Key Insights

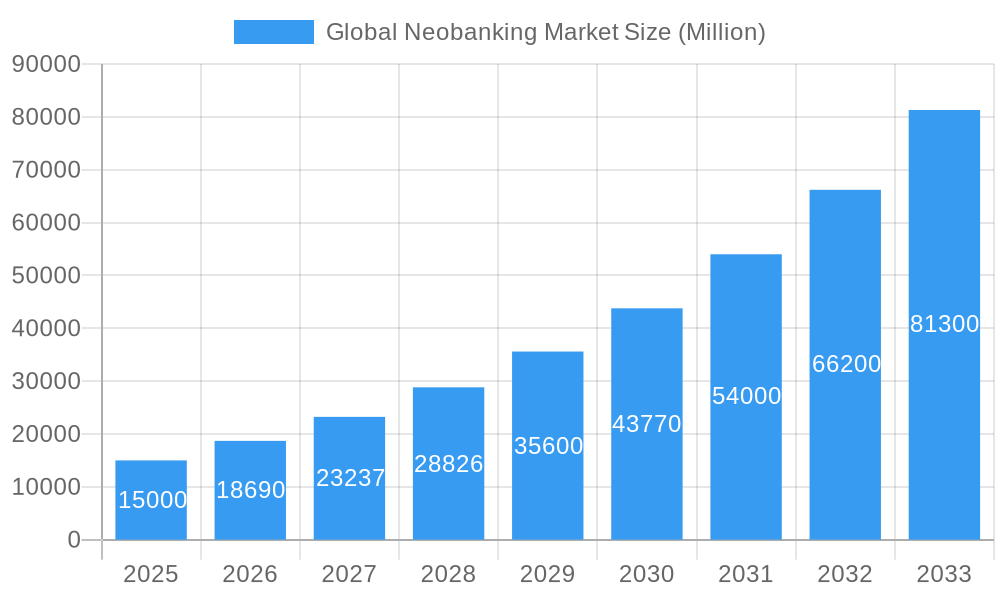

The global neobanking market is experiencing explosive growth, driven by increasing consumer demand for digital-first financial services and the inherent advantages of neobanks' technology-driven approach. A 24.60% Compound Annual Growth Rate (CAGR) from 2019-2024 indicates a significant market expansion, projected to continue its upward trajectory through 2033. This rapid expansion is fueled by several key factors. Firstly, the millennial and Gen Z demographics are increasingly comfortable managing their finances digitally, favoring the convenience and user-friendly interfaces offered by neobanks. Secondly, the ability of neobanks to offer personalized financial products and services, often at lower costs than traditional banks, is a major draw. Finally, the seamless integration of various financial tools within neobanking apps provides a holistic financial management solution, enhancing user engagement and loyalty. Key players such as Monzo, Chime, Starling, and Revolut are leading this charge, constantly innovating to capture market share. Competition within the sector remains fierce, however, with established players and emerging startups continuously vying for customer attention.

Global Neobanking Market Market Size (In Billion)

The market segmentation is complex, with different neobanks catering to specific demographics and financial needs. While precise segment data is unavailable, it’s likely that segments based on geographic location, user demographics (age, income), and service offerings (personal banking, business banking, investment services) exist. Geographic expansion continues to be a major strategy for neobanks, seeking to tap into underserved markets globally. Regulatory hurdles and cybersecurity concerns remain significant restraints; however, industry best practices and regulatory adaptations are expected to address these in the coming years. The overall outlook remains overwhelmingly positive, suggesting continued substantial growth in the neobanking sector for the foreseeable future, making it a highly attractive and dynamic market for investment and innovation. Future projections indicate further market consolidation, as larger players acquire smaller ones, and increased competition from established banks adopting neobanking technologies.

Global Neobanking Market Company Market Share

This comprehensive report provides a detailed analysis of the global neobanking market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data from the historical period (2019-2024) to project future market trends accurately. The report offers a deep dive into market structure, competitive landscape, key trends, dominant segments, and future growth potential. The market is estimated to be worth xx Million in 2025.

Global Neobanking Market Structure & Competitive Landscape

The global neobanking market exhibits a moderately concentrated structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated to be xx, indicating a moderately competitive landscape. Several factors shape this dynamic environment:

- Innovation Drivers: The relentless pursuit of technological advancements, particularly in mobile-first banking solutions, AI-powered personalized services, and open banking APIs, fuels intense competition and rapid product development.

- Regulatory Impacts: Varying regulatory landscapes across different jurisdictions significantly influence market entry barriers and operational costs. Stringent KYC/AML regulations, data privacy laws, and licensing requirements create challenges for neobanks.

- Product Substitutes: Traditional banking services and emerging fintech solutions pose significant competitive threats, necessitating continuous innovation and differentiation by neobanks.

- End-User Segmentation: The market caters to a diverse clientele, including millennials, Gen Z, small businesses, and underserved populations. Tailored service offerings and targeted marketing strategies are crucial for success.

- M&A Trends: The neobanking sector has witnessed a surge in mergers and acquisitions (M&A) activity in recent years. The volume of M&A deals reached approximately xx in 2024, indicating consolidation within the industry. This trend is driven by the need for scale, technological capabilities, and broader market reach.

Global Neobanking Market Market Trends & Opportunities

The global neobanking market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several key trends are shaping this expansion:

- Market Size Growth: The market is expanding significantly, driven by increasing adoption of digital banking solutions and the growing preference for convenient and personalized financial services. Market penetration rates are gradually increasing, especially in emerging markets.

- Technological Shifts: The ongoing evolution of technologies, including AI, machine learning, blockchain, and cloud computing, is driving innovation and improving the efficiency and security of neobanking services.

- Consumer Preferences: Consumers, particularly younger demographics, increasingly favor digital-first experiences, seamless mobile interfaces, and personalized financial management tools.

- Competitive Dynamics: The market is highly competitive, with numerous players constantly innovating to gain market share and attract customers. This competition fosters product diversification and improved service offerings.

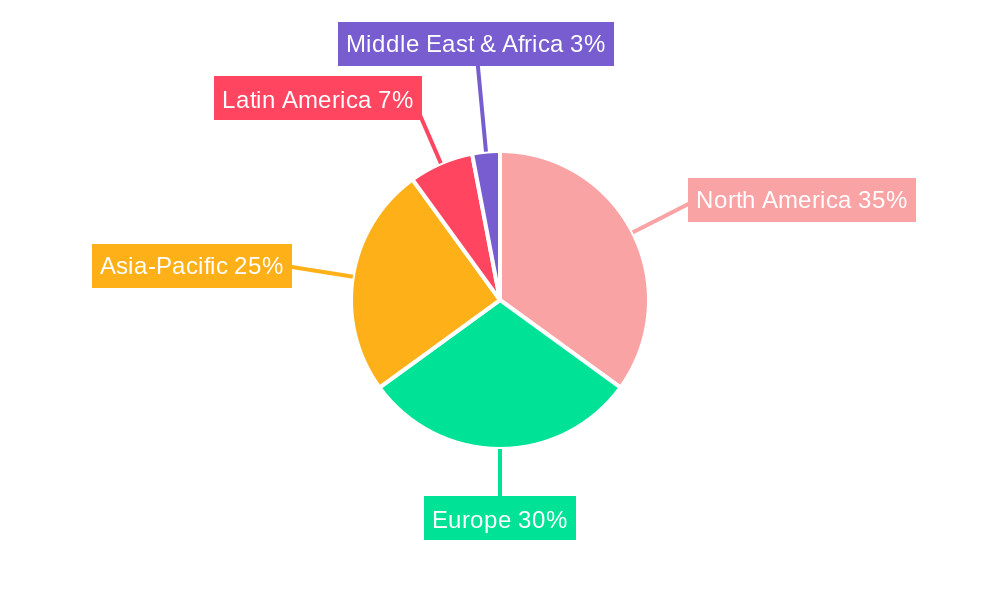

Dominant Markets & Segments in Global Neobanking Market

The North American market currently holds a leading position in the global neobanking sector, largely driven by its advanced technological infrastructure, high smartphone penetration rates, and favorable regulatory environment. Key growth drivers include:

- Robust Technological Infrastructure: The presence of advanced technological infrastructure facilitates the seamless development and deployment of neobanking applications.

- Favorable Regulatory Landscape: Relatively less stringent regulations in some North American jurisdictions compared to other regions make market entry and operation easier for neobanks.

- High Smartphone Penetration: High rates of smartphone ownership among the target demographic enhance the accessibility and reach of neobanking services.

Other regions, such as Europe and Asia-Pacific, are also witnessing rapid growth, fueled by increasing internet and smartphone penetration, coupled with rising demand for digital financial solutions.

Global Neobanking Market Product Analysis

Neobanks offer a wide range of products and services, including current accounts, savings accounts, debit cards, personal loans, investment platforms, and international money transfers. The competitive advantage lies in leveraging technology to offer superior customer experiences, including enhanced security, personalized financial management tools, and 24/7 accessibility. Continuous innovation in features and functionalities drives market leadership.

Key Drivers, Barriers & Challenges in Global Neobanking Market

Key Drivers: Technological advancements (AI, mobile-first platforms), increasing smartphone penetration, growing demand for personalized financial services, and favorable regulatory environments in some regions are driving market growth.

Challenges: Regulatory complexities, particularly KYC/AML compliance and data privacy regulations, pose significant hurdles. Competition from established banks and other fintech players, coupled with supply chain vulnerabilities, can impact profitability and sustainability.

Growth Drivers in the Global Neobanking Market Market

Technological innovation, regulatory changes fostering open banking, rising demand for personalized financial services, and increasing financial inclusion in emerging markets are key growth drivers. Government initiatives promoting fintech innovation also play a significant role.

Challenges Impacting Global Neobanking Market Growth

Stringent regulatory compliance, cybersecurity threats, maintaining profitability amidst intense competition, and ensuring data privacy while leveraging customer data are major challenges. Managing operational costs and expanding into new markets effectively are also crucial considerations.

Key Players Shaping the Global Neobanking Market Market

- Monzo Bank Ltd

- Chime Financial Inc

- Starling Banks

- MoneyLion

- Sofi

- N

- Judo Bank

- Tinkoff Bank

- Nubank

- Revolut

- List Not Exhaustive

Significant Global Neobanking Market Industry Milestones

- October 2022: Kitzone Neo Bank in India launches the country's first assured cashback debit cards, along with mini-ATM and POS terminal services.

- September 2022: N26 becomes the first neobank to integrate with Bizum in Spain, enabling seamless money transfers and payments.

Future Outlook for Global Neobanking Market Market

The global neobanking market is poised for continued robust growth, driven by technological innovation, evolving consumer preferences, and expanding financial inclusion initiatives. Strategic partnerships, international expansion, and the development of innovative financial products and services will be crucial for success in this dynamic market.

Global Neobanking Market Segmentation

-

1. Account Type

- 1.1. Bussiness Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile- Banking

- 2.2. Payments

- 2.3. Money- Transfers

- 2.4. Savings Account

- 2.5. Loans

- 2.6. Others

-

3. Application

- 3.1. Personal

- 3.2. Enterprise

- 3.3. Other Application

Global Neobanking Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Global Neobanking Market Regional Market Share

Geographic Coverage of Global Neobanking Market

Global Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 58.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Digitalization of Banking Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Bussiness Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile- Banking

- 5.2.2. Payments

- 5.2.3. Money- Transfers

- 5.2.4. Savings Account

- 5.2.5. Loans

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Enterprise

- 5.3.3. Other Application

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. North America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Bussiness Account

- 6.1.2. Savings Account

- 6.2. Market Analysis, Insights and Forecast - by Services

- 6.2.1. Mobile- Banking

- 6.2.2. Payments

- 6.2.3. Money- Transfers

- 6.2.4. Savings Account

- 6.2.5. Loans

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal

- 6.3.2. Enterprise

- 6.3.3. Other Application

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. Europe Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Bussiness Account

- 7.1.2. Savings Account

- 7.2. Market Analysis, Insights and Forecast - by Services

- 7.2.1. Mobile- Banking

- 7.2.2. Payments

- 7.2.3. Money- Transfers

- 7.2.4. Savings Account

- 7.2.5. Loans

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal

- 7.3.2. Enterprise

- 7.3.3. Other Application

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Asia Pacific Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Bussiness Account

- 8.1.2. Savings Account

- 8.2. Market Analysis, Insights and Forecast - by Services

- 8.2.1. Mobile- Banking

- 8.2.2. Payments

- 8.2.3. Money- Transfers

- 8.2.4. Savings Account

- 8.2.5. Loans

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal

- 8.3.2. Enterprise

- 8.3.3. Other Application

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Middle East Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Bussiness Account

- 9.1.2. Savings Account

- 9.2. Market Analysis, Insights and Forecast - by Services

- 9.2.1. Mobile- Banking

- 9.2.2. Payments

- 9.2.3. Money- Transfers

- 9.2.4. Savings Account

- 9.2.5. Loans

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal

- 9.3.2. Enterprise

- 9.3.3. Other Application

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. South America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Bussiness Account

- 10.1.2. Savings Account

- 10.2. Market Analysis, Insights and Forecast - by Services

- 10.2.1. Mobile- Banking

- 10.2.2. Payments

- 10.2.3. Money- Transfers

- 10.2.4. Savings Account

- 10.2.5. Loans

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal

- 10.3.2. Enterprise

- 10.3.3. Other Application

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Monzo Bank Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chime Financial Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Starling Banks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MoneyLion

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sofi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 N

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Judo Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tinkoff Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nubank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Revolut**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Monzo Bank Ltd

List of Figures

- Figure 1: Global Global Neobanking Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 3: North America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: North America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 5: North America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 6: North America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 11: Europe Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 12: Europe Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 13: Europe Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: Europe Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 19: Asia Pacific Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 20: Asia Pacific Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 21: Asia Pacific Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Asia Pacific Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 27: Middle East Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 28: Middle East Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 29: Middle East Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 30: Middle East Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 35: South America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 36: South America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 37: South America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 38: South America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 2: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 3: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Neobanking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 6: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 7: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 10: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 11: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 14: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 15: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 18: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 19: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 22: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 23: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Neobanking Market?

The projected CAGR is approximately 58.6%.

2. Which companies are prominent players in the Global Neobanking Market?

Key companies in the market include Monzo Bank Ltd, Chime Financial Inc, Starling Banks, MoneyLion, Sofi, N, Judo Bank, Tinkoff Bank, Nubank, Revolut**List Not Exhaustive.

3. What are the main segments of the Global Neobanking Market?

The market segments include Account Type, Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Digitalization of Banking Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, India's First Assured Cashback Debit Cards are being introduced by Rajasthan-based Kitzone Neo Bank, which is also providing the Mini ATM and Pos Terminal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Neobanking Market?

To stay informed about further developments, trends, and reports in the Global Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence