Key Insights

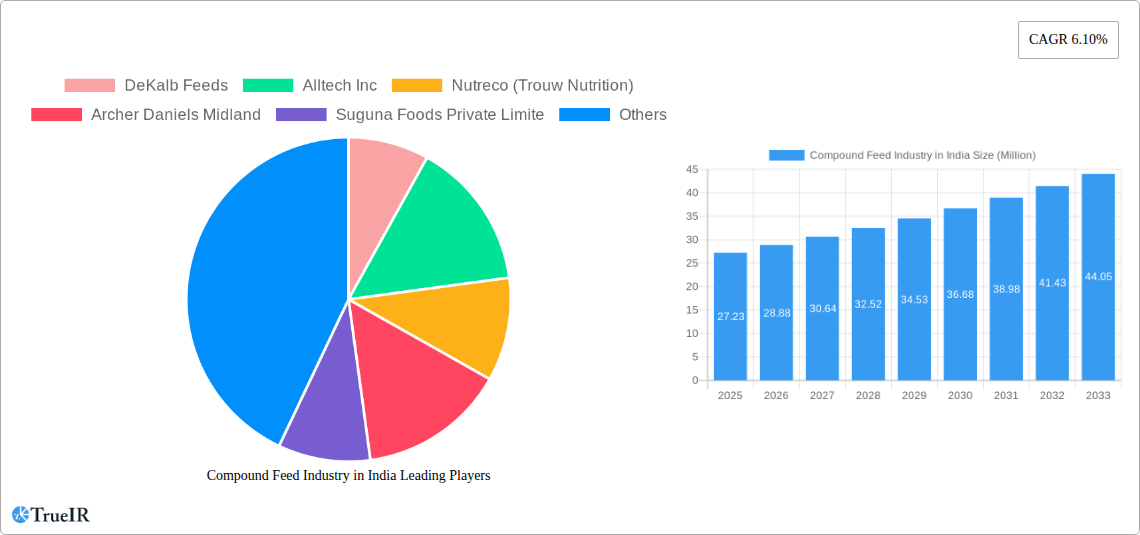

The Indian compound feed market is poised for robust expansion, projected to reach approximately USD 27.23 million in 2025, with a healthy Compound Annual Growth Rate (CAGR) of 6.10% anticipated between 2025 and 2033. This growth is propelled by an increasing demand for high-quality animal protein, driven by a burgeoning population and a rising per capita income, which fuels a greater consumption of meat, dairy, and eggs. The government's focus on enhancing livestock productivity and the adoption of modern farming practices by both large-scale producers and smallholder farmers are significant contributors. Furthermore, growing awareness among farmers regarding the benefits of scientifically formulated compound feeds, such as improved animal health, higher yield, and reduced mortality rates, is a key driver. The market is segmented by animal type, with Ruminants and Poultry likely dominating due to their substantial contribution to India's protein supply. Cereals and Cakes & Meals are expected to be the primary ingredient segments, reflecting the availability and cost-effectiveness of these raw materials in the Indian agricultural landscape.

Compound Feed Industry in India Market Size (In Million)

The trajectory of the Indian compound feed market is also shaped by evolving trends such as the increasing incorporation of specialized additives and supplements to enhance nutritional value and disease resistance. Technological advancements in feed production and processing, including automation and precision feeding, are gaining traction, contributing to efficiency and quality improvements. However, challenges such as the volatility in raw material prices, driven by climate change and global supply chain disruptions, can impact profit margins. Stringent regulatory frameworks concerning feed safety and quality, while essential for long-term market health, can also present compliance hurdles for smaller players. Despite these restraints, the overall outlook remains optimistic, with significant opportunities for market expansion, particularly in addressing the growing needs of the aquaculture and swine sectors as dietary preferences diversify. Key global and domestic players are actively investing in expanding their production capacities and product portfolios to cater to this dynamic market.

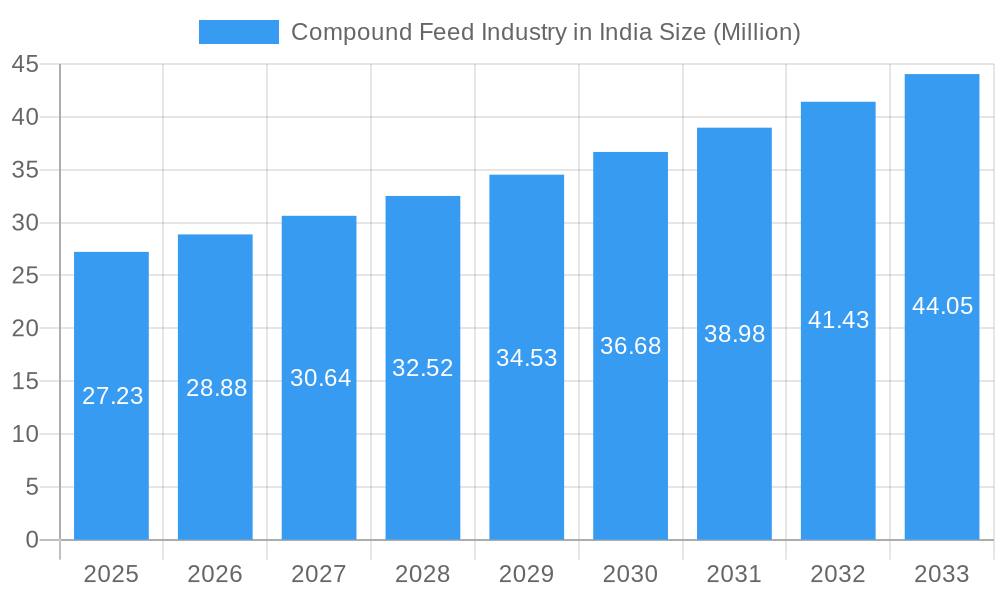

Compound Feed Industry in India Company Market Share

Compound Feed Industry in India: Market Dynamics, Growth Prospects, and Competitive Landscape (2019–2033)

This comprehensive report offers an in-depth analysis of the Compound Feed Industry in India, a rapidly expanding sector critical to the nation's agricultural and food security. Covering the historical period (2019–2024), base year (2025), estimated year (2025), and forecast period (2025–2033), this report leverages high-volume keywords such as "Indian animal feed market," "poultry feed India," "cattle feed market," "aquaculture feed India," and "feed additives India" to enhance SEO visibility and reach key industry stakeholders. Gain actionable insights into market structure, trends, dominant segments, product innovations, key drivers, barriers, challenges, influential players, significant milestones, and the future outlook of this vital industry.

Compound Feed Industry in India Market Structure & Competitive Landscape

The Indian Compound Feed Industry is characterized by a moderately concentrated market structure, with a few large players holding significant market share, complemented by a growing number of regional and specialized manufacturers. Innovation is a key driver, fueled by advancements in animal nutrition science, genetic improvements in livestock, and the increasing adoption of precision feeding technologies. Regulatory frameworks, overseen by bodies like the Food Safety and Standards Authority of India (FSSAI) and the Bureau of Indian Standards (BIS), play a crucial role in ensuring product quality, safety, and preventing adulteration, impacting market entry and operational standards. Product substitutes, such as traditional feed ingredients and farm-level feed formulation, present a competitive challenge, though the efficiency and standardized nutrition offered by compound feed are increasingly preferred. End-user segmentation is diverse, encompassing large-scale poultry farms, dairy cooperatives, aquaculture producers, and smaller livestock operations. Mergers and acquisitions (M&A) activity is anticipated to grow as larger companies seek to consolidate market presence, expand their product portfolios, and acquire technological capabilities, leading to a more integrated industry landscape. Quantitative analysis indicates a concentration ratio of approximately 60% held by the top five players in 2024, with an estimated M&A volume of USD 200 Million in the last two years.

Compound Feed Industry in India Market Trends & Opportunities

The Compound Feed Industry in India is poised for substantial growth, driven by escalating demand for animal protein, a burgeoning population, and increasing disposable incomes. The market size is projected to expand from approximately USD 25 Billion in 2024 to an estimated USD 40 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.5%. Technological shifts are revolutionizing the sector, with a growing adoption of advanced feed processing techniques, including pelleting, extrusion, and micronization, which enhance nutrient digestibility and palatability. The integration of digital technologies for supply chain management, inventory control, and farm advisory services is also gaining traction. Consumer preferences are increasingly leaning towards farm-raised protein sources that are perceived as safe, hygienic, and produced sustainably. This trend directly influences demand for high-quality compound feeds that contribute to improved animal health and meat/milk quality. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Opportunities abound for companies focusing on developing specialized feeds for niche segments, offering customized nutrition solutions, and embracing sustainable production practices. The penetration rate of compound feed, currently at around 45% for commercial livestock, presents significant room for expansion. The increasing awareness among farmers regarding the economic benefits of optimized nutrition, including reduced mortality rates and enhanced productivity, is a pivotal factor driving market penetration. Furthermore, government initiatives promoting animal husbandry and fisheries are creating a conducive environment for the growth of the compound feed sector.

Dominant Markets & Segments in Compound Feed Industry in India

The Poultry segment stands as the dominant market within the Indian Compound Feed Industry, accounting for an estimated 55% of the total market share in 2024. This dominance is propelled by several key growth drivers, including the nation's high per capita consumption of chicken and eggs, continuous advancements in poultry breeding leading to higher feed conversion ratios, and the relatively lower cost of production compared to other meat sources. Government policies supporting the poultry sector, such as subsidies for feed procurement and infrastructure development, further bolster its growth.

The Ruminants segment, encompassing cattle and buffalo feed, is the second-largest and a rapidly growing segment, holding approximately 30% of the market share. The increasing demand for milk and dairy products, driven by a growing population and rising incomes, is the primary growth catalyst. Initiatives aimed at improving dairy productivity and farmer incomes, such as the National Dairy Development Board's programs, significantly contribute to the demand for quality cattle feed. The development of innovative cattle feed formulations that enhance milk yield and quality, along with improved digestive health, is a key trend.

Aquaculture feed is another significant and high-growth segment, estimated at 10% of the market share. India's vast coastline and inland water resources, coupled with government focus on boosting fish production for both domestic consumption and exports, are key drivers. Emerging technologies in aquaculture farming and the increasing adoption of scientific feeding practices are propelling demand for specialized aquaculture feeds that optimize growth rates and minimize disease outbreaks.

The Swine segment, while smaller, is projected for substantial growth due to increasing demand for pork in certain regions and the potential for export markets. The Other Animal Types segment, which includes feed for horses, rabbits, and pet animals, represents a niche but growing area, driven by the increasing trend of pet ownership and the demand for specialized nutrition.

In terms of Ingredients, Cereals (such as maize and rice bran) remain the primary components of compound feed, forming over 50% of the feed mix due to their cost-effectiveness and energy content. Cakes and Meals (like soybean meal and groundnut meal) are crucial for protein content, followed by By-products from the food processing industry and essential Supplements comprising vitamins, minerals, and amino acids. The consistent availability and cost of these ingredients significantly influence the overall market dynamics and profitability of compound feed manufacturers.

Compound Feed Industry in India Product Analysis

Product innovation in the Indian Compound Feed Industry is largely focused on enhancing nutritional efficacy, improving animal health, and optimizing feed conversion ratios. Manufacturers are developing specialized feed formulations tailored to specific life stages, breeds, and production goals of various animal types. This includes the development of extruded feeds for aquaculture that improve buoyancy and digestibility, amino-acid fortified poultry feeds to reduce crude protein levels and environmental impact, and pelletized cattle feeds with enhanced mineral profiles for increased milk production and reproductive efficiency. Competitive advantages are derived from superior ingredient sourcing, advanced processing technologies, stringent quality control, and the provision of technical support and advisory services to farmers. The integration of functional ingredients, such as prebiotics, probiotics, and organic acids, is a key trend aimed at improving gut health and reducing the reliance on antibiotics.

Key Drivers, Barriers & Challenges in Compound Feed Industry in India

Key Drivers:

- Growing Demand for Animal Protein: A rising population and increasing disposable incomes are driving higher consumption of meat, eggs, and dairy products, directly boosting the demand for compound feed.

- Government Support and Policies: Initiatives like the National Livestock Mission and fisheries development schemes provide subsidies, incentives, and infrastructure support, fostering industry growth.

- Technological Advancements: Innovations in animal nutrition, feed processing, and farming practices lead to more efficient and cost-effective feed solutions.

- Farmer Awareness and Education: Increased understanding among farmers about the benefits of balanced nutrition for animal health and productivity is a significant driver.

Barriers & Challenges:

- Volatility in Raw Material Prices: Fluctuations in the prices of key ingredients like maize and soybean meal, driven by weather patterns and global demand, pose a significant challenge to cost management and profitability.

- Supply Chain Inefficiencies: Logistics, storage, and transportation challenges, particularly in remote areas, can impact the timely availability of feed and increase costs.

- Regulatory Compliance: Adhering to evolving food safety and quality standards, as well as environmental regulations, can be complex and resource-intensive for manufacturers.

- Competition from Traditional/Home-Grown Feeds: In some rural areas, traditional feeding practices and on-farm feed mixing remain prevalent, posing a competitive challenge.

- Limited Access to Credit for Smallholder Farmers: This can restrict their ability to invest in higher-quality compound feeds, thus limiting market penetration in certain segments.

Growth Drivers in the Compound Feed Industry in India Market

The growth of the Compound Feed Industry in India is propelled by a confluence of technological, economic, and regulatory factors. Economically, the rising middle class and increasing demand for protein-rich diets are fundamental drivers. Technologically, advancements in feed formulation science, including precision nutrition and the use of novel ingredients, are enhancing the efficacy of compound feeds. Regulatory frameworks are also playing a positive role; for instance, government emphasis on food safety standards indirectly promotes the use of scientifically formulated compound feeds over potentially unregulated alternatives. The expansion of the poultry and dairy sectors, supported by government schemes aimed at increasing animal productivity, directly fuels the demand for compound feed. Furthermore, the increasing adoption of modern farming practices and a greater understanding of animal husbandry among farmers are crucial growth catalysts.

Challenges Impacting Compound Feed Industry in India Growth

Several challenges are impacting the growth of the Compound Feed Industry in India. Regulatory complexities, while essential for quality, can sometimes lead to delays in product approvals and market entry. Supply chain disruptions, including logistical bottlenecks and inadequate storage infrastructure, especially in remote agricultural regions, can hinder the efficient distribution of feed. Competitive pressures are intensifying, with both established players and emerging manufacturers vying for market share, leading to price wars and squeezed profit margins. The volatile prices of raw materials, such as maize and soybean, due to climatic factors and global market dynamics, pose a significant threat to cost stability and profitability. Additionally, the limited access to affordable credit for many small and marginal farmers can restrict their purchasing power for premium compound feeds.

Key Players Shaping the Compound Feed Industry in India Market

- DeKalb Feeds

- Alltech Inc

- Nutreco (Trouw Nutrition)

- Archer Daniels Midland

- Suguna Foods Private Limited

- Cargill Inc

- Japfa Comfeeds India Pvt Ltd

- Kyodo Shiryo Company

- New Hope Group

- Godrej Agrovet Limited

- Nutreco NV

- BASF SE

Significant Compound Feed Industry in India Industry Milestones

- December 2022: The Asian Development Bank (ADB) and ABIS Exports India Private Limited (ABIS) entered into an agreement to subscribe to non-convertible debentures for USD 16 Million to enhance food security in India by supporting the construction of a microfiche feed plant and by training up to 6,000 farmers in climate-resilient fish farming practices as well as financial literacy.

- January 2022: eFeed, an Indian start-up, initiated its plans to establish nutrition advisory centers across the north-eastern districts of India with the purpose of driving sustainable and accountable animal husbandry.

- September 2021: Suguna Feeds launched their cattle feed variants, MilkyBest+ and NutriBest, at their feed mill in Udumalpet, India. Both of these cattle feed variants are relatively cheaper than most brands in the Indian market while offering higher quality.

Future Outlook for Compound Feed Industry in India Market

The future outlook for the Compound Feed Industry in India is exceptionally positive, driven by sustained demand for animal protein and increasing government focus on the livestock and fisheries sectors. Strategic opportunities lie in the development of more specialized and value-added feed products, such as organic feeds, functional feeds for disease prevention, and precision nutrition solutions. The adoption of advanced manufacturing technologies and digitalization across the value chain will enhance efficiency and traceability. The growing emphasis on sustainability and ethical sourcing presents opportunities for companies that can demonstrate environmentally friendly production practices. Market penetration in untapped rural areas and the development of tailored solutions for smallholder farmers will be crucial for long-term growth. The industry is expected to witness continued consolidation and investment, fostering innovation and a more competitive landscape, ultimately contributing to India's food security and agricultural prosperity.

Compound Feed Industry in India Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes and Meals

- 2.3. By-products

- 2.4. Supplements

Compound Feed Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

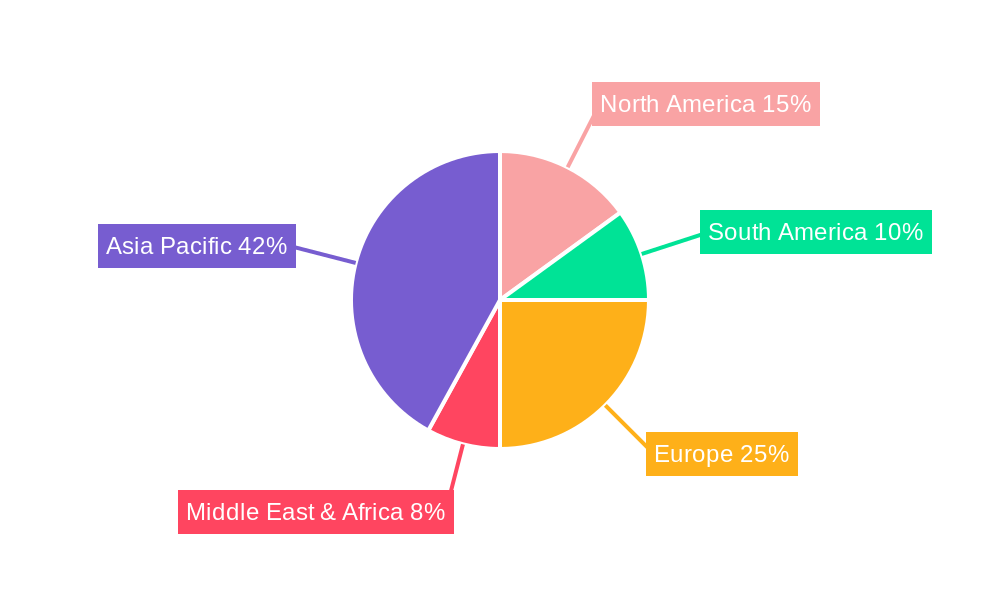

Compound Feed Industry in India Regional Market Share

Geographic Coverage of Compound Feed Industry in India

Compound Feed Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Meat and Dairy Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes and Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes and Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes and Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes and Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes and Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Compound Feed Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes and Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DeKalb Feeds

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alltech Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutreco (Trouw Nutrition)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suguna Foods Private Limite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargill Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Japfa Comfeeds India Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kyodo Shiryo Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 New Hope Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Godrej Agrovet Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nutreco NV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BASF SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DeKalb Feeds

List of Figures

- Figure 1: Global Compound Feed Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Compound Feed Industry in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: North America Compound Feed Industry in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Compound Feed Industry in India Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: North America Compound Feed Industry in India Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Compound Feed Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Compound Feed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Compound Feed Industry in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: South America Compound Feed Industry in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Compound Feed Industry in India Revenue (Million), by Ingredient 2025 & 2033

- Figure 11: South America Compound Feed Industry in India Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Compound Feed Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Compound Feed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Compound Feed Industry in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Compound Feed Industry in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Compound Feed Industry in India Revenue (Million), by Ingredient 2025 & 2033

- Figure 17: Europe Compound Feed Industry in India Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Compound Feed Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Compound Feed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Compound Feed Industry in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Compound Feed Industry in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Compound Feed Industry in India Revenue (Million), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Compound Feed Industry in India Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Compound Feed Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Compound Feed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Compound Feed Industry in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Compound Feed Industry in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Compound Feed Industry in India Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Compound Feed Industry in India Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Compound Feed Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Compound Feed Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global Compound Feed Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Global Compound Feed Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 12: Global Compound Feed Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 17: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 18: Global Compound Feed Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 29: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 30: Global Compound Feed Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Compound Feed Industry in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 38: Global Compound Feed Industry in India Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 39: Global Compound Feed Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Compound Feed Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Industry in India?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Compound Feed Industry in India?

Key companies in the market include DeKalb Feeds, Alltech Inc, Nutreco (Trouw Nutrition), Archer Daniels Midland, Suguna Foods Private Limite, Cargill Inc, Japfa Comfeeds India Pvt Ltd, Kyodo Shiryo Company, New Hope Group, Godrej Agrovet Limited, Nutreco NV, BASF SE.

3. What are the main segments of the Compound Feed Industry in India?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Consumption of Meat and Dairy Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: The Asian Development Bank (ADB) and ABIS Exports India Private Limited (ABIS) entered into an agreement to subscribe to non-convertible debentures for USD 16 million to enhance food security in India by supporting the construction of a microfiche feed plant and by training up to 6,000 farmers in climate-resilient fish farming practices as well as financial literacy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Industry in India?

To stay informed about further developments, trends, and reports in the Compound Feed Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence