Key Insights

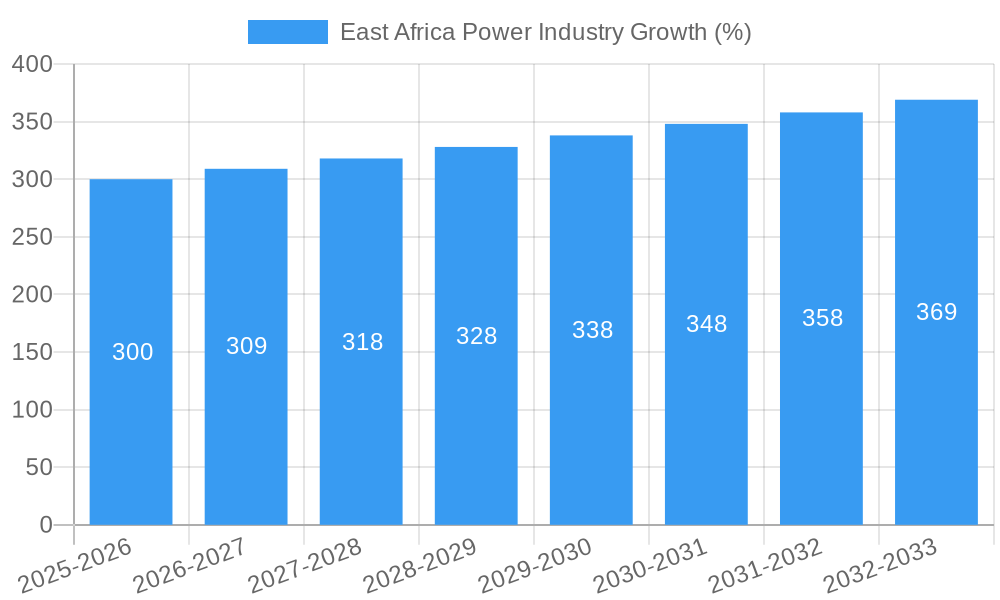

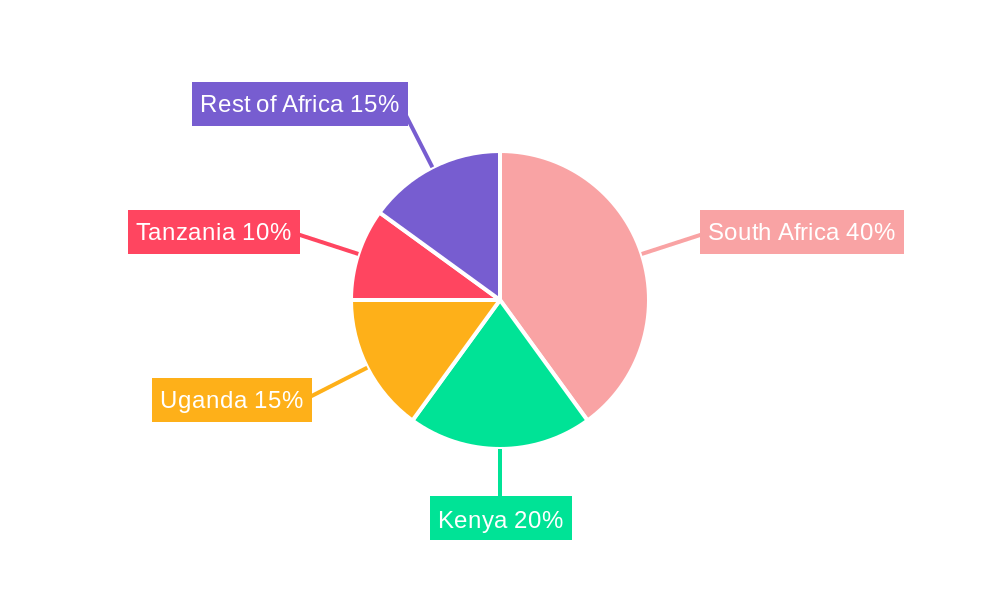

The East African power industry is experiencing robust growth, driven by increasing energy demands from a burgeoning population and expanding industrial sectors. A Compound Annual Growth Rate (CAGR) exceeding 3% suggests a significant expansion over the forecast period (2025-2033). Key drivers include government initiatives promoting renewable energy sources, rapid urbanization leading to higher electricity consumption in residential and commercial sectors, and the increasing industrialization across the region. The power generation segment, encompassing both hydro and non-hydro renewables (solar, wind, geothermal), is experiencing particularly strong growth, fueled by substantial investments in renewable energy infrastructure. While challenges remain, including infrastructure limitations and grid instability in certain areas, the overall outlook for the East African power sector is positive. Power transmission and distribution networks require significant upgrades to accommodate the increasing generation capacity and ensure reliable electricity supply to consumers. The industrial sector presents a substantial growth opportunity due to its high energy intensity, while the residential and commercial sectors are showing consistent, albeit slower, growth relative to industrial demand. Key players, including national electricity companies like Kenya Power and Lighting Company PLC and Tanzania Electric Supply Company, are actively involved in expansion projects and collaborations to address these opportunities and challenges. The regional disparities within East Africa are significant, with some countries experiencing faster growth than others, driven by factors including specific government policies, available resources, and investment climate. South Africa, due to its larger economy and more developed infrastructure, holds a significant share of the regional market.

The market size in 2025 is estimated at $XX million (please provide the missing market size figure for a more accurate projection). Using the provided CAGR of >3%, a conservative estimate suggests a steady increase in market value throughout the forecast period, potentially reaching several billion dollars by 2033. This substantial increase will be primarily driven by investment in new power generation capacity and improvements in transmission and distribution infrastructure to meet rising demand. While restraints such as inconsistent regulatory frameworks and financing challenges exist in some countries, the significant potential for growth and the considerable investments already underway strongly suggest a positive long-term trajectory for the East African power market.

East Africa Power Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the East Africa power industry, covering market structure, trends, opportunities, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry professionals, and policymakers. The report leverages extensive data analysis and qualitative insights to provide a holistic view of this dynamic market. Expect detailed breakdowns of market segments, competitive landscapes, and future growth projections, all expressed in Millions (M).

East Africa Power Industry Market Structure & Competitive Landscape

This section analyzes the East African power industry's competitive landscape, including market concentration, innovation, regulation, substitution, end-user segmentation, and M&A activity. The historical period (2019-2024) reveals a moderately concentrated market, with a Herfindahl-Hirschman Index (HHI) of xx, indicating some level of competition. However, the presence of state-owned enterprises significantly influences market dynamics.

- Market Concentration: The HHI for the power generation sector was xx in 2024, indicating a moderately concentrated market. Transmission and distribution sectors show similar concentration levels, with HHI values of xx and xx respectively.

- Innovation Drivers: The push for renewable energy sources (hydro and non-hydro) is a significant driver of innovation, particularly in geothermal and solar technologies.

- Regulatory Impact: Government policies and regulations, including licensing and tariff structures, heavily influence market access and investment decisions. Recent regulatory reforms in xx country have boosted private sector participation.

- Product Substitutes: While limited, increasing adoption of off-grid solar solutions presents a potential substitute for grid electricity in rural areas.

- End-User Segmentation: The industrial sector represents the largest share of electricity consumption (xx%), followed by the commercial (xx%) and residential (xx%) sectors.

- M&A Trends: The number of M&A transactions in the East African power sector averaged xx per year between 2019 and 2024, with a total transaction value of approximately $xx Million. Most deals involved smaller companies being acquired by larger players or state-owned enterprises.

East Africa Power Industry Market Trends & Opportunities

The East African power industry is experiencing significant growth driven by rising energy demand, increasing investments in renewable energy, and supportive government policies. The market size grew at a CAGR of xx% between 2019 and 2024, reaching $xx Million in 2024. This growth is projected to continue at a CAGR of xx% from 2025 to 2033, reaching $xx Million by 2033. Technological advancements, especially in renewable energy and smart grid technologies, are accelerating market transformation. Consumer preferences are shifting towards reliable and affordable electricity, driving demand for improved grid infrastructure and diversified energy sources. Competitive dynamics are characterized by increasing private sector participation alongside state-owned entities. Market penetration of renewable energy sources has steadily increased, reaching xx% in 2024 and projected to reach xx% by 2033.

Dominant Markets & Segments in East Africa Power Industry

Kenya and Tanzania represent the largest power markets in East Africa, driven by strong economic growth and expanding populations. Within the power generation segment, Hydropower currently dominates, but Non-Hydro Renewables (primarily geothermal and solar) are rapidly expanding. The industrial sector is the largest end-user segment.

Key Growth Drivers:

- Expanding Infrastructure: Government investments in power transmission and distribution networks are improving electricity access across the region.

- Supportive Policies: Government initiatives promoting renewable energy development and private sector participation are fostering growth.

- Economic Growth: Steady economic growth in key East African countries fuels energy demand.

Market Dominance Analysis: Kenya's dominance stems from its advanced infrastructure and higher levels of private sector investment. Tanzania's significant hydropower potential contributes to its large market share. The industrial segment's dominance is attributed to its high energy intensity.

East Africa Power Industry Product Analysis

Technological advancements in power generation are driving product innovation. The increasing adoption of smart grids, renewable energy technologies (e.g., geothermal, solar, wind), and energy storage solutions is improving efficiency, reliability, and sustainability. These innovations are tailored to meet the unique challenges and opportunities of the East African context, focusing on affordability, accessibility, and sustainability.

Key Drivers, Barriers & Challenges in East Africa Power Industry

Key Drivers: Rising energy demand fueled by economic growth and population increase; supportive government policies promoting renewable energy and private sector participation; increasing investments in power generation and transmission infrastructure; technological advancements in renewable energy and smart grid technologies.

Key Challenges: Inadequate infrastructure in many regions; high initial capital costs associated with renewable energy projects; regulatory uncertainties and bureaucratic hurdles; limited access to finance for private sector projects; power losses due to aging infrastructure and theft; competition for resources and land use; skills gap in the sector.

Growth Drivers in the East Africa Power Industry Market

The East African power industry's growth is driven by rising energy demand from expanding populations and economies, increasing investments in renewable energy projects, and supportive government policies. Technological advancements in energy storage and smart grid technologies are also playing a crucial role. Furthermore, regional integration efforts aimed at improving cross-border electricity trade are expected to further stimulate growth.

Challenges Impacting East Africa Power Industry Growth

Significant challenges include limited access to financing, inadequate infrastructure, especially in rural areas, regulatory complexities hindering private sector participation, and the persistent issue of electricity theft contributing to significant power losses (estimated at xx% in 2024). Addressing these challenges is vital for realizing the sector's full potential.

Key Players Shaping the East Africa Power Industry Market

- Power Generation Companies

- Tanzania Electric Supply Company (TANESCO)

- Uganda Electricity Transmission Company Limited (UETCL)

- Tower Transmission and Distribution Companies

- Kenya Electricity Transmission Company (KETRACO)

- Ethiopian Electric Company (EEC)

- Uganda Electricity Generation Company Limited (UEGCL)

- Kenya Power and Lighting Company PLC (Kenya Power)

- Kenya Electricity Generating Company Plc (KenGen)

Significant East Africa Power Industry Industry Milestones

- September 2021: Safaricom's proposal for a USD 300 Million smart meter system to Kenya Power to reduce power losses.

- November 2020: Kenya Electricity Generating Company PLC announces an extensive renewable energy project pipeline, targeting the Olkaria 1 Unit 6 geothermal power plant (83.3 MW).

Future Outlook for East Africa Power Industry Market

The East African power industry is poised for continued strong growth, driven by sustained economic expansion, population growth, and the increasing adoption of renewable energy sources. Strategic investments in grid infrastructure, supportive regulatory frameworks, and technological innovations will be crucial in unlocking the region's considerable power generation potential and ensuring universal access to reliable and affordable electricity. The market is expected to present significant opportunities for both domestic and international players.

East Africa Power Industry Segmentation

-

1. Sector

-

1.1. Power Generation

- 1.1.1. Thermal

- 1.1.2. Hydro and Non-Hydro Renewables

- 1.2. Power Transmission and Distribution

-

1.1. Power Generation

-

2. Geography

- 2.1. Kenya

- 2.2. Ethiopia

- 2.3. Tanzania

- 2.4. Uganda

- 2.5. Rest of East Africa

East Africa Power Industry Segmentation By Geography

- 1. Kenya

- 2. Ethiopia

- 3. Tanzania

- 4. Uganda

- 5. Rest of East Africa

East Africa Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Hydro and Non-Hydro Renewables are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Power Generation

- 5.1.1.1. Thermal

- 5.1.1.2. Hydro and Non-Hydro Renewables

- 5.1.2. Power Transmission and Distribution

- 5.1.1. Power Generation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kenya

- 5.2.2. Ethiopia

- 5.2.3. Tanzania

- 5.2.4. Uganda

- 5.2.5. Rest of East Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kenya

- 5.3.2. Ethiopia

- 5.3.3. Tanzania

- 5.3.4. Uganda

- 5.3.5. Rest of East Africa

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kenya East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Power Generation

- 6.1.1.1. Thermal

- 6.1.1.2. Hydro and Non-Hydro Renewables

- 6.1.2. Power Transmission and Distribution

- 6.1.1. Power Generation

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kenya

- 6.2.2. Ethiopia

- 6.2.3. Tanzania

- 6.2.4. Uganda

- 6.2.5. Rest of East Africa

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Ethiopia East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Power Generation

- 7.1.1.1. Thermal

- 7.1.1.2. Hydro and Non-Hydro Renewables

- 7.1.2. Power Transmission and Distribution

- 7.1.1. Power Generation

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kenya

- 7.2.2. Ethiopia

- 7.2.3. Tanzania

- 7.2.4. Uganda

- 7.2.5. Rest of East Africa

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Tanzania East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Power Generation

- 8.1.1.1. Thermal

- 8.1.1.2. Hydro and Non-Hydro Renewables

- 8.1.2. Power Transmission and Distribution

- 8.1.1. Power Generation

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kenya

- 8.2.2. Ethiopia

- 8.2.3. Tanzania

- 8.2.4. Uganda

- 8.2.5. Rest of East Africa

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Uganda East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Power Generation

- 9.1.1.1. Thermal

- 9.1.1.2. Hydro and Non-Hydro Renewables

- 9.1.2. Power Transmission and Distribution

- 9.1.1. Power Generation

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kenya

- 9.2.2. Ethiopia

- 9.2.3. Tanzania

- 9.2.4. Uganda

- 9.2.5. Rest of East Africa

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Rest of East Africa East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Power Generation

- 10.1.1.1. Thermal

- 10.1.1.2. Hydro and Non-Hydro Renewables

- 10.1.2. Power Transmission and Distribution

- 10.1.1. Power Generation

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Kenya

- 10.2.2. Ethiopia

- 10.2.3. Tanzania

- 10.2.4. Uganda

- 10.2.5. Rest of East Africa

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. South Africa East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 12. Sudan East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 13. Uganda East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 15. Kenya East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa East Africa Power Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Power Generation Companies

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 nzania Electric Supply Company

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Uganda Electricity Transmission Company Limited*List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Tower Transmission and Distribution Companies

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Kenya Electricty Transmission Company

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 hiopian Electric Company

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Uganda Electricity Generation Company Limited

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Kenya Power and Lightinh Company PLC

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Kenya Electricity Generating Company Plc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Power Generation Companies

List of Figures

- Figure 1: East Africa Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: East Africa Power Industry Share (%) by Company 2024

List of Tables

- Table 1: East Africa Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: East Africa Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 5: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: East Africa Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: East Africa Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: South Africa East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Sudan East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Uganda East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Tanzania East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Kenya East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa East Africa Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa East Africa Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 24: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 25: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 27: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 29: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 30: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 31: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 33: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 35: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 36: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 37: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 39: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 41: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 42: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 43: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 45: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 47: East Africa Power Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 48: East Africa Power Industry Volume Gigawatt Forecast, by Sector 2019 & 2032

- Table 49: East Africa Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: East Africa Power Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 51: East Africa Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: East Africa Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Power Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the East Africa Power Industry?

Key companies in the market include Power Generation Companies, nzania Electric Supply Company, Uganda Electricity Transmission Company Limited*List Not Exhaustive, Tower Transmission and Distribution Companies, Kenya Electricty Transmission Company, hiopian Electric Company, Uganda Electricity Generation Company Limited, Kenya Power and Lightinh Company PLC, Kenya Electricity Generating Company Plc.

3. What are the main segments of the East Africa Power Industry?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand.

6. What are the notable trends driving market growth?

Hydro and Non-Hydro Renewables are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In September 2021, Kenyan telecoms operator Safaricom, announced that the company has submitted a proposal to Kenya Power for the installation of a USD 300 million smart meter system at the utility, The main objective behind the proposal was to control power losses of the utility company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Power Industry?

To stay informed about further developments, trends, and reports in the East Africa Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence