Key Insights

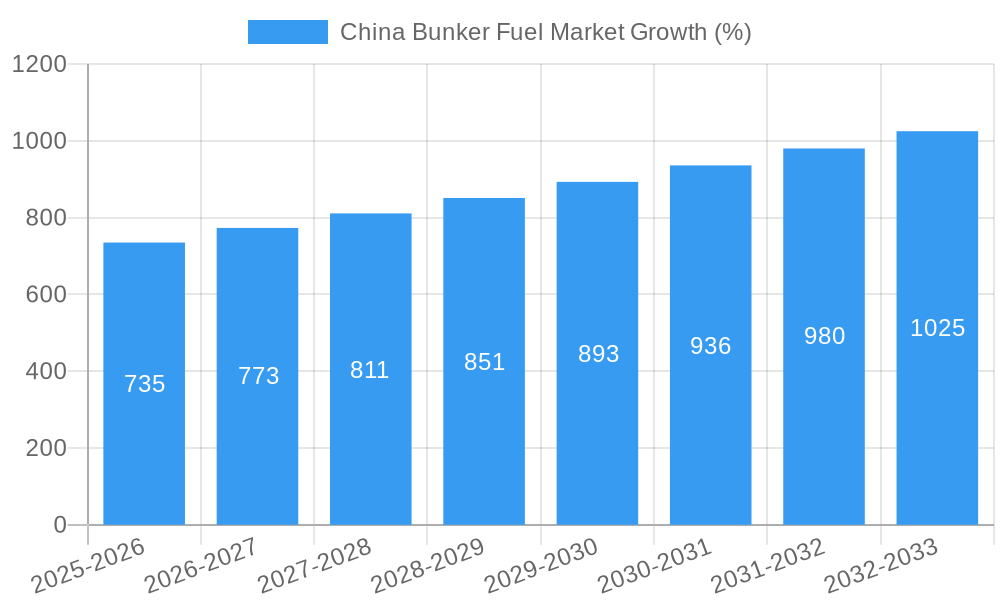

The China bunker fuel market, exhibiting a CAGR exceeding 4.50%, presents a significant growth opportunity. Driven by robust economic activity and increasing maritime trade within and from China, the market is projected to expand considerably between 2025 and 2033. Key growth drivers include China's expanding fleet size, particularly in container and tanker segments, along with rising energy demands for industrial and manufacturing activities. The market is segmented by fuel type (High Sulfur Fuel Oil (HSFO), Very-low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), and Others) and vessel type (Containers, Tankers, General Cargo, Bulk Carriers, and Others). The shift towards cleaner fuels like VLSFO, mandated by stricter environmental regulations, is a prominent trend shaping the market landscape. While the transition to cleaner fuels presents challenges for some suppliers, it also opens opportunities for those investing in greener technologies and compliant infrastructure. Competition within the market is intense, with major players such as Sinopec Fuel Oil Sales Co Ltd, Cosco Shipping Lines Co Ltd, and China Merchants Energy Shipping Co Ltd vying for market share alongside international fuel suppliers and ship owners. The market's future trajectory will depend on the interplay of regulatory changes, global economic conditions, and evolving maritime transportation patterns within China.

Despite the positive outlook, certain restraints exist. These include fluctuating crude oil prices, which directly impact bunker fuel costs, and the potential for economic slowdowns impacting shipping volumes. The market's dependence on global crude oil supplies also presents a vulnerability. To mitigate these risks, companies are increasingly diversifying their fuel sources and exploring long-term contracts to secure stable fuel supplies. Successful players will need to adapt to the changing regulatory environment, invest in efficient logistics and supply chain management, and leverage technological advancements to optimize fuel consumption and reduce emissions. A deeper analysis should consider the impact of government policies promoting sustainable shipping and the adoption of alternative fuels like LNG. The market is anticipated to continue its growth trajectory, driven by long-term growth in China's economy and the increasing demands of its maritime sector, albeit at a pace influenced by the dynamic interplay of global and local factors.

China Bunker Fuel Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning China Bunker Fuel Market, offering invaluable insights for industry stakeholders. With a comprehensive analysis spanning the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate market trends, opportunities, and challenges. The study covers key segments, including High Sulfur Fuel Oil (HSFO), Very-low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), and others, across various vessel types like containers, tankers, and bulk carriers.

China Bunker Fuel Market Market Structure & Competitive Landscape

The China bunker fuel market exhibits a moderately concentrated structure, with key players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation is driven by the need for cleaner fuels and improved efficiency, spurred by increasingly stringent environmental regulations. The market is heavily influenced by global fuel price fluctuations and government policies related to emissions control. Product substitutes, primarily alternative marine fuels like LNG, are gaining traction, presenting both opportunities and challenges for established players.

- Market Concentration: The top 5 players control approximately xx% of the market in 2024.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, with a total value of approximately xx Million USD. The trend is projected to continue, albeit at a moderated pace, driven by consolidation efforts among fuel suppliers and shipping companies.

- End-User Segmentation: The market is segmented based on vessel type, with tankers and container ships dominating consumption. The growth of e-commerce and increasing global trade contribute significantly to this demand.

- Regulatory Impact: Stringent environmental regulations, particularly those concerning sulfur content in marine fuels, are reshaping the market, driving the adoption of VLSFO and alternative fuels.

China Bunker Fuel Market Market Trends & Opportunities

The China bunker fuel market is projected to witness robust growth over the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by the expansion of China's maritime trade and the burgeoning demand for container shipping. Technological advancements, such as the development of more efficient fuel systems and the adoption of alternative fuels, are further shaping market dynamics. Consumer preferences are shifting towards cleaner and more environmentally friendly fuels, aligning with global sustainability initiatives. However, intensifying competition and fluctuating global fuel prices present ongoing challenges. Market penetration rates for VLSFO are expected to increase significantly, reaching xx% by 2033, driven by the stricter emission regulations. The market size is expected to reach xx Million USD by 2033.

Dominant Markets & Segments in China Bunker Fuel Market

The coastal regions of China, particularly the major ports of Shanghai, Shenzhen, and Ningbo-Zhoushan, dominate the bunker fuel market. VLSFO is the fastest-growing fuel type, driven by increasingly stringent IMO 2020 regulations. The tanker segment holds the largest share of the market, followed by container vessels.

Key Growth Drivers:

- Expanding Maritime Trade: China's robust economic growth and its position as a global manufacturing and trading hub fuel demand for bunker fuels.

- Infrastructure Development: Continuous investments in port infrastructure and logistics enhance the efficiency of shipping operations and fuel consumption.

- Government Policies: Although the Chinese government is working on its emission reduction goals, governmental policies related to shipping and trade impact the demand and type of fuel being consumed.

China Bunker Fuel Market Product Analysis

The market features a wide range of bunker fuels, each catering to specific vessel types and emission regulations. Technological advancements focus on reducing sulfur content, improving fuel efficiency, and developing alternative fuels. The competitive advantage lies in offering a reliable supply chain, competitive pricing, and compliance with stringent environmental regulations.

Key Drivers, Barriers & Challenges in China Bunker Fuel Market

Key Drivers:

- Increasing global trade and China's role in global supply chains.

- Growth in container shipping and expansion of port infrastructure.

- Demand for cleaner fuels driven by environmental regulations.

Key Challenges:

- Fluctuating global crude oil prices impacting fuel costs.

- Stringent environmental regulations requiring compliance and investment.

- Intense competition from numerous fuel suppliers and shipping companies. Supply chain disruptions causing fuel shortages, impacting the market dynamics. This was particularly evident in xx (Year) leading to xx Million USD losses for the industry.

Growth Drivers in the China Bunker Fuel Market Market

The market's growth is propelled by China's expanding maritime trade, infrastructure development, and increasing demand for cleaner fuels. The government's focus on improving port efficiency and supporting the shipping industry further contributes to growth.

Challenges Impacting China Bunker Fuel Market Growth

Fluctuating crude oil prices, environmental regulations, and intense competition pose significant challenges. Supply chain disruptions and geopolitical uncertainties also introduce volatility into the market.

Key Players Shaping the China Bunker Fuel Market Market

- 2 Sinopec Fuel Oil Sales Co Ltd

- 1 Cosco Shipping Lines Co Ltd

- 3 China Merchants Energy Shipping Co Ltd

- 6 Nan Fung Group

- 3 China Marine Bunker Co Ltd

- Ship Owners

- Fuel Suppliers

- 4 Sinotrans Limited

- 1 PetroChina Company Limited

- 5 Parakou Group

- 4 Brightoil Petroleum (Holdings) Limited

- 2 Orient Overseas Container Line (OOCL)

Significant China Bunker Fuel Market Industry Milestones

- 2020: Implementation of IMO 2020 sulfur cap significantly impacts fuel choices.

- 2022: Increased investments in LNG bunkering infrastructure.

- xx (Year): Significant M&A activity among major players. (Further details regarding specific events would need to be added.)

Future Outlook for China Bunker Fuel Market Market

The China bunker fuel market is poised for continued growth, driven by the long-term expansion of China's economy and maritime trade. Strategic investments in cleaner fuel infrastructure and technological advancements will shape the market's future. The increasing adoption of VLSFO and exploration of alternative fuels will dominate the growth trajectory.

China Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Others

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

China Bunker Fuel Market Segmentation By Geography

- 1. China

China Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Nature of Oil Market

- 3.4. Market Trends

- 3.4.1. Trade Tensions between the United States and China is Likely to Restrain the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 2 Sinopec Fuel Oil Sales Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 Cosco Shipping Lines Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3 China Merchants Energy Shipping Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 Nan Fung Group*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3 China Marine Bunker Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ship Owners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuel Suppliers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Sinotrans Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 1 PetroChina Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 Parakou Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 Brightoil Petroleum (Holdings) Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 2 Orient Overseas Container Line (OOCL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 2 Sinopec Fuel Oil Sales Co Ltd

List of Figures

- Figure 1: China Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: China Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: China Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: China Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: China Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: China Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: China Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: China Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: China Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: China Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 13: China Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: China Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 15: China Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Bunker Fuel Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the China Bunker Fuel Market?

Key companies in the market include 2 Sinopec Fuel Oil Sales Co Ltd, 1 Cosco Shipping Lines Co Ltd, 3 China Merchants Energy Shipping Co Ltd, 6 Nan Fung Group*List Not Exhaustive, 3 China Marine Bunker Co Ltd, Ship Owners, Fuel Suppliers, 4 Sinotrans Limited, 1 PetroChina Company Limited, 5 Parakou Group, 4 Brightoil Petroleum (Holdings) Limited, 2 Orient Overseas Container Line (OOCL).

3. What are the main segments of the China Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel.

6. What are the notable trends driving market growth?

Trade Tensions between the United States and China is Likely to Restrain the Market Growth.

7. Are there any restraints impacting market growth?

4.; Volatile Nature of Oil Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the China Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence