Key Insights

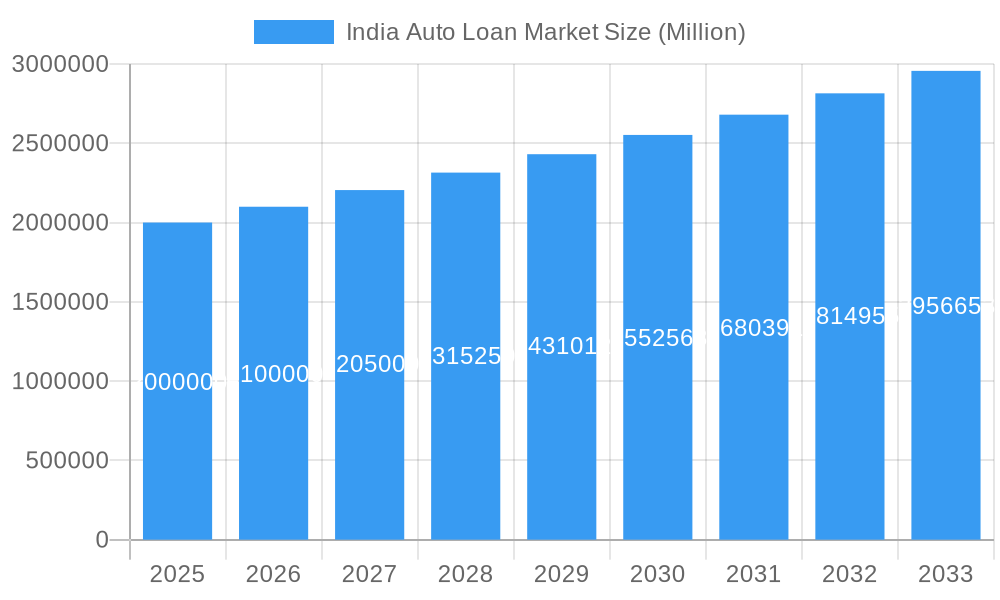

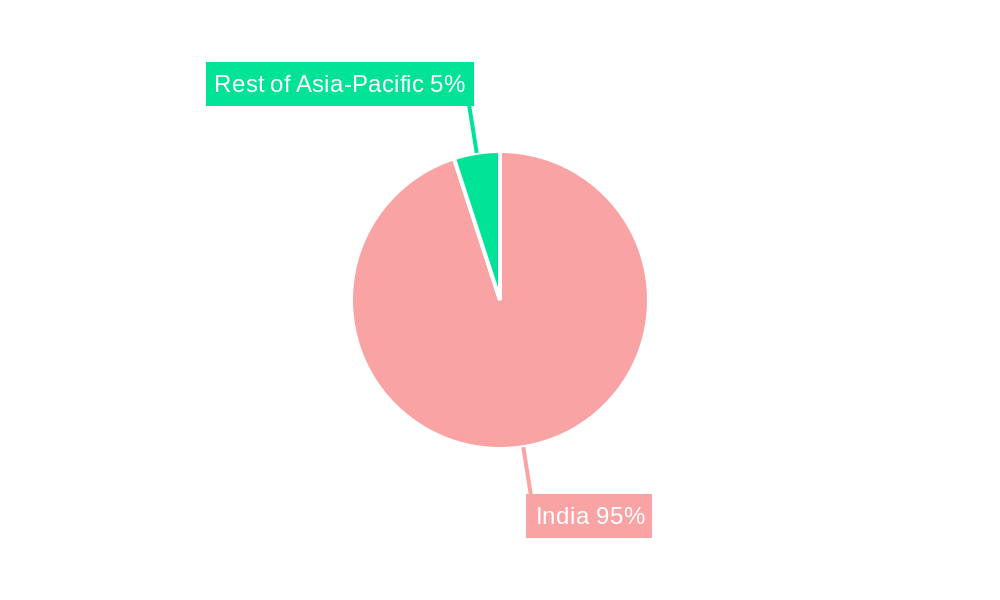

The India auto loan market is projected for substantial expansion, propelled by increasing disposable incomes, escalating vehicle ownership, and supportive government initiatives for automotive financing. The current market size is estimated at 24.46 billion, with a projected Compound Annual Growth Rate (CAGR) of 8.67% from a base year of 2024 through 2033. Key growth drivers include the rising popularity of used car financing, increased demand for both passenger and commercial vehicles, and enhanced accessibility via digital lending platforms. While banks lead as loan providers, Non-Banking Financial Companies (NBFCs) and Original Equipment Manufacturer (OEM) financing are gaining significant market share. Passenger vehicles dominate the market, reflecting India's growing middle class and demand for personal mobility. Challenges include fluctuating interest rates, stringent credit assessments, and potential economic slowdowns affecting borrower capacity. The Asia-Pacific region, with India at its forefront, commands a significant share due to its high population density, economic vitality, and thriving automotive sector.

India Auto Loan Market Market Size (In Billion)

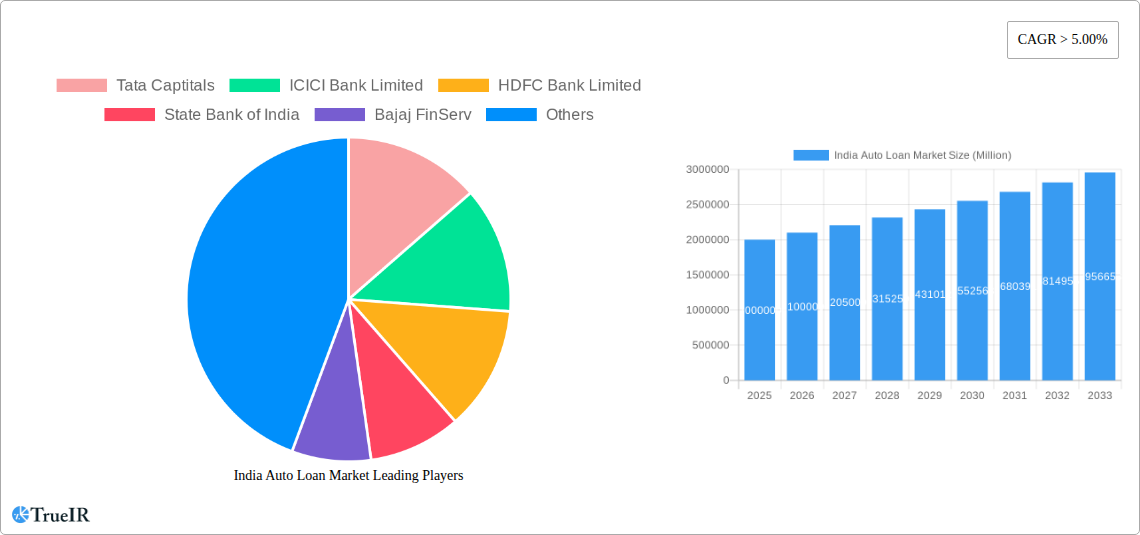

The forecast period (2024-2033) anticipates sustained market growth. This consistent expansion underscores strong consumer confidence and a positive economic outlook for India. Competition is intensifying among major banks (e.g., SBI, HDFC Bank, ICICI Bank) and prominent NBFCs (e.g., Bajaj Finserv, Tata Capital), who are actively innovating with financial products and digital solutions to meet rising demand. Strategic OEM partnerships are also enhancing the convenience and accessibility of auto financing. The used vehicle segment presents considerable growth opportunities for lenders. Success in this dynamic market will depend on navigating regulatory landscapes and effectively managing lending risks.

India Auto Loan Market Company Market Share

India Auto Loan Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning India Auto Loan Market, projecting significant growth from 2025 to 2033. Leveraging extensive market research and incorporating the latest industry developments, this report is an invaluable resource for investors, lenders, and automotive industry stakeholders seeking to navigate this rapidly evolving landscape. The report covers market size, segmentation, competitive dynamics, key players, and future trends, offering crucial insights to inform strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

India Auto Loan Market Market Structure & Competitive Landscape

The Indian auto loan market is characterized by a moderately concentrated structure, with a few dominant players and a larger number of smaller lenders. Key players, including Tata Capitals, ICICI Bank Limited, HDFC Bank Limited, State Bank of India, Bajaj FinServ, Axis Bank Limited, Ally Financials Inc, Kotak Mahindra Finance, Toyota Financial Services, and Mahindra & Mahindra Financial Services Limited, compete fiercely, driving innovation and influencing market dynamics.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements, such as digital lending platforms and AI-driven credit scoring, are transforming the market. The rise of electric vehicles (EVs) is also creating new opportunities.

- Regulatory Impacts: RBI regulations governing lending practices and interest rates significantly impact market operations.

- Product Substitutes: Peer-to-peer lending and other alternative financing options present some competitive pressure.

- End-User Segmentation: The market is broadly segmented by vehicle type (passenger and commercial), ownership (new and used), and end-user (individual and enterprise).

- M&A Trends: The past five years have witnessed xx mergers and acquisitions (M&A) deals, with a total transaction value of approximately xx Million. Consolidation is expected to continue.

India Auto Loan Market Market Trends & Opportunities

The Indian auto loan market is experiencing robust growth, driven by rising disposable incomes, increasing vehicle ownership, and favorable government policies. The market size, which stood at xx Million in 2024, is projected to reach xx Million by 2033. This translates to a substantial CAGR of xx% during the forecast period. Technological advancements, particularly the rise of fintech and digital lending platforms, are streamlining processes and improving access to credit. Consumer preferences are shifting towards more convenient and customized financing options, leading to the growth of online lending platforms and personalized loan offers. The competitive landscape is dynamic, with new entrants and established players vying for market share through innovative products and services. Market penetration rates remain relatively low, indicating considerable untapped potential for growth.

Dominant Markets & Segments in India Auto Loan Market

By Vehicle Type: The passenger vehicle segment dominates the market, accounting for approximately xx% of the total loan volume. Growth is primarily driven by rising demand for personal vehicles in urban and semi-urban areas. The commercial vehicle segment is also experiencing growth, albeit at a slower pace, driven by expanding logistics and transportation sectors.

By Ownership: The new vehicle segment commands the larger share, reflecting the growing preference for new vehicles among consumers. However, the used vehicle segment is witnessing substantial growth, fueled by affordability and the rising popularity of pre-owned cars.

By End-User: Individual borrowers constitute the majority of the market, reflecting the high demand for personal vehicles. The enterprise segment is also expanding, driven by the increasing needs of businesses for fleet financing.

By Loan Provider: Banks are the dominant loan providers, followed by OEMs and other financing institutions. The rise of non-bank financial companies (NBFCs) is increasing competition in the market.

Key Growth Drivers:

- Rising disposable incomes and improved access to credit: A larger middle class with increasing purchasing power fuels demand for vehicles.

- Government initiatives promoting vehicle ownership: Policies and infrastructure development support the growth of the automotive industry.

- Technological advancements in finance: Digital lending platforms increase efficiency and accessibility.

India Auto Loan Market Product Analysis

The Indian auto loan market offers a range of products tailored to diverse customer needs, including conventional loans, balloon payment loans, and lease financing options. Technological advancements, such as AI-powered credit scoring and digital lending platforms, are improving the efficiency and accessibility of auto loans. The focus is on personalized solutions, competitive interest rates, and flexible repayment options, which enhance market fit and attract borrowers.

Key Drivers, Barriers & Challenges in India Auto Loan Market

Key Drivers: Rising disposable incomes, increasing urbanization, and government initiatives promoting vehicle ownership are driving market expansion. Technological advancements, such as digital lending platforms, are improving efficiency and access to credit. The increasing demand for commercial vehicles due to infrastructural projects and the expanding logistics sector is also a significant growth driver.

Challenges: Stringent regulatory requirements, including KYC/AML norms, can pose challenges to lenders. Supply chain disruptions caused by global events may impact the availability of vehicles and hence affect loan demand. High competition among lenders can lead to price wars and pressure on margins. The high NPAs (Non Performing Assets) in the market present a significant challenge for the sector.

Growth Drivers in the India Auto Loan Market Market

The Indian auto loan market's growth is fueled by rising disposable incomes, increasing urbanization leading to higher vehicle demand, and government initiatives promoting vehicle ownership. Further, technological advancements, especially digital lending platforms, are boosting efficiency and improving credit access. Expansion of the commercial vehicle segment due to infrastructure development adds to the growth trajectory.

Challenges Impacting India Auto Loan Market Growth

Challenges include stringent regulatory oversight and compliance requirements, supply chain disruptions potentially affecting vehicle availability, and intense competition leading to pricing pressures. Additionally, managing Non-Performing Assets (NPAs) remains a significant concern for lenders in the market.

Key Players Shaping the India Auto Loan Market Market

- Tata Capitals

- ICICI Bank Limited

- HDFC Bank Limited

- State Bank of India

- Bajaj FinServ

- Axis Bank Limited

- Ally Financials Inc

- Kotak Mahindra Finance

- Toyota Financial Services

- Mahindra & Mahindra Financial Services Limited

Significant India Auto Loan Market Industry Milestones

June 2023: Tata Motors Finance (TMF) extended a USD 3.05 Million credit facility to BluSmart Mobility for fleet expansion in Delhi NCR. This highlights the growing interest in financing electric vehicle operations.

May 2023: Suzuki Motorcycle India partnered with Bajaj Finance to offer financing for Suzuki two-wheelers, indicating strategic collaborations to boost sales and market penetration.

Future Outlook for India Auto Loan Market Market

The India Auto Loan Market is poised for sustained growth, driven by a young population, rising disposable incomes, and continued government support for the automotive sector. Strategic partnerships between OEMs and financing institutions, coupled with the adoption of digital lending technologies, will be key growth catalysts. The market presents significant opportunities for both established and new players who can effectively navigate the regulatory landscape and offer innovative, customer-centric financing solutions.

India Auto Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicle

- 2.2. Used Vehicle

-

3. End User

- 3.1. Individual

- 3.2. Enterprise

-

4. Loan Provider

- 4.1. Banks

- 4.2. OEM

- 4.3. Credit Unions

- 4.4. Other Loan Providers

India Auto Loan Market Segmentation By Geography

- 1. India

India Auto Loan Market Regional Market Share

Geographic Coverage of India Auto Loan Market

India Auto Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Demand For Passenger Vehicles; Quick Processing of Loan through Digital Banking

- 3.3. Market Restrains

- 3.3.1. Rising Inflation In the Automobile Market

- 3.4. Market Trends

- 3.4.1. Rising Interest Rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Auto Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicle

- 5.2.2. Used Vehicle

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Enterprise

- 5.4. Market Analysis, Insights and Forecast - by Loan Provider

- 5.4.1. Banks

- 5.4.2. OEM

- 5.4.3. Credit Unions

- 5.4.4. Other Loan Providers

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tata Captitals

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ICICI Bank Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC Bank Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Bank of India

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bajaj FinServ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Bank Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ally Financials Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kotak Mahindra Fianace

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Financial Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mahindra & Mahindra Financial Services Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tata Captitals

List of Figures

- Figure 1: India Auto Loan Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Auto Loan Market Share (%) by Company 2025

List of Tables

- Table 1: India Auto Loan Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: India Auto Loan Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 3: India Auto Loan Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: India Auto Loan Market Revenue billion Forecast, by Loan Provider 2020 & 2033

- Table 5: India Auto Loan Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Auto Loan Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: India Auto Loan Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 8: India Auto Loan Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: India Auto Loan Market Revenue billion Forecast, by Loan Provider 2020 & 2033

- Table 10: India Auto Loan Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Auto Loan Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the India Auto Loan Market?

Key companies in the market include Tata Captitals, ICICI Bank Limited, HDFC Bank Limited, State Bank of India, Bajaj FinServ, Axis Bank Limited, Ally Financials Inc, Kotak Mahindra Fianace, Toyota Financial Services, Mahindra & Mahindra Financial Services Limited.

3. What are the main segments of the India Auto Loan Market?

The market segments include Vehicle Type, Ownership, End User, Loan Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase In Demand For Passenger Vehicles; Quick Processing of Loan through Digital Banking.

6. What are the notable trends driving market growth?

Rising Interest Rates.

7. Are there any restraints impacting market growth?

Rising Inflation In the Automobile Market.

8. Can you provide examples of recent developments in the market?

June 2023:Tata Motors Finance (TMF), a prominent automotive lender, extended a structured credit facility of USD 3.05 million to BluSmart Mobility, a leading EV ride-hailing service and EV charging superhub infrastructure provider, to help it expand its fleet and operations in Delhi NCR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Auto Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Auto Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Auto Loan Market?

To stay informed about further developments, trends, and reports in the India Auto Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence