Key Insights

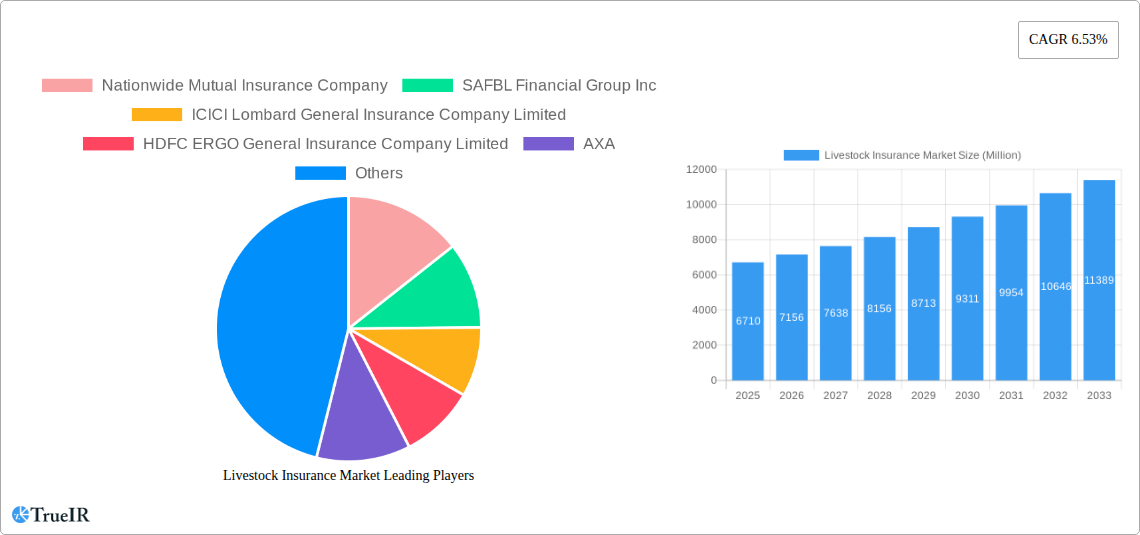

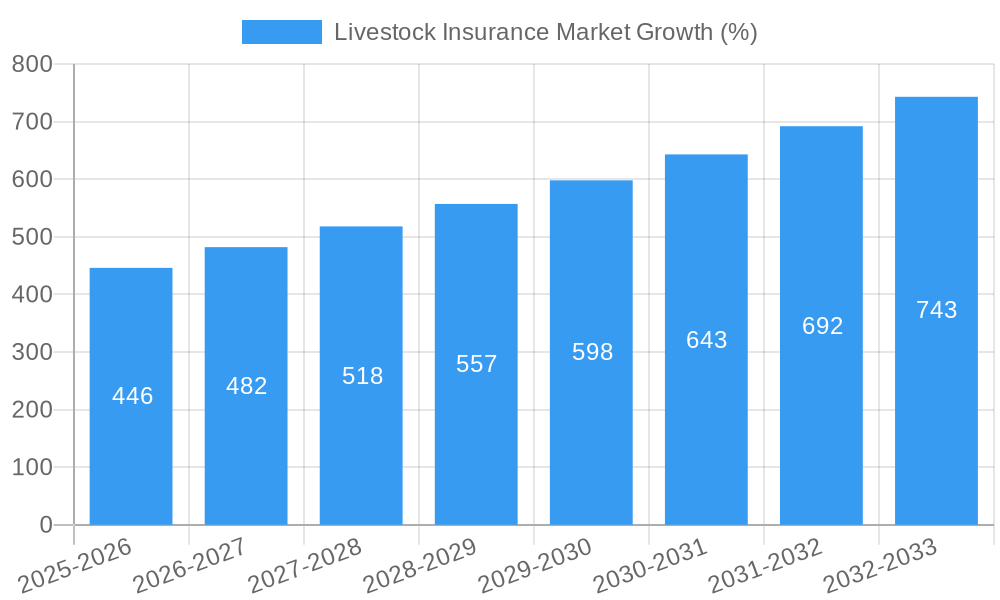

The global livestock insurance market, valued at $6.71 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.53% from 2025 to 2033. This expansion is driven by several key factors. Increasing frequency and severity of climate-related events like droughts and floods are significantly impacting livestock populations, compelling farmers to seek risk mitigation through insurance. Government initiatives promoting agricultural insurance and financial inclusion in developing nations are also fueling market growth. Furthermore, technological advancements such as precision livestock farming, remote sensing, and data analytics are enabling more accurate risk assessment and efficient claims processing, boosting market confidence and adoption. The market is segmented by livestock type (e.g., cattle, poultry, swine), insurance type (e.g., mortality, morbidity), and geographical region. Key players, including Nationwide Mutual Insurance Company, AXA, and ICICI Lombard, are actively expanding their livestock insurance portfolios to capitalize on this growing demand.

However, challenges remain. Data scarcity and infrastructure limitations in many regions hinder comprehensive risk assessment and efficient claims management. The complexity of livestock valuation and the inherent unpredictability of livestock health can lead to difficulties in accurately pricing policies and managing risk. Furthermore, lack of awareness and understanding of the benefits of livestock insurance amongst farmers, particularly in developing countries, poses a significant barrier to broader market penetration. Nevertheless, the long-term outlook for the livestock insurance market remains positive, fueled by increasing agricultural risks, technological innovations, and supportive government policies. Continued efforts to address data gaps, enhance risk assessment methodologies, and improve farmer education will be crucial for unlocking the full potential of this vital market segment.

Livestock Insurance Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Livestock Insurance Market, offering invaluable insights for industry professionals, investors, and stakeholders. Leveraging extensive research and data from 2019-2024 (Historical Period), with a base year of 2025 and a forecast period extending to 2033, this report illuminates current market trends and predicts future growth opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Livestock Insurance Market Structure & Competitive Landscape

The Livestock Insurance Market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Innovation in this sector is primarily driven by technological advancements in risk assessment, data analytics, and claims processing. Stringent regulatory frameworks, particularly concerning animal welfare and data privacy, significantly impact market operations. Substitute products are limited, primarily focusing on self-insurance strategies for smaller livestock operations. The market is segmented primarily by livestock type (e.g., cattle, poultry, swine), geographic location, and insurance type (e.g., mortality, morbidity).

Mergers and acquisitions (M&A) activity has been moderate in recent years. The total M&A volume for the period 2019-2024 is estimated at xx Million. Key M&A trends include:

- Consolidation among smaller insurers to achieve economies of scale.

- Strategic acquisitions to expand geographical reach and product offerings.

- Increased investment in technology-driven insurers.

Livestock Insurance Market Trends & Opportunities

The Livestock Insurance Market is experiencing significant growth, driven by several key factors. Rising livestock populations globally, coupled with increasing awareness of the financial risks associated with livestock mortality and morbidity, are fueling demand for insurance products. Technological advancements, such as the use of IoT devices for real-time monitoring of livestock health, are enhancing risk assessment and claims management. Changing consumer preferences towards greater risk mitigation and financial security are also contributing to market expansion. The market’s competitive dynamics are shaped by factors including pricing strategies, product innovation, and distribution channels. The market penetration rate for livestock insurance is currently estimated at xx%, with significant growth potential in underserved regions and livestock segments. This growth is projected to continue, driven by increasing technological adoption and enhanced risk management practices.

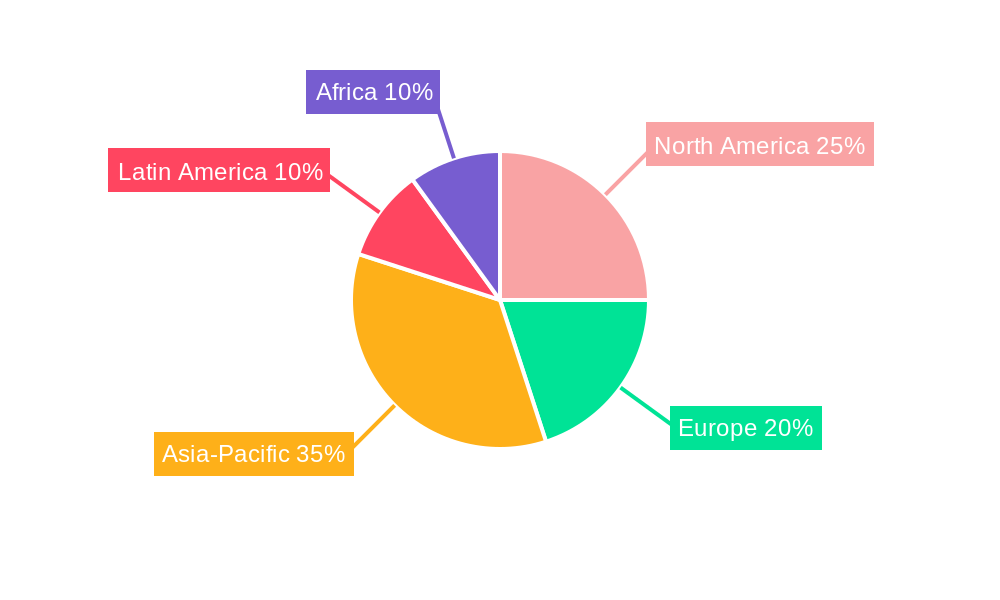

Dominant Markets & Segments in Livestock Insurance Market

The North American region currently holds a dominant position in the global Livestock Insurance Market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to:

- Developed Infrastructure: Robust infrastructure supporting efficient insurance operations.

- Favorable Regulatory Environment: Supportive government policies and regulations promoting insurance adoption.

- High Livestock Density: A large and concentrated livestock population base.

Key growth drivers for the North American market include:

- Technological advancements in precision livestock farming.

- Increased awareness of climate change risks and their impact on livestock.

- Government initiatives promoting agricultural insurance.

Other regions, particularly in developing economies, present substantial growth opportunities, driven by increasing livestock production and government efforts to support the agricultural sector.

Livestock Insurance Market Product Analysis

Product innovations in the Livestock Insurance Market are primarily focused on enhancing risk assessment accuracy, improving claims processing efficiency, and expanding product coverage. Technological advancements, such as the use of telematics, remote sensing, and AI-powered analytics, are driving the development of more sophisticated and customized insurance products. These innovative products are improving risk management for livestock owners and enabling insurers to offer more competitive pricing and broader coverage options. The market is seeing a shift towards parametric insurance models that offer faster and more predictable payouts based on pre-defined triggers.

Key Drivers, Barriers & Challenges in Livestock Insurance Market

Key Drivers:

- Rising livestock populations and their associated economic value.

- Increased awareness of livestock mortality and morbidity risks.

- Technological advancements enabling improved risk assessment and management.

- Government initiatives promoting agricultural insurance.

Challenges and Restraints:

- Data scarcity and limitations in risk assessment for certain livestock types and regions.

- High administrative costs associated with individual livestock insurance policies.

- Challenges in accurately assessing and compensating for losses due to disease outbreaks or natural disasters. The potential economic impact of disease outbreaks (e.g., avian flu) can result in significant losses for insurers, estimated at xx Million annually.

Growth Drivers in the Livestock Insurance Market Market

The primary growth drivers are rising livestock populations, technological advancements offering superior risk assessment and management, and government support for the agricultural sector. These factors, combined with increasing awareness of risks and financial vulnerability among livestock owners, create a fertile ground for market expansion.

Challenges Impacting Livestock Insurance Market Growth

The principal challenges include the accurate assessment of losses, the high administrative burden, and data scarcity, particularly in developing economies. Regulatory complexities and the potential impact of unforeseen events, like disease outbreaks, pose significant obstacles to growth.

Key Players Shaping the Livestock Insurance Market Market

- Nationwide Mutual Insurance Company

- SAFBL Financial Group Inc

- ICICI Lombard General Insurance Company Limited

- HDFC ERGO General Insurance Company Limited

- AXA

- Reliance General Insurance Company Limited (Part of Reliance Capital)

- ProAg (Tokio Marine HCC Group of Companies)

- Sunderland Marine (NorthStandard Limited)

- The Hartford

- Royal Sundaram General Insurance Co Limited

Significant Livestock Insurance Market Industry Milestones

- July 2023: AXA completed its acquisition of GacM Spain for USD 326 Million, expanding its market presence.

- November 2023: AXA completed the purchase of Laya Healthcare Limited for USD 684 Million, signifying a significant investment in the health and insurance sector, indirectly impacting the livestock insurance market through related risk management strategies.

Future Outlook for Livestock Insurance Market Market

The Livestock Insurance Market is poised for continued growth, driven by technological innovation, increasing awareness of risk, and supportive government policies. Strategic opportunities exist in expanding into underserved markets, developing innovative products, and leveraging data analytics to improve risk management. The market's potential is significant, particularly in developing economies where livestock farming is a major source of livelihood and vulnerable to various risks.

Livestock Insurance Market Segmentation

-

1. Type

- 1.1. Commercial Mortality

- 1.2. Non-commercial Mortality

-

2. Application

- 2.1. Dairy

- 2.2. Cattle

- 2.3. Swine

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Bancassurance

- 3.3. Agents

- 3.4. Brokers

Livestock Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

- 6. Rest of the World

Livestock Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver

- 3.4. Market Trends

- 3.4.1. Global Dairy Trade Expansion Fuels Livestock Insurance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Commercial Mortality

- 5.1.2. Non-commercial Mortality

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Cattle

- 5.2.3. Swine

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Bancassurance

- 5.3.3. Agents

- 5.3.4. Brokers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Latin America

- 5.4.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Commercial Mortality

- 6.1.2. Non-commercial Mortality

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Cattle

- 6.2.3. Swine

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Bancassurance

- 6.3.3. Agents

- 6.3.4. Brokers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Commercial Mortality

- 7.1.2. Non-commercial Mortality

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Cattle

- 7.2.3. Swine

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Bancassurance

- 7.3.3. Agents

- 7.3.4. Brokers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Commercial Mortality

- 8.1.2. Non-commercial Mortality

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Cattle

- 8.2.3. Swine

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Bancassurance

- 8.3.3. Agents

- 8.3.4. Brokers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Commercial Mortality

- 9.1.2. Non-commercial Mortality

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Cattle

- 9.2.3. Swine

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Bancassurance

- 9.3.3. Agents

- 9.3.4. Brokers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Commercial Mortality

- 10.1.2. Non-commercial Mortality

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Cattle

- 10.2.3. Swine

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Bancassurance

- 10.3.3. Agents

- 10.3.4. Brokers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of the World Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Commercial Mortality

- 11.1.2. Non-commercial Mortality

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy

- 11.2.2. Cattle

- 11.2.3. Swine

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Direct Sales

- 11.3.2. Bancassurance

- 11.3.3. Agents

- 11.3.4. Brokers

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nationwide Mutual Insurance Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAFBL Financial Group Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ICICI Lombard General Insurance Company Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HDFC ERGO General Insurance Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Reliance General Insurance Company Limited (Part of Reliance Capital)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ProAg (Tokio Marine HCC Group of Companies)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sunderland Marine (NorthStandard Limited)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Hartford

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Royal Sundaram General Insurance Co Limited**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nationwide Mutual Insurance Company

List of Figures

- Figure 1: Livestock Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Livestock Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 23: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 25: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 31: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 33: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 37: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 39: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 41: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 45: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 47: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 49: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 53: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 55: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 56: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 57: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Livestock Insurance Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the Livestock Insurance Market?

Key companies in the market include Nationwide Mutual Insurance Company, SAFBL Financial Group Inc, ICICI Lombard General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, AXA, Reliance General Insurance Company Limited (Part of Reliance Capital), ProAg (Tokio Marine HCC Group of Companies), Sunderland Marine (NorthStandard Limited), The Hartford, Royal Sundaram General Insurance Co Limited**List Not Exhaustive.

3. What are the main segments of the Livestock Insurance Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver.

6. What are the notable trends driving market growth?

Global Dairy Trade Expansion Fuels Livestock Insurance Demand.

7. Are there any restraints impacting market growth?

Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver.

8. Can you provide examples of recent developments in the market?

November 2023: AXA completed the purchase of Laya Healthcare Limited for a price of USD 684 million, as previously reported by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Livestock Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Livestock Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Livestock Insurance Market?

To stay informed about further developments, trends, and reports in the Livestock Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence