Key Insights

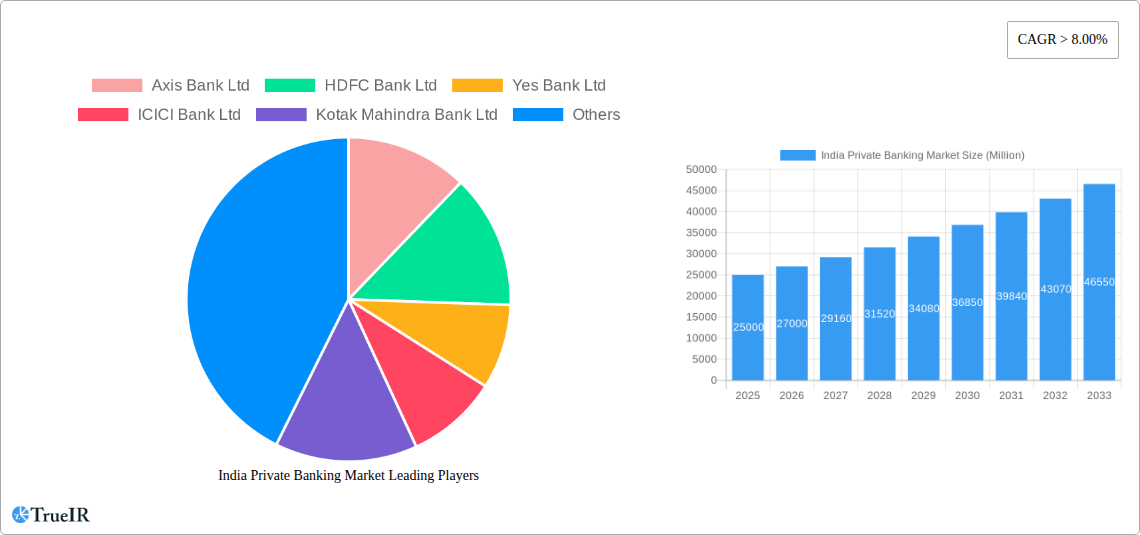

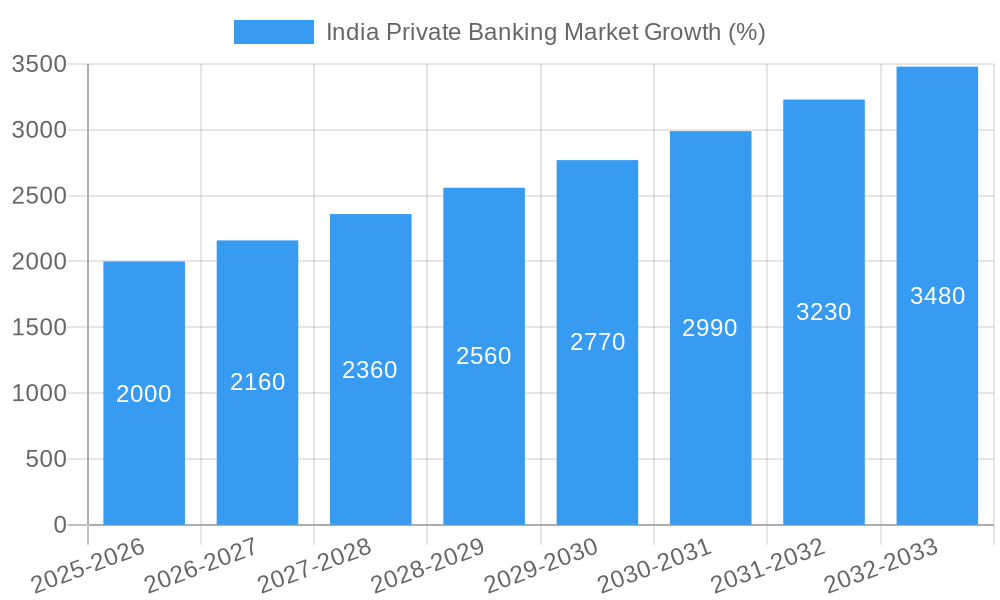

The India private banking market is experiencing robust growth, driven by a burgeoning affluent population, increasing disposable incomes, and rising demand for sophisticated wealth management services. The market's Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by factors such as the expanding middle class seeking personalized financial solutions, the growing adoption of digital banking technologies, and the increasing need for investment and retirement planning. Major players like Axis Bank, HDFC Bank, ICICI Bank, and Kotak Mahindra Bank are actively competing to capture market share through strategic acquisitions, product innovation, and expansion of their digital platforms. However, challenges remain, including stringent regulatory norms and the need to cater to a diverse customer base with varying financial literacy levels. The market is segmented based on services offered (wealth management, investment banking, etc.) and customer demographics (high-net-worth individuals, ultra-high-net-worth individuals). While precise market size figures for 2025 are unavailable, we can infer it to be substantially larger than its 2024 figure given the aforementioned CAGR, placing it in the several billion dollar range.

Looking ahead to 2033, the India private banking market is projected to continue its impressive growth. The increasing penetration of financial technology, combined with government initiatives focused on financial inclusion and economic development, will act as significant catalysts. The focus will shift towards offering more personalized and technologically advanced solutions tailored to the unique needs of individual clients. Competition will intensify further as both established players and new entrants vie for market dominance. Successfully navigating this competitive landscape will require banks to invest in advanced analytics, strengthen customer relationship management, and adopt agile strategies to adapt to the ever-evolving financial landscape. The potential for growth in underserved regions and customer segments presents further opportunities for expansion and diversification.

India Private Banking Market: A Comprehensive Report (2019-2033)

This dynamic report offers a deep dive into the burgeoning India Private Banking Market, providing a detailed analysis of its structure, trends, opportunities, and challenges from 2019 to 2033. Leveraging extensive data and insightful analysis, this report is an invaluable resource for industry professionals, investors, and strategists seeking to navigate this rapidly evolving market. The report covers key players like Axis Bank Ltd, HDFC Bank Ltd, Yes Bank Ltd, ICICI Bank Ltd, Kotak Mahindra Bank Ltd, IndusInd Bank, IDBI Bank Ltd, Federal Bank, IDFC First Bank Ltd, and City Union Bank Ltd, among others. The market is projected to reach xx Million by 2033, exhibiting substantial growth opportunities.

India Private Banking Market Market Structure & Competitive Landscape

The Indian private banking market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the landscape is dynamic, driven by intense competition and ongoing consolidation. The market is characterized by a high degree of innovation, particularly in digital banking and wealth management solutions. Regulatory changes, including those related to data privacy and KYC norms, significantly impact market dynamics. While traditional banking products remain dominant, the emergence of fintechs and digital platforms is creating new product substitutes. End-user segmentation is primarily driven by net worth, risk appetite, and demographic factors. The merger and acquisition (M&A) activity has been significant, particularly in the past few years, with the HDFC-HDFC Bank merger representing a landmark event. Market concentration ratios show a moderate level of concentration, with the top 5 banks accounting for approximately xx% of the market in 2024. M&A volumes have been increasing, indicating consolidation and expansion strategies among key players. The competitive landscape is marked by intense rivalry, driving innovation and customer-centric approaches.

India Private Banking Market Market Trends & Opportunities

The India Private Banking Market is experiencing robust growth, fueled by rising disposable incomes, increasing wealth creation, and the growing adoption of digital banking solutions. The market size expanded from xx Million in 2019 to xx Million in 2024, registering a CAGR of xx% during this period. This growth trajectory is projected to continue during the forecast period (2025-2033), with the market expected to reach xx Million by 2033. Technological advancements, particularly in areas like AI, big data analytics, and blockchain technology, are significantly influencing market dynamics. These technologies are driving improvements in customer experience, risk management, and operational efficiency. Consumer preferences are shifting towards personalized services, digital convenience, and integrated financial solutions. The competitive landscape is evolving, with new entrants and established players constantly vying for market share. Market penetration rates indicate significant growth potential, especially in underserved regions and customer segments. The CAGR for the forecast period is expected to remain healthy, driven by continued economic expansion and rising wealth levels.

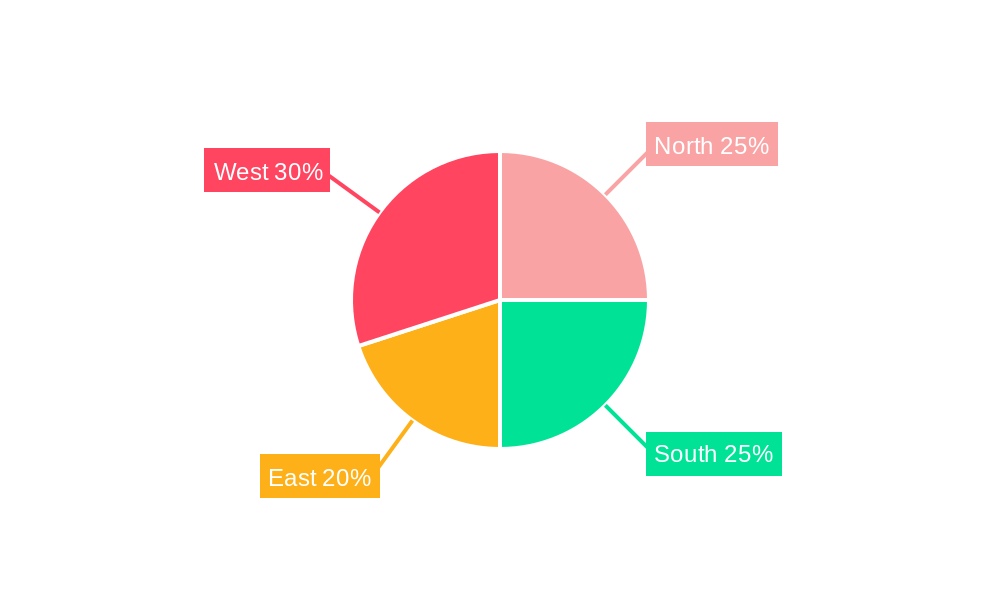

Dominant Markets & Segments in India Private Banking Market

The metropolitan areas of Mumbai, Delhi, Bengaluru, and Chennai represent the dominant markets for private banking services in India. These cities boast a high concentration of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) who constitute the primary customer base for private banking services.

- Key Growth Drivers:

- Robust economic growth and rising disposable incomes.

- Expanding HNWIs and UHNWIs population.

- Favorable government policies promoting financial inclusion.

- Increasing adoption of digital banking technologies.

- Growing demand for wealth management and investment advisory services.

The dominance of these regions is attributable to their advanced infrastructure, higher levels of financial literacy, and presence of key players in the private banking sector. The growth of private banking in tier-II and tier-III cities is also gaining momentum, driven by improving infrastructure and increasing affluence in these areas. The segment focused on HNWIs and UHNWIs holds the largest market share, reflecting the significant demand for personalized and sophisticated wealth management solutions.

India Private Banking Market Product Analysis

Private banking products are evolving to meet the changing needs of affluent clients. Traditional products like wealth management, investment banking, and credit facilities are supplemented by increasingly sophisticated digital solutions, such as robo-advisors, mobile banking apps, and personalized financial planning tools. The integration of fintech solutions is creating innovative, customer-centric products with enhanced convenience and accessibility. The key competitive advantage lies in providing personalized, high-touch services, leveraging advanced technology to optimize client experience and investment outcomes. Innovation focuses on improving user experience through digital channels while maintaining the personal touch that is central to private banking.

Key Drivers, Barriers & Challenges in India Private Banking Market

Key Drivers:

- Rising Affluence: The growth of HNWIs and UHNWIs is a primary driver, fueling the demand for sophisticated wealth management and financial services.

- Technological Advancements: Digitalization is transforming customer experience, efficiency, and product offerings.

- Government Initiatives: Policies focused on financial inclusion and economic growth create a favorable environment.

Challenges:

- Regulatory Scrutiny: Compliance costs and evolving regulations pose significant challenges for private banks.

- Cybersecurity Threats: The increasing reliance on digital platforms increases vulnerabilities to cyberattacks.

- Competition: Intense competition from both established and emerging players creates pressure on margins and market share. The increasing presence of fintechs is also a significant challenge.

Growth Drivers in the India Private Banking Market Market

The Indian private banking market's growth is driven by increasing disposable incomes, a burgeoning HNWIs segment, and expanding access to digital financial services. Government initiatives to boost financial inclusion and economic growth further fuel market expansion. Technological advancements, including AI and big data analytics, enable personalized services and improved operational efficiency, while increasing wealth management needs also contribute to growth.

Challenges Impacting India Private Banking Market Growth

Challenges include stringent regulatory compliance, cybersecurity risks, and intense competition from both domestic and international players. Maintaining profitability while managing rising compliance costs and adapting to evolving customer expectations pose significant hurdles. Supply chain disruptions in the IT sector can also impact the delivery of services and operational efficiency.

Key Players Shaping the India Private Banking Market Market

- Axis Bank Ltd

- HDFC Bank Ltd

- Yes Bank Ltd

- ICICI Bank Ltd

- Kotak Mahindra Bank Ltd

- IndusInd Bank

- IDBI Bank Ltd

- Federal Bank

- IDFC First Bank Ltd

- City Union Bank Ltd

- List Not Exhaustive

Significant India Private Banking Market Industry Milestones

- December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank, significantly altering the market landscape and creating a banking giant. The merger is anticipated to finalize in Q2 2023.

- March 2022: Axis Bank's proposed acquisition of Citibank's consumer businesses in India enhanced its market position and expanded its customer base.

Future Outlook for India Private Banking Market Market

The future outlook for the India Private Banking Market remains positive, driven by continued economic growth, rising affluence, and technological advancements. Strategic opportunities exist in expanding digital offerings, leveraging AI for personalized services, and catering to the growing needs of the HNWIs and UHNWIs segments. The market is poised for further growth and consolidation, with significant potential for both established players and new entrants.

India Private Banking Market Segmentation

-

1. BY Banking Sector

-

1.1. Retail Banking

- 1.1.1. Commercial Banking

- 1.1.2. Investment Banking

-

1.1. Retail Banking

India Private Banking Market Segmentation By Geography

- 1. India

India Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Private Sector Bank Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Private Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 5.1.1. Retail Banking

- 5.1.1.1. Commercial Banking

- 5.1.1.2. Investment Banking

- 5.1.1. Retail Banking

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axis Bank Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HDFC Bank Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yes Bank Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ICICI Bank Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kotak Mahindra Bank Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Induslnd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IDBI Bank Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Federal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IDFC First Bank Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 City Union Bank Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Axis Bank Ltd

List of Figures

- Figure 1: India Private Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Private Banking Market Share (%) by Company 2024

List of Tables

- Table 1: India Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Private Banking Market Revenue Million Forecast, by BY Banking Sector 2019 & 2032

- Table 3: India Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Private Banking Market Revenue Million Forecast, by BY Banking Sector 2019 & 2032

- Table 5: India Private Banking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Private Banking Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Private Banking Market?

Key companies in the market include Axis Bank Ltd, HDFC Bank Ltd, Yes Bank Ltd, ICICI Bank Ltd, Kotak Mahindra Bank Ltd, Induslnd Bank, IDBI Bank Ltd, Federal Bank, IDFC First Bank Ltd, City Union Bank Ltd *List Not Exhaustive.

3. What are the main segments of the India Private Banking Market?

The market segments include BY Banking Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Private Sector Bank Assets is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank. The merger is expected to conclude in Q2 of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Private Banking Market?

To stay informed about further developments, trends, and reports in the India Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence