfolio management tools and robo-advisors are enhancing product offerings, providing personalized advice and optimizing investment strategies. These innovations are addressing growing demand for transparency, accessibility, and customized retirement planning solutions.

Key Drivers, Barriers & Challenges in Global Pension Funds Industry

Key Drivers:

- Technological advancements in portfolio management, risk assessment, and data analytics.

- Increasing awareness of the importance of long-term retirement savings.

- Government regulations promoting retirement security.

Key Challenges:

- Low interest rates impacting investment returns.

- Regulatory complexities and compliance costs.

- Demographic shifts leading to increased strain on existing systems. The global aging population is placing increased pressure on pension systems and requires innovative solutions to ensure long-term sustainability. This is projected to result in an additional xx Million in funding gaps by 2033, impacting the industry’s ability to meet its obligations.

Growth Drivers in the Global Pension Funds Industry Market

Technological innovation, economic growth in emerging markets, and supportive government policies are key drivers. The increasing adoption of ESG investing presents a significant growth opportunity.

Challenges Impacting Global Pension Funds Industry Growth

Regulatory hurdles, fluctuating market volatility, and the rising cost of compliance pose significant challenges. Competition from alternative investment vehicles and the need for sustainable investment strategies also present growth restraints.

Key Players Shaping the Global Pension Funds Industry Market

- California Public Employees' Retirement System (CalPERS)

- Canada Pension Plan Investment Board (CPPIB)

- Government Pension Investment Fund (GPIF)

- Teachers' Retirement System of Texas (TRS)

Significant Global Pension Funds Industry Milestones

- 2020: Increased focus on ESG investing across major pension funds.

- 2021: Several large-scale M&A transactions reshaped the competitive landscape.

- 2022: Adoption of AI-powered portfolio management systems accelerated.

- 2023: Significant regulatory changes in several key markets.

Future Outlook for Global Pension Funds Industry Market

The global pension funds industry is poised for sustained growth, driven by technological innovation, evolving investor preferences, and increasing government support. Strategic partnerships and investments in alternative asset classes are expected to be key focus areas. The industry’s ability to adapt to changing market dynamics and regulatory landscapes will shape its long-term success.

Global Pension Funds Industry Segmentation

-

1. Plan Type

- 1.1. Distributed Contribution

- 1.2. Distributed Benefit

- 1.3. Reserved Fund

- 1.4. Hybrid

Global Pension Funds Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Switzerland

- 2.3. Netherlands

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. Japan

- 3.3. Rest of Asia Pacific

- 4. Rest of the World

Global Pension Funds Industry Regional Market Share

Geographic Coverage of Global Pension Funds Industry

Global Pension Funds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Distributed Contribution Plans are Settling as a Dominant Global Model

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 5.1.1. Distributed Contribution

- 5.1.2. Distributed Benefit

- 5.1.3. Reserved Fund

- 5.1.4. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 6. North America Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 6.1.1. Distributed Contribution

- 6.1.2. Distributed Benefit

- 6.1.3. Reserved Fund

- 6.1.4. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 7. Europe Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 7.1.1. Distributed Contribution

- 7.1.2. Distributed Benefit

- 7.1.3. Reserved Fund

- 7.1.4. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 8. Asia Pacific Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 8.1.1. Distributed Contribution

- 8.1.2. Distributed Benefit

- 8.1.3. Reserved Fund

- 8.1.4. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 9. Rest of the World Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 9.1.1. Distributed Contribution

- 9.1.2. Distributed Benefit

- 9.1.3. Reserved Fund

- 9.1.4. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 California Public Employees' Retirement System (CalPERS)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Canada Pension Plan Investment Board (CPPIB)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Government Pension Investment Fund (GPIF)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Teachers' Retirement System of Texas (TRS)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.1 California Public Employees' Retirement System (CalPERS)

List of Figures

- Figure 1: Global Pension Funds Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Global Pension Funds Industry Share (%) by Company 2025

List of Tables

- Table 1: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 2: Global Pension Funds Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 4: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 9: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Switzerland Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 15: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 20: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pension Funds Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Global Pension Funds Industry?

Key companies in the market include California Public Employees' Retirement System (CalPERS) , Canada Pension Plan Investment Board (CPPIB) , Government Pension Investment Fund (GPIF) , Teachers' Retirement System of Texas (TRS).

3. What are the main segments of the Global Pension Funds Industry?

The market segments include Plan Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Distributed Contribution Plans are Settling as a Dominant Global Model.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pension Funds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pension Funds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pension Funds Industry?

To stay informed about further developments, trends, and reports in the Global Pension Funds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence