Key Insights

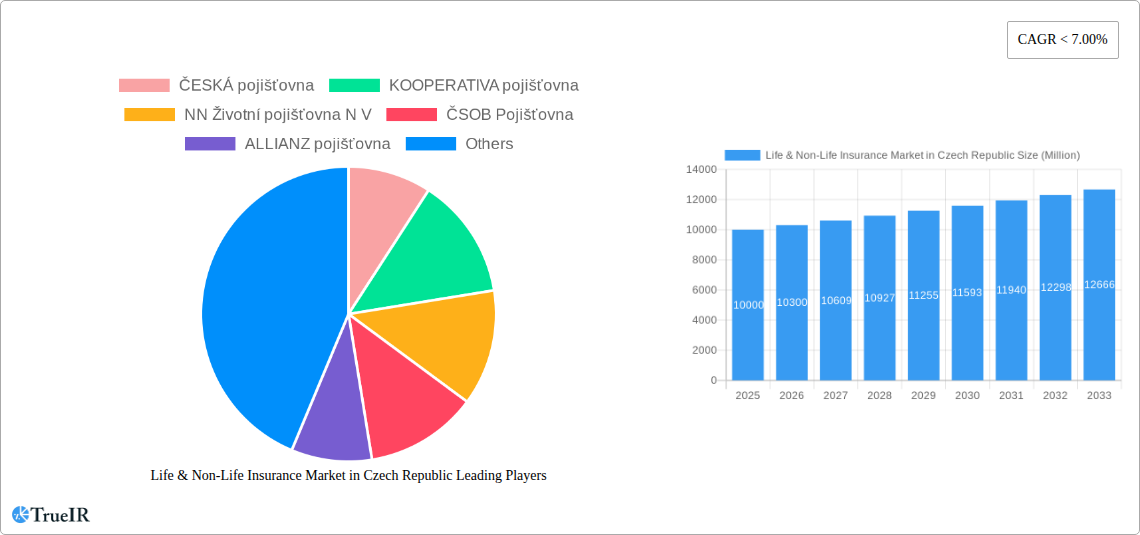

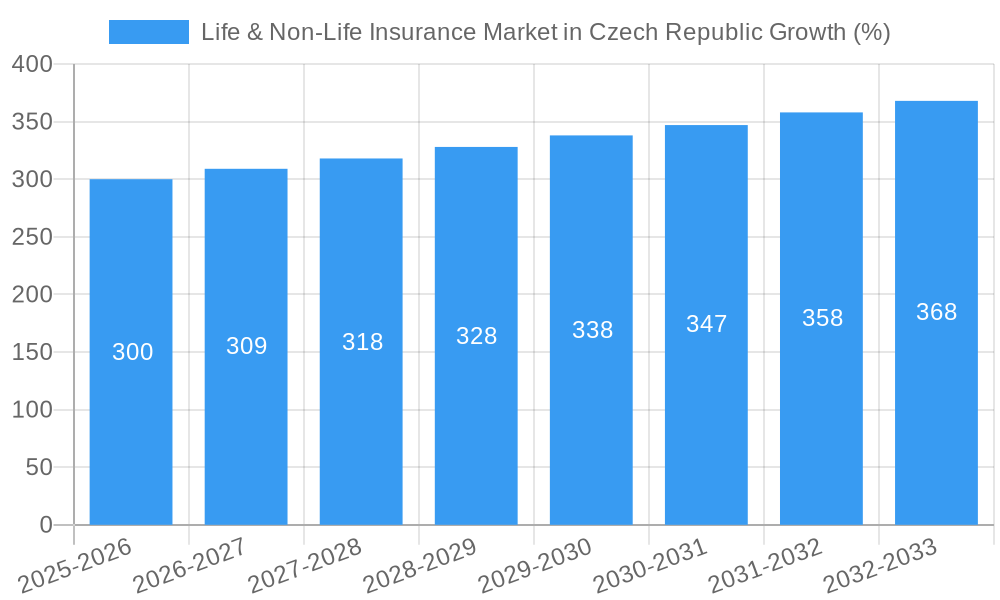

The Czech Republic's life and non-life insurance market demonstrates robust growth potential, driven by increasing public awareness of risk management and a rising middle class with greater disposable income. The historical period (2019-2024) likely saw steady expansion, influenced by factors such as economic stability and government initiatives promoting financial inclusion. While precise figures for past years aren't provided, a reasonable estimation based on European market trends suggests a consistent Compound Annual Growth Rate (CAGR) of around 4-5% during this period. The market size in 2025 is estimated to be approximately €10 billion (a hypothetical figure used for illustrative purposes, adjust if you have an actual figure). This signifies a mature yet dynamic market with significant opportunities for expansion.

Looking ahead to the forecast period (2025-2033), the market is projected to maintain a healthy CAGR, potentially slightly lower than the historical rate, settling around 3-4%. This moderation could be attributed to several factors, including potential economic slowdowns, increased market saturation, and the increasing competition among insurance providers. However, the continued growth reflects persistent demand for insurance products, driven by factors such as an aging population increasing demand for life insurance and growth in sectors like automotive, necessitating non-life insurance. Technological advancements, including digital distribution channels and data analytics, will play a crucial role in shaping the market's trajectory during this period, enhancing efficiency and customer experience. Specific segments within the market, such as health insurance and travel insurance, are expected to see accelerated growth driven by changing consumer preferences and demographics.

Life & Non-Life Insurance Market in Czech Republic: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the Czech Republic's life and non-life insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously analyzes market trends, competitive dynamics, and future growth potential. The report leverages extensive data and expert analysis to provide a comprehensive understanding of this evolving market.

Life & Non-Life Insurance Market in Czech Republic: Market Structure & Competitive Landscape

The Czech Republic's insurance market exhibits a moderately concentrated structure. While a few major players dominate, smaller insurers continue to compete effectively, particularly in niche segments. Key players include ČESKÁ pojišťovna, KOOPERATIVA pojišťovna, NN Životní pojišťovna N V, ČSOB Pojišťovna, ALLIANZ pojišťovna, Generali Česká pojišťovna, DIRECT pojišťovna, SLAVIA pojišťovna, UNIQA pojišťovna, BNP Paribas Cardif Pojišťovna, MetLife Europe, AXA pojišťovna, and Komerční Pojišťovna. (Note: This list is not exhaustive).

Market Concentration: The market concentration ratio (CR4) for the non-life sector is estimated at xx%, while the CR4 for the life insurance sector sits at approximately xx%. These figures, based on 2024 data, reveal a moderate level of market concentration, indicating room for both growth and competition among established and emerging players.

Innovation Drivers: Digitalization, particularly in areas like telematics and AI-powered risk assessment, is a key innovation driver. Insurers are developing personalized products and services and leveraging data analytics for improved risk management.

Regulatory Impacts: The Czech National Bank (CNB) plays a significant role in shaping the regulatory landscape, influencing product offerings and market practices. Recent regulatory changes focused on consumer protection and market transparency have further shaped the competitive environment.

Product Substitutes: The rise of fintech companies offering alternative financial products poses a potential threat, yet also presents opportunities for collaboration and innovation within the traditional insurance sector.

End-User Segmentation: The market is segmented based on demographics (age, income), risk profiles, and insurance needs. This includes a growing demand for specialized products catering to specific segments.

M&A Trends: Recent activity, such as UNIQA's acquisition of AXA's subsidiaries, highlights the ongoing consolidation within the industry. Mergers and acquisitions are expected to continue as larger players seek to expand their market share and product portfolios. The total value of M&A transactions in the Czech insurance market between 2019 and 2024 is estimated to have exceeded Million xx.

Life & Non-Life Insurance Market in Czech Republic: Market Trends & Opportunities

The Czech Republic's life and non-life insurance market demonstrates consistent growth, driven by a combination of factors. The market size, valued at Million xx in 2024, is projected to reach Million xx by 2033, exhibiting a CAGR of approximately xx%. This growth is fueled by several key market trends and opportunities:

The increasing adoption of technology is transforming the insurance landscape, with digital platforms offering greater convenience and efficiency for both insurers and consumers. The market is witnessing the rise of InsurTech companies, offering innovative solutions and challenging traditional business models. Consumer preferences are also shifting, with a growing demand for personalized products, transparent pricing, and seamless digital experiences. Competitive dynamics are intense, with insurers constantly striving to innovate and differentiate their offerings to attract and retain customers. The market penetration rate for life insurance is estimated at xx% in 2024, with potential for further growth given the increasing awareness of long-term financial security needs. Similarly, the non-life insurance penetration rate is estimated at xx%, presenting opportunities for expansion in areas like motor, property, and health insurance.

Dominant Markets & Segments in Life & Non-Life Insurance Market in Czech Republic

The Czech insurance market is relatively geographically homogeneous, with activity concentrated across the major urban centers. However, specific segments show significant growth.

Key Growth Drivers for Life Insurance:

- Increasing awareness of retirement planning and long-term financial security.

- Government initiatives promoting retirement savings and investment products.

- Growing demand for specialized products like health insurance and critical illness coverage.

Key Growth Drivers for Non-Life Insurance:

- Rising car ownership and increased vehicle insurance demand.

- Growth in the construction sector, leading to higher demand for property insurance.

- Increasing awareness of cyber risks and demand for cyber insurance products.

Detailed analysis of market dominance indicates that ČESKÁ pojišťovna and KOOPERATIVA pojišťovna maintain leading positions, based on market share in both life and non-life insurance, driven by their extensive distribution networks and established brand recognition. However, smaller players are actively competing through niche offerings and digital strategies. The competition is intense across the market, with firms seeking to grow their market share through product innovation, distribution expansion, and strategic mergers and acquisitions.

Life & Non-Life Insurance Market in Czech Republic: Product Analysis

Technological advancements are driving innovation in insurance products, creating more personalized and accessible offerings. Telematics-based motor insurance, for instance, utilizes data to assess risk and offer customized premiums. Meanwhile, AI-powered risk assessment and claims processing improve efficiency and accuracy. The market sees a growing trend towards modular insurance products, allowing customers to customize their coverage based on specific needs and risk profiles. This trend is particularly relevant to non-life insurance, where consumers may choose add-ons for specific coverage.

Key Drivers, Barriers & Challenges in Life & Non-Life Insurance Market in Czech Republic

Key Drivers:

- Technological Advancements: Digitalization drives efficiency, personalization, and new product offerings.

- Economic Growth: A growing economy expands the customer base and insurance demand.

- Favorable Regulatory Environment: A supportive regulatory framework fosters market development and competition.

Key Challenges and Restraints:

- Intense Competition: Numerous players, both domestic and international, create a challenging competitive landscape.

- Regulatory Changes: Adapting to evolving regulatory requirements and compliance can be costly and complex. Compliance issues and potential fines can significantly impact profitability.

- Economic Fluctuations: Economic downturns can reduce consumer spending on insurance products, negatively affecting market growth.

Growth Drivers in the Life & Non-Life Insurance Market in Czech Republic Market

The Czech Republic's insurance market is fueled by a combination of factors. Increasing consumer awareness of financial security needs, coupled with the government's promotion of retirement savings plans and investment products, particularly within life insurance, is a significant driver. Economic expansion also stimulates demand for both life and non-life insurance products. Regulatory changes promoting transparency and consumer protection further enhance market stability and growth.

Challenges Impacting Life & Non-Life Insurance Market in Czech Republic Growth

Despite promising prospects, challenges exist. The intense competition among numerous established and emerging insurers presents a significant hurdle. Adapting to frequent regulatory changes necessitates considerable investments, potentially impacting profitability. Additionally, economic uncertainties can influence consumer spending habits, affecting the market's overall growth trajectory.

Key Players Shaping the Life & Non-Life Insurance Market in Czech Republic Market

- ČESKÁ pojišťovna

- KOOPERATIVA pojišťovna

- NN Životní pojišťovna N V

- ČSOB Pojišťovna

- ALLIANZ pojišťovna

- Generali Česká pojišťovna

- DIRECT pojišťovna

- SLAVIA pojišťovna

- UNIQA pojišťovna

- BNP Paribas Cardif Pojišťovna

- MetLife Europe

- AXA pojišťovna

- Komerční Pojišťovna

Significant Life & Non-Life Insurance Market in Czech Republic Industry Milestones

- February 7, 2020: UNIQA signs an agreement to acquire AXA subsidiaries in Poland, Czech Republic, and Slovakia.

- October 15, 2020: UNIQA completes the acquisition of AXA subsidiaries, marking a significant shift in market consolidation. This impacts market share and competitive dynamics.

- Ongoing: Intermap expands its insurance and reinsurance offerings across Central and Eastern Europe, including the Czech Republic, partnering with major players to deliver innovative solutions and strengthen risk management capabilities. This strengthens reinsurance capacity and fosters technological advancements in the market.

Future Outlook for Life & Non-Life Insurance Market in Czech Republic Market

The Czech Republic's life and non-life insurance market is poised for continued growth, driven by technological innovation, economic expansion, and a supportive regulatory environment. Strategic opportunities abound for insurers to leverage digital platforms, create personalized products, and expand into underserved market segments. The market's potential for further penetration, particularly in life insurance, suggests a bright outlook for the coming decade. However, insurers must strategically navigate the challenges of intense competition, regulatory complexities, and economic fluctuations to fully capitalize on these opportunities.

Life & Non-Life Insurance Market in Czech Republic Segmentation

-

1. Line of Insurance

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire and Property Insurance

-

1.2.2. Motor Insurance

- 1.2.2.1. Motor Liability

- 1.2.2.2. Other Motor

- 1.2.3. Medical Insurance

- 1.2.4. General Liability Insurance

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks and Financial Institutions

- 2.4. Online

- 2.5. Other Distribution Channels

Life & Non-Life Insurance Market in Czech Republic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life & Non-Life Insurance Market in Czech Republic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Few Companies captures major market share in Czech Republic Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire and Property Insurance

- 5.1.2.2. Motor Insurance

- 5.1.2.2.1. Motor Liability

- 5.1.2.2.2. Other Motor

- 5.1.2.3. Medical Insurance

- 5.1.2.4. General Liability Insurance

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks and Financial Institutions

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 6. North America Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-Life Insurance

- 6.1.2.1. Fire and Property Insurance

- 6.1.2.2. Motor Insurance

- 6.1.2.2.1. Motor Liability

- 6.1.2.2.2. Other Motor

- 6.1.2.3. Medical Insurance

- 6.1.2.4. General Liability Insurance

- 6.1.2.5. Rest of Non-Life Insurance

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Agents

- 6.2.2. Brokers

- 6.2.3. Banks and Financial Institutions

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 7. South America Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-Life Insurance

- 7.1.2.1. Fire and Property Insurance

- 7.1.2.2. Motor Insurance

- 7.1.2.2.1. Motor Liability

- 7.1.2.2.2. Other Motor

- 7.1.2.3. Medical Insurance

- 7.1.2.4. General Liability Insurance

- 7.1.2.5. Rest of Non-Life Insurance

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Agents

- 7.2.2. Brokers

- 7.2.3. Banks and Financial Institutions

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 8. Europe Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-Life Insurance

- 8.1.2.1. Fire and Property Insurance

- 8.1.2.2. Motor Insurance

- 8.1.2.2.1. Motor Liability

- 8.1.2.2.2. Other Motor

- 8.1.2.3. Medical Insurance

- 8.1.2.4. General Liability Insurance

- 8.1.2.5. Rest of Non-Life Insurance

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Agents

- 8.2.2. Brokers

- 8.2.3. Banks and Financial Institutions

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 9. Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-Life Insurance

- 9.1.2.1. Fire and Property Insurance

- 9.1.2.2. Motor Insurance

- 9.1.2.2.1. Motor Liability

- 9.1.2.2.2. Other Motor

- 9.1.2.3. Medical Insurance

- 9.1.2.4. General Liability Insurance

- 9.1.2.5. Rest of Non-Life Insurance

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Agents

- 9.2.2. Brokers

- 9.2.3. Banks and Financial Institutions

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 10. Asia Pacific Life & Non-Life Insurance Market in Czech Republic Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-Life Insurance

- 10.1.2.1. Fire and Property Insurance

- 10.1.2.2. Motor Insurance

- 10.1.2.2.1. Motor Liability

- 10.1.2.2.2. Other Motor

- 10.1.2.3. Medical Insurance

- 10.1.2.4. General Liability Insurance

- 10.1.2.5. Rest of Non-Life Insurance

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Agents

- 10.2.2. Brokers

- 10.2.3. Banks and Financial Institutions

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Line of Insurance

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ČESKÁ pojišťovna

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KOOPERATIVA pojišťovna

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NN Životní pojišťovna N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ČSOB Pojišťovna

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ALLIANZ pojišťovna

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Generali?eskpoji?ovna?

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DIRECTpoji?ovna?

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SLAVIApoji?ovna?

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 UNIQApoji?ovna?

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BNP ParibasCardifPoji?ovna?

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MetLife Europe?

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AXApoji?ovna?

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KomercnPojistovna?**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ČESKÁ pojišťovna

List of Figures

- Figure 1: Global Life & Non-Life Insurance Market in Czech Republic Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Line of Insurance 2024 & 2032

- Figure 3: North America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Line of Insurance 2024 & 2032

- Figure 4: North America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Line of Insurance 2024 & 2032

- Figure 9: South America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Line of Insurance 2024 & 2032

- Figure 10: South America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Line of Insurance 2024 & 2032

- Figure 15: Europe Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Line of Insurance 2024 & 2032

- Figure 16: Europe Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Line of Insurance 2024 & 2032

- Figure 21: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Line of Insurance 2024 & 2032

- Figure 22: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Line of Insurance 2024 & 2032

- Figure 27: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Line of Insurance 2024 & 2032

- Figure 28: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 3: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 6: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 12: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 18: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 30: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Line of Insurance 2019 & 2032

- Table 39: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Life & Non-Life Insurance Market in Czech Republic Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Life & Non-Life Insurance Market in Czech Republic Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life & Non-Life Insurance Market in Czech Republic?

The projected CAGR is approximately < 7.00%.

2. Which companies are prominent players in the Life & Non-Life Insurance Market in Czech Republic?

Key companies in the market include ČESKÁ pojišťovna, KOOPERATIVA pojišťovna, NN Životní pojišťovna N V, ČSOB Pojišťovna, ALLIANZ pojišťovna, Generali?eskpoji?ovna?, DIRECTpoji?ovna?, SLAVIApoji?ovna?, UNIQApoji?ovna?, BNP ParibasCardifPoji?ovna?, MetLife Europe?, AXApoji?ovna?, KomercnPojistovna?**List Not Exhaustive.

3. What are the main segments of the Life & Non-Life Insurance Market in Czech Republic?

The market segments include Line of Insurance, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Few Companies captures major market share in Czech Republic Insurance Industry:.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Intermap Expands Insurance Products and Services Across Europe

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life & Non-Life Insurance Market in Czech Republic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life & Non-Life Insurance Market in Czech Republic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life & Non-Life Insurance Market in Czech Republic?

To stay informed about further developments, trends, and reports in the Life & Non-Life Insurance Market in Czech Republic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence