Key Insights

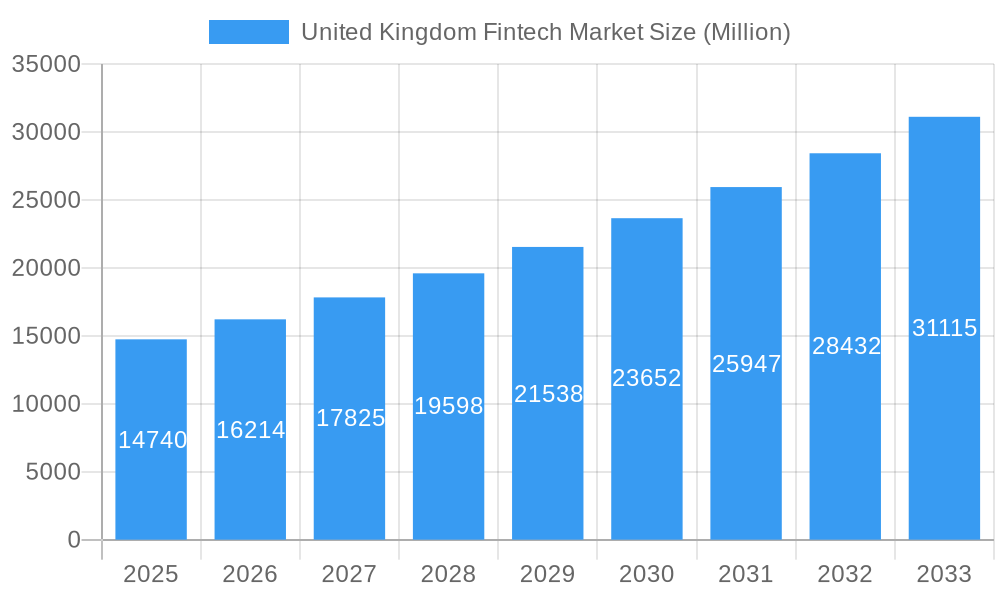

The UK Fintech market, valued at £14.74 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is driven by several key factors. Increased smartphone penetration and internet access have fueled the adoption of digital financial services across all demographics. Furthermore, a supportive regulatory environment, fostering innovation and competition, has encouraged the emergence of numerous FinTech companies offering diverse services, ranging from mobile banking and payments to investment platforms and peer-to-peer lending. The growing demand for convenient, personalized, and cost-effective financial solutions is another significant driver, particularly amongst younger generations. While data privacy concerns and security risks pose some challenges, the market's resilience and the ongoing development of robust security measures are mitigating these restraints. The market's segmentation reflects this diversity, encompassing various niches within the broader financial technology landscape.

United Kingdom Fintech Market Market Size (In Billion)

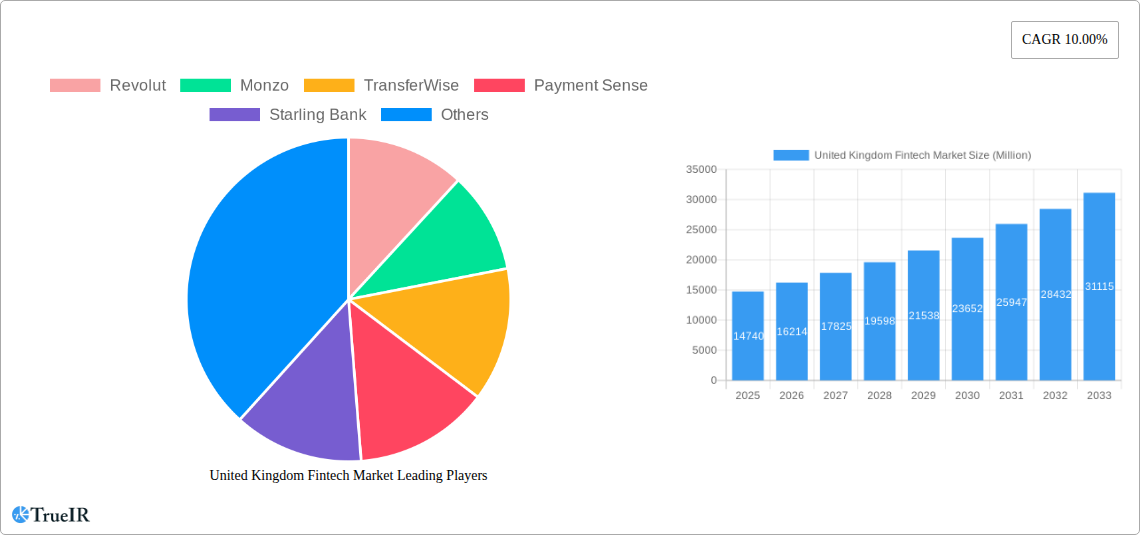

The leading players in this dynamic market, including Revolut, Monzo, TransferWise (now Wise), Starling Bank, and others, are continuously innovating and expanding their service offerings to cater to evolving customer needs. Competition is fierce, driving improvements in user experience, product features, and pricing. Future growth will likely be shaped by advancements in artificial intelligence (AI), blockchain technology, and open banking initiatives, which promise to further enhance the efficiency, security, and accessibility of financial services in the UK. The continued focus on regulatory compliance and consumer protection will be crucial in maintaining the market's sustainable growth trajectory. Geographical variations in adoption rates might exist, with larger metropolitan areas potentially showing higher penetration rates than more rural regions, indicating opportunities for targeted expansion strategies.

United Kingdom Fintech Market Company Market Share

United Kingdom Fintech Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning United Kingdom Fintech market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report delivers a comprehensive overview of market structure, trends, opportunities, and challenges. Leveraging extensive data analysis and qualitative insights, this research identifies key players, growth drivers, and future projections for this rapidly evolving sector.

United Kingdom Fintech Market Market Structure & Competitive Landscape

The UK Fintech market is characterized by a dynamic competitive landscape, with a mix of established players and innovative startups. Market concentration is moderate, with a few dominant players alongside numerous smaller, specialized firms. Innovation is a key driver, fueled by advancements in AI, blockchain, and open banking. Regulatory impacts, particularly from the Financial Conduct Authority (FCA), significantly shape market dynamics, influencing product development and compliance. Product substitutes, such as traditional banking services, exert competitive pressure, while M&A activity remains robust, leading to market consolidation.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the UK Fintech market in 2024 is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: The volume of M&A deals in the UK Fintech sector from 2019 to 2024 totalled approximately xx Million USD, with a notable increase in the last two years.

- Innovation Drivers: AI-powered personalization, blockchain-based security solutions, and open banking APIs are driving significant innovation.

- Regulatory Impacts: FCA regulations concerning data privacy, financial crime, and consumer protection shape market practices.

- End-User Segmentation: The market is segmented by customer demographics (age, income), business type (SME, enterprise), and financial service needs (payments, lending, investing).

United Kingdom Fintech Market Market Trends & Opportunities

The UK Fintech market is experiencing robust growth, driven by increasing smartphone penetration, rising digital adoption, and a favorable regulatory environment. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements like AI, blockchain, and cloud computing are transforming the landscape, enabling the development of innovative financial products and services. Consumer preferences are shifting towards personalized, seamless, and cost-effective financial solutions, creating significant opportunities for Fintech companies. The competitive landscape is dynamic, with both established players and agile startups vying for market share. Market penetration rates for various Fintech solutions vary, with payments and lending experiencing the highest adoption.

Dominant Markets & Segments in United Kingdom Fintech Market

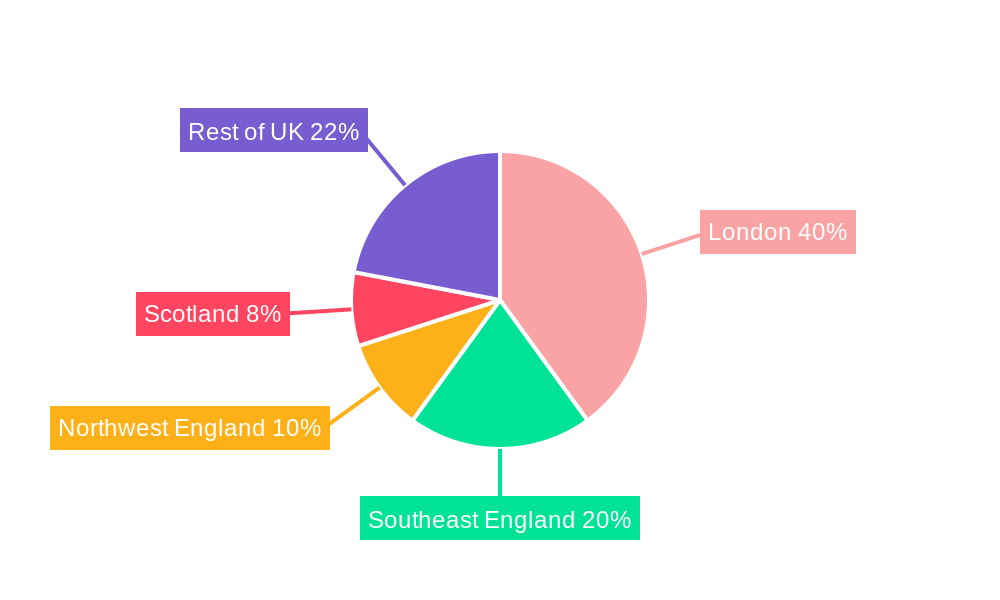

London remains the undisputed dominant center for Fintech activity in the UK, benefitting from a robust talent pool, strong financial infrastructure, and supportive government policies. The payments segment commands the largest market share, driven by the widespread adoption of mobile payment apps and contactless transactions.

- Key Growth Drivers in London:

- Concentrated talent pool of developers and financial professionals.

- Established financial infrastructure and access to capital.

- Pro-Fintech government policies and initiatives.

- Supportive regulatory environment fostering innovation.

United Kingdom Fintech Market Product Analysis

Fintech product innovation is rapid and diverse, encompassing mobile payments, digital lending platforms, robo-advisors, and open banking solutions. Competitive advantages arise from superior user experience, advanced technology integration (e.g., AI, blockchain), and strong brand recognition. Technological advancements enhance efficiency, security, and personalization, improving the overall customer journey and value proposition. Market fit is crucial, with successful products addressing specific customer needs and market gaps.

Key Drivers, Barriers & Challenges in United Kingdom Fintech Market

Key Drivers: Technological advancements (AI, blockchain), increasing digital adoption, supportive government policies (e.g., open banking initiatives), and the growing demand for personalized financial services.

Challenges: Intense competition, regulatory hurdles (e.g., data privacy regulations), cybersecurity threats, and the need to maintain customer trust. The impact of these challenges on market growth is estimated to be a reduction of xx Million USD annually.

Growth Drivers in the United Kingdom Fintech Market Market

The UK Fintech market's growth is propelled by several key factors: rapid technological advancements enabling innovative product development, increasing digital adoption among consumers, supportive government policies fostering innovation, and strong venture capital investment. These factors contribute to the sector's expansion and diversification.

Challenges Impacting United Kingdom Fintech Market Growth

Significant barriers to UK Fintech market growth include stringent regulatory requirements, cybersecurity risks, and the need to manage customer data responsibly. The competitive intensity and the potential for disruption from established players also present challenges.

Key Players Shaping the United Kingdom Fintech Market Market

- Revolut

- Monzo

- Wise (formerly TransferWise)

- Payment Sense

- Starling Bank

- Nutmeg

- Soldo

- YoYo

- Money Box

- WeGift io

Significant United Kingdom Fintech Market Industry Milestones

- September 2023: Moneybox launched a new market-leading Cash ISA, offering 4.65% AER (variable) on deposits of GBP 500 (USD 629.99) or more. This signifies a competitive move within the savings and investment segment.

- March 2023: TransferWise rebranded to Wise, reflecting its global expansion and reaching 16 Million customers worldwide, moving EUR 100 Billion (USD 107.17 Billion) annually. This highlights a major milestone in market leadership and global reach.

Future Outlook for United Kingdom Fintech Market Market

The UK Fintech market is poised for continued growth, fueled by technological innovation, evolving consumer preferences, and supportive regulatory frameworks. Strategic opportunities exist in areas such as embedded finance, open banking, and AI-driven personalized financial services. The market is expected to see increased consolidation and further international expansion in the coming years.

United Kingdom Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer And Payments

- 1.2. Savings And Investments

- 1.3. Digital Lending And Lending marketplaces

- 1.4. Online Insurance And Insurance Marketplaces

- 1.5. Other Service Propositions

-

2. Technology

- 2.1. Mobile Apps

- 2.2. AI and Machine Learning

- 2.3. Cryptocurrency

- 2.4. Other Technologies

-

3. User Type

- 3.1. Consumers

- 3.2. Businesses

United Kingdom Fintech Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Fintech Market Regional Market Share

Geographic Coverage of United Kingdom Fintech Market

United Kingdom Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Support is Driving the Market; Strong Financial Ecosystem is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Support is Driving the Market; Strong Financial Ecosystem is Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising Payments and Digital Banking in the United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer And Payments

- 5.1.2. Savings And Investments

- 5.1.3. Digital Lending And Lending marketplaces

- 5.1.4. Online Insurance And Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Mobile Apps

- 5.2.2. AI and Machine Learning

- 5.2.3. Cryptocurrency

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by User Type

- 5.3.1. Consumers

- 5.3.2. Businesses

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Revolut

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Monzo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TransferWise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Payment Sense

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Starling Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutmeg

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Soldo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YoYo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Money Box

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeGift io**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Revolut

List of Figures

- Figure 1: United Kingdom Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: United Kingdom Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: United Kingdom Fintech Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: United Kingdom Fintech Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: United Kingdom Fintech Market Revenue Million Forecast, by User Type 2020 & 2033

- Table 6: United Kingdom Fintech Market Volume Billion Forecast, by User Type 2020 & 2033

- Table 7: United Kingdom Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United Kingdom Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United Kingdom Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 10: United Kingdom Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 11: United Kingdom Fintech Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: United Kingdom Fintech Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 13: United Kingdom Fintech Market Revenue Million Forecast, by User Type 2020 & 2033

- Table 14: United Kingdom Fintech Market Volume Billion Forecast, by User Type 2020 & 2033

- Table 15: United Kingdom Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Fintech Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the United Kingdom Fintech Market?

Key companies in the market include Revolut, Monzo, TransferWise, Payment Sense, Starling Bank, Nutmeg, Soldo, YoYo, Money Box, WeGift io**List Not Exhaustive.

3. What are the main segments of the United Kingdom Fintech Market?

The market segments include Service Proposition, Technology, User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Support is Driving the Market; Strong Financial Ecosystem is Driving the Market.

6. What are the notable trends driving market growth?

Rising Payments and Digital Banking in the United Kingdom.

7. Are there any restraints impacting market growth?

Government Support is Driving the Market; Strong Financial Ecosystem is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Moneybox, the award-winning saving and investing platform, launched a new market-leading Cash ISA, offering 4.65% AER (variable) on deposits of GBP 500 (USD 629.99) or more. Designed to encourage people to grow their savings tax-free over the medium-long term, this new Cash ISA allows up to three withdrawals within 12 months from the account opening date without compromising the attractive interest rate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Fintech Market?

To stay informed about further developments, trends, and reports in the United Kingdom Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence