Key Insights

The Asia-Pacific neo-banking market is poised for substantial expansion, driven by escalating smartphone adoption, a digitally adept youth demographic, and a growing preference for seamless, tailored financial solutions. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 47%, increasing from an estimated market size of 261.4 billion in the base year 2025. This growth is propelled by the region's burgeoning digital economy, the demand for accessible banking in underserved areas, and the widespread integration of fintech innovations such as mobile payments and AI-powered financial management. Segmentation encompasses customer demographics, service offerings (personal finance management, lending, payments), and regional sub-markets within Asia-Pacific. Despite challenges including cybersecurity risks, regulatory complexities, and competition from incumbents, the market outlook remains exceptionally strong, underpinned by the continuous embrace of digital finance and a clear inclination towards intuitive, technology-driven banking experiences. Leading companies like WeBank, Paytm, and KakaoBank are instrumental in redefining financial services across the region.

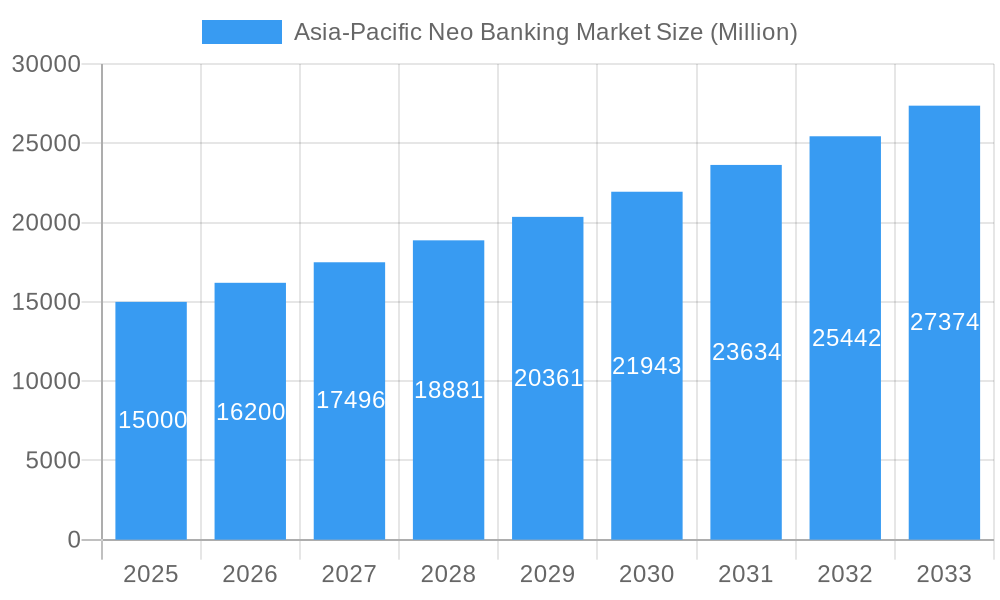

Asia-Pacific Neo Banking Market Market Size (In Billion)

The competitive arena is characterized by a blend of established institutions and agile newcomers striving for market leadership. Success hinges on strategic alliances, technological innovation, and assertive market engagement. Regional growth trajectories will be influenced by digital literacy levels, governmental policies, and existing financial infrastructure. Markets with high smartphone penetration and youthful populations, notably India and Southeast Asia, are anticipated to exhibit accelerated growth. Future expansion will be contingent on the successful adoption of advanced technologies like blockchain and enhanced financial education to foster broader neo-banking uptake. Adapting to evolving regulatory frameworks and shifting consumer expectations will be paramount for sustained success in this dynamic market.

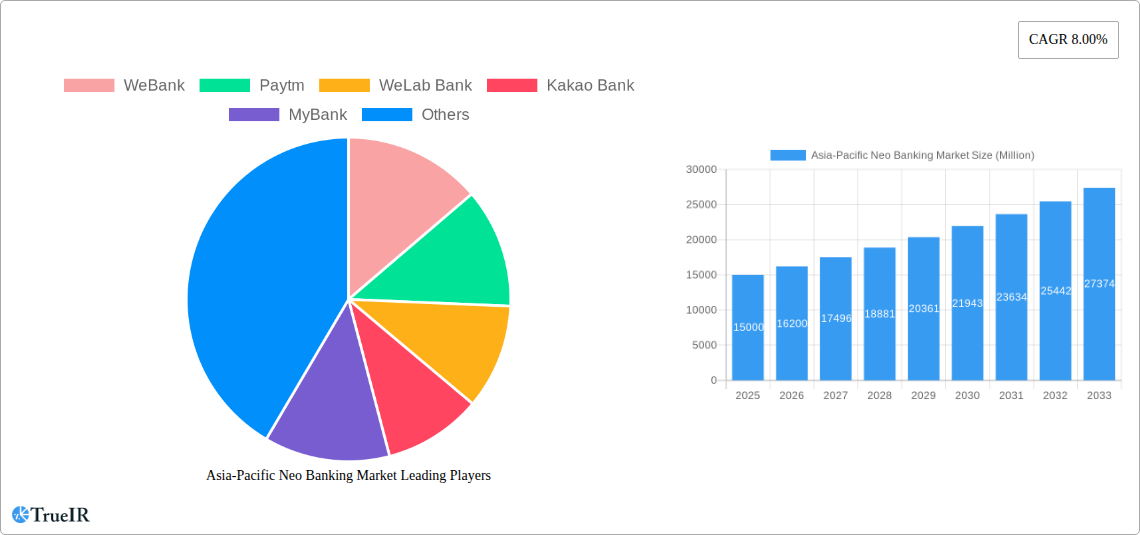

Asia-Pacific Neo Banking Market Company Market Share

Asia-Pacific Neo Banking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Asia-Pacific neo banking market, offering invaluable insights for investors, industry players, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. Expect detailed segmentation, market sizing (in Millions), CAGR projections, and analysis of key players like WeBank, Paytm, WeLab Bank, Kakao Bank, and more.

Asia-Pacific Neo Banking Market Structure & Competitive Landscape

The Asia-Pacific neo banking market exhibits a moderately concentrated structure, with a few major players vying for market share alongside numerous smaller, agile fintech companies. Innovation is a key driver, with companies constantly introducing new digital products and services to cater to evolving consumer needs. Regulatory frameworks vary across the region, significantly impacting market entry and operations. The market also faces competitive pressure from traditional banks adopting digital strategies. Product substitutes include traditional banking services and other fintech solutions. End-user segmentation is largely driven by demographics and tech-savviness, with younger generations adopting neo banking solutions more readily. The market has witnessed a moderate level of M&A activity in recent years, with a projected xx Million in deals during the study period. Concentration ratios, as measured by the Herfindahl-Hirschman Index (HHI), are projected to remain at xx in 2025, indicating a moderately competitive market.

- Market Concentration: Moderately concentrated, with a HHI of xx in 2025.

- Innovation Drivers: Development of AI-powered services, personalized financial management tools, and open banking initiatives.

- Regulatory Impacts: Vary significantly across countries, impacting market entry and operations.

- Product Substitutes: Traditional banking services, other fintech platforms.

- End-User Segmentation: Primarily driven by demographics (age, income) and technological proficiency.

- M&A Trends: Moderate activity, with an estimated xx Million in deal value during 2019-2024.

Asia-Pacific Neo Banking Market Trends & Opportunities

The Asia-Pacific neo banking market is experiencing robust growth, driven by increasing smartphone penetration, rising internet usage, and a preference for digital-first financial services among younger demographics. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% from 2025 to 2033. Technological advancements, such as AI and blockchain, are transforming the landscape, enabling faster transactions, enhanced security, and personalized offerings. Consumer preferences are shifting towards convenience, transparency, and personalized experiences. Intense competition is driving innovation and pushing players to offer increasingly sophisticated products and services. Market penetration remains relatively low compared to Western markets, presenting significant growth opportunities. Key opportunities lie in expanding into underserved markets, developing innovative products tailored to specific consumer segments, and leveraging partnerships with other fintech companies.

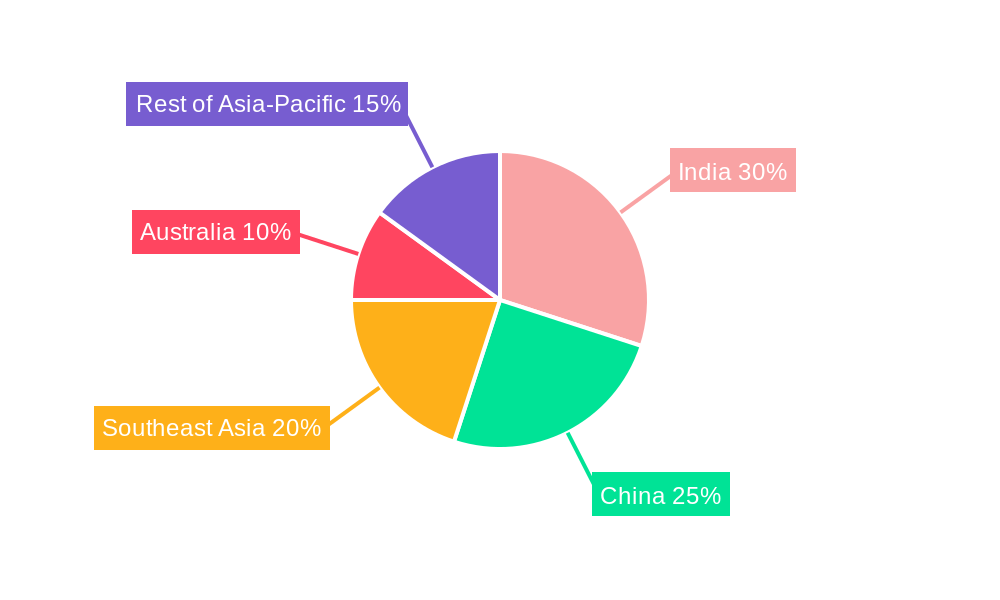

Dominant Markets & Segments in Asia-Pacific Neo Banking Market

China and India are currently the dominant markets, accounting for a combined xx% of the overall market share in 2025. This dominance stems from large populations, high smartphone penetration, and a burgeoning fintech ecosystem.

- Key Growth Drivers in China: Strong government support for digital finance, extensive mobile infrastructure, and a large, tech-savvy population.

- Key Growth Drivers in India: Rising smartphone adoption, increasing internet penetration, and a large unbanked population.

- Other Key Markets: Singapore, South Korea, and Australia are also experiencing significant growth, driven by factors such as strong regulatory frameworks and high consumer adoption rates.

Asia-Pacific Neo Banking Market Product Analysis

Neo banks in the Asia-Pacific region offer a wide range of products and services, including mobile banking, digital payments, personal loans, and investment products. These offerings are characterized by seamless user interfaces, personalized recommendations, and innovative features like AI-powered financial management tools. The integration of open banking APIs allows users to manage multiple accounts and financial products through a single platform, enhancing convenience and accessibility. The competitive advantage lies in delivering a superior user experience, offering personalized financial guidance and leveraging data analytics for efficient risk management.

Key Drivers, Barriers & Challenges in Asia-Pacific Neo Banking Market

Key Drivers:

- Rapid digitalization and increased smartphone penetration.

- Growing demand for convenient and accessible financial services.

- Supportive government policies in several countries promoting fintech growth.

- Technological advancements, including AI and blockchain.

Key Barriers and Challenges:

- Stringent regulatory requirements and varying compliance standards across countries.

- Cybersecurity risks and concerns about data privacy.

- Intense competition from established banks and other fintech companies.

- Infrastructure limitations in some regions, particularly concerning internet access. This limits accessibility for a significant portion of the population, slowing market growth.

Growth Drivers in the Asia-Pacific Neo Banking Market Market

The market is propelled by increasing digital literacy, the expanding middle class, and supportive government initiatives. The rise of mobile-first services and embedded finance models further accelerates growth. Technological advancements like AI personalize services, enhancing the user experience. Open banking frameworks improve interoperability and access to data, fostering innovation.

Challenges Impacting Asia-Pacific Neo Banking Market Growth

Regulatory uncertainty across the region poses a significant challenge. Cybersecurity threats and data privacy concerns remain paramount. Competition from established financial institutions necessitates continuous innovation and investment. Building trust and addressing concerns about data security are crucial for sustained growth.

Key Players Shaping the Asia-Pacific Neo Banking Market Market

- WeBank

- Paytm

- WeLab Bank

- Kakao Bank

- MyBank

- Douugh

- Crypto.com

- Toss Bank

- InstantPay

- Kyash

Significant Asia-Pacific Neo Banking Market Industry Milestones

- December 2021: Kakao Bank announced an MOU with Kyobo Life Insurance, Kyobo Bookstore, and Kyobo Securities for data cooperation and partnerships, expanding its product offerings and market reach.

- April 2022: WeLab Bank became the first virtual bank in Hong Kong granted permission to provide digital wealth advising services, marking a significant expansion of its services.

Future Outlook for Asia-Pacific Neo Banking Market Market

The Asia-Pacific neo banking market is poised for sustained growth, driven by technological innovation, increasing digital adoption, and expanding financial inclusion. Strategic partnerships, product diversification, and a focus on enhancing the customer experience will be crucial for success. The market’s potential is significant, with ample opportunities for both established players and new entrants to capitalize on the region's dynamic financial landscape.

Asia-Pacific Neo Banking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments and Tranfer

- 2.3. Loans

- 2.4. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Australia

- 4.4. Singapore

- 4.5. Hongkong

- 4.6. Rest of Asia-Pacific

Asia-Pacific Neo Banking Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Singapore

- 5. Hongkong

- 6. Rest of Asia Pacific

Asia-Pacific Neo Banking Market Regional Market Share

Geographic Coverage of Asia-Pacific Neo Banking Market

Asia-Pacific Neo Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Number of Customers for Neo Banking is Raising Significantly in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Tranfer

- 5.2.3. Loans

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Singapore

- 5.4.5. Hongkong

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Australia

- 5.5.4. Singapore

- 5.5.5. Hongkong

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. China Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Business Account

- 6.1.2. Saving Account

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Mobile Banking

- 6.2.2. Payments and Tranfer

- 6.2.3. Loans

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Enterprise

- 6.3.2. Personal

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Australia

- 6.4.4. Singapore

- 6.4.5. Hongkong

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. India Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Business Account

- 7.1.2. Saving Account

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Mobile Banking

- 7.2.2. Payments and Tranfer

- 7.2.3. Loans

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Enterprise

- 7.3.2. Personal

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Australia

- 7.4.4. Singapore

- 7.4.5. Hongkong

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Australia Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Business Account

- 8.1.2. Saving Account

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Mobile Banking

- 8.2.2. Payments and Tranfer

- 8.2.3. Loans

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Enterprise

- 8.3.2. Personal

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Australia

- 8.4.4. Singapore

- 8.4.5. Hongkong

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Singapore Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Business Account

- 9.1.2. Saving Account

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Mobile Banking

- 9.2.2. Payments and Tranfer

- 9.2.3. Loans

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Enterprise

- 9.3.2. Personal

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Australia

- 9.4.4. Singapore

- 9.4.5. Hongkong

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. Hongkong Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Business Account

- 10.1.2. Saving Account

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Mobile Banking

- 10.2.2. Payments and Tranfer

- 10.2.3. Loans

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Enterprise

- 10.3.2. Personal

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Australia

- 10.4.4. Singapore

- 10.4.5. Hongkong

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Rest of Asia Pacific Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 11.1.1. Business Account

- 11.1.2. Saving Account

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Mobile Banking

- 11.2.2. Payments and Tranfer

- 11.2.3. Loans

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Enterprise

- 11.3.2. Personal

- 11.3.3. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Australia

- 11.4.4. Singapore

- 11.4.5. Hongkong

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 WeBank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Paytm

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 WeLab Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kakao Bank

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MyBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Douugh

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Crypto com

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toss Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 InstantPay

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kyash**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 WeBank

List of Figures

- Figure 1: Global Asia-Pacific Neo Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 3: China Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: China Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 5: China Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: China Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 7: China Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: China Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: China Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 11: China Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: India Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 13: India Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 14: India Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 15: India Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: India Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 17: India Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: India Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: India Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: India Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: India Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 23: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 24: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 25: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 33: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 34: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 35: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 36: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 43: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 44: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 45: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 46: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 49: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 53: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 54: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 55: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 56: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 57: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 7: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 12: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 13: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 17: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 22: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 23: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 27: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 32: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 33: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Neo Banking Market?

The projected CAGR is approximately 47%.

2. Which companies are prominent players in the Asia-Pacific Neo Banking Market?

Key companies in the market include WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto com, Toss Bank, InstantPay, Kyash**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Neo Banking Market?

The market segments include Account Type, Service, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Number of Customers for Neo Banking is Raising Significantly in the Region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, WeLab Bank has become the first virtual bank in Hong Kong to be granted permission to provide digital wealth advising services. The Bank soft-launched its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) for selected customers after receiving Type 1 (Dealing in securities) and Type 4 (Advising on securities) licenses from the Hong Kong Securities and Futures Commission (HKSFC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Neo Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Neo Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Neo Banking Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Neo Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence