Key Insights

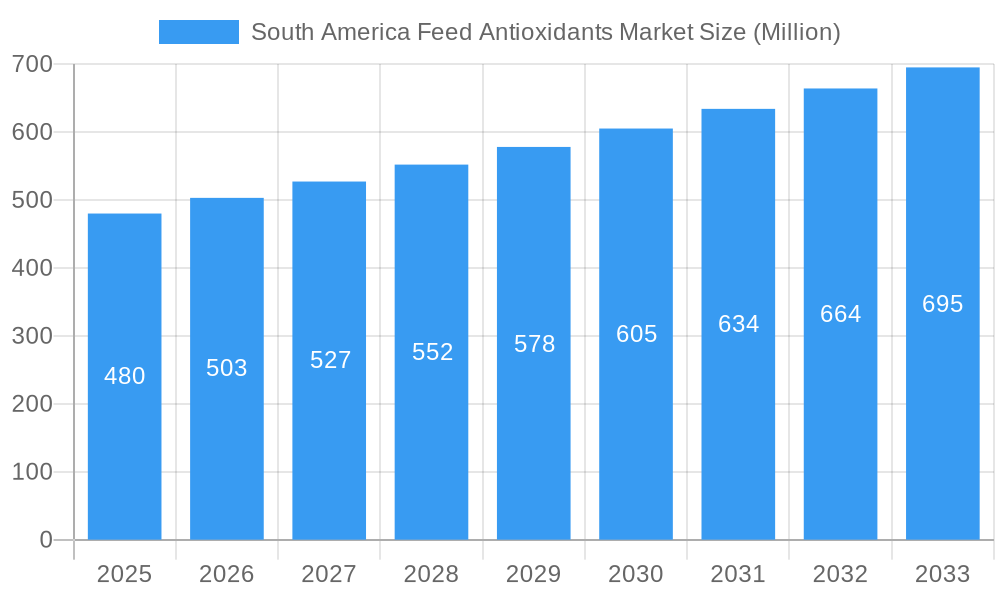

The South America Feed Antioxidants Market is projected for substantial growth, with an estimated market size of 175.8 million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.3%. This expansion is driven by increasing demand for premium animal feed, spurred by the expanding livestock and aquaculture sectors. Key factors include heightened farmer awareness of oxidation's negative impacts on feed quality, nutritional content, and shelf-life. The imperative to enhance animal health, optimize feed conversion ratios, and improve profitability is a significant driver for feed antioxidant adoption. Furthermore, stringent animal feed safety and quality regulations are bolstering market demand. The increasing focus on sustainable animal farming and minimizing post-harvest feed losses also contribute to a positive market outlook.

South America Feed Antioxidants Market Market Size (In Million)

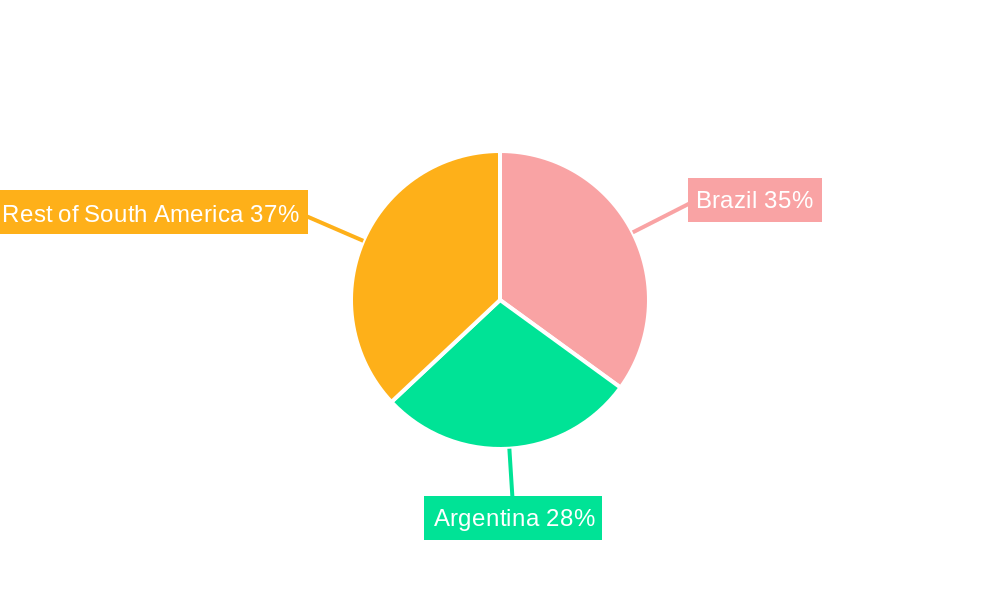

The market is segmented by antioxidant type, with BHA and BHT anticipated to maintain significant market share due to their proven effectiveness and affordability. However, increasing interest in natural antioxidants and advancements in novel synthetic alternatives will fuel growth in the "Others" segment. Poultry and swine segments are expected to lead animal type segmentation, reflecting their substantial contribution to regional protein production. Aquaculture is also poised for rapid growth with the intensification of fish farming. Geographically, Brazil and Argentina are projected to be the dominant markets, supported by their extensive agricultural operations and established animal husbandry. The remainder of South America presents significant growth potential as these nations advance their agricultural infrastructure and protein production capabilities. Potential challenges include fluctuating raw material prices and the emergence of alternative feed preservation methods.

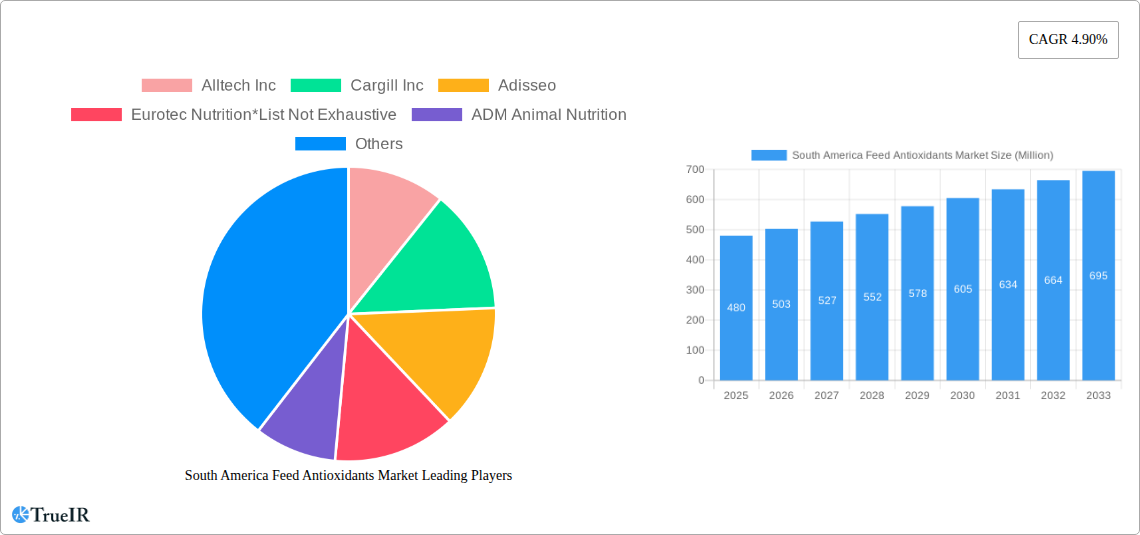

South America Feed Antioxidants Market Company Market Share

South America Feed Antioxidants Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

Unlock the lucrative potential of the South America Feed Antioxidants Market with this in-depth report. Covering a critical period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report provides unparalleled insights into market dynamics, key trends, competitive strategies, and future growth trajectories. Leverage high-volume keywords such as "animal feed additives," "feed preservatives," "poultry feed antioxidants," "swine feed antioxidants," "ruminant feed antioxidants," and "aquaculture feed antioxidants" to enhance your search rankings and attract industry professionals.

South America Feed Antioxidants Market Market Structure & Competitive Landscape

The South America Feed Antioxidants Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for animal protein, the growing awareness of animal health and welfare, and the constant need to improve feed quality and shelf-life. Regulatory impacts, while varied across countries, are generally pushing for safer and more effective antioxidant solutions, influencing product development and market entry strategies. Product substitutes, including natural antioxidants and improved storage practices, are present but often struggle to match the cost-effectiveness and efficacy of synthetic options in large-scale commercial operations. End-user segmentation is driven by the specific nutritional requirements and production scales of different animal types, with poultry and swine segments exhibiting the highest demand. Mergers and acquisitions (M&A) activity, while not extensive, plays a crucial role in consolidating market power and expanding product portfolios. For instance, the acquisition of smaller, specialized antioxidant manufacturers by larger conglomerates has been observed, aiming to enhance R&D capabilities and broaden geographical reach. The competitive landscape is further shaped by price sensitivity and the need for robust distribution networks to serve diverse agricultural regions. Concentration Ratio: Approximately 55-65% of the market is held by the top 5 players. M&A Volumes: An estimated 5-8 significant M&A deals have occurred within the historical period.

South America Feed Antioxidants Market Market Trends & Opportunities

The South America Feed Antioxidants Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is intrinsically linked to the escalating global demand for animal protein, a trend particularly pronounced in South America due to its growing population and rising disposable incomes. As livestock and aquaculture sectors continue to scale up, the requirement for high-quality feed that ensures optimal animal health, nutrient absorption, and prolonged shelf-life becomes paramount. Feed antioxidants play a pivotal role in preserving the nutritional integrity of feed, preventing the oxidation of fats and vitamins, and thereby minimizing feed spoilage and enhancing palatability. Technological advancements are continuously shaping the market, with a growing emphasis on developing more potent, cost-effective, and naturally derived antioxidant solutions. While synthetic antioxidants like BHA (Butylated Hydroxyanisole) and BHT (Butylated Hydroxytoluene) have historically dominated, there is a discernible shift towards a more balanced portfolio, incorporating synergistic blends and exploring novel compounds. Consumer preferences are also indirectly influencing the market; as consumers demand healthier and more sustainably produced animal products, feed manufacturers are incentivized to invest in premium feed ingredients that contribute to animal well-being and reduce reliance on antibiotics. The competitive dynamics are intense, with established global players vying for market share against emerging regional manufacturers. Opportunities lie in catering to the specific needs of different animal types, developing customized antioxidant solutions for various feed formulations, and expanding into underserved geographical regions within South America. The market penetration rate for feed antioxidants is estimated to be around 70-75% in major livestock-producing nations, with significant untapped potential in smaller agricultural operations and developing segments like aquaculture. The increasing adoption of advanced feed processing technologies also presents an opportunity, as these processes can sometimes degrade natural antioxidants, necessitating the addition of synthetic counterparts. Furthermore, the growing focus on reducing post-harvest losses in the agricultural supply chain indirectly benefits the feed antioxidant market, as spoilage at the feed production stage is a critical concern. The development of smart packaging solutions that incorporate antioxidant properties is another emerging area that could further bolster market growth.

Dominant Markets & Segments in South America Feed Antioxidants Market

Within the South America Feed Antioxidants Market, Brazil stands out as the dominant geographical market, driven by its colossal livestock industry, particularly in poultry and swine production. The country's extensive agricultural infrastructure, coupled with supportive government policies aimed at boosting animal protein exports, creates a fertile ground for feed additive demand. Argentina follows as a significant contributor, with its strong beef and poultry sectors also driving the consumption of feed antioxidants. The "Rest of South America" encompasses a growing but fragmented market, with countries like Colombia, Chile, and Peru exhibiting increasing potential due to expanding livestock and aquaculture operations.

In terms of Type, while BHA and BHT have traditionally held a strong position due to their cost-effectiveness and efficacy, Ethoxyquin is witnessing a surge in demand, especially in regions with higher regulatory scrutiny and a focus on specific applications like pet food and aquaculture. The "Others" category, which includes natural antioxidants like tocopherols (Vitamin E) and rosemary extract, is also gaining traction, driven by consumer demand for natural ingredients and a growing emphasis on feed safety.

The Animal Type segmentation reveals that Poultry and Swine are the largest consumers of feed antioxidants. This is directly attributable to the high-volume production and rapid growth cycles of these animals, where feed quality and stability are critical for economic viability. Ruminant nutrition also presents a substantial market, as antioxidants help preserve the quality of feed for cattle, particularly in extensive grazing systems. The Aquaculture segment, while currently smaller, is exhibiting the fastest growth rate, fueled by the expansion of fish and shrimp farming operations across the continent.

Key Growth Drivers in Brazil:

- Massive scale of poultry and swine production for domestic consumption and export.

- Government incentives for agricultural modernization and export promotion.

- Significant investment in feed milling infrastructure.

- Increasing adoption of advanced animal nutrition practices.

Market Dominance in Poultry and Swine:

- The rapid growth cycles and high feed intake of poultry and swine necessitate consistent feed quality.

- Antioxidants prevent fat rancidity and vitamin degradation, crucial for optimal growth and health.

- Economic pressures in these high-volume industries make efficient feed utilization a priority.

Emerging Trends in Aquaculture:

- Rapid expansion of fish and shrimp farming to meet rising seafood demand.

- Need for stable, nutrient-rich feeds to support aquatic animal health and growth.

- Growing interest in antioxidants to protect feed during storage in humid environments.

South America Feed Antioxidants Market Product Analysis

Product innovation in the South America Feed Antioxidants Market is focused on enhancing efficacy, improving stability, and exploring synergistic formulations. Manufacturers are developing advanced synthetic antioxidants with improved absorption rates and targeted action. Concurrently, there's a significant push towards natural antioxidants, such as Vitamin E and various plant extracts, driven by consumer demand for cleaner labels and a perception of better animal welfare. These natural options offer competitive advantages in specific market niches. The application scope of feed antioxidants is broad, extending from preserving the quality of bulk feed ingredients to ensuring the shelf-life of finished feed pellets. Competitive advantages are being carved out through superior product performance, cost-effectiveness, and the ability to provide tailored solutions for different feed types and animal species. Technological advancements are leading to more sophisticated blending techniques that maximize the synergistic benefits of multiple antioxidant compounds.

Key Drivers, Barriers & Challenges in South America Feed Antioxidants Market

Key Drivers:

- Growing Demand for Animal Protein: The burgeoning global and regional demand for meat, poultry, and fish directly fuels the need for high-quality animal feed, thereby increasing the consumption of feed antioxidants. This is a primary economic driver.

- Focus on Animal Health and Welfare: Increased awareness among farmers and consumers regarding animal health and the prevention of diseases leads to greater adoption of feed additives that contribute to well-being.

- Technological Advancements in Feed Production: Modern feed milling processes often involve heat treatments that can degrade nutrient quality, necessitating the use of antioxidants to preserve essential nutrients and extend shelf-life.

- Government Support and Subsidies: Several South American governments are promoting agricultural development and export, which indirectly supports the feed industry and the demand for its inputs.

- Increasing Farm Productivity: Farmers are continuously seeking ways to improve feed conversion ratios and overall farm productivity, making high-quality, well-preserved feed a critical component.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the cost of key raw materials for antioxidant production can impact market pricing and profitability.

- Regulatory Hurdles and Varying Standards: Different countries within South America have distinct regulatory frameworks for feed additives, creating complexity for manufacturers and distributors. This includes differing approval processes and restrictions on certain compounds.

- Supply Chain Disruptions: Geopolitical events, logistical challenges, and natural disasters can disrupt the supply chain, impacting the availability and timely delivery of feed antioxidants.

- Competition from Natural Alternatives: While synthetic antioxidants remain dominant, the growing consumer preference for natural products presents a competitive challenge, pushing for research and development in this area.

- Economic Instability in Some Regions: Economic downturns or currency fluctuations in certain South American countries can impact the purchasing power of farmers, potentially slowing down the adoption of premium feed additives.

- Lack of Awareness in Smaller Farms: In some smaller, less industrialized agricultural operations, there might be a lack of awareness regarding the full benefits of using feed antioxidants.

Growth Drivers in the South America Feed Antioxidants Market Market

The South America Feed Antioxidants Market is propelled by several interconnected growth drivers. Technologically, advancements in feed processing require robust antioxidant solutions to counteract nutrient degradation, ensuring optimal feed quality and value. Economically, the escalating global and regional demand for animal protein, particularly in emerging economies, directly translates to increased demand for animal feed and its essential additives like antioxidants. Regulatory environments are increasingly favoring the use of feed additives that enhance animal health and food safety, often leading to the adoption of more sophisticated antioxidant formulations. Furthermore, the continuous need for farmers to improve feed conversion ratios and reduce spoilage to enhance profitability inherently drives the demand for effective feed preservatives. The expansion of aquaculture is another significant growth catalyst, as specialized feed formulations for aquatic species require precise antioxidant protection.

Challenges Impacting South America Feed Antioxidants Market Growth

Several challenges can impede the growth of the South America Feed Antioxidants Market. Regulatory complexities across different nations within the region can create significant hurdles for market entry and product registration, leading to extended timelines and increased compliance costs. Supply chain vulnerabilities, including logistical inefficiencies and potential disruptions, can affect the consistent availability of raw materials and finished products, impacting delivery schedules and customer satisfaction. Intense competitive pressures from both established global players and emerging local manufacturers can lead to price wars and reduced profit margins. Moreover, the fluctuating economic conditions in some South American countries can impact the purchasing power of feed manufacturers and farmers, potentially delaying or reducing investment in premium feed additives. The inherent volatility of raw material prices also poses a challenge to maintaining stable pricing and profitability.

Key Players Shaping the South America Feed Antioxidants Market Market

- Alltech Inc

- Cargill Inc

- Adisseo

- Eurotec Nutrition

- ADM Animal Nutrition

- Novozymes

- DSM

- BASF SE

- DuPont de Nemours, Inc.

- Evonik Industries AG

Significant South America Feed Antioxidants Market Industry Milestones

- 2019: Increased focus on natural antioxidants and their incorporation into poultry feed formulations.

- 2020: Heightened demand for feed antioxidants due to supply chain disruptions impacting feed quality in certain regions.

- 2021: Expansion of aquaculture feed production driving demand for specialized antioxidants.

- 2022: Greater adoption of advanced feed milling technologies necessitating enhanced antioxidant protection.

- 2023: Strategic partnerships and mergers aimed at expanding product portfolios and geographical reach in key South American markets.

- 2024: Growing regulatory scrutiny on certain synthetic antioxidants, prompting research into alternatives.

Future Outlook for South America Feed Antioxidants Market Market

The future outlook for the South America Feed Antioxidants Market remains exceptionally positive, driven by persistent growth catalysts. The ever-increasing global demand for animal protein will continue to underpin the need for high-quality animal feed, directly translating into sustained demand for effective feed antioxidants. Strategic opportunities lie in the development and promotion of novel, highly effective, and sustainable antioxidant solutions, including bio-based and natural alternatives, to meet evolving consumer preferences and regulatory landscapes. The rapid expansion of the aquaculture sector presents a significant untapped market with immense growth potential. Furthermore, investing in robust distribution networks and localized technical support will be crucial for capturing market share in diverse South American regions. The market is expected to witness a steady increase in the adoption of synergistic antioxidant blends, offering enhanced protection and cost-effectiveness, thereby solidifying its trajectory of robust growth.

South America Feed Antioxidants Market Segmentation

-

1. Type

- 1.1. BHA

- 1.2. BHT

- 1.3. Ethoxyquin

- 1.4. Others

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Antioxidants Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Antioxidants Market Regional Market Share

Geographic Coverage of South America Feed Antioxidants Market

South America Feed Antioxidants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. Increasing Meat Consumption Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. BHA

- 5.1.2. BHT

- 5.1.3. Ethoxyquin

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. BHA

- 6.1.2. BHT

- 6.1.3. Ethoxyquin

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. BHA

- 7.1.2. BHT

- 7.1.3. Ethoxyquin

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. BHA

- 8.1.2. BHT

- 8.1.3. Ethoxyquin

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Alltech Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cargill Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Adisseo

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eurotec Nutrition*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ADM Animal Nutrition

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Alltech Inc

List of Figures

- Figure 1: South America Feed Antioxidants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Feed Antioxidants Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: South America Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Antioxidants Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Antioxidants Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: South America Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: South America Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Antioxidants Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: South America Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: South America Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Antioxidants Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: South America Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: South America Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Antioxidants Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Antioxidants Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the South America Feed Antioxidants Market?

Key companies in the market include Alltech Inc, Cargill Inc, Adisseo, Eurotec Nutrition*List Not Exhaustive, ADM Animal Nutrition.

3. What are the main segments of the South America Feed Antioxidants Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 175.8 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

Increasing Meat Consumption Drives the Market.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Antioxidants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Antioxidants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Antioxidants Market?

To stay informed about further developments, trends, and reports in the South America Feed Antioxidants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence