Key Insights

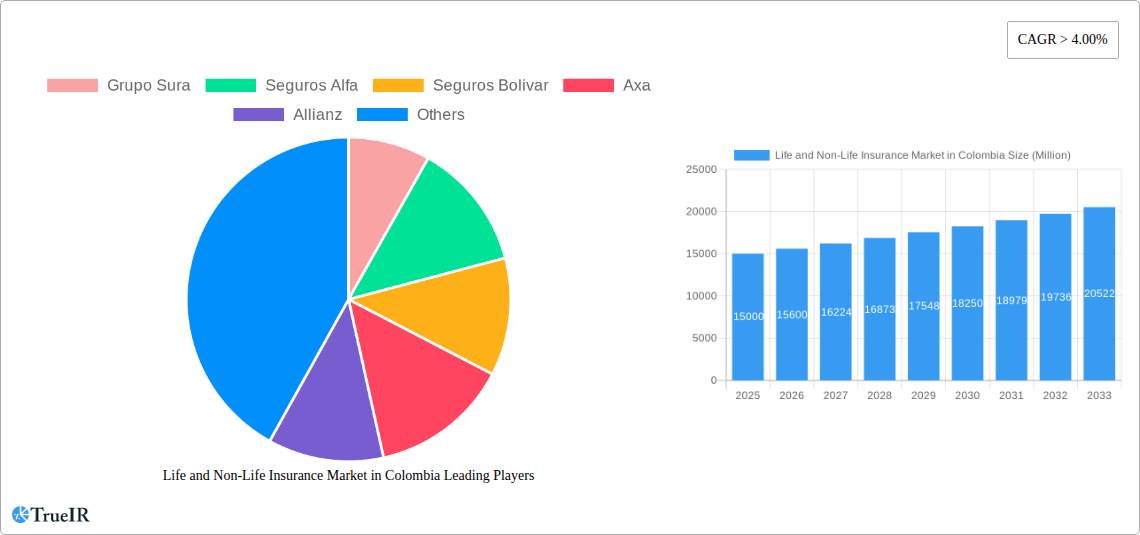

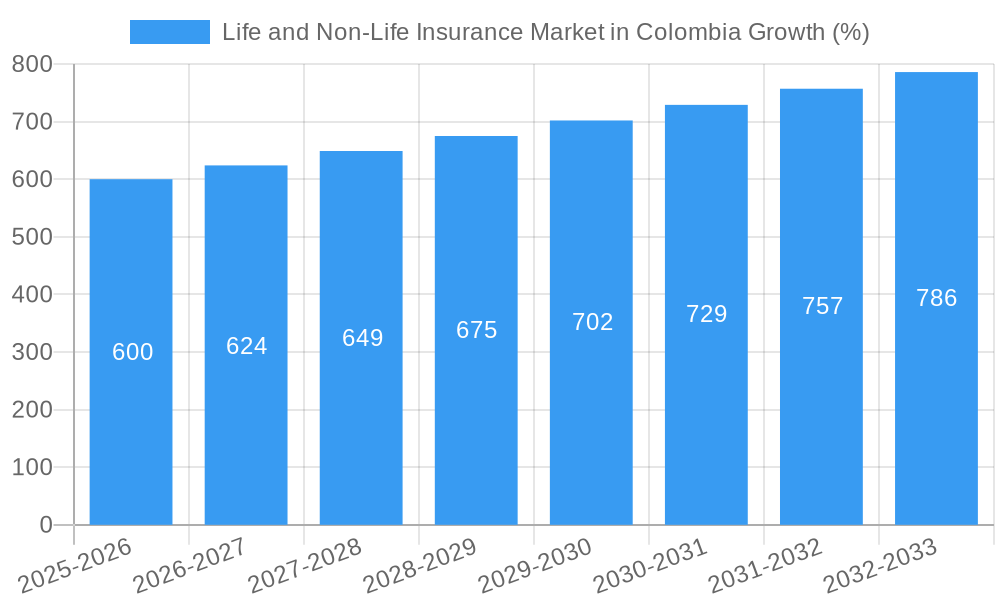

The Colombian life and non-life insurance market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes and a growing middle class are increasing demand for financial protection products. Furthermore, government initiatives promoting financial inclusion and insurance penetration are positively impacting market growth. Increased awareness of the importance of insurance, particularly for health and retirement planning, is also contributing to market expansion. However, challenges remain. Economic volatility and inflationary pressures can impact consumer spending on insurance. Competition among established players like Grupo Sura, Seguros Alfa, Seguros Bolívar, AXA, Allianz, Mapfre, Suramericana, Alfa Vida, and Bolívar, alongside the entry of new players, creates a dynamic and competitive landscape. Addressing challenges related to insurance fraud and improving financial literacy amongst the population are crucial to further market development.

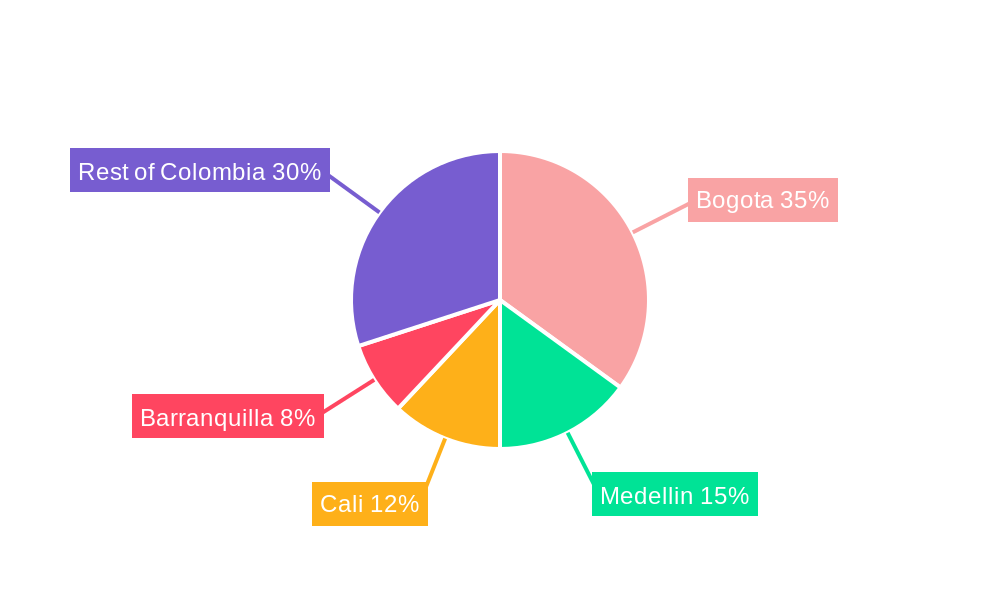

The segmentation of the market reveals significant opportunities within both life and non-life insurance segments. Growth in specific product categories, like health insurance and retirement plans within life insurance, and motor and property insurance within non-life insurance, is expected to outpace overall market growth. Regional variations exist, with more developed urban areas generally exhibiting higher insurance penetration. To further exploit growth potential, insurers are focusing on digitalization and the development of innovative products tailored to meet evolving customer needs and preferences. This includes leveraging technology to enhance customer experience and streamline operations, as well as expanding into underserved markets through partnerships and strategic collaborations. The forecast period anticipates continued market consolidation and diversification of product offerings, resulting in a dynamic and evolving insurance sector in Colombia.

Dynamic Report: Life and Non-Life Insurance Market in Colombia (2019-2033)

This comprehensive report delivers an in-depth analysis of the burgeoning Life and Non-Life Insurance Market in Colombia, projecting robust growth from 2025 to 2033. Ideal for investors, insurers, and market strategists, this study provides critical insights into market dynamics, competitive landscapes, and future opportunities within this dynamic sector. With a focus on key players like Grupo Sura, Seguros Alfa, Seguros Bolivar, Axa, Allianz, Mapfre, Suramericana, Alfa Vida, Bolivar, and Cardif (list not exhaustive), this report offers invaluable data for informed decision-making.

Life and Non-Life Insurance Market in Colombia Market Structure & Competitive Landscape

This section analyzes the Colombian insurance market's structure, identifying key competitive dynamics and influencing factors. We examine market concentration, using concentration ratios to assess dominance. Innovation drivers, such as technological advancements and evolving consumer needs, are evaluated alongside the impact of regulatory frameworks on market players. The report also explores product substitution trends and the role of mergers and acquisitions (M&A) activities, quantifying M&A volume during the historical period (2019-2024) and projecting trends for the forecast period (2025-2033). End-user segmentation, focusing on demographic and socioeconomic factors impacting insurance consumption, is thoroughly investigated. The analysis includes qualitative insights derived from expert interviews and industry reports, supplementing quantitative data to paint a complete picture of the Colombian insurance market's competitive landscape. The concentration ratio for 2024 is estimated at xx%, indicating a xx level of market concentration. M&A volume during 2019-2024 totaled approximately xx Million USD.

- Market Concentration: Analysis of concentration ratios (e.g., CR4, CR8) to assess market dominance.

- Innovation Drivers: Examination of technological advancements (e.g., InsurTech, digitalization) and their impact on product offerings and customer experience.

- Regulatory Impacts: Assessment of the influence of government policies, regulations, and supervisory bodies on market operations.

- Product Substitutes: Analysis of alternative financial products and services that compete with insurance offerings.

- End-User Segmentation: Detailed segmentation by demographics (age, income, location), risk profiles, and insurance needs.

- M&A Trends: Quantitative and qualitative analysis of merger and acquisition activities, including deal size, frequency, and strategic implications.

Life and Non-Life Insurance Market in Colombia Market Trends & Opportunities

This section provides a comprehensive overview of the Colombian life and non-life insurance market's evolution, encompassing market size, growth trajectories, and emerging opportunities. We detail market size growth from 2019 to 2024, projecting compound annual growth rates (CAGR) and market penetration rates for the forecast period (2025-2033). Technological shifts, such as the adoption of digital platforms and data analytics, are analyzed for their influence on market dynamics. Shifting consumer preferences, including rising demand for specific insurance types and evolving risk perceptions, are explored. Furthermore, the competitive dynamics, including the strategies employed by key players, are meticulously analyzed. The estimated market size in 2025 is xx Million USD, with a projected CAGR of xx% from 2025 to 2033. The market penetration rate in 2024 was approximately xx%, expected to reach xx% by 2033.

Dominant Markets & Segments in Life and Non-Life Insurance Market in Colombia

This section identifies the leading regions, countries, or segments within the Colombian life and non-life insurance market, providing in-depth analysis of their dominance. Key growth drivers are highlighted using bullet points, complemented by detailed paragraphs analyzing the underlying factors contributing to market leadership. The analysis considers factors like economic development, demographic trends, infrastructure development, and the influence of government policies and regulations. The analysis may reveal that the urban areas of major cities drive market growth.

- Key Growth Drivers:

- Expanding middle class and rising disposable incomes.

- Increasing awareness of insurance products and benefits.

- Government initiatives promoting financial inclusion.

- Development of robust infrastructure supporting insurance operations.

- Favorable regulatory environment fostering competition.

Life and Non-Life Insurance Market in Colombia Product Analysis

This section offers a concise summary of product innovations, applications, and competitive advantages within the Colombian life and non-life insurance market. The focus is on technological advancements and their market fit, highlighting how technological integration improves product offerings and customer experiences. We will analyze the impact of digital platforms, mobile applications, and data analytics in shaping product development and distribution.

Key Drivers, Barriers & Challenges in Life and Non-Life Insurance Market in Colombia

This section examines the key drivers and challenges impacting the growth trajectory of the Colombian life and non-life insurance market. Key drivers are analyzed in terms of technological advancements, economic growth, and supportive government policies. Specific examples are provided, focusing on initiatives promoting financial inclusion and technological innovations boosting efficiency and reach. Challenges are analyzed in terms of supply-chain disruptions, regulatory hurdles, and intense competition. The impact of these challenges on market growth is assessed with quantifiable data wherever possible. For example, regulatory changes might have led to xx% decrease in new policy issuance.

Growth Drivers in the Life and Non-Life Insurance Market in Colombia Market

This section expands on the key growth drivers identified earlier, emphasizing technological advancements, positive economic trends, and conducive regulatory environments. Specific examples are provided.

Challenges Impacting Life and Non-Life Insurance Market in Colombia Growth

This section deepens the discussion on market barriers and restraints, addressing regulatory complexities, supply-chain vulnerabilities, and the pressures of intense competition with quantifiable impacts on growth metrics.

Key Players Shaping the Life and Non-Life Insurance Market in Colombia Market

- Grupo Sura

- Seguros Alfa

- Seguros Bolivar

- Axa

- Allianz

- Mapfre

- Suramericana

- Alfa Vida

- Bolivar

- Cardif

Significant Life and Non-Life Insurance Market in Colombia Industry Milestones

- October 26, 2021: Micro Insurance Company partners with Colombian Fintech CrediOrbe to offer microinsurance products to underserved loan applicants. This signifies a push towards financial inclusion and innovation in the microinsurance segment.

- September 30, 2021: Generali Employee Benefits partners with BUPA Global to expand international private medical insurance (IPMI) offerings in Colombia. This highlights the growing demand for international health insurance solutions.

Future Outlook for Life and Non-Life Insurance Market in Colombia Market

The Colombian life and non-life insurance market presents significant growth opportunities driven by factors such as increasing penetration rates, favorable demographic trends, and continuous technological advancements. Strategic opportunities exist in leveraging technology to expand reach, personalize offerings, and improve operational efficiency. The market's potential for sustained growth is high, given the ongoing economic development and rising demand for risk mitigation solutions.

Life and Non-Life Insurance Market in Colombia Segmentation

-

1. Insurance Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire

- 1.2.2. Motor

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Others

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Other Distribution Channels

Life and Non-Life Insurance Market in Colombia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life and Non-Life Insurance Market in Colombia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of Financial Sector and Foreign Penetration into the Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motor

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-Life Insurance

- 6.1.2.1. Fire

- 6.1.2.2. Motor

- 6.1.2.3. Marine

- 6.1.2.4. Health

- 6.1.2.5. Others

- 6.1.1. Life insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Agents

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-Life Insurance

- 7.1.2.1. Fire

- 7.1.2.2. Motor

- 7.1.2.3. Marine

- 7.1.2.4. Health

- 7.1.2.5. Others

- 7.1.1. Life insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Agents

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-Life Insurance

- 8.1.2.1. Fire

- 8.1.2.2. Motor

- 8.1.2.3. Marine

- 8.1.2.4. Health

- 8.1.2.5. Others

- 8.1.1. Life insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Agents

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-Life Insurance

- 9.1.2.1. Fire

- 9.1.2.2. Motor

- 9.1.2.3. Marine

- 9.1.2.4. Health

- 9.1.2.5. Others

- 9.1.1. Life insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Agents

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific Life and Non-Life Insurance Market in Colombia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Life insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-Life Insurance

- 10.1.2.1. Fire

- 10.1.2.2. Motor

- 10.1.2.3. Marine

- 10.1.2.4. Health

- 10.1.2.5. Others

- 10.1.1. Life insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Agents

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Grupo Sura

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seguros Alfa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Seguros Bolivar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Axa

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allianz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mapfre

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suramericana

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alfa Vida

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bolivar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cardif**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Grupo Sura

List of Figures

- Figure 1: Global Life and Non-Life Insurance Market in Colombia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 3: North America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 4: North America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 9: South America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 10: South America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Life and Non-Life Insurance Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Life and Non-Life Insurance Market in Colombia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 15: Europe Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 16: Europe Life and Non-Life Insurance Market in Colombia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Life and Non-Life Insurance Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 21: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 22: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 27: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 28: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 12: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 18: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 30: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 39: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Life and Non-Life Insurance Market in Colombia Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Life and Non-Life Insurance Market in Colombia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life and Non-Life Insurance Market in Colombia?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Life and Non-Life Insurance Market in Colombia?

Key companies in the market include Grupo Sura, Seguros Alfa, Seguros Bolivar, Axa, Allianz, Mapfre, Suramericana, Alfa Vida, Bolivar, Cardif**List Not Exhaustive.

3. What are the main segments of the Life and Non-Life Insurance Market in Colombia?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of Financial Sector and Foreign Penetration into the Insurance Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On 26th October 2021, Micro Insurance Company, a global end-to-end microinsurance platform, which offers custom insurance solutions, partnered with CrediOrbe based in Colombia. CrediOrbe is a fintech firm headquartered in Colombia. The partnership is aimed to create an insurance product for customers who are unable to get loans by CrediOrbe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life and Non-Life Insurance Market in Colombia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life and Non-Life Insurance Market in Colombia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life and Non-Life Insurance Market in Colombia?

To stay informed about further developments, trends, and reports in the Life and Non-Life Insurance Market in Colombia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence