Key Insights

The Indonesian health and medical insurance market, valued at approximately [Estimate based on "Market size XX" and "Value Unit Million". Let's assume XX is 1000 for this example. Adjust as needed based on actual data.] million in 2025, is experiencing robust growth, exceeding a 5% Compound Annual Growth Rate (CAGR). This expansion is driven by several key factors. Rising disposable incomes are empowering Indonesians to prioritize healthcare, fueling demand for both individual and group health insurance plans. A growing awareness of health risks and the increasing prevalence of chronic diseases are also significant drivers. Government initiatives promoting health insurance coverage are further bolstering market growth, particularly within the public/social health insurance sector. The private health insurance segment is also thriving, with significant contributions from both domestic and international players. This competitive landscape is fostering innovation in product offerings and distribution channels, with online sales witnessing considerable growth.

However, several challenges persist. Limited health insurance penetration in rural areas and a lack of health insurance literacy among certain demographics pose significant restraints. Furthermore, the regulatory landscape and the complexity associated with navigating the various insurance products can create barriers to entry for consumers. The market is segmented by product type (individual/group), provider (public/private), and distribution channel (agents, brokers, banks, online). Key players like Allianz Care, AXA Indonesia, AIA Financial Indonesia, and Prudential Indonesia are competing aggressively, offering diverse product portfolios and leveraging multiple distribution channels to capture market share. The forecast period (2025-2033) projects continued expansion, driven by increasing affordability, evolving consumer preferences, and ongoing government support, potentially leading to higher penetration rates in under-served regions.

Indonesia Health and Medical Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Indonesia health and medical insurance market, covering market structure, competitive landscape, trends, opportunities, and future outlook from 2019 to 2033. The report leverages extensive data and qualitative insights to offer a robust understanding of this dynamic sector. With a focus on key players like Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, and more, this report is an essential resource for industry professionals, investors, and policymakers.

Indonesia Health and Medical Insurance Market Structure & Competitive Landscape

The Indonesian health and medical insurance market exhibits a moderately concentrated structure, with several large players dominating the private health insurance segment. The market's structure is influenced by factors including government regulations, the increasing prevalence of chronic diseases, and rising consumer awareness of health insurance benefits. Innovation drivers include technological advancements in telemedicine, digital health platforms, and data analytics. Regulatory impacts, such as mandates for health insurance coverage, significantly shape market dynamics. Product substitutes, such as traditional forms of healthcare financing, continue to compete with insurance products. End-user segmentation is primarily driven by factors such as income levels, age, and health status. The market has witnessed a moderate volume of M&A activity in recent years, driven by strategic expansion goals and the pursuit of market share.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: An estimated xx Million USD worth of M&A deals were recorded between 2019 and 2024.

- Innovation Drivers: Telemedicine, AI-powered diagnostics, and digital health platforms are key drivers.

- Regulatory Impact: Government initiatives to expand health insurance coverage are shaping market growth.

Indonesia Health and Medical Insurance Market Market Trends & Opportunities

The Indonesian health and medical insurance market is experiencing robust growth, fueled by a confluence of factors. Rising disposable incomes, an expanding middle class, and a heightened awareness of health risks are key drivers. Technological advancements, particularly the proliferation of digital health platforms and telemedicine, are reshaping the industry landscape, creating exciting new opportunities for insurers to engage with consumers and improve service delivery. Consumer preferences are evolving towards more comprehensive and affordable plans, prompting insurers to innovate in product design and distribution strategies. The market is fiercely competitive, with established players and new entrants vying for market share, resulting in both price pressures and a surge in innovative solutions. We project a Compound Annual Growth Rate (CAGR) of xx% for the market during the forecast period (2025-2033), with market penetration rates increasing from xx% in 2025 to xx% by 2033. Significant opportunities exist in underserved segments, including rural populations, individuals with low incomes, and specialized insurance products tailored to specific health needs, such as chronic disease management or preventative care.

Dominant Markets & Segments in Indonesia Health and Medical Insurance Market

By Product Type: The Group Health Insurance Products segment maintains its dominance, accounting for xx Million USD in market value in 2025, largely driven by the demand for employee benefits from large employers. However, the Single/Individual Health Insurance Products segment exhibits the most rapid growth, reflecting a rising health consciousness among individuals and improvements in plan affordability.

By Provider: The Private Health Insurance segment commands the largest market share, representing xx Million USD in 2025. This dominance is attributed to superior coverage and service quality compared to the public sector. The Public/Social Health Insurance sector is undergoing expansion but faces ongoing challenges related to coverage expansion and efficient resource allocation.

By Distribution Channel: While agents and brokers remain crucial distribution channels, the rapid growth of online sales underscores a significant shift towards digital distribution models, offering convenience and broader reach to consumers.

- Key Growth Drivers (Group Health Insurance): Rising corporate social responsibility initiatives, government incentives for employee benefits, and the increasing recognition of the value of a healthy workforce.

- Key Growth Drivers (Single/Individual Health Insurance): Expansion of the middle class, increased health awareness fueled by public health campaigns, and the availability of more affordable and flexible plan options.

- Key Growth Drivers (Private Health Insurance): Superior service quality, broader coverage options, and a growing consumer preference for more comprehensive healthcare solutions.

- Key Growth Drivers (Online Sales): Convenience, cost-effectiveness, 24/7 accessibility, and the ability to reach a wider geographic customer base.

Indonesia Health and Medical Insurance Market Product Analysis

The Indonesian health insurance market features a range of products, from basic hospital and medical coverage to comprehensive plans incorporating wellness programs and international coverage. Technological advancements such as telemedicine integration and digital claims processing are improving efficiency and customer experience. Competitive advantages stem from strong distribution networks, comprehensive product portfolios, and robust customer service capabilities. Products are tailored to meet the specific needs of diverse customer segments, including families, individuals, and corporations. There's a growing trend towards value-added services, including preventative healthcare and wellness programs, to boost customer satisfaction and retention.

Key Drivers, Barriers & Challenges in Indonesia Health and Medical Insurance Market

Key Drivers: Rising incomes and a growing health consciousness among Indonesians are significant market drivers. Government initiatives aimed at expanding health insurance coverage, coupled with technological advancements such as telemedicine and digital health platforms, are further accelerating market growth. The increasing prevalence of non-communicable diseases is also contributing to demand.

Challenges: Regulatory complexities, encompassing licensing requirements and pricing regulations, present significant hurdles for insurers. Inadequate healthcare infrastructure in some regions limits accessibility and equitable distribution of healthcare resources. High administrative costs and the persistent problem of insurance fraud negatively impact profitability. Competition from traditional healthcare financing methods poses an ongoing challenge to market penetration. The estimated xx Million USD loss due to fraudulent claims in 2024 underscores the need for robust fraud prevention measures.

Growth Drivers in the Indonesia Health and Medical Insurance Market Market

The Indonesian health and medical insurance market is propelled by a burgeoning middle class with increasing disposable incomes, translating into higher demand for health insurance products. Government policies supporting and promoting broader health insurance coverage, combined with technological advancements that enhance both accessibility and operational efficiency, are key catalysts for market expansion. Furthermore, a rising awareness of health risks and the escalating prevalence of non-communicable diseases are significant factors driving market growth. This heightened awareness is leading to proactive health management and increased demand for preventative care.

Challenges Impacting Indonesia Health and Medical Insurance Market Growth

Regulatory complexities and administrative hurdles slow market expansion. Inadequate infrastructure, particularly in rural areas, limits access to healthcare services. Furthermore, high operational costs and the risk of fraudulent claims pose substantial challenges to profitability and sustainable growth. Competition from traditional healthcare financing methods and from international players needs to be addressed.

Key Players Shaping the Indonesia Health and Medical Insurance Market Market

- Allianz Care

- PT Sun Life Financial Indonesia

- AXA Indonesia

- AIA Financial Indonesia

- ManuLife Indonesia

- Prudential Indonesia

- Cigna Insurance

- PT Reasuransi Indonesia Utama (Persero)

- AVIVA

- PT Great Eastern Life Indonesia

- BNI Life

- BCA Life

Significant Indonesia Health and Medical Insurance Market Industry Milestones

- June 2022: Allianz Asia Pacific and HSBC extended their strategic partnership for 15 years, boosting Allianz's distribution network.

- April 2022: PT Sun Life Financial Indonesia partnered with PT Bank CIMB Niaga Tbk, expanding its reach to 7 Million customers.

Future Outlook for Indonesia Health and Medical Insurance Market Market

The Indonesian health and medical insurance market is poised for continued growth, driven by a young and expanding population, increasing health awareness, and supportive government policies. Opportunities lie in expanding coverage to underserved segments, leveraging technology for efficiency gains, and developing innovative product offerings tailored to evolving consumer needs. The market's robust growth trajectory is expected to continue throughout the forecast period, presenting significant opportunities for both domestic and international players.

Indonesia Health and Medical Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

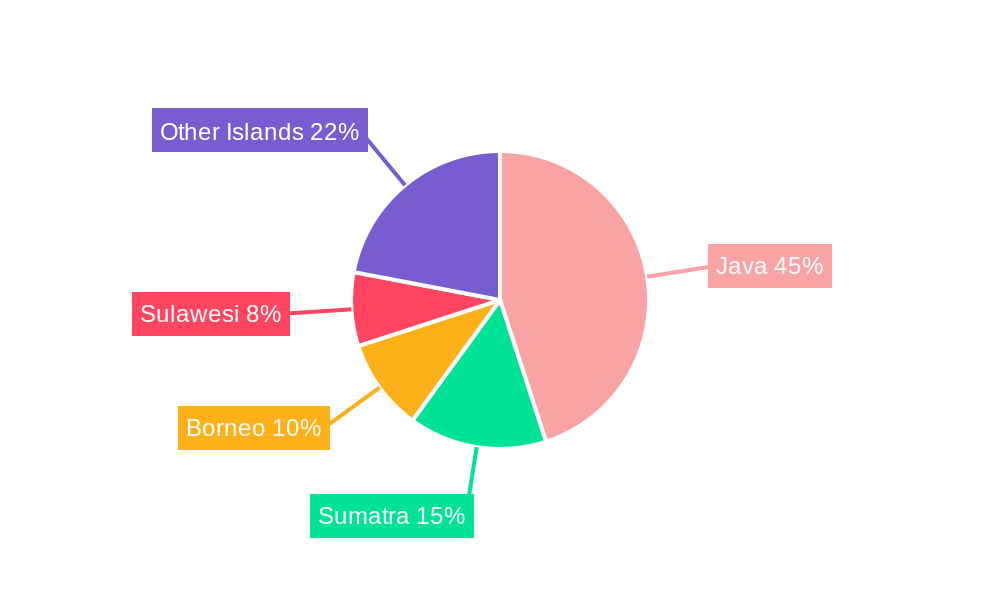

Indonesia Health and Medical Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Public Health Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. India Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Allianz Care

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PT Sun Life Financial Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 AXA Indonesia

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AIA Financial Indonesia

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ManuLife Indonesia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Prudential Indonesia

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cigna Insurance

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PT Reasuransi Indonesia Utama (Persero)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AVIVA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PT Great Eastern Life Indonesia**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BNI Life

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 BCA Life

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Allianz Care

List of Figures

- Figure 1: Indonesia Health and Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Health and Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Health and Medical Insurance Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Indonesia Health and Medical Insurance Market?

Key companies in the market include Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, Cigna Insurance, PT Reasuransi Indonesia Utama (Persero), AVIVA, PT Great Eastern Life Indonesia**List Not Exhaustive, BNI Life, BCA Life.

3. What are the main segments of the Indonesia Health and Medical Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Public Health Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence