Key Insights

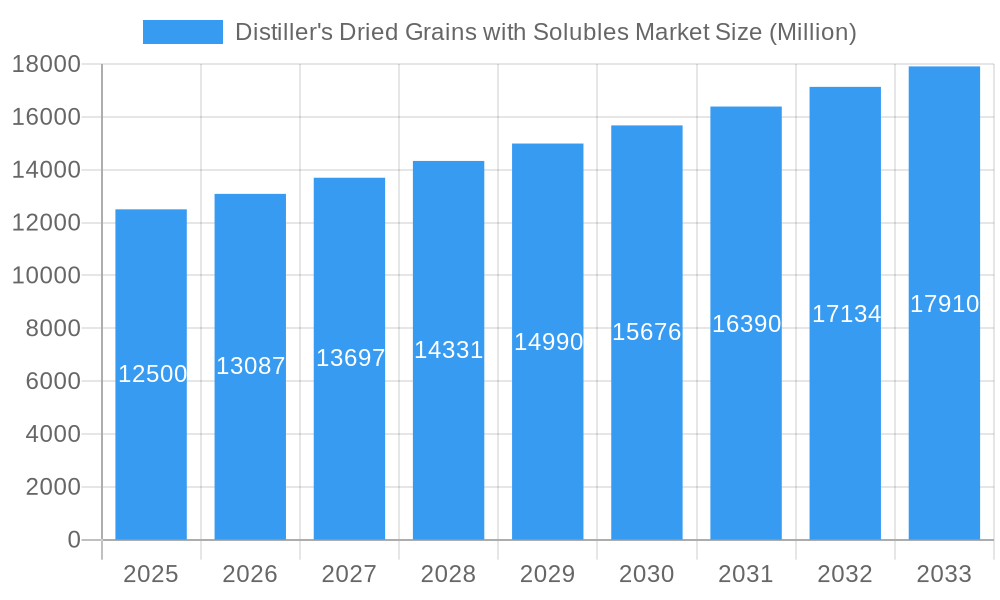

The global Distiller's Dried Grains with Solubles (DDGS) market is poised for robust expansion, projected to reach a substantial market size of approximately $12,500 million by 2025 and experiencing a Compound Annual Growth Rate (CAGR) of 4.70% through 2033. This upward trajectory is primarily fueled by the escalating demand for animal feed driven by the burgeoning global population and the increasing consumption of meat and dairy products. DDGS, a byproduct of the ethanol production process, offers a cost-effective and nutrient-rich alternative to traditional feed ingredients, making it an attractive option for feed manufacturers. Furthermore, growing environmental consciousness and the industry's focus on sustainable practices are bolstering the adoption of DDGS, as it represents an efficient utilization of agricultural byproducts, thereby contributing to a circular economy within the food and feed sectors.

Distiller's Dried Grains with Solubles Market Market Size (In Billion)

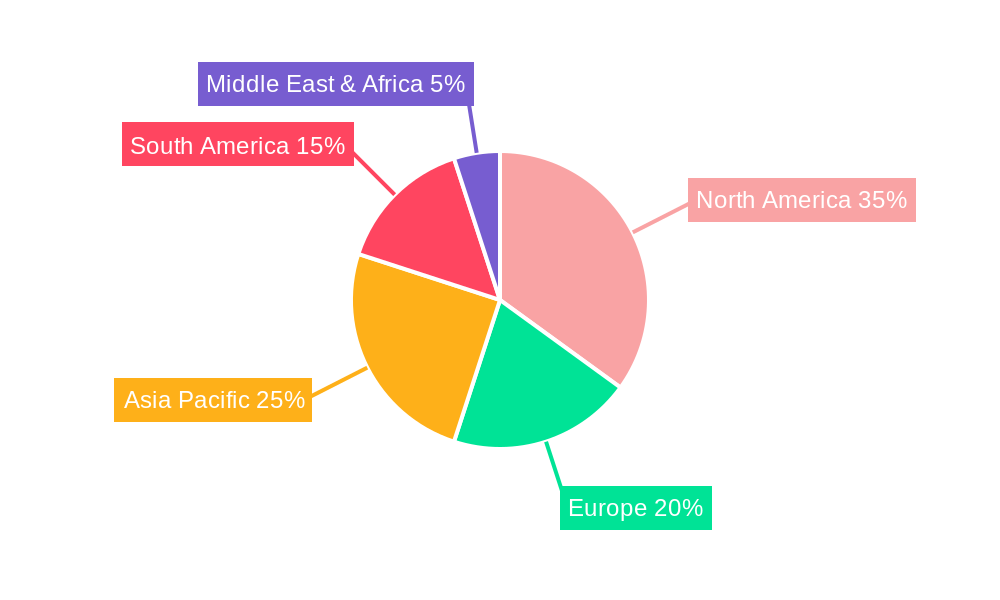

The market's growth is further amplified by advancements in ethanol production technology, leading to higher yields and improved quality of DDGS. Key drivers include the significant role of corn as a primary feedstock for ethanol, thereby ensuring a consistent supply of DDGS. Emerging economies, particularly in Asia Pacific and South America, are witnessing increased demand for animal protein, which in turn drives the need for animal feed and consequently DDGS. However, the market faces certain restraints, including fluctuations in corn prices and the potential for logistical challenges in transporting this bulky commodity across long distances. Despite these headwinds, the market's inherent value proposition as a sustainable and economical feed ingredient, coupled with ongoing innovation in its application and processing, ensures a promising outlook for the global Distiller's Dried Grains with Solubles market.

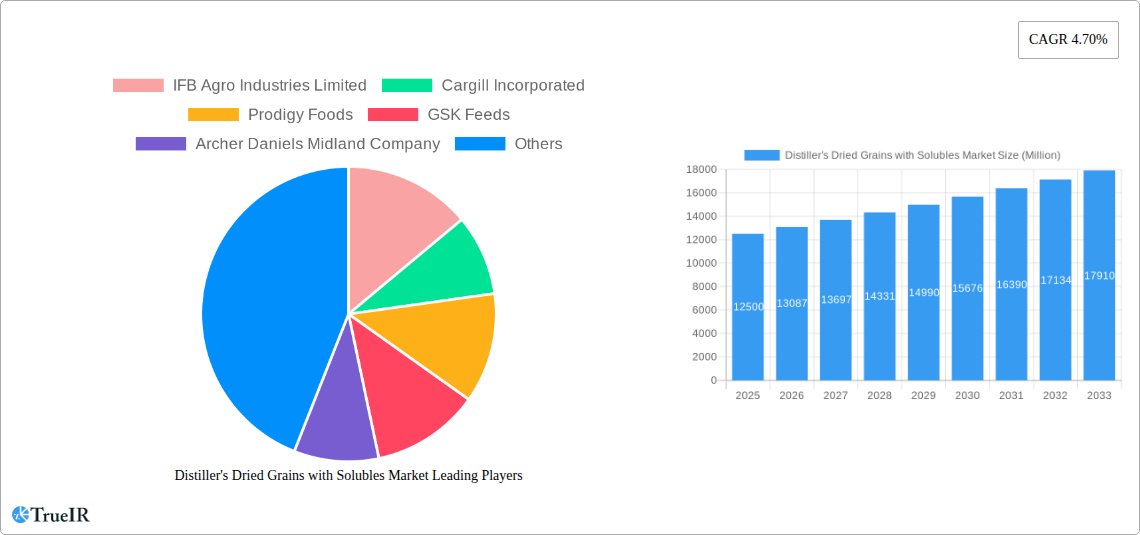

Distiller's Dried Grains with Solubles Market Company Market Share

Distiller's Dried Grains with Solubles (DDGS) Market Report: Unlocking Global Feed Value (2019–2033)

This comprehensive Distiller's Dried Grains with Solubles (DDGS) market report delivers an in-depth analysis of the global DDGS industry, a vital co-product of the ethanol production process increasingly recognized for its nutritional value in animal feed. Spanning the historical period of 2019–2024 and projecting through 2033, this report provides critical insights for stakeholders navigating the dynamic DDGS market size, DDGS market trends, and DDGS market opportunities. Our analysis is grounded in the base year of 2025, with estimations for the same year, offering a clear picture of the current market landscape and future trajectory. We delve into segmentation by DDGS type (Corn, Wheat, Rice, Blended Grains, Other Types) and animal type (Ruminants, Poultry, Swine, Other Animal Types), identifying key growth drivers and influential industry developments.

Distiller's Dried Grains with Solubles Market Structure & Competitive Landscape

The Distiller's Dried Grains with Solubles market exhibits a moderate level of concentration, with a few dominant players alongside a substantial number of regional and smaller manufacturers. Innovation is primarily driven by advancements in ethanol production efficiency, leading to improved DDGS quality and consistency, alongside research into novel feed applications. Regulatory impacts, particularly concerning feed safety standards and international trade policies, play a significant role in market access and product formulation. Product substitutes, such as soybean meal and other protein-rich feed ingredients, pose a competitive challenge, necessitating continuous value proposition enhancement for DDGS. End-user segmentation is critical, with the poultry feed market and ruminant feed market representing the largest consumers. Mergers and acquisitions (M&A) are observed as a strategy for market consolidation and geographical expansion, with recent M&A volumes in the past three years estimated at approximately $500 Million globally. Key companies actively shaping this landscape include Archer Daniels Midland Company, Cargill Incorporated, IFB Agro Industries Limited, Prodigy Foods, GSK Feeds, Nugen Feeds, Nutrigo Feeds, and Prorich Agro Food.

Distiller's Dried Grains with Solubles Market Trends & Opportunities

The Distiller's Dried Grains with Solubles market is poised for robust growth, driven by increasing global demand for animal protein and a sustained focus on sustainable feed solutions. The global DDGS market value is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, reaching an estimated value of over $25 Billion by the end of the forecast period. This expansion is fueled by the rising awareness of DDGS as a cost-effective, protein-rich, and nutrient-dense alternative to traditional feed ingredients, particularly in the livestock feed industry. Technological shifts in ethanol production are continuously enhancing the nutritional profile and palatability of DDGS, expanding its applicability across various animal species and life stages. Consumer preferences for ethically and sustainably produced food are indirectly benefiting DDGS, as it contributes to a more circular economy by utilizing by-products from bioenergy production. The competitive dynamics are characterized by a growing emphasis on quality control, supply chain efficiency, and product differentiation through specialized formulations. Opportunities abound for market penetration in emerging economies with expanding livestock sectors and for the development of value-added DDGS products catering to specific nutritional requirements. Furthermore, the increasing adoption of advanced processing techniques to improve DDGS digestibility and reduce anti-nutritional factors presents significant avenues for innovation and market leadership. The integration of DDGS into compound feed formulations is becoming more sophisticated, with a greater understanding of its amino acid profile and energy content, leading to optimized animal performance and reduced overall feed costs for farmers. The development of novel applications, such as its use in aquaculture feed and pet food, further broadens the market potential and diversification.

Dominant Markets & Segments in Distiller's Dried Grains with Solubles Market

The Corn DDGS segment dominates the global market, accounting for an estimated 75% of total production and consumption, primarily due to the widespread availability of corn as a feedstock for ethanol production in major producing regions like North America and Europe. The Poultry segment is the largest end-user by animal type, driven by the rapid expansion of the global poultry industry and the demand for high-protein feed to support broiler growth and egg production. Within regions, North America, particularly the United States, remains the leading market for DDGS, owing to its established ethanol infrastructure and significant livestock population.

- Dominant Segments:

- Type: Corn DDGS

- Animal Type: Poultry

- Key Growth Drivers for Dominant Segments:

- Corn DDGS: Abundant and cost-effective feedstock availability, established processing infrastructure, and high nutritional value for livestock.

- Poultry: Escalating global demand for poultry meat and eggs, cost-efficiency of DDGS in poultry feed formulations, and its protein and amino acid profile supporting rapid growth.

- Regional Dominance: North America, led by the United States, continues to be the powerhouse for DDGS production and export, benefiting from supportive government policies for biofuel production and a large, established livestock sector. Emerging markets in Asia and Latin America are witnessing significant growth due to the expansion of their respective animal agriculture industries and increasing adoption of DDGS as a feed ingredient. Government policies promoting biofuel production and the utilization of agricultural by-products are crucial factors in fostering market growth and dominance in these regions. Infrastructure development, including efficient transportation networks for both raw materials and finished DDGS, is also paramount in ensuring market accessibility and competitiveness.

Distiller's Dried Grains with Solubles Market Product Analysis

Product innovation in the Distiller's Dried Grains with Solubles market focuses on enhancing nutritional content, improving digestibility, and ensuring consistent quality. Advances in processing technologies allow for the optimization of amino acid profiles, increased energy density, and reduced levels of anti-nutritional factors. These advancements enable DDGS to be a highly effective and versatile ingredient across various animal feed applications, providing a competitive advantage over conventional protein sources. The primary application remains as a protein and energy supplement in livestock feed, contributing to improved animal health and productivity.

Key Drivers, Barriers & Challenges in Distiller's Dried Grains with Solubles Market

Key Drivers:

- Growing Demand for Animal Protein: Rising global population and increasing disposable incomes are fueling the demand for meat, dairy, and eggs, consequently boosting the demand for animal feed.

- Cost-Effectiveness of DDGS: DDGS offers a more economical protein source compared to traditional ingredients like soybean meal, making it attractive for feed manufacturers.

- Sustainability and Circular Economy: Utilization of a co-product from bioethanol production aligns with sustainability goals and promotes a circular economy.

- Nutritional Value: DDGS is a rich source of protein, fiber, phosphorus, and other essential nutrients beneficial for animal growth and health.

- Government Policies: Supportive policies for biofuel production and the utilization of agricultural by-products contribute to market growth.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in ethanol production, linked to biofuel mandates and feedstock availability, can impact DDGS supply and price stability.

- Quality Variability: Differences in processing methods and feedstock can lead to variations in DDGS composition and quality, requiring stringent quality control measures.

- Competition from Substitutes: Soybean meal and other protein sources present ongoing competition, influencing DDGS market share.

- Regulatory Hurdles: Evolving feed safety regulations and international trade policies can create barriers for market access and export.

- Logistics and Transportation Costs: The bulk nature of DDGS can result in significant transportation costs, impacting its competitiveness in distant markets. Supply chain disruptions, such as those seen in the historical period due to global events, can significantly impact availability and pricing, with an estimated impact of 10-15% on market stability during such periods.

Growth Drivers in the Distiller's Dried Grains with Solubles Market Market

Key growth drivers for the Distiller's Dried Grains with Solubles market are predominantly economic and policy-driven. The escalating global demand for animal protein, coupled with the inherent cost-effectiveness of DDGS as a protein and energy supplement in animal feed, forms a primary economic impetus. Government mandates promoting biofuel production directly influence DDGS supply, thereby acting as a significant policy-driven growth catalyst. Furthermore, increasing awareness and adoption of sustainable agricultural practices and the principles of a circular economy are creating a favorable environment for by-product utilization, positioning DDGS as an environmentally conscious feed ingredient. Technological advancements in optimizing DDGS for specific nutritional needs and enhancing its digestibility are also crucial growth enablers.

Challenges Impacting Distiller's Dried Grains with Solubles Market Growth

Challenges impacting the Distiller's Dried Grains with Solubles market growth are multifaceted. Regulatory complexities surrounding feed safety and international trade agreements can impede market access and create uncertainties for exporters. Supply chain volatility, stemming from fluctuations in ethanol production volumes and feedstock availability, poses a persistent risk to consistent supply and price stability. Competitive pressures from alternative protein sources, such as soybean meal, necessitate continuous efforts to highlight the cost-benefit advantages of DDGS. Additionally, logistical and transportation costs associated with moving a bulk commodity can impact its overall competitiveness, especially in international markets, potentially increasing final product costs by 5-10% depending on the destination.

Key Players Shaping the Distiller's Dried Grains with Solubles Market Market

- IFB Agro Industries Limited

- Cargill Incorporated

- Prodigy Foods

- GSK Feeds

- Archer Daniels Midland Company

- Nugen Feeds

- Nutrigo Feeds

- Prorich Agro Food

Significant Distiller's Dried Grains with Solubles Market Industry Milestones

- 2019-2020: Increased global focus on renewable energy and biofuels led to a surge in ethanol production, consequently boosting DDGS availability.

- 2020-2021: Supply chain disruptions due to the COVID-19 pandemic impacted global trade and logistics for DDGS, leading to price volatility.

- 2022: Advancements in feed formulation technology allowed for greater inclusion of DDGS in poultry and swine diets, enhancing its market penetration.

- 2023: Increased awareness of DDGS's nutritional benefits and cost-effectiveness drove its adoption in emerging markets, particularly in Asia and Latin America.

- 2024: Growing emphasis on sustainable agriculture and by-product utilization further solidified DDGS's position in the global animal feed market.

Future Outlook for Distiller's Dried Grains with Solubles Market Market

The future outlook for the Distiller's Dried Grains with Solubles market remains highly positive, driven by sustained demand for affordable and sustainable animal feed ingredients. Strategic opportunities lie in further optimizing DDGS for specialized animal nutrition, expanding its application into aquaculture, and developing innovative value-added products. The increasing integration of DDGS into global feed supply chains, coupled with ongoing technological advancements in ethanol and DDGS processing, will continue to drive market expansion and solidify its role as a crucial component of the global livestock industry. The market potential is estimated to grow by an additional 20% by 2033, driven by these factors.

Distiller's Dried Grains with Solubles Market Segmentation

-

1. Type

- 1.1. Corn

- 1.2. Wheat

- 1.3. Rice

- 1.4. Blended Grains

- 1.5. Other Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Other Animal Types

Distiller's Dried Grains with Solubles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Distiller's Dried Grains with Solubles Market Regional Market Share

Geographic Coverage of Distiller's Dried Grains with Solubles Market

Distiller's Dried Grains with Solubles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Awareness of Health Benefits Offered by the DDGS Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corn

- 5.1.2. Wheat

- 5.1.3. Rice

- 5.1.4. Blended Grains

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Corn

- 6.1.2. Wheat

- 6.1.3. Rice

- 6.1.4. Blended Grains

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Corn

- 7.1.2. Wheat

- 7.1.3. Rice

- 7.1.4. Blended Grains

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Corn

- 8.1.2. Wheat

- 8.1.3. Rice

- 8.1.4. Blended Grains

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Corn

- 9.1.2. Wheat

- 9.1.3. Rice

- 9.1.4. Blended Grains

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Distiller's Dried Grains with Solubles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Corn

- 10.1.2. Wheat

- 10.1.3. Rice

- 10.1.4. Blended Grains

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminants

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IFB Agro Industries Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Prodigy Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GSK Feeds

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Archer Daniels Midland Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nugen Feeds

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nutrigo Feeds

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prorich Agro Food

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 IFB Agro Industries Limited

List of Figures

- Figure 1: Global Distiller's Dried Grains with Solubles Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 5: North America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 11: South America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Distiller's Dried Grains with Solubles Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Distiller's Dried Grains with Solubles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Distiller's Dried Grains with Solubles Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Distiller's Dried Grains with Solubles Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Distiller's Dried Grains with Solubles Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 17: Europe Distiller's Dried Grains with Solubles Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Distiller's Dried Grains with Solubles Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Distiller's Dried Grains with Solubles Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Distiller's Dried Grains with Solubles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 12: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 18: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 30: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 39: Global Distiller's Dried Grains with Solubles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Distiller's Dried Grains with Solubles Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Distiller's Dried Grains with Solubles Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Distiller's Dried Grains with Solubles Market?

Key companies in the market include IFB Agro Industries Limited, Cargill Incorporated, Prodigy Foods, GSK Feeds, Archer Daniels Midland Company, Nugen Feeds, Nutrigo Feeds, Prorich Agro Food.

3. What are the main segments of the Distiller's Dried Grains with Solubles Market?

The market segments include Type, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Awareness of Health Benefits Offered by the DDGS Feed.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Distiller's Dried Grains with Solubles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Distiller's Dried Grains with Solubles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Distiller's Dried Grains with Solubles Market?

To stay informed about further developments, trends, and reports in the Distiller's Dried Grains with Solubles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence