Key Insights

The North American Swine Feed Premix Market is projected for robust expansion, anticipating a market size of USD 11.64 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.8%. This growth trajectory is propelled by escalating demand for premium animal feed, driven by global population increases and subsequent rises in meat consumption. Essential market drivers include the imperative to enhance swine health and productivity, optimize feed conversion efficiency, and mitigate disease impacts through fortified premixes. Technological advancements in animal nutrition and heightened farmer awareness of scientifically formulated premixes further stimulate market demand. Precision farming and data-driven animal husbandry practices also favor the adoption of bespoke premix solutions tailored to specific swine dietary requirements and life stages.

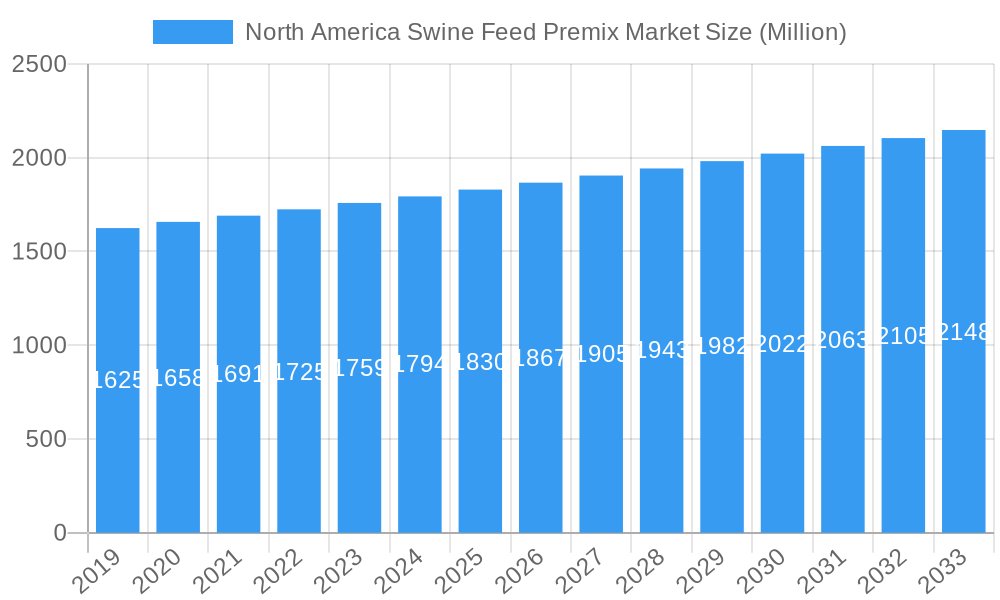

North America Swine Feed Premix Market Market Size (In Billion)

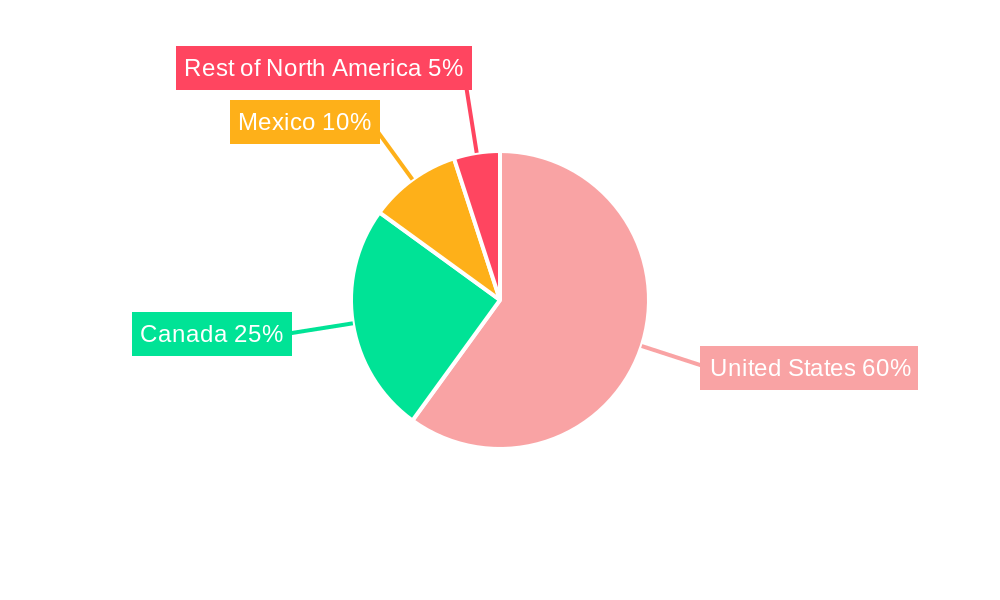

While the market exhibits a positive outlook, certain constraints exist. Fluctuations in raw material prices, including vitamins and amino acids, can affect premix manufacturers' profitability and end-user costs. Stringent regulatory frameworks for feed additives and their safety necessitate continuous compliance and research, adding operational complexity. The dominant market segments are anticipated to remain Antibiotics, Vitamins, and Amino Acids, underscoring their critical role in animal health and growth. Geographically, the United States leads the market share, followed by Canada and Mexico, with the Rest of North America contributing to regional performance. Key industry players are actively investing in research and development to innovate and expand product portfolios, aiming to secure a more significant market share in this dynamic sector.

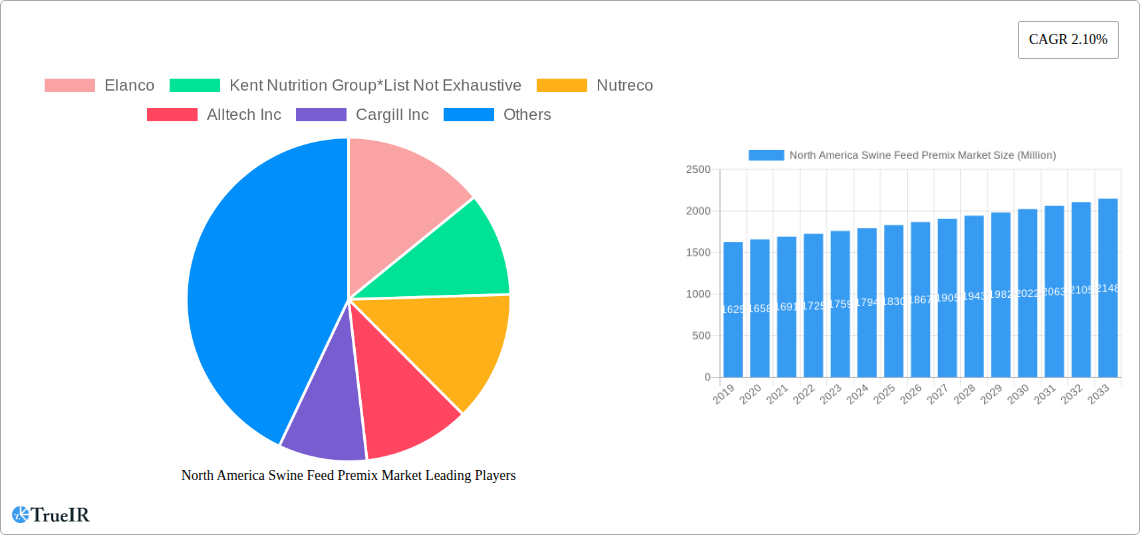

North America Swine Feed Premix Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America Swine Feed Premix Market, covering the period from 2019 to 2033. The analysis focuses on the base year of 2025 and forecasts growth through 2033. It meticulously examines market structure, competitive dynamics, prevailing trends, key opportunities, dominant segments, product innovations, primary drivers, inherent challenges, and significant industry milestones. Optimized with high-volume keywords such as "swine feed premix," "animal nutrition," "pork production," "feed additives," "animal health," and "livestock supplements," this report aims to enhance search engine visibility and attract a broad spectrum of industry stakeholders, including feed manufacturers, livestock producers, nutritionists, veterinarians, and investors.

North America Swine Feed Premix Market Market Structure & Competitive Landscape

The North America Swine Feed Premix Market is characterized by a moderately consolidated structure, with a few key players holding substantial market share, alongside a growing number of regional and specialized manufacturers. Innovation serves as a significant driver, with companies investing heavily in R&D to develop premixes that enhance animal health, improve feed efficiency, and address emerging disease challenges. Regulatory impacts, particularly concerning the judicious use of antibiotics and the demand for antibiotic-free production systems, are reshaping product formulations and market strategies. Product substitutes, such as single-ingredient additives or alternative feed management practices, present a competitive pressure, although the inherent benefits of comprehensive premixes maintain their market relevance. End-user segmentation is primarily driven by the scale of pork production operations, with large integrated farms and contract growers representing significant demand. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to expand product portfolios, geographical reach, and technological capabilities, with an estimated XX number of significant M&A deals recorded in the historical period, indicating active market consolidation.

North America Swine Feed Premix Market Market Trends & Opportunities

The North America Swine Feed Premix Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period. This expansion is fueled by an increasing global demand for pork, driven by population growth and rising disposable incomes, particularly in emerging economies. Technological advancements are playing a crucial role, with the development of novel feed additives that enhance nutrient absorption, improve gut health, and bolster immune responses in swine. The growing consumer preference for high-quality, safe, and sustainably produced pork is a significant trend, encouraging feed manufacturers to develop premixes that contribute to improved animal welfare and reduced environmental impact. Competitive dynamics are intensifying, with companies differentiating themselves through product innovation, tailored nutritional solutions, and strong technical support for their customers. Opportunities lie in the development of specialized premixes for different life stages of swine, including starter, grower, and finisher phases, as well as for specific production systems, such as antibiotic-free or organic farming. The "Rest of North America" segment, encompassing emerging swine production regions, presents a substantial untapped market with significant growth potential. Market penetration rates for advanced feed premixes are expected to increase as producers recognize the economic benefits of improved feed conversion ratios and reduced disease incidence. Furthermore, the integration of precision nutrition technologies, allowing for highly customized premix formulations based on real-time animal data, represents a frontier for future growth and innovation.

Dominant Markets & Segments in North America Swine Feed Premix Market

The United States stands as the dominant market within the North America Swine Feed Premix Market, accounting for an estimated 60% of the total market revenue. This dominance is attributed to the country's large-scale swine farming operations, advanced agricultural infrastructure, and significant investment in animal nutrition research and development. Within the Ingredient Type segment, Amino Acids are expected to witness the highest growth, driven by the increasing adoption of crystalline amino acids to optimize diets and reduce crude protein levels, thereby improving cost-effectiveness and environmental sustainability. Minerals and Vitamins also represent substantial segments, forming the foundational components of most swine feed premixes and benefiting from consistent demand. The "Rest of North America" geography, including countries with developing swine industries, presents a compelling opportunity for market expansion, with projected growth rates exceeding those of more established markets. Key growth drivers in these emerging regions include supportive government policies aimed at boosting domestic pork production, increasing investment in modern farming practices, and a rising demand for animal protein. Canada and Mexico also contribute significantly to the market, with established swine industries and a continuous demand for high-quality feed additives. The adoption of specialized premixes catering to specific regional challenges, such as climate variations or prevalent diseases, will be crucial for capturing market share in these diverse geographical landscapes.

North America Swine Feed Premix Market Product Analysis

Product innovations in the North America Swine Feed Premix Market are centered on enhancing animal health, optimizing growth performance, and addressing the evolving demands of sustainable pork production. Companies are developing premixes that incorporate novel probiotics, prebiotics, and organic acids to improve gut health and reduce the reliance on antibiotic growth promoters. Advanced formulations are also focusing on providing precise nutrient profiles to maximize feed efficiency and minimize nutrient excretion, thereby reducing environmental impact. Competitive advantages are being built around the efficacy and safety of these advanced premixes, backed by robust scientific research and field trial data. The integration of specialized functional ingredients, such as immune modulators and antioxidants, further enhances the value proposition of these products, offering a holistic approach to swine nutrition and well-being.

Key Drivers, Barriers & Challenges in North America Swine Feed Premix Market

The North America Swine Feed Premix Market is propelled by several key drivers. Technologically, advancements in feed formulation science and ingredient processing are enabling the development of more effective and efficient premixes. Economically, the rising global demand for pork and the need for cost-effective animal production solutions are creating significant market pull. Policy-driven factors, such as government incentives for sustainable agriculture and initiatives to reduce antibiotic use in livestock, are also shaping market growth. Specific examples include the development of enzyme-enhanced premixes that improve nutrient digestibility and the increasing demand for phytase to reduce phosphorus excretion.

However, the market faces significant barriers and challenges. Regulatory complexities, particularly concerning the approval of new feed additives and evolving guidelines on antibiotic usage, can slow down product development and market entry. Supply chain issues, including the availability and cost fluctuations of key raw materials, can impact production efficiency and profitability. Competitive pressures from both established players and emerging market entrants necessitate continuous innovation and cost optimization. Quantifiable impacts include potential delays in product launches due to regulatory hurdles and increased operational costs stemming from raw material price volatility, estimated to affect profit margins by 2-4%.

Growth Drivers in the North America Swine Feed Premix Market Market

Key growth drivers in the North America Swine Feed Premix Market include the escalating global demand for pork, fueled by population growth and changing dietary patterns, which necessitates increased efficiency in swine production. Technologically, ongoing research and development in animal nutrition are leading to the creation of highly specialized and effective premixes that enhance feed conversion ratios, improve animal health, and reduce disease incidence. Economically, the need for cost-effective livestock farming solutions encourages producers to invest in premixes that optimize resource utilization and minimize waste. Regulatory tailwinds, such as the global push towards antibiotic reduction in animal agriculture, are creating significant demand for alternative feed additives and innovative premix formulations that support animal immune systems naturally.

Challenges Impacting North America Swine Feed Premix Market Growth

Challenges impacting North America Swine Feed Premix Market growth are primarily rooted in regulatory complexities. Evolving government regulations concerning the use of feed additives, particularly antibiotics and their alternatives, require constant adaptation and significant investment in compliance. Supply chain issues, including the sourcing of raw materials, price volatility of key ingredients, and logistical disruptions, can lead to increased production costs and potential shortages. Competitive pressures from a fragmented market, including both large multinational corporations and smaller regional players, necessitate continuous innovation and aggressive market strategies. The increasing consumer demand for transparency in animal agriculture and ethical sourcing also presents a challenge, requiring manufacturers to provide comprehensive product traceability and sustainability certifications, which can add to operational overhead.

Key Players Shaping the North America Swine Feed Premix Market Market

- Elanco

- Kent Nutrition Group

- Nutreco

- Alltech Inc

- Cargill Inc

- Lallemand Animal Nutrition

- ADM Animal Nutrition

Significant North America Swine Feed Premix Market Industry Milestones

- 2019: Increased regulatory scrutiny on antibiotic use in animal feed across North America, driving demand for antibiotic-free premixes.

- 2020: Significant advancements in gut health solutions and the introduction of novel probiotic strains in swine feed premixes.

- 2021: Growing emphasis on sustainability and reduced environmental impact in feed formulation, leading to premixes that optimize nutrient utilization.

- 2022: Introduction of personalized nutrition solutions for swine, leveraging data analytics to tailor premix formulations.

- 2023: Heightened focus on mycotoxin control in feed, leading to the development of advanced mycotoxin binders and deactivators in premixes.

- 2024: Expansion of research into the role of the microbiome in swine health, influencing the development of next-generation premixes.

Future Outlook for North America Swine Feed Premix Market Market

The future outlook for the North America Swine Feed Premix Market is exceptionally promising, driven by sustained global pork demand and a continuous push for enhanced animal health and production efficiency. Strategic opportunities lie in the development and commercialization of highly specialized premixes that cater to niche markets, such as antibiotic-free, organic, or genetically optimized swine breeds. The integration of digital technologies, including AI and blockchain, for enhanced supply chain management and product traceability will also be a key growth catalyst. Furthermore, the increasing focus on circular economy principles within the feed industry will open avenues for innovative, sustainably sourced premix ingredients, positioning companies that prioritize these aspects for significant market leadership and long-term success in the evolving landscape of animal nutrition.

North America Swine Feed Premix Market Segmentation

-

1. Ingredient Type

- 1.1. Antibiotics

- 1.2. Vitamins

- 1.3. Antioxidants

- 1.4. Amino Acids

- 1.5. Minerals

- 1.6. Others

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

North America Swine Feed Premix Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Swine Feed Premix Market Regional Market Share

Geographic Coverage of North America Swine Feed Premix Market

North America Swine Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Well Established Swine Production Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Antibiotics

- 5.1.2. Vitamins

- 5.1.3. Antioxidants

- 5.1.4. Amino Acids

- 5.1.5. Minerals

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. United States North America Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Antibiotics

- 6.1.2. Vitamins

- 6.1.3. Antioxidants

- 6.1.4. Amino Acids

- 6.1.5. Minerals

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Canada North America Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Antibiotics

- 7.1.2. Vitamins

- 7.1.3. Antioxidants

- 7.1.4. Amino Acids

- 7.1.5. Minerals

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Mexico North America Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Antibiotics

- 8.1.2. Vitamins

- 8.1.3. Antioxidants

- 8.1.4. Amino Acids

- 8.1.5. Minerals

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Rest of North America North America Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Antibiotics

- 9.1.2. Vitamins

- 9.1.3. Antioxidants

- 9.1.4. Amino Acids

- 9.1.5. Minerals

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Elanco

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kent Nutrition Group*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nutreco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alltech Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cargill Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lallemand Animal Nutrition

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ADM Animal Nutrition

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Elanco

List of Figures

- Figure 1: North America Swine Feed Premix Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Swine Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: North America Swine Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 2: North America Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Swine Feed Premix Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Swine Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 5: North America Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Swine Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 8: North America Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Swine Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 11: North America Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Swine Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 14: North America Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Swine Feed Premix Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the North America Swine Feed Premix Market?

Key companies in the market include Elanco, Kent Nutrition Group*List Not Exhaustive, Nutreco, Alltech Inc, Cargill Inc, Lallemand Animal Nutrition, ADM Animal Nutrition.

3. What are the main segments of the North America Swine Feed Premix Market?

The market segments include Ingredient Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Well Established Swine Production Industry Drives the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Swine Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Swine Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Swine Feed Premix Market?

To stay informed about further developments, trends, and reports in the North America Swine Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence