Key Insights

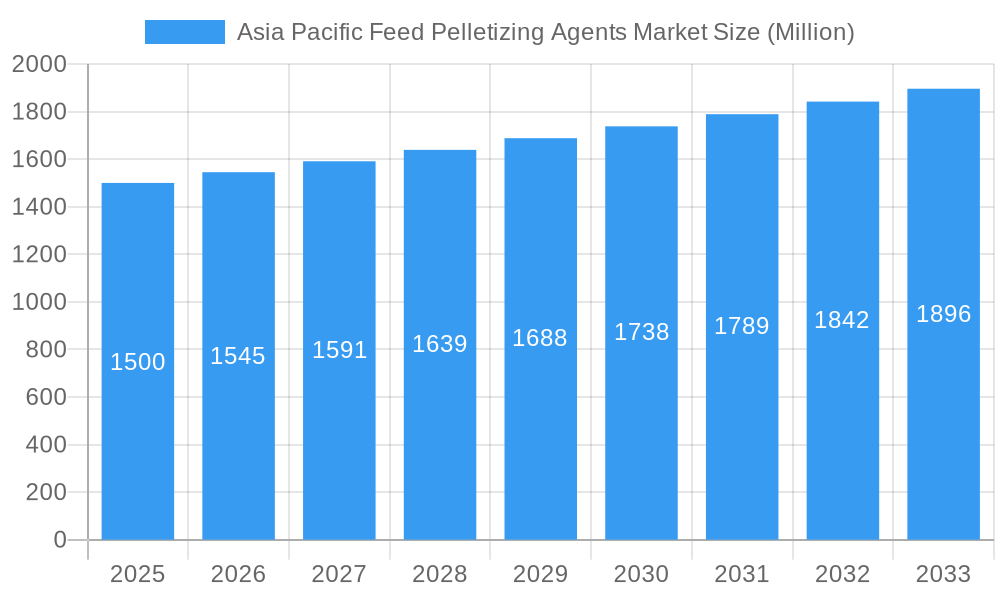

The Asia Pacific feed pelletizing agents market, valued at approximately $XX million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 3.00% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for animal protein globally, particularly in rapidly developing economies within the Asia-Pacific region like China and India, fuels the need for efficient and cost-effective feed production. Feed pelletization enhances feed quality, improves animal digestibility, reduces feed waste, and facilitates easier transportation and storage, thereby contributing to higher farm productivity and profitability. Furthermore, the growing adoption of sustainable and eco-friendly feed production practices is bolstering the demand for binders derived from renewable resources like lignin and hemi-cellulose, creating a niche for bio-based pelletizing agents. However, market growth might be somewhat constrained by fluctuating raw material prices, particularly for mineral-based binders, and the potential for regulatory changes impacting the use of certain additives in animal feed. The market segmentation highlights the dominance of ruminant feed, followed by poultry and swine, reflecting the livestock composition in the region. Key players like Brenntag Group, BASF SE, and Borregaard LignoTech are shaping the market landscape through innovation in binder technology and strategic partnerships with feed producers. The competitive landscape is characterized by both large multinational corporations and regional players catering to specific market needs.

Asia Pacific Feed Pelletizing Agents Market Market Size (In Billion)

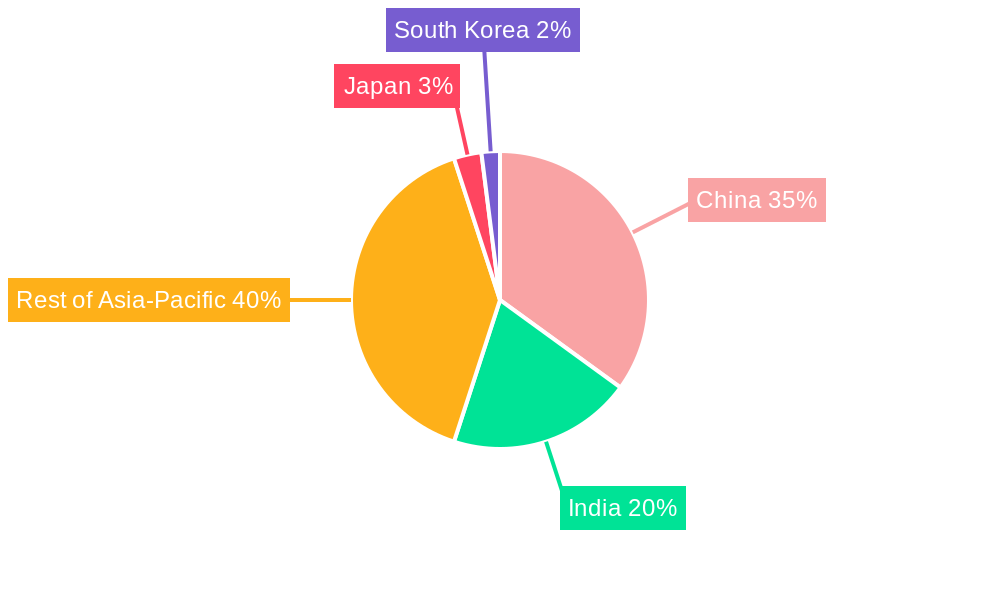

The regional breakdown indicates that China, India, and other Southeast Asian nations are major contributors to market growth, primarily due to their large livestock populations and expanding aquaculture industry. Japan and South Korea represent more mature markets with a focus on high-quality and specialized feed products. Future growth will likely be influenced by advancements in binder technology focusing on improved binding efficiency, enhanced nutrient preservation, and reduced environmental impact. The integration of digital technologies in feed formulation and production processes will also play a crucial role in optimizing the use of pelletizing agents and improving overall feed efficiency. Government initiatives promoting sustainable agriculture and livestock farming will further shape the market's trajectory in the coming years. Specific opportunities exist in developing innovative binders tailored to specific animal species and dietary needs, alongside a growing demand for traceable and sustainably sourced ingredients.

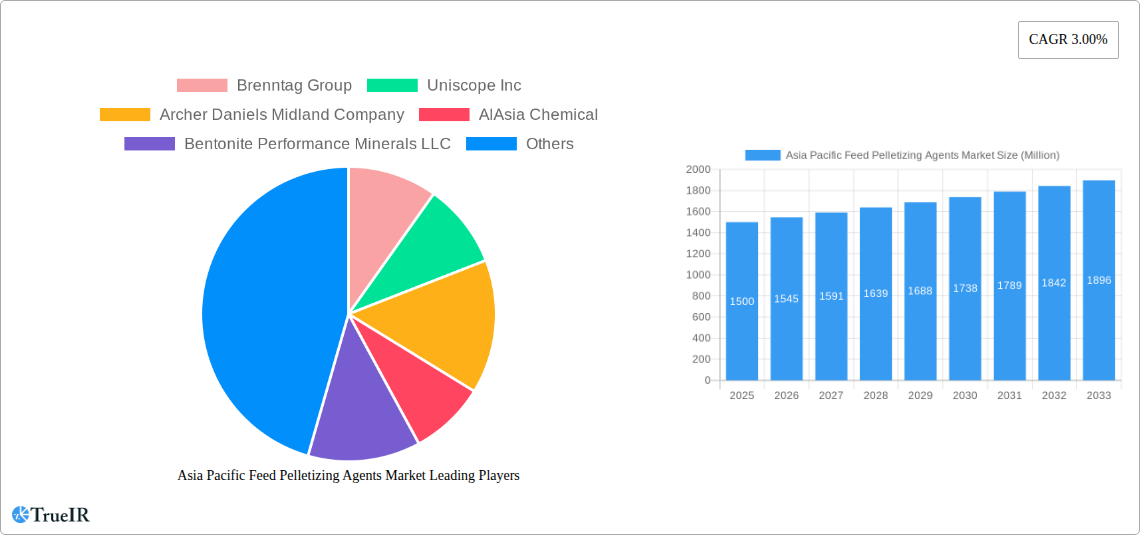

Asia Pacific Feed Pelletizing Agents Market Company Market Share

Asia Pacific Feed Pelletizing Agents Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Asia Pacific Feed Pelletizing Agents market, offering invaluable insights for businesses, investors, and industry stakeholders. Leveraging extensive market research and data analysis across the study period (2019-2033), with a focus on the base year 2025 and forecast period 2025-2033, this report unveils the market's current state and future trajectory. The report covers key market segments, competitive landscapes, growth drivers, challenges, and significant industry milestones. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia Pacific Feed Pelletizing Agents Market Structure & Competitive Landscape

The Asia Pacific Feed Pelletizing Agents market exhibits a moderately concentrated structure, with key players like Brenntag Group, Uniscope Inc, Archer Daniels Midland Company, AlAsia Chemical, Bentonite Performance Minerals LLC, BASF SE, Ashapura Group, Borregaard LignoTech, and Kiotechagi holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation in binder technology, particularly in sustainable and high-performance alternatives, is a key driver. Regulatory changes related to feed safety and environmental sustainability significantly impact market dynamics. Product substitutes, such as alternative binding agents, pose a moderate competitive threat. The market is segmented by type (Lignin-based Binders/Lignosulfonates, Hemi-cellulose Binders, Mineral Binders (Clays), Specialty Binders) and animal type (Ruminant, Poultry, Swine, Aquaculture, Pets, Others). M&A activity in the past five years has been moderate, with approximately xx deals recorded, primarily focused on expanding geographical reach and product portfolios.

- Market Concentration: Moderately concentrated, HHI (2024) estimated at xx.

- Innovation Drivers: Sustainable and high-performance binder technologies.

- Regulatory Impacts: Stringent feed safety and environmental regulations.

- Product Substitutes: Alternative binding agents.

- End-User Segmentation: Diverse, catering to various animal feed applications.

- M&A Trends: Moderate activity, focused on expansion and diversification.

Asia Pacific Feed Pelletizing Agents Market Market Trends & Opportunities

The Asia Pacific Feed Pelletizing Agents market is experiencing robust growth, driven by factors including the rising demand for animal protein, increasing adoption of pelletized feed, and growing focus on feed efficiency. The market size in 2024 is estimated at xx Million, and is projected to reach xx Million by 2033, showcasing significant potential. Technological advancements, such as the development of bio-based binders and improved pelletizing technologies, are further enhancing market growth. Changing consumer preferences towards sustainable and high-quality animal products are creating opportunities for environmentally friendly and performance-enhancing feed additives. Intensified competition among major players is stimulating innovation and price optimization. The market penetration rate for pelletized feed is steadily increasing across the region, driven by improvements in feed quality and handling.

Dominant Markets & Segments in Asia Pacific Feed Pelletizing Agents Market

China and India dominate the Asia Pacific Feed Pelletizing Agents market, accounting for over xx% of the total market value in 2024. The poultry segment is the largest consumer of feed pelletizing agents, followed by swine and ruminant. Lignin-based binders hold the largest market share amongst the various types.

- Key Growth Drivers in China: Rapid expansion of livestock farming and poultry production.

- Key Growth Drivers in India: Growing demand for poultry and aquaculture feed.

- Poultry Segment Dominance: Driven by high demand and efficient pelletization processes.

- Lignin-based Binders Market Share: Cost-effectiveness and sustainability appeal.

Country-Specific Analysis: Detailed breakdowns of market size and growth trends for key countries, including market share for each segment within these markets will be provided in the full report.

Asia Pacific Feed Pelletizing Agents Market Product Analysis

The Asia Pacific Feed Pelletizing Agents market features a wide range of products tailored to meet the specific needs of various animal feed applications. Innovation focuses on developing sustainable and high-performance binders with improved binding strength, water resistance, and cost-effectiveness. Bio-based binders, such as lignin-based and hemi-cellulose binders, are gaining traction due to their eco-friendly nature. The market also witnesses continuous advancements in specialized binders designed for particular animal species, enhancing nutrient utilization and improving pellet quality.

Key Drivers, Barriers & Challenges in Asia Pacific Feed Pelletizing Agents Market

Key Drivers:

- Rising demand for animal protein sources.

- Growing adoption of pelletized feed for efficient feed management.

- Increasing focus on improving feed efficiency and reducing feed costs.

- Technological advancements in binder technology and pelletizing equipment.

Challenges:

- Fluctuations in raw material prices (e.g., lignin, clay).

- Stringent regulations regarding feed safety and environmental standards impacting production costs.

- Intense competition from both domestic and international players.

- Supply chain disruptions, especially for specialized binders.

Growth Drivers in the Asia Pacific Feed Pelletizing Agents Market Market

The Asia Pacific Feed Pelletizing Agents market's growth is fuelled by the increasing demand for animal protein, driving the need for efficient and cost-effective feed production. Technological advancements, such as the development of sustainable and high-performance binders, are further enhancing market growth. Government policies promoting sustainable agriculture and livestock farming also positively influence market expansion.

Challenges Impacting Asia Pacific Feed Pelletizing Agents Market Growth

Major challenges include fluctuating raw material prices, stringent environmental regulations impacting production costs, and intense competition among market players. Supply chain disruptions and potential trade barriers can also negatively affect market growth.

Key Players Shaping the Asia Pacific Feed Pelletizing Agents Market Market

- Brenntag Group

- Uniscope Inc

- Archer Daniels Midland Company

- AlAsia Chemical

- Bentonite Performance Minerals LLC

- BASF SE

- Ashapura Group

- Borregaard LignoTech

- Kiotechagi

Significant Asia Pacific Feed Pelletizing Agents Market Industry Milestones

- 2020: Introduction of a new lignin-based binder by Borregaard LignoTech, enhancing pellet durability.

- 2022: Merger between two smaller players in the mineral binder segment, leading to increased market consolidation.

- 2023: Launch of a sustainable, bio-based binder by BASF, targeting the poultry feed segment.

- Further milestones: Details on additional significant events will be provided in the full report.

Future Outlook for Asia Pacific Feed Pelletizing Agents Market Market

The Asia Pacific Feed Pelletizing Agents market is poised for continued growth, driven by increasing demand for animal protein, technological advancements, and supportive government policies. Strategic investments in research and development, focusing on sustainable and high-performance binders, will shape the market's future. The market offers significant opportunities for both established players and new entrants to capitalize on the growing demand for efficient and cost-effective feed solutions.

Asia Pacific Feed Pelletizing Agents Market Segmentation

-

1. Type

- 1.1. Lignin-based Binders/ Lignosulfonates

- 1.2. Hemi-cellulose Binders

- 1.3. Mineral Binders (Clays)

- 1.4. Specialty Binders

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Pets

- 2.6. Others

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia Pacific Feed Pelletizing Agents Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Feed Pelletizing Agents Market Regional Market Share

Geographic Coverage of Asia Pacific Feed Pelletizing Agents Market

Asia Pacific Feed Pelletizing Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Demand for meat production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lignin-based Binders/ Lignosulfonates

- 5.1.2. Hemi-cellulose Binders

- 5.1.3. Mineral Binders (Clays)

- 5.1.4. Specialty Binders

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Pets

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lignin-based Binders/ Lignosulfonates

- 6.1.2. Hemi-cellulose Binders

- 6.1.3. Mineral Binders (Clays)

- 6.1.4. Specialty Binders

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Pets

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lignin-based Binders/ Lignosulfonates

- 7.1.2. Hemi-cellulose Binders

- 7.1.3. Mineral Binders (Clays)

- 7.1.4. Specialty Binders

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Pets

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lignin-based Binders/ Lignosulfonates

- 8.1.2. Hemi-cellulose Binders

- 8.1.3. Mineral Binders (Clays)

- 8.1.4. Specialty Binders

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Pets

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lignin-based Binders/ Lignosulfonates

- 9.1.2. Hemi-cellulose Binders

- 9.1.3. Mineral Binders (Clays)

- 9.1.4. Specialty Binders

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Pets

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Feed Pelletizing Agents Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lignin-based Binders/ Lignosulfonates

- 10.1.2. Hemi-cellulose Binders

- 10.1.3. Mineral Binders (Clays)

- 10.1.4. Specialty Binders

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Pets

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Brenntag Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Uniscope Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AlAsia Chemical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bentonite Performance Minerals LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ashapura Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Borregaard LignoTech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kiotechagi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Brenntag Group

List of Figures

- Figure 1: Asia Pacific Feed Pelletizing Agents Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Feed Pelletizing Agents Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Feed Pelletizing Agents Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Feed Pelletizing Agents Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Asia Pacific Feed Pelletizing Agents Market?

Key companies in the market include Brenntag Group, Uniscope Inc, Archer Daniels Midland Company, AlAsia Chemical, Bentonite Performance Minerals LLC, BASF SE, Ashapura Group, Borregaard LignoTech, Kiotechagi.

3. What are the main segments of the Asia Pacific Feed Pelletizing Agents Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Demand for meat production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Feed Pelletizing Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Feed Pelletizing Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Feed Pelletizing Agents Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Feed Pelletizing Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence