Key Insights

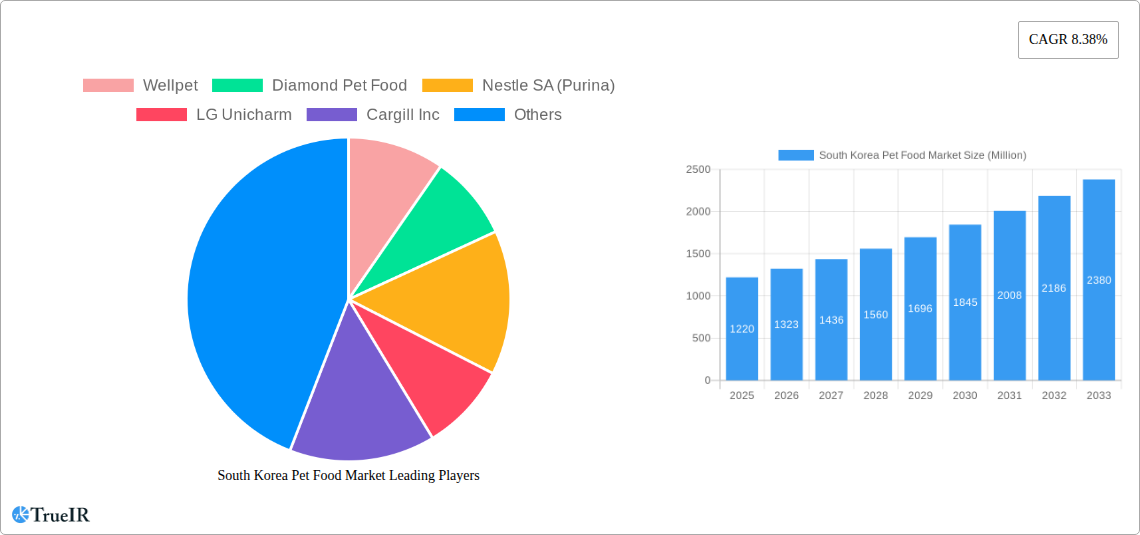

The South Korean pet food market, valued at $1.22 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.38% from 2025 to 2033. This surge is driven by several key factors. The increasing humanization of pets, coupled with rising disposable incomes and a growing trend towards premiumization in pet food choices, are significantly boosting market demand. Owners are increasingly seeking high-quality, specialized diets for their pets, reflecting a greater awareness of pet health and nutrition. This preference for premium products is fueling the growth of segments like veterinary diets and specialty pet food stores. The expanding e-commerce sector also plays a crucial role, providing convenient access to a wider variety of pet food options for consumers. While challenges remain, such as fluctuating raw material prices and potential economic downturns impacting consumer spending, the overall market outlook remains positive. The dominance of key players like Nestle Purina, Mars Inc., and other international brands indicates a strong competitive landscape. However, the growing preference for locally produced and specialized pet foods creates opportunities for smaller, niche brands to flourish.

South Korea Pet Food Market Market Size (In Billion)

The market segmentation reveals valuable insights into consumer preferences. The dog and cat segments are expected to remain the largest contributors, driven by the high pet ownership rates in South Korea. Within product types, the demand for dry and wet pet foods is substantial, with a growing interest in treats and snacks reflecting the increasing pampering of pets. Distribution channels are diversifying, with online channels witnessing significant growth alongside established supermarket and specialty store channels. The historical period (2019-2024) likely saw steady growth, setting the stage for the accelerated expansion projected for the forecast period (2025-2033). Future market growth will depend on the continued rise in pet ownership, shifting consumer preferences toward premium products, the development of innovative pet food formulations, and the adaptability of businesses to changing consumer behaviour. The strategic actions of major players, including product diversification, targeted marketing campaigns, and expansion into new distribution channels, will be critical to success in this dynamic market.

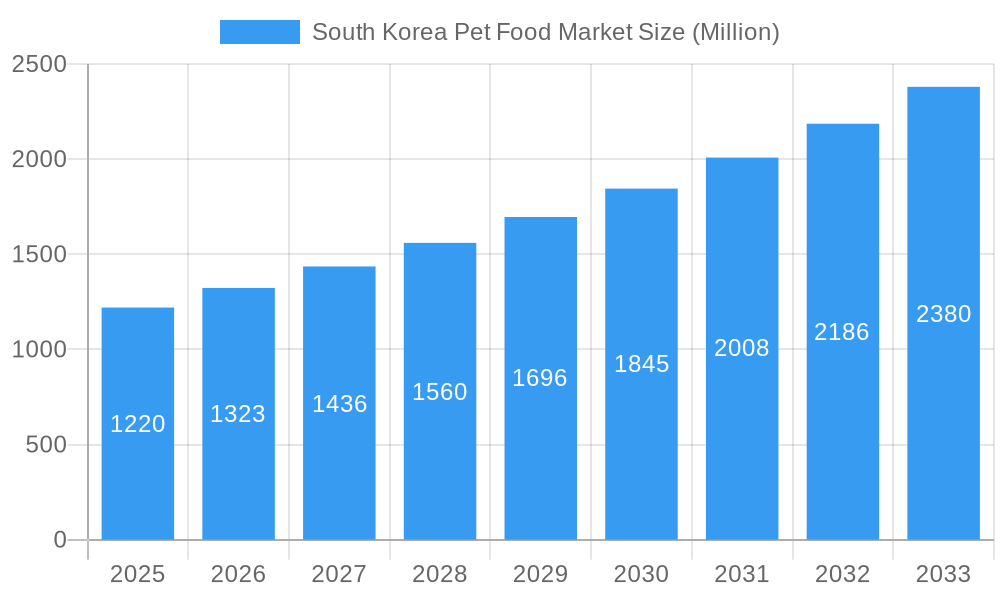

South Korea Pet Food Market Company Market Share

South Korea Pet Food Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the South Korea pet food market, offering invaluable insights for businesses and investors seeking to navigate this thriving sector. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025 and forecast period from 2025 to 2033. Leveraging high-volume keywords like "South Korea pet food market," "pet food market trends," "South Korea pet food industry," and "pet food market size," this report is optimized for maximum search visibility and industry engagement.

South Korea Pet Food Market Structure & Competitive Landscape

The South Korea pet food market exhibits a moderately consolidated structure, with key players like Nestle SA (Purina), Mars Inc, and CJ CheilJedang Corp holding significant market share. The market's competitive landscape is characterized by intense rivalry, fueled by innovation, new product launches, and strategic acquisitions. The concentration ratio (CR4) for 2024 is estimated at xx%, indicating a moderately concentrated market. Innovation in pet food formulations (e.g., functional foods, organic options) is a major driver, alongside evolving consumer preferences towards premium and natural pet food. Regulatory impacts, such as labeling requirements and food safety standards, play a vital role in shaping market dynamics. Product substitutes, such as homemade pet food, pose a competitive challenge. The market is segmented by pet type (dogs, cats, others), product type (dry, wet, veterinary diets, treats), and distribution channel (supermarkets, specialty stores, online).

- Market Concentration: CR4 (2024) estimated at xx%

- Innovation Drivers: Functional foods, organic options, premiumization.

- Regulatory Impacts: Stringent labeling, food safety standards.

- Product Substitutes: Homemade pet food, raw food diets.

- End-User Segmentation: Dog owners constitute the largest segment, followed by cat owners.

- M&A Trends: A notable increase in M&A activity in recent years, driven by consolidation and expansion strategies. The number of M&A deals in the historical period (2019-2024) is estimated at xx.

South Korea Pet Food Market Trends & Opportunities

The South Korea pet food market is experiencing robust growth, driven by several key factors. The market size reached approximately xx Million USD in 2024 and is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million USD by 2033. This growth reflects rising pet ownership, increasing disposable incomes, and a growing awareness of pet health and nutrition among South Korean consumers. Technological advancements, particularly in pet food processing and packaging, are also impacting the market. Consumer preferences are shifting toward premium, natural, and specialized pet food products, catering to specific dietary needs and health concerns. This trend is further amplified by the increasing humanization of pets. The competitive dynamics are characterized by both domestic and international players vying for market share, with strong emphasis on branding, product innovation, and distribution network expansion. Market penetration rates for premium pet food are steadily increasing, with xx% estimated for 2024.

Dominant Markets & Segments in South Korea Pet Food Market

The South Korean pet food market is dominated by the dog food segment, driven by a higher number of dog owners compared to cat owners. Within product types, dry pet food currently holds the largest market share due to its convenience and affordability. However, the wet pet food segment is witnessing significant growth, fueled by increasing consumer preference for higher quality and palatability. Online channels are witnessing rapid expansion, driven by the rise of e-commerce and increasing internet penetration. The Seoul metropolitan area represents a key regional market due to high pet ownership and disposable incomes.

- Pet Type: Dogs (largest segment), Cats, Other Pet Types (relatively smaller)

- Product Type: Dry Pet Foods (largest), Wet Pet Foods (growing rapidly), Veterinary Diets (niche but growing), Treats and Snacks (significant segment), Other Product Types

- Distribution Channel: Supermarkets/Hypermarkets (largest), Specialty Stores (growing), Online Channels (rapid growth), Other Distribution Channels

Key Growth Drivers:

- Increasing pet ownership and humanization of pets.

- Rising disposable incomes and higher spending on pet care.

- Growing awareness of pet health and nutrition.

- Expansion of e-commerce and online pet food retail.

- Government initiatives promoting animal welfare and pet health.

South Korea Pet Food Market Product Analysis

Recent product innovations in the South Korean pet food market focus on functional ingredients that cater to specific health needs, such as joint health, skin and coat health, and digestive support. The market is seeing a rise in premium and natural pet food products, with an increased emphasis on organic and sustainably sourced ingredients. These innovations enhance product differentiation and appeal to the growing segment of health-conscious pet owners. This shift toward premiumization aligns well with the evolving consumer preferences and positions these products strategically within the competitive landscape.

Key Drivers, Barriers & Challenges in South Korea Pet Food Market

Key Drivers:

The South Korean pet food market is propelled by rising pet ownership, increasing disposable incomes, and the growing trend of pet humanization. Technological advancements in pet food manufacturing and the growing popularity of online shopping contribute significantly. Furthermore, supportive government policies and regulations promoting animal welfare and pet health are boosting market growth.

Challenges:

The market faces challenges such as increasing raw material costs, stringent regulations regarding food safety and labeling, and intense competition from both domestic and international players. Supply chain disruptions and economic fluctuations can also impact market growth. A potential barrier is the relatively high price point of premium pet food, potentially limiting access for some consumers.

Growth Drivers in the South Korea Pet Food Market

Key growth drivers include rising pet ownership, increasing disposable incomes, the trend of pet humanization leading to increased spending on pet care, and technological advancements in pet food manufacturing and distribution. Government support for pet welfare and the expanding e-commerce sector also play a significant role.

Challenges Impacting South Korea Pet Food Market Growth

Challenges include fluctuating raw material costs, stringent regulatory requirements impacting product development and launch, intense competition from established international players, and potential supply chain vulnerabilities. Economic downturns can impact consumer spending on premium pet food.

Key Players Shaping the South Korea Pet Food Market

- Wellpet

- Diamond Pet Food

- Nestle SA (Purina)

- LG Unicharm

- Cargill Inc

- Hill's Pet Nutrition Inc

- ANF

- Mars Inc

- CJ CheilJedang Corp

Significant South Korea Pet Food Market Industry Milestones

- November 2022: Mars Petcare acquired Champion Petfood, strengthening its position in the premium and natural pet food segment.

- January 2022: Dongwon F&B partnered with Bmsmile to develop functional moist pet food, expanding its product offerings.

Future Outlook for South Korea Pet Food Market

The South Korean pet food market is poised for continued growth, driven by sustained increases in pet ownership, rising disposable incomes, and the ongoing trend of pet humanization. Strategic investments in product innovation, particularly in functional and premium pet foods, coupled with expansion into e-commerce channels, will be crucial for success. The market presents significant opportunities for both domestic and international players to capitalize on the increasing demand for high-quality pet food products.

South Korea Pet Food Market Segmentation

-

1. Pet Type

- 1.1. Dogs

- 1.2. Cats

- 1.3. Other Pet Types

-

2. Product Type

- 2.1. Dry Pet Foods

- 2.2. Wet Pet Foods

- 2.3. Veterinary Diets

- 2.4. Treats and Snacks

- 2.5. Other Product Types

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Channels

- 3.4. Other Distribution Channels

South Korea Pet Food Market Segmentation By Geography

- 1. South Korea

South Korea Pet Food Market Regional Market Share

Geographic Coverage of South Korea Pet Food Market

South Korea Pet Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Increasing pet population and consumer expenditure on premium pet food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Pet Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pet Type

- 5.1.1. Dogs

- 5.1.2. Cats

- 5.1.3. Other Pet Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Dry Pet Foods

- 5.2.2. Wet Pet Foods

- 5.2.3. Veterinary Diets

- 5.2.4. Treats and Snacks

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Channels

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Pet Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wellpet

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Diamond Pet Food

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestle SA (Purina)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Unicharm

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hill's Pet Nutrition Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ANF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mars Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CJ CheilJedang Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wellpet

List of Figures

- Figure 1: South Korea Pet Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Pet Food Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Pet Food Market Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 2: South Korea Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Pet Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Pet Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South Korea Pet Food Market Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 6: South Korea Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: South Korea Pet Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: South Korea Pet Food Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Pet Food Market?

The projected CAGR is approximately 8.38%.

2. Which companies are prominent players in the South Korea Pet Food Market?

Key companies in the market include Wellpet, Diamond Pet Food, Nestle SA (Purina), LG Unicharm, Cargill Inc, Hill's Pet Nutrition Inc, ANF, Mars Inc, CJ CheilJedang Corp.

3. What are the main segments of the South Korea Pet Food Market?

The market segments include Pet Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Increasing pet population and consumer expenditure on premium pet food.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

November 2022: Mars Petcare signed an agreement to acquire Champion Petfood, a global pet food brand with a significant presence in South Korea. Champion pet food was a trusted brand in the premium and natural pet food category and saw a lot of consumer footfall. This acquisition aims to integrate Champion pet food's expertise in this field country's and Mars's brand loyalty.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Pet Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Pet Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Pet Food Market?

To stay informed about further developments, trends, and reports in the South Korea Pet Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence